Both of the exchanging software by MetaQuotes is still the most favored online retail Forex exchanging software. The developer, released MetaTrader 4 (MT4) back in 2005, right around the time when the retail Forex industry was booming. It is no wonder, therefore, that this came to be the most favored exchanging software. However, change is coming, since the developer announced that they would no longer be selling the MT4 software. Although it is still available, the company is not issuing any more copies of the software. Due to this, it is now time to consider a move to MetaTrader 5 (MT5) early before its predecessor is completely kicked out.

Even after the developer released the latest version in 2010, the previous one remains to be the most favored. In a report by FinanceFeeds, there are currently 1,231 Forex brokers with a license for MT4. These include white-label brokers, full-service brokerages, and even IBs. This is not surprising since a white-label license for the exchanging software costs just $5,000. It is not just the brokers who enjoy MT4, though; traders don’t like to change their habits, so they stick to what they know. (Comparing MetaTrader 4 and 5: MT4 vs. MT5)

Nevertheless, the developing company has been slowly urging brokers and traders to adapt MT5 over MT4 through various enticements since 2016, trying to phase out the latter. For traders, they have to wonder what they might find different in MT5. In many ways, the two software are very similar – especially in the way they look, but there are still some key differences. MT5 has some new features that just might make it time to upgrade to the newer version of the exchanging software. By the end of this article, you should know whether it’s time for you to make the upgrade and why. (Some of the: MetaTrader 4 advanced features)

MetaTrader 5 has more timeframes and assets

The first release, MT4, has 9 timeframes to work with, but MT5 introduces 12 more timeframes like the 10-minute, 20-minute, 2-hour, 4-hour, yearly timeframes, and others. These timeframes were not available in MT4, and some traders may have wished to have them. Now they can with MT5. The idea behind including various timeframes is to make the exchanging software versatile enough to fit every trader’s style instead of forcing them to adapt to specific timeframes. Furthermore, it would help traders perform better and more accurate technical analysis before exchanging. (This is: How to launch an expert advisor on MT4)

Development of custom indicators

Since MT4 is already very favored, there are a lot of custom indicators one can find online to use in their exchange. These custom indicators are written in MQL4 (MetaQuotes Language), which is a programming language only compatible with MT4. Therefore, these indicators cannot work with MT5 or any other exchanging software. Custom technical indicators are very helpful in exchanging the forex market, and MT5 is struggling to find developers willing to write code for MT5-compatible custom indicators. As a result, MT5 users have a much harder time trying to find indicators than those using MT4. (Some of the: Best technical indicators and how to use them)

As for MT5, the software’s indicators are written in MQL5, an updated version of MT4’s programming language. This new language is supposed to be much easier to use and it is supposed to entice developers to make more custom indicators. Despite how unfavoured MT5 is right now, its future is bright because creating custom indicators will be very easy due to the easier coding language that is MQL5. As such, in terms of upgradability, MT5 is certainly the way to go as it is more future-proof. Ever since MetaQuotes announced that they will no longer provide MT4 licenses, more developers have joined the MT5 fray and there are many more custom technical indicators and add-ons for MT5 now. (Use these: Uncommon technical indicators)

