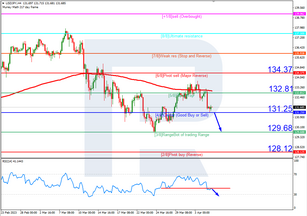

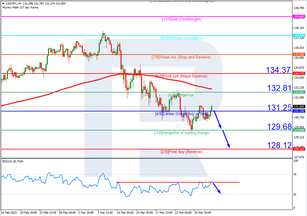

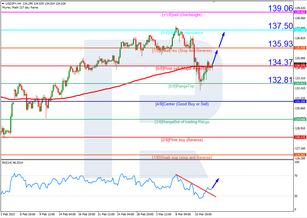

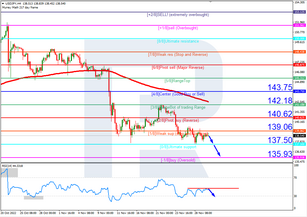

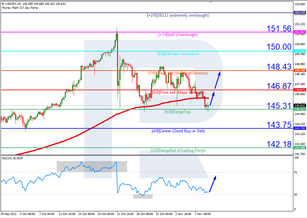

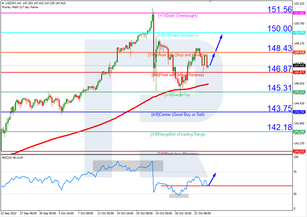

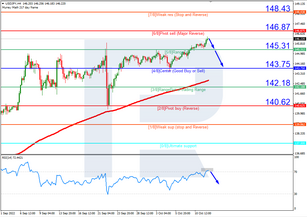

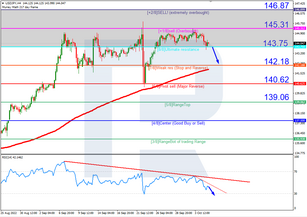

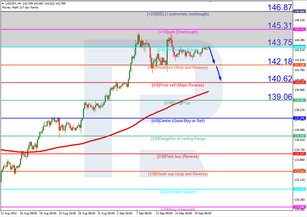

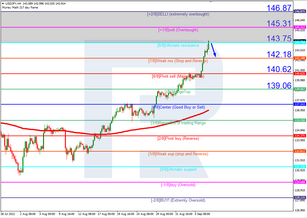

12.04.2023USDJPY, “US Dollar vs Japanese Yen”On H4, the quotes have broken the 200-day Moving Average and are now above it, which indicates possible development of an uptrend. The RSI has rebounded from the support line. In these circumstances, the quotes are expected to break 6/8 (134.37) and rise ...

12.04.2023

73