As a Forex trader, you’ve probably wondered at some point how much Forex trading brokers make from their business, right? Or maybe you’re thinking about starting your own Forex brokerage firm and wondering if it’s a worthwhile venture. Whatever your reason, the curiosity is certainly understandable; I wonder about the same thing. (What are the: Most common questions Forex traders ask)

However, it is very difficult to know how much the average Forex broker makes because they are not required to provide this information to the public, but we can still get an estimate. Forex brokers listed on exchanges, on the other hand, do provide reports on their earnings quarterly and annually, and these brokers can help us determine an accurate estimate. (Are you curious: How to create your own Forex brokerage firm)

HOW DO FOREX BROKERS MAKE MONEY?

Earnings by the top Forex brokers Breakdown

To learn how much brokers make on average, we can instead look at some of the top Forex brokers’ financial statements.

Forex Capital Markets (FXCM)

What better way to know how much brokers make than to look at one of the largest brokers? This is the perfect example to see just how much a Forex broker can make. The image below shows how FXCM’s stock has been performing over the past 4 years. The big dip at the beginning of January 2015 came from SNB’s action to de-peg the Swiss franc from the euro – that was not a good day for FXCM.

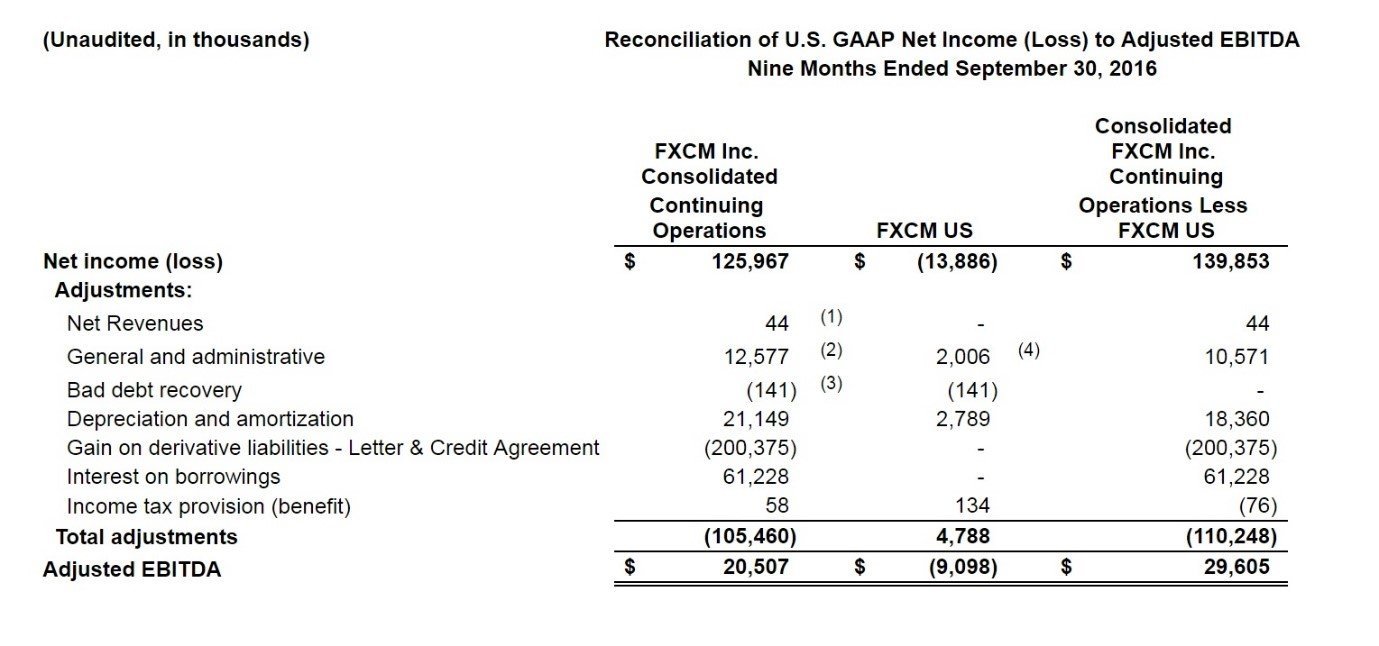

Despite this setback, the company still went on and still kept performing okay in the circumstances. According to a report released by the company on its website, FXCM made $61.4 million in revenues just in the 3rd quarter of 2016. Out of this, earnings before interest, tax, depreciation, and amortization (EBITDA) was $6.4 million. Other financial statements revealed that the EBITDA for the 3 quarters of 2016 up to the 30th of September was slightly above $20 million.

