On this website, we mostly focus on the FX arena, but it is not the only avenue for trading. As you may have noticed by now, many FX brokers offer commodities in the form of CFDs including metals like gold, silver, etc. Many retail traders don’t take advantage of this offering, yet it can be very profitable to anyone. In this post, we’re going to show you how you can trade metal CFDs right from the same platform you use to trade currency pairs. Then we shall also focus on specific metals that are most common and how to trade them. Before we get there, though, first we shall need to look at the metals arena, its history, and currency status.

How the metals arena became more accessible

In the past, trading of metals on various exchanges was strictly the purview of the elite and corporate investors. First of all, unlike stock arenas that can be found practically in every country worldwide, there aren’t as many commodities exchanges in the world. Second, commodities are sold either in the form of options or futures, both of which had never been as attractive for the individual trader or investor. (Find out: What's going on with oil and how does it affect traders)

For one, metals have very high capital requirements, even more than what you need to buy stocks. If you consider, say, buying futures for gold at the New York Mercantile Exchange (NYMEX) would require an initial margin of $4,950. Keep in mind that these are futures contracts representing 100 ounces of gold, which means that the trader could receive a margin call if their account balance fell below the maintenance margin of $4,500. As an example, assume that an ounce of gold is currently priced at $1,200, then the value of gold fell to just $1,995. Since the contract represents 100 ounces of gold, the total loss on the account would be $500 – ($5 * 100). Thus, if the trader had only $5,000 in their account, they would already be getting a margin call from their broker because their account had reached the maintenance margin. (Get into more details on Trading commodities)

Now compare this to the stock arena like the New York Stock Exchange when it comes to stock trading. There is technically no minimum capital requirement in buying stocks, so you could theoretically buy a single share of Apple for the current price of $228. Of course, this is not advisable since there are broker fees and commissions tacked on the trade, but you can do it nonetheless. As you can see from this example, the commodities arena locked out a lot of individual investors, leaving it mainly for institutional investors and the ultra-rich capable of depositing millions with their broker to avoid margin calls. (Interested in trading stocks? Learn: How to trade on the NYSE)

Moreover, they have a high cost per tick. In our example with gold futures at NYMEX, every tick costs $10, which means that it is possible to lose a huge chunk of your capital when the value of the commodity goes down. With stocks and other arenas, however, the cost per tick is significantly less thereby allowing more people to participate even without huge bank accounts. After all, just ask yourself why there are so many investing apps for the stock arena and none for the commodities arena. This is where the CFDs come into play, and why they have changed the game when it comes to the commodities arena. (Have you ever asked yourself: Should You Invest In CFDs Or Stocks To Make More Money?)

When trading CFDs, you don’t buy the futures or the options contracts but merely track the value of the underlying commodity. This frees the trader from any margin requirements by a commodity exchange. AInthat, there are added benefits when additional features like leverage are included to increase the potential profits. Since 2009, there has been increasing competition among FX companies, and that forced them to come up with CCFD offerings. At first, CFDs were mainly for trading stocks, but they soon realized that there were even more opportunities if commodity CFDs were also included. Today, the best FX brokers typically offer several CFDs for commodities including metals. The most popular ones are gold and silver, although other precious metals like platinum and palladium may also be available as trading instruments. To further make access to these products simpler, there are now micro-lots that allow traders to place their orders with even very small amounts of capital. (This is: How to protect yourself from margin call)

Why you should invest in metals’ CFDs

At this point, you may be thinking that just because something is available and easy to access doesn’t mean you should invest in it. That is until you start to consider the special place that metals have in the financial arena. To understand this, we first have to look at the components of the financial arena, which is divided into the capital arena and the money arena. There are perhaps a lot of ways to classify financial arenas, but these two classifications are the broadest forms. (You can: Learn All About The Gambit FX Trading Strategy)

Capital arena

The capital arena is an arm of the financial arena that allows for the long-term trading of debt and securities. Long-term in this context is defined as being more than a year. Some of the debt traded may include bonds that a company or government entity may use to acquire debt. A notable example is the European Central Bank’s program of buying €2.4 trillion in bonds to stimulate economic growth in the area. Companies also issue corporate bonds or shares to the public to raise money for projects. As for the securities, a company may issue stocks in the primary arena for the same reason. (Learn these: 10 steps of successful traders)