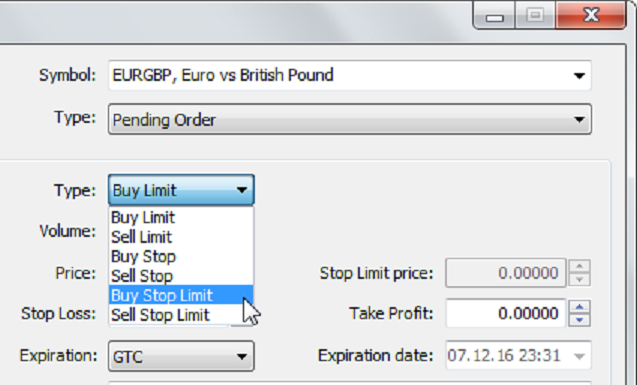

New exchanging instruction types

In the FX arena, there are different types of requests you can make to your broker to act on a particular currency pair. MT4 has 4 types of pending instructions – buy, sell limits; and buy, sell stops. MT5 introduces buy-stop and sell-stop limits. Many traders get confused by the various types of instructions, so let’s try and make it as simple and brief as possible. A buy-stop limit is activated when the specified value is achieved, and the pending instruction places a buy instruction above that value and a stop loss below. It is used when a trader believes values will rise after reaching a target value. The sell-stop limit is the opposite, used when you think values will drop after hitting a ceiling. (Learn How To Use Trade Volume Analysis In The Forex Markets)

Typical instruction types

These are the instruction types you can expect on all exchanging software:

Market/instant instruction

This one is straightforward, and it simply asks your broker to fill in your instructions at the current market value for that currency pair. Buy instructions are filled at the asking value while sell instructions are filled at the bid value, at that time. Depending on how you’re choosing a Forex broker, the instruction may be filled at a suitable value or not if there is slippage. (Instant vs Market Execution)

Pending instructions

Unlike a market instruction where the broker is instructed to fill the position, a pending instruction asks the broker to do so after a condition is met. In the forex market, this condition is the value of an asset, and if the specified value is met, then an instruction is filled. Because the market can move in various ways, there are also a variety of pending instructions to cover them all. (The Elliot wave theory and how to use it)

Buy Limit

You use this pending instruction if you think that the markets will start to rise after dropping to a certain level. For example, if the markets are trending downwards, and you believe the value is about to reach a level of support, you can use the buy limit instruction to catch the subsequent uptrend that will follow. (The: Head and shoulder pattern exchanging strategy)

Sell limit

The sell limit is the opposite of the buy limit, in that it is used if you believe the value will bounce downward after reaching a certain ceiling. You can use this pending instruction when the markets are trending upward and the value is headed toward a level of resistance. Once the specified value is achieved, a sell instruction will be executed in anticipation of the fall in values. (The: Super Apit 8 forex exchanging system)

Buy stop

A buy stop is used if you believe the current uptrend will go on even after reaching a certain value. The specified value in the buy-stop instruction should be higher than the current market value, and you think that it will keep going up. Such an instruction is ideal for breakouts when you believe that the markets will break above a resistance level and keep going up. In such a case, the buy stop would execute a buy instruction above the resistance level. (Tips about Risk-management on Forex)

Sell stop

When you think a downtrend will continue, that’s when you use the sell stop to catch it. Imagine that the markets are trending downwards, seemingly toward a level of support where the trend will typically reverse direction. If instead, you believe that the downtrend will break below the support level and keep falling, you can place a sell-stop instruction below this support level. If the markets do indeed break below the support, then the sell-stop instruction would initiate a short position and give you the profits from that. (Learn about How to find the best Forex spreads)

MT5 pending instructions

With the MetaTrader 5 upgrade come two more types of pending instructions intended to improve traders’ experience and cover more scenarios. These include:

Buy stop limit

This one combines the buy limit and a stop instruction. Here, you believe that the values will rise after reaching a perceived support level, but you still want the values to drop as much as possible before the instruction is filled. Therefore, at the specified ask value is reached, a stop instruction is placed, thereby ensuring that your instruction will be filled. At the same time, a buy limit instruction is placed so that your instruction is filled at the specified value in the buy limit field. Here, you have to enter two figures, the stop instruction and the buy limit. (Are you: Investing for the future?)

Sell stop limit

If you think values will drop after reaching a resistance level, the sell-stop limit instruction will help you achieve the best value. When the specified bid value is achieved, a stop instruction is executed, making sure you don’t miss the trade. A sell-stop instruction is also placed above this value to hang on until the highest level is reached.