The statement above was released by FXCM Inc. to show how the company would be affected by its US exit. The US subsidiary of FXCM Inc., FXCM US had suffered a net loss of $13.89 million due to fines and repayment of the loan owed to Leucadia National Corporation. As for the entire company, the net income was $125.97 million for the first 3 quarters of 2016. (Who are the: Best-regulated Forex brokers)

The profits for the entire year are yet to be released, but perhaps there will be an improvement. FXCM sold its clients to GAIN Capital Holdings at $500 for each client who placed a trade within 76 days since the 8th of February 2017 and $250 for clients who placed a trade between the 77th and 153rd days from the same date. For a company with over 170,000 clients around the world a significant portion of them being based in the US, the sale might bring in more income for the company. (Know the: Lessons on self-defense: Forex scams)

In addition, they are laying off 150 employees, which will further reduce their costs of operation. All-in-all, it’s fair to say that FXCM makes a good profit, and perhaps their exit from the US market may be a boost for them. On the other hand, dismal performance in the stock market may not be good for the company.

GAIN Capital Holdings Inc.

With FXCM out of the US market, GAIN Capital through its Forex market subsidiary Forex.com is probably going to lead the US Forex market. Even before the buying of clients from FXCM, Forex.com was already a major Forex broker all over the world, and now the profits can only go up.

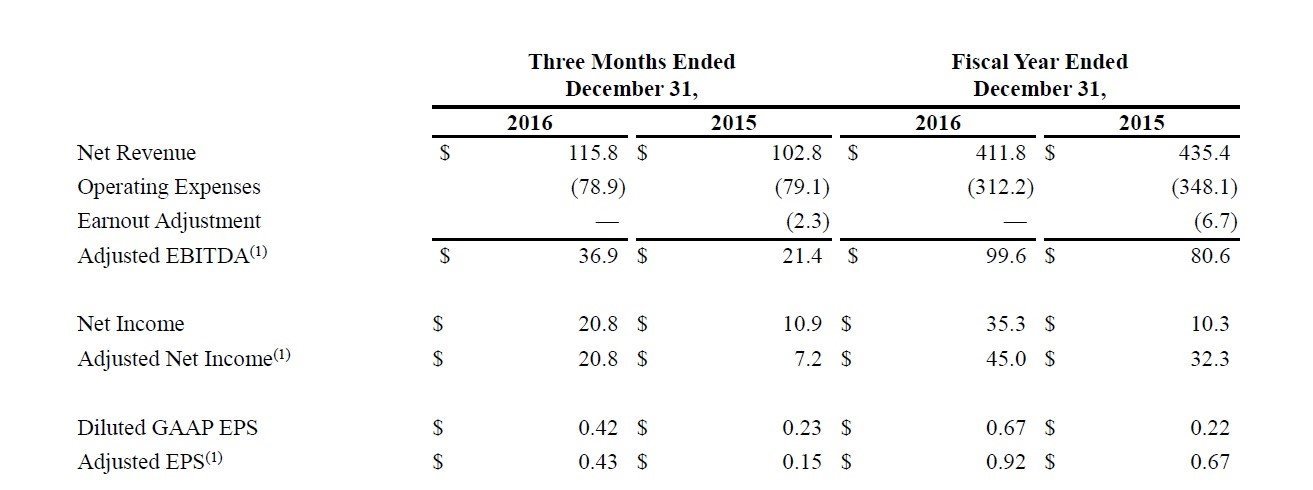

The chart below shows the financial statements made available on the company’s Press releases section of its website:

The revenues for the entire year 2016 were $411.8 million with a net income of about $35 million. Of these figures, $336.3 million of revenue came from the retail segment to generate profits of $115.7 while the rest came from the institutional and futures segments. Forex.com gained 47,000 new clients from FXCM following the deal in February to push the total number of US clients above 70,000.

Income for GAIN Capital was also high in 2016 following the finalization of the acquisition of City Index for $118 million. At the moment, GAIN Capital has over 200,000 clients around the world, 235,000 as of the 1st of November 2014. (Do you know: How to find reliable trading signals)

GAIN Capital is a giant Forex broker and their profits can show us how much Forex brokers make. However, you’re probably also wondering how much smaller Forex brokers make, but that is very difficult to know. What we can do is figure out how much another average broker makes.

Pepperstone

Based in Australia, this broker has quickly grown to become a favorite Forex broker. In an interview with the Sidney Morning Herald in 2014, one of the founders of Pepperstone, Owen Kerr, said that the company had 23,000 clients – mainly in Australia and Asia as they still didn’t have permission to sign up for US clients. This still translated to EBITDA of $36 million in 2013 and $48 million in 2014. For a company that was only founded in 2010, that’s pretty remarkable, but it isn’t even close to what they could get.

Pepperstone is also seeking an IPO to be listed on the Australian Stock Exchange (ASX). According to the Australian Financial Review (BRW) magazine, were Pepperstone to be valued at 20x its 2014 earnings, each of the 2 founders would be worth $300 million. That should give you an inkling of how much Forex brokers can make. Also, you can check our Alpari Trading accounts comparison for more.