Access to the capital arenas is granted mainly to institutions already in the financial arenas like stock exchanges, investment banks, and hedge funds; although there is still some access granted to individuals. These capital arena entities are also interconnected globally, although they tend to be concentrated in financial hubs like New York, London, and Hong Kong. Because they are usually the most heavily traded, capital arenas are also the most followed as an indicator of the world’s economy. (Everything you need to know about Trading using central banks' reports)

In general, capital arenas are considered to be riskier, which is why any entity involved is monitored by financial regulators like the FCA. Their huge impact on the global economy also means the capital arenas need a lot of scrutiny (These are: The 3 Most Trusted Exchange Authorities in The World)

Money arena

Unlike the capital arena where investors are not in a hurry, money arenas are something of a temporary location to keep your money. Money arenas involve those trades that typically don’t go over a year. Some examples of this include the stock arena once again, the FX arena, and the commodities arena including metals. The main role of the money arena within the financial arena is to ensure there is always liquidity in the financial arena. Here, the main participants are speculative traders like you and me, and not surprisingly these products are much more stable. This is because we would never go for something we thought would lose money. (For US residents, these are the: 5 tips for opening a PAMM account in the US)

What do these have to do with metal CFDs?

From the above definitions, a clear pattern emerges showing the movement of funds from the money arena to the financial arena. In the financial arena, stocks are the key to everything, and their value is determined by the assets they represent. For example, Apple shares represent the company’s assets and the fluctuation of the share prices represents the company’s performance and the confidence of investors in the company. Anyway, resources are transferred from one sector to another, whereby we have 4 separate sectors – household, commercial firms, public sector, and financial intermediaries. Most of the funds are collected in the household at first, but then it is funneled into the money arena through the banks that eventually lead to the capital arena. (Everything you need to know about Looking for arena correction)

Out of all this, the takeaway is to notice and take advantage of the balance that needs to be maintained to effectively balance your capital. Since metals fall under the money arena, they are less risky and thus used to hedge against risk in other investments. Just ask yourself this, why does the value of gold go down when the government bonds performance goes higher? It’s because the metals arena is used to hedge against any shortcomings in the economy. This way, an investor can always keep their money growing in both down times and good times. This is why you should also consider investing in the metals arena yourself, as it can be a good source of passive income while also keeping your investments safe. (Some: Simple Day Trading Strategies You Can Use In The FX Arena)

How the metals arena works

By now, you should be completely convinced of the need for participation in the metals arena and eager to get into it. That is the right attitude, but you’re going to need some guidance into how the arena works in the first place. After all, no one ever succeeded until they knew exactly what they were getting into. We shall start by describing how metals are classified before getting into the exchange itself.

Types of Metals and their classification

According to experts, metals are classified into two main groups i.e. black and color. The former category, black, includes iron, manganese, and chromium as well as all alloys that contain these metals. As for the latter category, color, there is still some controversy, but here is where the metals arena is focused. Weirdly, about 90% of the global metal exchange involves metals in the ‘black’ category, yet there is very little mention of iron in the metals arena. Perhaps this is because most of the exchange of steel and iron occurs directly between the supplier and consumer without going through an exchange. Due to this, there is very little liquidity when it comes to iron and steel, and FX brokers are reluctant to include such an offering with their list of exchanging conditions. It also makes sense because steel and iron are the most frequently used in construction whereas the other category of metals is just too expensive for such projects. (Do you know: How easy is it to exchange Cryptocurrency in the FX arena?)

That being said, we shall focus on the remaining 10% of metals traded that are categorized as ‘colored’. Again, these too are classified into two sub-categories – precious and base metals.

Precious metals

These are metals that have a high economic value and can be used either industrially or as an investment. In industry, they are used to make specialized components for electronics, jewelry, etc. For us, we need only focus on these precious materials merely as investments and nothing more. Some of these precious metals include:

- Gold – for speculators, it is the most popular metal for exchanging in the commodities arena. Due to its close association with the dollar, it is very critical in the money arena

- Silver – something of a little brother to gold, it is also a very liquid metal in the commodities arena and can also be very volatile

- Platinum – it is used in the manufacture of jewelry and other industrial parts. For these reasons, platinum is highly sought after by manufacturers creating high liquidity for it in the arenas as well

- Palladium – mainly used in industrial manufacture, it too has high liquidity that makes it good for exchanging in the arenas