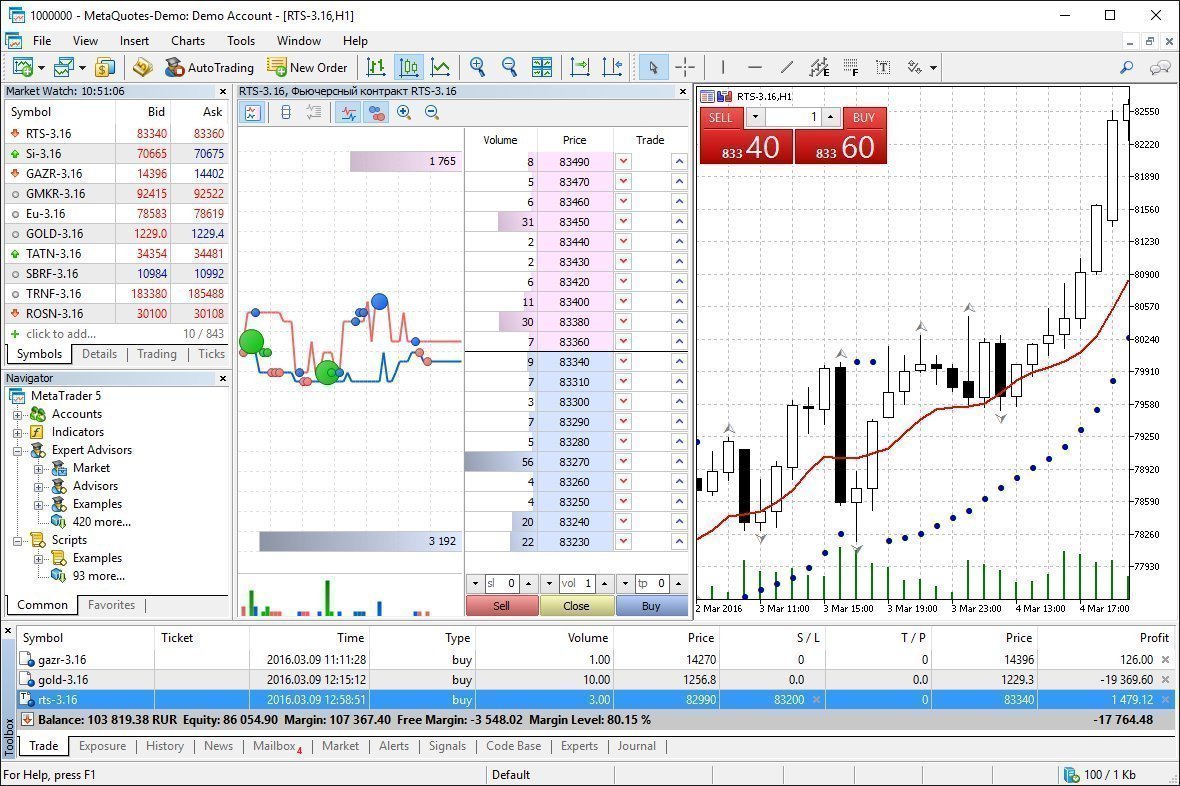

Market depth features

When is the best time to place a trade? One challenge all forex traders face is the question of what other traders are thinking and doing. Even after doing all the necessary research on technical and fundamental analysis, the question still lingers. In MT5, MetaQuotes has introduced a feature that analyses market depth in instruction for people to know how other traders are leaning. (Here are the: Fundamentals of fundamental exchanging)

If it were the stock market where all trades go through an exchange, the information would not be so difficult to attain. However, with the Forex market being decentralized, it is very difficult to know how other traders besides you are leaning. Information about when other traders are making trades is what we refer to as the depth of the market. It is determined by looking at the number of pending instructions to buy or sell a certain instrument and at what time. (The: Basics of stock exchanging)

Why is market-depth data important?

