Fundamental analysis of USD/RUB

Filter:

USD/RUB

Clear

Popular

EUR/USD

GBP/USD

USD/CHF

USD/JPY

AUD/USD

Brent

XAU/USD

All instruments:

Forex

USD/CAD

EUR/JPY

EUR/GBP

NZD/USD

EUR/AUD

GBP/JPY

CAD/JPY

EUR/CAD

NZD/JPY

GBP/CHF

CHF/JPY

EUR/NZD

GBP/AUD

CAD/CHF

AUD/NZD

NZD/CAD

GBP/CAD

AUD/CHF

Energy

WTI

Brent

Indexes

S&P500

DOW30

DXY

Select

AUD/CAD

AUD/JPY

AUD/SGD

AUD/USD

BTC/USD

CHF/BGN

CHF/RON

CHF/SGD

CHF/TRY

EUR/CHF

EUR/CZK

EUR/DKK

EUR/HKD

EUR/HUF

EUR/ILS

EUR/MXN

EUR/NOK

EUR/PLN

EUR/RON

EUR/RUB

EUR/SEK

EUR/SGD

EUR/TRY

EUR/USD

EUR/ZAR

GBP/BGN

GBP/CZK

GBP/DKK

GBP/HKD

GBP/HUF

GBP/NOK

GBP/NZD

GBP/PLN

GBP/RON

GBP/SEK

GBP/SGD

GBP/TRY

GBP/USD

GBP/USD

GBP/ZAR

HKD/JPY

NZD/CAD

NZD/CHF

SGD/HKD

SGD/JPY

TRY/JPY

USD/BGN

USD/CHF

USD/CNH

USD/CNY

USD/CZK

USD/DKK

USD/EUR

USD/HKD

USD/HUF

USD/ILS

USD/JPY

USD/MXN

USD/NOK

USD/NOK

USD/PLN

USD/RON

USD/RUB

USD/SEK

USD/SGD

USD/TRY

USD/ZAR

All Forex brokers

All Forex brokers

Alpari

EXNESS

FBS

FIBO Group

HYCM

IG

Instaforex

NordFX

RoboForex

Long-term review The US labor market report for June was a real blow to the Russian ruble. Meanwhile, the rally of Chinese stocks, which has been ongoing for eight trading days, allowed the ruble to recover losses. According to the IMF, China will escape recession in 2020. In addition, if the coun....

09.07.2020

22

Long-term review The USD/RUB bears are frightened by the second coronavirus wave in China, a surge in the number of infected people to record high in some US states, and pessimistic speeches provided by Jerome Powell. They have even allowed their opponents to raise the quote above the psychologic....

18.06.2020

10

Long-term review The USD/RUB bears were losing ground as the US stock indices slowed down their rally after the FOMC meeting in June. Besides, the increased risk of Brent falling below the psychologically important mark of $40 per barrel put more pressure on the bears. The Fed is not going to fol....

11.06.2020

23

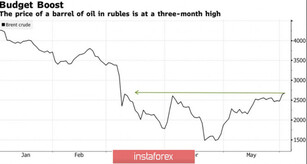

Oil’s contribution The current president assumed power in Russia in 2000 and stayed in power de facto during these 20 years. Leaving aside political questions, let’s focus on the economy and try to find a correlation between the price of oil and the price of the USD against the RUB. Until 2015, whil...

11.06.2020

18

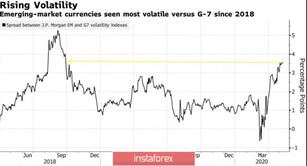

Intro Currencies of developing countries such as the RUB, TRY, and MXN are by definition unstable. That’s why they fluctuate more than main ones, offering wider profit opportunities. At the same time, they are normally weaker than the USD. In the long run, therefore, you are likely to see USD/RUB, U...

