14.04.2023XAUUSD, “Gold vs US Dollar”At the resistance, gold has formed a Hanging Man reversal pattern. The instrument is now going by the reversal signal in a descending wave. The target for the pullback might be 2025.50. Upon testing the support, the price could rebound from it and continue the up...

14.04.2023

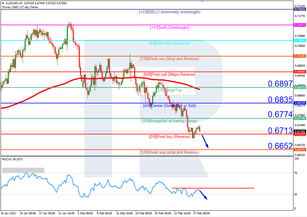

263