There are several uses of market-depth data that could make a huge difference in your exchanging career. The first use is in determining market sentiment. Market sentiment is essentially how other traders feel about a specific market, which can be very important information. Imagine you discover that, say, there were more pending instructions to sell a certain currency pair than there were to buy. Automatically, you would realize that the majority of forex traders assumed that values for the currency pair would drop. (These are the: Indicators of mood in the forex market)

This is not to say that you should make your trades based solely on the depth of market data, but it should clue you in. For example, if the situation just described happened right before a news announcement by the FED and the pair was the EUR/USD, perhaps traders believe there may be dovish monetary policies going to be announced. While exchanging the forex market, it is always a good idea to go with the tide, and it may be one of the situations where the herd mentality works in your favor. Remember, values shift based on supply and demand, so knowing market sentiment can put you on the right track. (Some of the: Forex market sentiment indicators)

However, the main use of market depth data is to determine the best time to trade. For example, you may learn that there are 1,000 pending instructions to buy the GBP/USD pair at a value of 1.2345, but only 100 to buy at 1.2445. This knowledge tells you that there will be more market depth at a value of 1.2345 than at 1.2445. market depth means volatility, and if you can ride the wave when there is a large market depth can mean more profits. In our example, values may rise sharply from 1.2345 because many pending instructions to buy will be executed at this value. (Concept of Currency correlation and how to use it)

Besides, you can learn other information about the market you’re exchanging. Back to our example, you can deduce that there may be a resistance level at 1.2445 because only a few pending instructions to buy have been placed at that value. You too can respond to this information by covering your position at this value because you know it is unlikely values will go higher. (All you need to know about Hedging)

As you can see, there are a lot of uses for market-depth data, but where do you find it?

How do you find out the market depth?

No matter how important it may be, the depth of market data is very difficult to find because the whole industry is decentralized. The only way to get this information, therefore, is from your forex broker. Unfortunately, even your forex broker faces the same challenge, and they can only provide Tier II Market Depth. Ever wondered: What's going on with oil and how does it affect traders?)

Tier II Depth of Market data is provided based on the broker’s own clients’ trades. Since the broker can see what all their clients are doing, they can tell the number and direction of pending instructions placed by their clients. The problem is that this information is only as good as the number of clients a broker has. A major forex broker with hundreds of thousands of traders, though, can provide reliable market-depth data. Nevertheless, working with a broker offering MT5 and who has a lot of clients should give you a very good idea of market depth. (Learn How To Use Position Trades In The FX Arena)

Better optimized backtesting/strategy tester

Before applying any forex exchanging strategy in a live account, you first need to know how effective it is in the markets. Usually, you do this on a demo account, but that takes time, maybe even months before you’re certain of its probability. Why not work backward instead? This is what we call backtesting, and it involves testing the efficacy of an exchange strategy based on historical data. After the process is complete, the hypothetical results are analyzed to see if the strategy could have been profitable over the period it could have been applied. (All you need to know about Identifying the false breakout exchanging strategy)

How does it work?

To understand how backtesting works, you have to imagine a hypothetical situation. For example, you wanted to see how profitable an exchanging strategy based on moving averages would be. You would then specify the conditions of your forex exchanging strategy into the exchanging software, and these would be applied to the historical data provided by your broker. (More on The pullback exchanging strategy)

When backtesting, the longer the period of the test, the more accurate the results will be. Usually, backtests will use data from 2001 to the present, which would cover various market situations. Finally, you can analyze how profitable the strategy could have been if it had been used. (Let’s try: Comparing fundamental and technical analysis)

How to perform a backtest

In this tutorial, we’re going to look at how you can perform a backtest using the MetaTrader software. There are several dedicated backtesting software available, but you have to pay for most of them. Besides, MetaTrader is the most favored exchange software, and you probably already have it installed right now. (This is: How to trade with cTrader)

Therefore, to perform the backtest on your MT4 software, you will first need to download the necessary historical data upon which the strategy will be tested. To do this, select ‘History Centre’ from the drop-down menu under ‘Tools’. Then select the currency pair and timeframe you want to test the strategy over. Click on ‘Download’ and wait for the process to complete. (How to create an exchange strategy)

Once this is done, open the ‘Strategy Tester’ window under ‘View’ – it should show up at the bottom of the MT4 window. Now select the currency pair whose historical data you downloaded and the timeframe. Under ‘Model’, choose ‘Every tick’ to get the most accurate results, and set your spread. (How to choose an exchange strategy?)