Base metals

Unlike the precious metals that are very rare and thus their high prices, base metals can be more easily found on the earth's surface. Their main use is in the industry for construction and manufacturing applications. Some of these metals include:

- Aluminium

- Copper

- Lead

- Nickel

- Zinc

How metals are traded

The metals arena works in much the same way as any other financial arena in the world depending on forces of supply and demand. When demand for a particular metal is up, the value of that metal will go up and vice versa. The only caveat to this change in value is that it occurs very slowly over time instead of reacting immediately to news announcements on the FX calendar. If, say, the US Bureau of Labour Statistics announced that unemployment had gone down, the FX arenas would be shaken immediately. The metals arena will react slower because the demand for metals doesn’t change just because of a lower economy but as a consequence. If unemployment goes down, for example, it means that there are more workers hence an increased need for metals and their eventual rise in value. However, this will happen sometime later unlike other financial arenas. (Some of the: Indicators of mood in the FX arena)

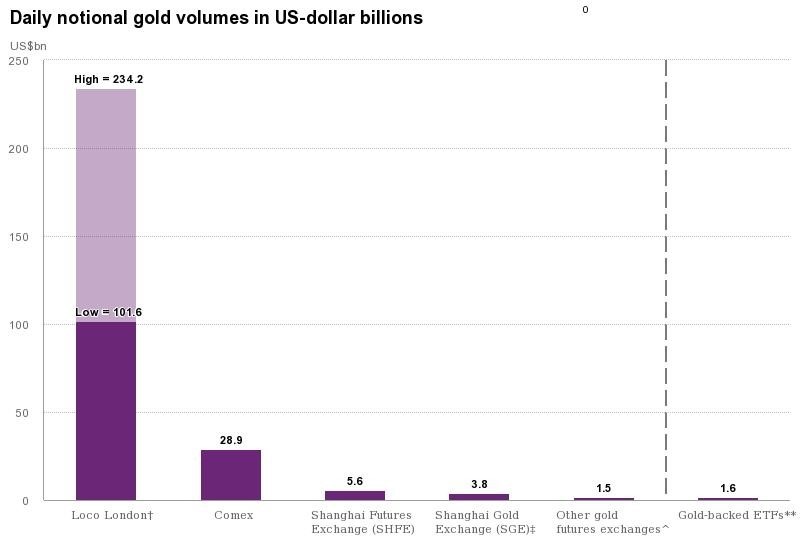

Do you remember the 4 pm fix for the FX arena that allowed for the rigging of arena prices? Well, there is also a fix that happens for the metals arena twice a day. The first fix occurred on the 19th of September 1919 and was conducted by the 5 principle gold traders at that time. This fix was done physically twice a day in London at the offices of N. M. Rothschild & Sons until 2004 when the fix finally was done by telephone. Today, the fix still happens twice, although it is conducted by Barclays rather than Rothschild. The first fix happens at 10:30 AM (London time) (5:30 AM EST) and the second one at 3:00 PM (London Time) (10:00 AM EST). Although there are only a handful of commodities exchanges in the world, it was still important to have a fix that would standardize the value of metals across all exchanges in the world to avoid confusion. (Ask yourself: How Did Tether Cryptocurrency Survive The Crypto Arena Selloff?)

There are several ways in which metals can be traded:

Spot transactions

This is the most common and straightforward way of exchanging metals because the transaction is carried out immediately and at the current arena prices. Delivery of the metals does not exceed two business days, after which the transaction is canceled. As mentioned before, the spot value of any metal is determined after the fix, which becomes the current arena price at that time. Before the fix, the value of a particular metal may vary depending on the arena force at the commodities exchange. (Know the difference between Instant vs Arena Execution)

With spot transactions, minimum values are depending on the metal. For gold, the standard volume is 5,000 troy ounces (155kg), with silver the volume is 100,000 troy ounces (3 tonnes), while platinum’s standard is 1,000 troy ounces.

