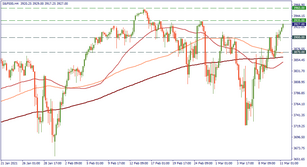

What's on The stock market seems to be on a bullish track now. The S&P bounced upwards from the support of 3870 where the three Moving Averages were converging and currently is flirting with the four-week resistance of 3935. What to do now? Mid-term action plan Watch how the index behaves agains...

11.03.2021

9