Myfxbook is an invaluable online resource for Forex traders seeking market data and industry knowledge. While many websites offer information, Myfxbook provides unique value through its breadth and depth of features.

As an established hub for traders, you have already discovered Myfxbook. But you may not be getting the most out of its offerings. By leveraging these tips, you can tap into the site’s full potential.

Connect your trading account(s) to Myfxbook

Myfxbook can act as a personal diary of your trading history so that you can keep track of your performance. Usually, you only look at how much you have gained or lost, but through Myfxbook, you can see much more about your trading activities.

After your account details are sent to Myfxbook, the platform’s software analyzes your account performance. Some of the information about your trading that you can learn from Myfxbook include:

- risk of ruin – which determines how many consecutive losses you can take before losing your total investment. The software performs this analysis from the average sizes of your wins and losses, then extrapolates those

- keeping track of your goals – you can set your daily and weekly goals, then track how far you have to go to reach them. This provides a target that keeps you motivated to work harder and also prevents you from taking unnecessary risks

- drawdown – the MT4 platform can generate a report with your account’s dropdown, but you can see how much drawdown you have by day on Myfxbook. By knowing this, you realize if you have been performing better or worse and whether you need to change your trading strategy

The most important thing, in the end, is that Myfxbook provides all this and more information on one platform so that you don’t have to look elsewhere. It is efficient and effective, definitely a must-have for every trader. First, though, you should connect your account to the website:

How to connect your account

There are several ways to add your trading account to your Myfxbook portfolio, but the easiest is through the executable expert advisor (EA). To download this EA, follow these steps:

- Log into your Myfxbook account, click on your Account name in the top-right corner, and select ‘Settings.’

- On the ‘Accounts’ tab, click ‘Add account.’

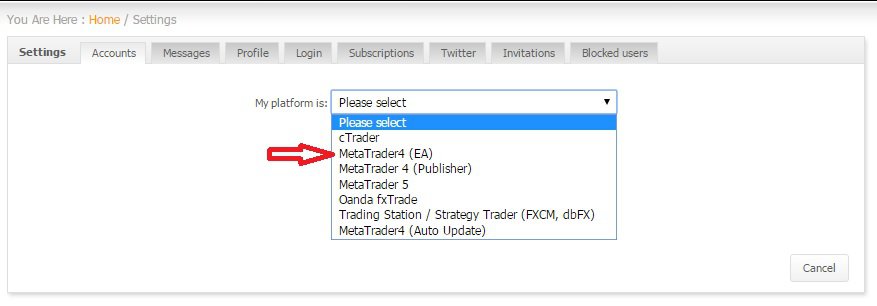

- On the next window, click on the drop-down menu and select ‘MetaTrader (EA) like in the image above

- An executable file should start downloading, and you should run it afterward

- During the installation, the program will list all the MetaTrader 4 platforms installed, and you select the ones where you would like the EA installed. The best option here is usually to select all of your MT4 platforms so that you can see how you perform on each. (Check out: LiteForex MT4 and MT5 Platforms Assessment)

- After the installation, close any MT4 platform if you have any open and restart them. You will probably need to input your credentials after the EA is installed

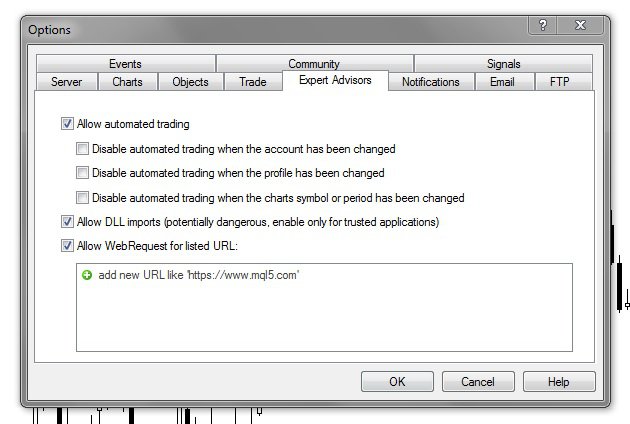

- Now go to the menu bar on MT4, click on ‘Tools,’ then ‘Options,’ and choose the ‘Expert Advisors’ tab. Here, it would be best to allow the EA to send information about your account by checking the boxes above. These allow sending data to and from Myfxbook from your account regularly. Do not worry about your account security. Myfxbook is a trusted platform, and you should feel secure allowing access

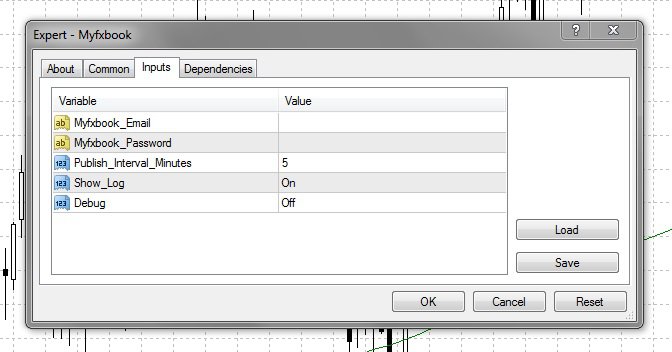

- From the navigator window, scroll down to the ‘Expert Advisors’ list and double-click on the ‘Myfxbook’ EA. Then select the ‘Inputs’ tab and enter your Myfxbook account details in the fields provided. You can then set how often your account’s performance details are uploaded, but you can’t go lower than 5 minutes