Swaps

Swap transactions are a bit more complicated because they involve both a spot transaction and a forward commitment. The spot transaction is referred to as the floating-leg component of the transaction while the forward commitment is the fixed-leg component. The floating-leg component is held by the consumer while the fixed-leg component is held by the producer. To understand how metal swaps work, it’s best to use a practical example. (Know: All about swaps)

Let’s take a company that manufactures computer processors using gold, and they would like to be assured they would receive gold for the next 5 years without fail. To do so, they agree to pay the spot value of gold. As an assurance, the producer, say, a gold mining company, could acquire a forward commitment that dictates the price at which they can sell the gold at a future time; perhaps after a year. In so doing, the consumer is assured of delivery of gold in the future, while the producer is sure of the price they can sell the gold at in the future. (You should: Learn How To Use Position Exchanging In The FX Arena For Profit)

Unlike futures that are traded over an exchange, forward commitments are over the counter without an intermediary. This allows forward commitments to be tailored to the specific needs of the producer and consumer, hence they cannot be resold in the open arena as they are particular to the needs of the two parties. A downside to these metal swaps is that they are not accessible to the retail exchanger like you or me and are only done by large institutional investors. For example, the standard swap deal consists of 1 tonne of product or 32,000 ounces. However, the London Metal Exchange launched a metal swap facility in 2012 that would go through the exchange to increase protection for both parties without interfering with the swap details. (This is the: Alchemy exchanging system for the FX arena)

Deposit operations

These are deals struck when an institution needs to attract the deposit of metals or to keep it in their vaults for a specific period. It is similar to what banks do when they want to urge investors to make deposits by increasing interest rates. In the metals arena, a company may offer higher interest rates for deposits of particular metals for a specified period. Even when a company does raise interest rates to attract metal deposits, the rates are usually lower than those of currency with a difference of about 1.5%, which explains the lower liquidity in the metals arena. (Make sure to: Think Twice When Making A Deposit In An FX Company)

Futures

These are the most common kinds of transactions in the metals arena, and they are conducted through various commodity exchanges in the world. A futures commitment is an agreement to buy a particular metal at a later date and a predetermined price. For example, a company may enter into a futures commitment to buy gold bullion at $1,200 one year from now. The benefit is that it gives the consumer assurance that they can acquire the raw materials they need and at what price. On the other hand, the producer also knows beforehand how much they can expect to be paid. Both parties are thereby free from fluctuating prices in the arenas. (Here is: All you need to know about future commitments)

What makes futures more accessible is that they can be sold in the open arena by either of the parties. For example, if a consumer had a futures commitment for gold at $1,200 that would mature in a year, and it seemed likely that gold prices would rise in a year, other consumers would also love to hold that futures commitment so they wouldn’t have to pay as much. All futures transactions are done through the metallic elements exchange, assuring the security of the contracts. (The: 10 rules of how to earn money with scalping)

Options

Unlike futures that dictate that the metal must be purchased at a particular date in the future, options only give the holder of the contract the right to buy the metal at a specific price, but not the obligation. If the maturity date for the options contract is reached and the buyer does not exercise the contract, then it simply expires. This is unlike a futures contract where the seller must get paid on the date of maturity. (All about Options trading)

An example of an options contract could be where the buyer gains the right to buy gold bullion at $1,200 within a year. If during the year the price of gold shoots up to $1,300, they can exercise the options contract and buy gold at $1,200 then sell it on the open arena at the spot value of $1,300 and make $100 for every ounce. If prices drop instead to $1,100, they can simply let the contract expire rather than lose $100 for every ounce. The only cost in the latter situation would be the broker fees. (You should be: Investing for the future)

Forward contracts

Forwards are a lot like futures, except that they are over the counter and not traded in an exchange. Their advantage over futures is that they can be customized between the two parties to meet their specific needs exactly.

Where metals are traded

Several commodities exchanges in the world offer metals in the various forms shown above. Here, we shall only focus on the world’s largest exchanges where the majority of the metal arena operates. Although a lot of focus is usually placed on the stock arenas, a lot of industries still depend on metal products, and this has kept the metals arena very liquid and active. In particular, New York and London have been the main hubs for metal trading, with the latter being known as the older of the two. (This is: How to trade on the NYSE)

London Metal Exchange (LME)

The LME was officially opened in 1877, although it was still operational since 1571 as the Royal Exchange, London. In 2012, LME was acquired by the Hong Kong Exchanges and Clearing for £1.4 billion. Nevertheless, LME remains to be one of the largest metal exchanges globally with an average trading volume of $11.6 trillion annually. In addition to the large trading volume, the London fixing of metal prices ensures that it remains relevant worldwide. The main metals traded on LME include lead, copper, zinc, aluminum, nickel, titanium, platinum, and palladium. A standard lot for trading could be between 170kg for silver and 25 tonnes for aluminum and copper. (All about Trading stock indices)

