AUD/USD Trade Ideas

Filter:

AUD/USD

Clear

Popular

EUR/USD

GBP/USD

USD/CHF

USD/JPY

AUD/USD

Brent

XAU/USD

All instruments:

Forex

USD/CAD

EUR/JPY

EUR/GBP

NZD/USD

EUR/AUD

GBP/JPY

CAD/JPY

EUR/CAD

NZD/JPY

GBP/CHF

CHF/JPY

EUR/NZD

GBP/AUD

CAD/CHF

AUD/NZD

NZD/CAD

GBP/CAD

AUD/CHF

Energy

WTI

Brent

Indexes

S&P500

DOW30

DXY

Select

AUD/CAD

AUD/JPY

AUD/SGD

AUD/USD

BTC/USD

CHF/BGN

CHF/RON

CHF/SGD

CHF/TRY

EUR/CHF

EUR/CZK

EUR/DKK

EUR/HKD

EUR/HUF

EUR/ILS

EUR/MXN

EUR/NOK

EUR/PLN

EUR/RON

EUR/RUB

EUR/SEK

EUR/SGD

EUR/TRY

EUR/USD

EUR/ZAR

GBP/BGN

GBP/CZK

GBP/DKK

GBP/HKD

GBP/HUF

GBP/NOK

GBP/NZD

GBP/PLN

GBP/RON

GBP/SEK

GBP/SGD

GBP/TRY

GBP/USD

GBP/USD

GBP/ZAR

HKD/JPY

NZD/CAD

NZD/CHF

SGD/HKD

SGD/JPY

TRY/JPY

USD/BGN

USD/CHF

USD/CNH

USD/CNY

USD/CZK

USD/DKK

USD/EUR

USD/HKD

USD/HUF

USD/ILS

USD/JPY

USD/MXN

USD/NOK

USD/NOK

USD/PLN

USD/RON

USD/RUB

USD/SEK

USD/SGD

USD/TRY

USD/ZAR

All Forex brokers

All Forex brokers

Alpari

EXNESS

FBS

FIBO Group

HYCM

IG

Instaforex

NordFX

RoboForex

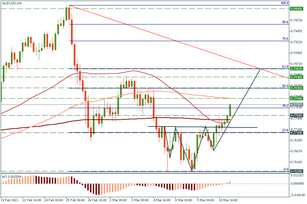

AUD/USD formed an inverted "Head and Shoulders’ and is targeting 0.7815, 0.7840, and 0.7860. The best place to buy is around 0.7750, but we can’t be sure that the price will offer an opportunity to enter in that area. Trade idea for AUD/USD BUY 0.7750; TP1 0.7790; TP2 0.7815; SL 0.7735 LOG IN Sourc...

11.03.2021

17

AUD/USD has formed a ‘harami’ on the D1 and a higher low on the H4. The pair will likely go up to test the resistance line that connects January highs. There (around 0.7790) will be a great place to sell: it will be the third time the price touches the resistance and a bearish harmonic pattern. Trad...

20.01.2021

14

Main / For Traders / Forex Analysis / Trading plan 09.09.202005:08 Control zones for AUD/USD on 09/09/2020 Relevance up to 05:00 2020-09-11 UTC+2 This week, work in the downward direction remains a priority. It is enough to keep the price below the opening level of yesterday's tradi...

09.09.2020

15

Main / For Traders / Forex Analysis / Trading plan 08.09.202011:13 AUD/USD may drop Relevance up to 11:00 2020-09-09 UTC+2 AUD/USD seems too overbought to climb higher. The fresh low will suggest seeling as the rate could escape from the up channel's body. Technically, the pair is st...

08.09.2020

17

Main / For Traders / Forex Analysis / Trading plan 04.09.202006:58 Control Zones AUD USD 04.09.20 Relevance up to 06:00 2020-09-06 UTC+2 The downward movement became a priority after yesterday's close of the US session below the WCZ 1/2 0.7325-0.7316. The growth of the pair should b...

04.09.2020

16

Main / For Traders / Forex Analysis / Trading plan 02.09.202007:39 Control zones for AUD/USD on 09/02/2020 Relevance up to 06:00 2020-09-04 UTC+2 Yesterday's decline during the US trading session allowed us to form a correctional pattern. The determining support is the WCZ 1/2 0.732...

02.09.2020

17

Main / For Traders / Forex Analysis / Trading plan 31.08.202006:03 Control zones for AUDUSD on 08/31/20 Relevance up to 04:00 UTC+2 Last week's close was at a high. This makes it possible for us to assume that the upward movement will continue with a high probability. Long deals fro...

31.08.2020

14

Main / For Traders / Forex Analysis 26.08.202006:24 Control zones for AUDUSD on 08/26/20 Relevance up to 04:00 2020-08-28 UTC+2 Last week's downward momentum is still the basis for choosing the direction of trade. The probability of continued bearish movement is estimated at 75%. The ...

26.08.2020

15

Main / For Traders / Forex Analysis 25.08.202016:53 AUDUSD trading plan Relevance up to 16:00 2020-08-26 UTC+2 AUDUSD is inside an upward sloping wedge pattern as we have identified from a previous analysis. The lower wedge boundary remains intact as price respects this support at 0.71...

25.08.2020

14

Relevance up to 11:00 2020-07-23 UTC+2 AUD/USD has rallied again as the USDX has plunged in the short term. The pair is trading at 0.7138 and it could jump way higher as the bearish divergence was invalidated by the last development.The pair has managed to make another higher high signaling a furt....

22.07.2020

18

Relevance up to 04:00 2020-07-19 UTC+2 Previously opened purchases must be kept. The first goal for growth is to renew weekly and monthly highs. It is important to understand that a reversal model will only form in case closing of trades occur below the WCZ 1/2 0.6949-0.6940. Until this happens, ....

17.07.2020

18

Relevance up to 06:00 2020-07-16 UTC+2 The downward movement from yesterday's US session made it possible for us to approach the WCZ 1/2 0.6912-0.6903. The test of this zone will be decisive for the upward movement, since the bullish momentum is not 100% realized. The test of WCZ 1/2 should be co....

14.07.2020

14