Finally, select the period over which to test the strategy. Here, the longer the period, the more accurate the results. A smaller period may not cover a variety of market conditions, but a longer period would. If you’re going to be using the strategy for the foreseeable future, you want to make sure it holds up to various market conditions. I suggest using at least 5 years of data for a long-term strategy and a year’s data for a short-term strategy. (Using the: Cycle extremes Forex exchanging strategy)

When all the preparation is done, click on ‘Start’ and wait. The backtesting may take a while depending on the period and the strategy itself, but you can continue exchanging nonetheless. After the backtest, the results will be tabulated and graphed, showing the potential returns from a $100,000 account balance. Then all that’s left is to decide whether the percentage profits are to your liking or not.

How effective is backtesting?

Backtesting is a very effective way to test a forex exchanging strategy, and that’s why it is so favored, even professional traders do it. However, the strategy tester on the MetaTrader 4 software is not the most accurate, which is where MetaTrader 5 beats it. The latter can deliver more than 90% modeling quality if you choose the best mode. If you’re going to trust your money in the hands of an exchanging strategy running on, say, a VPS, you had better be sure about it almost completely. Some backtesting software can deliver up to 99% modeling quality, but you might have to pay for these. Meanwhile, you can always backtest your current strategy on both MT4 and MT5 to get a good idea of how effective it is. (This is: Why Traders May Need To Use a VPS Service)

Transaction speed

MT5 has been made ‘lighter’ and faster in its operations so that there will not be any lag when it comes to executing instructions. MT4 is already pretty good, but it tends to lag especially when there are a lot of custom indicators included. MT5 aims to eliminate all such problems thanks to the improved programming language MQL5. Besides just overall speed, the use of one-click exchanging should also assist traders to make faster trades right from the real-time Forex charts.

Scalpers will also appreciate the new techniques for chart structuring. These focus on the 1 to 10-minute timeframes suitable for scalpers who work on shorter timeframes. This will be especially advantageous to those using the best Forex ECN brokers that offer excellent transaction speeds. (The: 10 rules of how to earn money with scalping)

Included economic calendar

On MT4, the economic calendar Forex is not available, and one has to look for other alternatives. The only feature available that resembles the economic calendar is the ‘News’ tab below the indicator window which features a few news headlines of current events. For a trader, these are not enough since the information is not well laid out. For traders on MT4, you can use our economic calendar to see relevant news. In MT5, though, the economic calendar is embedded into the software itself and the information can be categorized into the day weeks, and hours to be effective. Since traders can do all their fundamental analyses right from the software, the entire exchange experience is streamlined to make traders comfortable. This is a huge plus for the MT5 software. (This is: How to work with the economic calendar)

The verdict

Although many may not know, there has been a rambling among industry leaders about shifting to MT5 and phasing out MT4. In an interview with FinanceFeeds, Brad Alexander, CEO of FX Large, said that many companies in the FinTech sector are now creating add-ons and plugins for MT5 and only just a few for MT5. Clearly, this shows that MT5 is indeed future-proof compared to MT4, which is a good reason to upgrade. An example of this has been the release of ImpactCRM by ImpacTech which provides connectivity for a broker to liquidity providers, risk management tools, back office features, etc. (Learn: How to protect yourself from margin call)

It’s not just the brokers who are going to enjoy the new features, as we have seen all the great additions in MT5 above. Due to all these, MT5 seems like a clear winner in the battle for exchanging software. We at TopBrokers wholeheartedly advise all traders to start testing out the new features in MT5 early before MT4 becomes completely obsolete. As usual, begin with a demo or cent account so that you’re not tripped up and lose your money. Once you are comfortable with the software, there are several MT5 Forex brokers available to choose from.

To see some of the new features on MT5 for yourself, here is a video by MetaQuotes introducing them to you:

IndiaUS

IndiaUS