All the metals traded on the LME are classified by the exchange itself by the LME trademark and that of the manufacturer. If you are a producer and would want to have your metals listed on LME, then you would need at least two letters of recommendation from recognized metal consumers and certificates of quality from official control organizations. Once this is done, the metals are stocked by lots and placed in LME warehouses in Europe and the US. This is why customers may experience a difference in the final price of metals and those listed on the exchange – because of the transport costs. (Ichimoku trading techniques for the FX arena)

New York Mercantile Exchange (NYMEX)

NYMEX also has a long history in the commodities arena since it was officially created in 1882. Today, it is part of the CME Group along with the Chicago Board of Trade (CBOT), Chicago Mercantile Exchange (CME), and Commodity Exchange (COMEX). The latter one, COMEX, was a subsidiary of NYMEX until they were both acquired by CME Group for $11.2 billion in 2008. The NYMEX division of the exchange conducts trade of futures and options for various commodities like crude oil, natural gas, etc. with metals such as palladium, platinum, and uranium. The COMEX division is more specialized in metals trading offering options for metals such as gold, silver, copper, and aluminum. (Do you know these: 5 Tips to Choosing the Ideal Cryptocurrency Exchange?)

The reason why the metals arena can run 24 hours a day is mainly due to the contribution of the CME Group which has many trading centers around the world including Tokyo, Zurich, Sydney, Hong Kong, etc. through its various subsidiaries. Thanks to this and the use of electronic platforms today, the metal arena can be traded 24 hours a day. The only problem is that different exchanges provide different metals for trade, which means that there may be times when a certain commodity cannot be traded because the corresponding exchange is not active at the time. (The: 5 Most Popular Uses of BTC and Other Coins)

How retail brokers can provide metal CFDs

For a broker to provide CFDs for these metals, they don’t even need to become affiliated with the exchanges themselves. All a broker needs to do is track the value of a particular metal and list it among their trading instruments. Today, most commodities listed on exchanges are valued in both US dollars and euros, so it should not be too difficult to trace the price movements and include them in the FX trading platforms. As we already mentioned, there may be times when an exchange offering a particular metal is not opened, which is why the trading of metals through CFDs is not a 24-hour arena as the FX arena itself. Do you know how to do: Hedging?)

Global trends in the metals arena

To trade in any financial arena, you need to understand those factors that affect the value of metals. In the FX arena, this is usually interest rate decisions by central banks and other announcements on the FX economic calendar. In the metals arena, things are different because the price fluctuation of metals depends on macroeconomic factors rather than microeconomic ones. Some of these factors include:

Impact of China

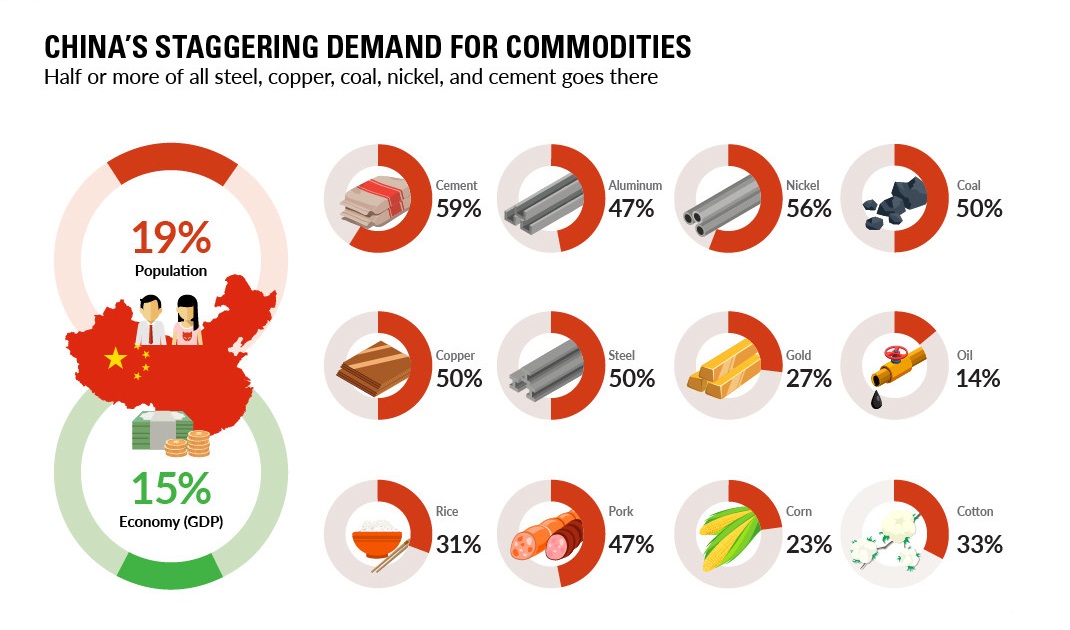

The Chinese economy is the second largest in the world by nominal GDP and the world’s largest by PPP. This means that China requires a lot of metals to build up its massive infrastructure needs to cater to its large population. The World Economic Forum recently reported that more than half of the world’s steel, copper, nickel, and other metals go to China, showing just how much demand for metals comes from the country. Not only does China have a huge demand for metals, but it is also a major supplier. Already, it is the highest producer of steel, aluminum, and gold, meaning that it has a twofold impact on metal prices. (All about Trading commodities)

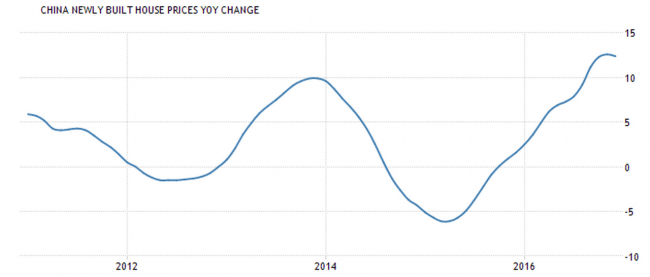

Indeed, there is a very clear correlation between the GDP growth in China and the value of commodities. From the year 2000 when China’s GDP was growing annually at double-digit rates, the value of commodities also rose sharply. Then when China’s economy began to slow down in 2011, the price of metals decreased by 50%. A more recent example can be noted from the ongoing trade war between China and the US with imposed tariffs. The value of gold dropped below the $1,200 psychological level partly because of interest rates but also due to the trade war. This is why other metals like silver, copper, platinum, nickel, and aluminum also experienced a decline in value in the past few months. (What's going on with oil and how does it affect traders)

Because of this, it is important to always keep an eye out for economic news on China and other factors that may affect Chinese demand and supply. For one, monetary policy determined by the PBoC can provide economic stimulation that increases the demand for metals and vice versa. Great economic news in terms of employment and infrastructure should also indicate how the metals arena may fare in the future. (Do you know: What will happen to Bitcoin in 2018?)

Mining technology

A major cost of mining metals goes to the technology required to refine the metals. As you know, most metals occur naturally but only as compounds and not pure metals. Furthermore, many need to be excavated from the ground, which is not very easy. Now there have been numerous attempts to improve the technology used in mining and that should make the mining process easier and faster. With improved mining technology, there will be more supply of metals and that can affect the price of metals. Companies like Cat and Komatsu are now working on automated excavation machines and intelligent mines that don’t require manual labor. These and other such advances in mining technology should be considered especially if you’re trading in the long term. (Look out for the: Main central bank meetings)

Regulations to protect the environment

While it is true that the mining of metals does indeed have a huge environmental impact, laws implemented by countries to address this problem usually cause rapid changes in metal prices. Again, we can look at China’s environmental protection policies that came into effect in 2013 with the proposal to introduce a carbon tax of $30 per tonne of CO2. Such a tax could increase the cost of production of metals like aluminum. It could also diminish the supply of metals when companies are forced to cut down on the use of coal as a fuel. Many other environmental programs around the world affect metal prices and these too should be kept in mind when trading metal CFDs. (Do you know: What is An ICO and How I Make Money On It?)