You can now go back to your Myfxbook page on your web browser, and the account(s) should appear on your portfolio. Information about your account will be uploaded periodically according to your settings, which will be reflected in your portfolio. You won’t even have to open your trading platform every time you need to check your trades because there are Forex charts online to view your account’s progress. Don't forget to check out the benefits of Trading with Admiral Markets.

Besides using the executable file, you can add the plugins and copy them into your installation folder. The two files needed are attached at the bottom of this page, from where you can download them. They include a *.dll file and a *.ex4 file. The ‘dll’ file should be copied into the MQL4/libraries folder, and the ‘ex4’ file should be copied to the MQL4/experts folder. To find these folders, click ‘File’ on your MT4 platform and click ‘Open data folder.’

(Find out more on EAs here: How to launch an expert advisor on MT4)

This method also requires that you give permissions to the plugins just like you would the downloadable EA, and it works just as effectively. The only downside is that you must copy the files into every MT4 folder, which can be problematic if you have several brokers’ platforms. Still, it can be helpful if you don’t have administrator privileges on your computer or don’t like installing many programs.

The final method to connecting your account is by entering your account details directly into your Myfxbook portfolio on the browser. This method is also easy if you have your account’s investor password. However, this method also seems problematic, and I even had trouble connecting my account using an investor password.

Join the discussion

Myfxbook also brings together thousands of traders to discuss Forex trading issues, which is an excellent resource for traders. Myfxbook boasts over 90,000 members, which is large enough to ensure you can receive varied opinions. One important thing you can learn is how to choose a Forex broker.

This is a fundamental question, yet it is more challenging to answer. Through the Forex broker reviews posted on Myfxbook, though, you will be able to make better decisions.

As I keep saying, you need to ride the wave when trading Forex, which means knowing how other traders think. In this way, Myfxbook can determine market sentiment so you can understand what to expect. The many forums on Myfxbook can thus be used to gauge which side many traders are leaning toward, which will help you plan your trades. Also, you can check out XM Broker Leverage and Forex Spreads Overview.

Compete against other traders

They say that traders are usually full of ego, and the contests on Myfxbook let you compete with others and find out just how good you are. Several competitions are generally running at any time, most of which are sponsored by Forex companies.

To join one of these contests, you only need to open a demo account with the broker sponsoring the contest and trade with the virtual money. The rewards for winning the contest are not virtual; you earn real money if you perform well. As you would expect, the sponsor will require that you open a live account with their company, into which the funds will be deposited – this is the catch.

The benefit of competition is not only to the ego but also to help you become a better trader. Regardless of your personality, competition tends to bring out the best in you and motivates you to become more serious. For new traders who have only ever had a demo account, one of these contests is the best way to add real-life stakes to trading, even though there is no risk. (Learn how to create a trading strategy)

The economic calendar

Myfxbook also provides a Forex calendar, which includes information on upcoming news releases. The great thing about Myfxbook’s economic calendar is that it also issues alerts when news announcements are made, informing you of the announcement immediately after it comes through. On other economic calendars, you must keep refreshing the page until the moment arrives, but the information is presented directly through a pop-up window followed by a ‘ding.’ (How to work with the economic calendar)

They also include a countdown timer to the most important announcements, making timing the event easier. Furthermore, the timer will automatically be adjusted to your time zone, so you won’t have to do the calculations yourself.

Auto trading

Since there are so many visitors to Myfxbook, many traders also offer trading signals for others to copy. If you have connected your account to Myfxbook, you will know that the platform performs an in-depth analysis of an account’s performance. Any signal provider’s account will be subject to the same scrutiny, and you can see most aspects of their trading history.

.png)

For those looking for a reliable trading signal for auto trading, Myfxbook allows you to choose the best provider because you get more information about their performance than other signal providers will show. Another advantage is that the process becomes simpler because your account is already connected to Myfxbook. Therefore, all you will need to do is subscribe to a provider, and their trades will automatically reflect on your Forex trading platforms.

Myfxbook’s auto trading supports MetaTrader 4 and cTrader so that more people can subscribe. The only downside is that Myfxbook’s auto trading only works with a few select brokers and not all of them. You can check from your Myfxbook account whether your connected accounts can be connected to auto trading. Still, this disadvantage limits the number of brokers you can use for this Myfxbook feature.

As for signal providers, Myfxbook has also got you covered – you get a reward of up to 0.5 pips for every winning trade. This reward may change occasionally, but getting a good number of subscribers can turn into a good reward.

Remember to check the Myfxbook MT4 plugins to learn more!