09.06.2020

60

Long-term review The Russian ruble is sweeping away all obstacles thanks to the continuous growth of US stock indices, oil, and the euro. Inspired by the EU's large-scale fiscal stimulus and hopes for the QE expansion, the euro has been strengthening against the US dollar for 11 trading days. The ....

04.06.2020

27

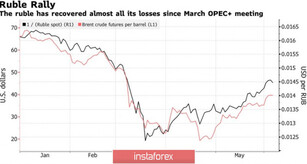

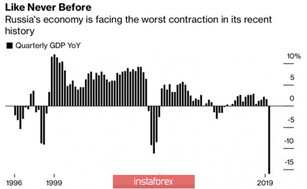

The USD/RUB pair has recently fallen to its 2-month low. It may seem that the ruble refuses to follow the basic law of fundamental analysis when a strong economy determines a strong currency. The Russian currency is extending gains for 5 consecutive trading sessions, while Bloomberg analysts expect ...

22.05.2020

24

Long-term review The fall of US stock indices and the ongoing concerns about the escalation of the US-China trade conflict are putting the Russian ruble under pressure. Moreover, Brent crude oil is in no hurry to continue the rally and is trading near the psychologically important mark of $30 per ....

14.05.2020

25

Relevance up to 22:00 UTC+2 Today, everyone is talking about yesterday's speech by Vladimir Putin regarding the situation with the coronavirus epidemic and the gradual easing of restrictive measures. Frankly, his address was not so interesting. Indeed, there were phrases regarding the abolition of....

12.05.2020

21

Relevance up to 21:00 UTC+2 Like many other major world currencies, yesterday the ruble was stuck in the same range. Its intraday fluctuations were insignificant. Nevertheless, it is hardly surprising taking into account the latest events. Some economists thought that the market would be stirred b....

28.04.2020

14

Relevance up to 21:00 UTC+2 Seems like the Russain rouble is the only currency which did not react to a historic production cut agreement between OPEC and its allies. Even the euro has somehow reacted to the deal. Today, practically everyone calls the agreement historic. According to the deal, the....

14.04.2020

16

Relevance up to 21:00 UTC+1 The Russian rouble continues to be flat. The pair was trading around 73.50 roubles per dollar. The US dollar was trying to strengthen during the day to 75 roubles. At some point, the dollar managed to increase to this level, however, failing to consolidate there. At the....

17.03.2020

12

Relevance up to 21:00 UTC+1 Oil prices collapsed, as well as the Russian rouble. If we take a look at how the rouble traded yesterday, we can see that the opening price was much lower. Thus, the rouble strengthened from yesterday's quotes. Moreover, oil prices are plunging. At the moment, Brent cr....

10.03.2020

15

Relevance up to 20:00 UTC+1 Following a string of a continuous decline over the past few days, the ruble opened today's session with a gap heading for the upward trend. The upward correction was expected since the ruble eased mainly on coronavirus fears and the panic among market players. Oil pric....

02.03.2020

6

Company does not offer investment advice and the analysis performed does not guarantee results As the date of the key US Federal Reserve meeting approached, there was another unpleasant surprise from the Department of Labor, indicating a slowdown in inflation in the country. Export prices declined....

14.12.2018

7

The dollar finally rose in price, which is largely due to panic on the stock exchanges. The fall of stock indices is usually accompanied by the strengthening of the dollar. In fact, not only American indices fall. Investors close their positions and withdraw money, and a well-known proverb says that...

12.02.2018

12

The Bank of Russia Board of Directors decided to cut the key rate from 8.25% to 7.75%, thus implementing the assumptions of the forward-looking policy. Unlike in previous statements, the central bank did not say that global geopolitical risks along with fluctuations in the Rouble posed upside risks ...

15.12.2017

11

The dollar rose slightly on Wednesday after the announcement of the results of the two-day meeting of the US Federal Reserve, which generally met the expectations of the market. FOMC announced its intention to launch a program to normalize the balance sheet in October. It is expected that the monthl...

22.09.2017

8