Growth of population

There are now more than 7 billion people on Earth, and by 2050 the World Economic Forum expects that 6.4 billion will be living in cities. All these people are going to need housing, transportation, and other infrastructure which depend on metals. This is going to create a huge demand for metals in the coming years, but how that demand is replenished will be the interesting part. Mines are usually located away from well-developed locations with good transport, and this could create an imbalance in how the metals reach their destination. These imbalances could provide trading opportunities for metal CFDs if you can spot them quickly. (The: 10 Most Important Resources to a Cryptocurrency Trader)

BRICS countries

These include Brazil, Russia, India, China, and South Africa, all countries with a dominant arena share in the metal arena. These countries produce the majority of metals for consumption around the world and thus have a major say in the prices of these metals. It is almost the same as OPEC nations which have the most oil deposits and can thus change the global oil prices if they wish. In the future, keeping an eye on the relations between these countries and their economies will provide insight into how metal CFDs will perform.

Where can you get information about metals?

Just like those resources cryptocurrency traders rely upon, some inform metal traders on global trends. One of the most enlightening is the metal indices for either precious or industrial metals. Here are some you can check out.

- S&P GSCI Precious Metals Index

- S&P GSCI Industrial Metals Select

- DBIQ Optimum Yield Industrial Metals Index

- UBS Bloomberg CMCI Industrial Metals Index

By keeping an eye on these indices, one can stay abreast with global trends in the metal arenas to better trade metal CFDs. (Do you know: Which Are The Most Influential Cryptocurrency Arenas By Country?)

Trading tips for various metals

It is not just enough to know what factors affect the metal arena, but also how you can trade specific metals. Unlike the FX arena with over 50 currency pairs, we can focus on the 5 most heavily traded metals so that you know how to trade them. Besides, these are the 5 most commonly listed metal CFDs by FX brokers. (Ever wondered: How much money do FX brokers make?)

Gold (XAU)

Gold is the most heavily traded metal CFD provided by FX agents because it is very liquid but not too volatile. In the short term, it is not too vulnerable to economic fluctuations, yet it can still experience huge ranges over the long term. This makes it very favorable for long-term and consecutive traders interested in positional trades to hedge against risk. When trading gold, it is important to be very conservative in the size and number of lots you choose considering your account balance. The minimum tick size for gold is 0.01 pips, unlike currency pairs that have up to 5 pips. The spread for gold is also higher than that of currency pairs meaning that you require a higher capital than other FX pairs. To protect yourself from a margin call, always ensure to take the appropriate risk management measures we discussed in a previous post. (Do you know: What is carry trade?)

The most important fact to consider when trading gold, however, is the global economy, in particular that of the US. In the picture above, the value of gold has been overlaid above the US dollar index and you can see that there is an obvious inverse proportionality. When the US economy strengthens, the value of gold drops because investors invest in US securities in exchange for selling gold. If you recall the difference between capital and money arenas, you should be able to understand why this is so. (What Is The Future Of Cryptocurrency In Finance?)

Therefore, when trading gold, you need to be aware of US economic policy. As an example, the value of gold has been gradually decreasing throughout this year because the Federal Reserve has been raising interest rates. Coming the 26th of September this month, the consensus is that interest rates would be raised even further, and that would decrease the value of gold even further. (Some of the: Cryptocurrency Regulations Around the World)

Gold prices don’t depend on the US only, because even global economic movements also have a major impact. During the 2007/2008 global recession and shortly thereafter, for example, the value of gold increased as investors were wary of investing in securities. When the recession was finally over, the value of gold began to level off. This shows that, when it comes to gold, global economic trends are key to understanding how the value will shift in the future. (These are: The 3 Most Trusted Exchange Authorities in The World)

Silver (XAG)

Compared to gold, silver is more volatile, although it is not as liquid. This could be an advantage or disadvantage to various traders depending on their risk appetite, but it is a good addition to your portfolio when considering metal CFDs. Moreover, it is not as volatile as exotic currency pairs that can experience drastic price changes even within the day. Instead, silver’s price fluctuations are more predictable, especially in the long term. Just like gold, though, silver CFDs also have a higher margin requirement than currency pairs and they also have a higher tick value. This means you should also be keen to take the necessary risk management measures to protect your account.

First off, the same factors that affect the value of gold also affect the value of silver. This is why, from the image above, you can see that the price fluctuations for both of these metal CFDs are almost symmetrical. It is because silver has always been regarded almost as an alternative to gold that investors use silver as a haven for their capital in times of financial crisis. When the global economy is good, on the other hand, they move their money into equities and out of silver. That is because silver is also a rare element, although not as much as gold. (This is: How to create a trading strategy)

Apart from the global economic trends, the value of silver is also affected by industry because it has uses beyond jewelry. Thus, the arena forces of demand and supply of silver will also affect the value of the metal and its CFDs. By keeping a close watch on the suppliers and consumers of silver, you can accurately predict how the silver CFDs will perform, and this accounts for the small variations when silver is compared to gold. Fortunately, you don’t need as much capital to trade in silver as you would gold, and that could even make it more favorable than gold. (Now: Cryptocurrency Ads Banned From Google And Social Media)

Copper (XCU)

Unlike the previous two, copper has a lot of uses in industry, and that makes this a very technical metal CFD to deal with. That should not scare you off, by the way, because it is a good thing. If you can remember your high school physics, you will know that copper is a very good conductor of heat and electricity and that makes it an important component of electrical equipment and devices. That should already strike a bell, because the increase in demand from, say, China, should increase the price of copper CFDs. Not only is it used by China for its infrastructure, but also because China is the world’s largest producer of electronics. That also should mean that economic trends in China would affect copper’s value. (Let’s try: Comparing fundamental and technical analysis)

It is also important to look at the origins of copper, which comes mainly from Chile with the largest deposits. Therefore, economic news and other events in Chile would affect the supply of copper worldwide and, subsequently, its value. For example, news of natural phenomena like earthquakes, political instability, workers’ strikes, and monetary policy in Chile would all affect the value of copper. (The: 10 most common mistakes FX traders make)

Finally, copper prices have a seasonal trend as can be seen from the image below. Demand rises from mid-November up to late April the following year before taking a slump. This is probably because of trading patterns by electronics manufacturers during this period. Knowing this, you should always be on the lookout for buying opportunities within this period and selling opportunities outside it. (Does Bitcoin Stand A Chance Of Becoming The Worldwide Currency?)

None of the factors described above is the complete solution to trading XCU CFDs, but rather they should all be taken into account. Fortunately, XCU can create high fluctuations that create great trading opportunities. Unfortunately, only a few brokers provide CFDs for XCU, and it may require a change of agency.

Platinum (XPT)

Here is another rare metal that is coveted by industry and speculators alike. In some measures, XPT is even rarer than gold because only 130 million tonnes are mined annually compared to over 1,700 million tonnes of gold. Add to that, the cost of mining and refining XPT is almost twice as high because the mining process is way less efficient and it takes a lot of time and ore to refine. That being said, the demand for XPT is not small because it is required especially in the automotive industry, as jewelry, and as an asset to store value. (This is: How to select a PAMM account)

To anticipate changes in global prices of XPT, one should look at South Africa most of all since 75% of the global supply originates from the country and 90% of reserves. Just like with XCU, therefore, a trader should be aware of news coming out of South Africa to do with workers’ strikes, monetary policies, and political instability as all these can affect supply. An example of such a crisis was the 2014 South African XPT strike where workers demanded a doubling of wages. Naturally, the price of XPT went up because there was diminished supply in the arenas. (Revealing FX Bonuses Of Brokers: How To Identify A Real Bonus)

About half of the demand for XPT is in Europe where it is used in the manufacture of catalytic converters. Trends in the automotive industry affect greatly the price of XPT since this is where 40% of demand goes. A recent example was the ban on diesel in Germany earlier this year which caused the value of XPT to drop below $1,000. Other changing trends in the industry, like the growth of electric cars, could also affect the price of XPT. (Why FX Trading Should Not Be Treated Like A Casino)

For anyone interested in XPT CFDs, these factors should be at the forefront, as well as the global economy. Due to its use in jewelry, a strong global economy fuels demand for XPT similar to other precious metals. It also has an inverse relationship with the US dollar because it is seen as a haven when the US economy is not doing so well.

Final Thoughts

We have covered every aspect of the metals arena and metal CFDs in this post, which should be enough to introduce you to the industry. As will all financial arenas, the key is to dip your toe first through practice on a demo account before actually trading your own money. Of course, you will also need to find a broker who offers these metal CFDs so that you can stand a chance.

Don't miss to check out our NordFX Trading Platforms and Tools Analysis.

RoboForex

RoboForex Exness

Exness FxPro

FxPro Alfa-Forex

Alfa-Forex Libertex

Libertex FxGlory

FxGlory XM

XM IC Markets

IC Markets Forex.com

Forex.com AXITrader

AXITrader