FxPro

Although not yet listed on any exchange, FxPro is among the fastest-growing Forex brokers in terms of clients. In addition, the company is seeking to launch an IPO that will get it listed on a London exchange. In the meantime, though, FxPro has announced that it has shelved its plans for an IPO following new regulations by the FCA that will limit the amount Forex traders can risk.

Being unlisted, we can’t get the revenues from the company itself, but there had been reports back in 2010 that the broker made $1,000 from every client per month. Back then, FxPro only had 17,000 clients, but now the client base is much wider and you can expect the profits should be too (make sure to check our Alfa Review).

From the above examples, it is clear that top forex brokers in the world do make a lot of money – enough to tempt you to start one yourself. If so, you will need to know how these brokers make the money in the first place.

How Forex brokers make money

Now that we know how much the largest Forex brokers make, just how exactly do they make their money? Here, the brokers have various avenues for making money, some of which involve charging their clients a fee and others from their investment. (Learn the: Common Forex terms you should know)

Hedging

The minimum capital requirement for running a Forex brokerage in the UK, US, and Australia is about $60.3 million. This amount is supposed to protect the company from going bankrupt in the case of huge client losses. The broker is not supposed to use this amount for trading, but they have all the customer deposits. For large brokers, the customer deposits tend to be enormous.

For example, FXCM reported that they had $725 million in customer equity by November 2016. They also reported having a regulatory capital requirement of $151.2 million, which is $90.9 million above the requirement. That brings the total amount of capital for investment closer to a billion dollars. To put that amount in context, let’s look at the value assets under management (AUM) by most hedge funds around the world:

The chart above is a representation of the findings by Preqin which studied the world’s top hedge funds with AUM above $1 billion; aptly titled the ‘$1bn Club’, as of April 2016. As you can see, most hedge funds around the world have AUM worth $1 to $4.9 billion. For a large enough Forex broker, such as FXCM, they seem to be very close to achieving the same status as the world’s top hedge funds.

This means that hedging forex brokers can then use these funds to invest in various markets and other venues, just like hedge funds do. This provides the highest returns for the Forex brokers even compared to the spreads and commissions charged to their clients. When you think about it, spreads that go as low as 0 pips are not enough to produce the kinds of profits the brokers make, so it only makes sense that they must be getting their money from somewhere else.

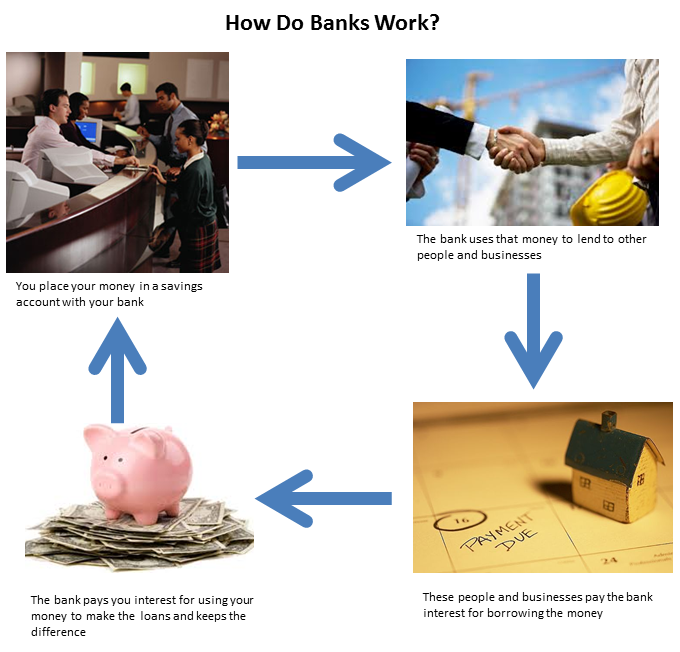

The forex brokers act like banks, although they will never admit it. In the same way, people make deposits to banks, which are then lent out to loanees, the brokers use client deposits to make their investments. Also considering that brokers usually hire the best finance experts, it is not difficult to imagine that they are good at investing.

You have also probably heard of people complaining about their brokers trading against them. This refers to when a broker makes a trade opposite to yours in the markets, thus causing the client’s trades to turn into a loss. When a retail client places an order and the broker sees it going bad, they know that you’re wrong, and they can just make the opposite trade to yours. Having a larger capital, they can place high-value trades, enough to sway market prices.

As you know, market prices are determined by demand and supply, so when an asset, or in this case, a currency, is being bought, this means there is a high demand for it and the price goes up. So, when you’ve, say, shorted the EUR/USD and an hour later your trade is in the red and tumbling, the broker can place a long position. Their trade will further cause the value of the euro to go up and your losses will get even higher because of the size of their trade.

This is how brokers make money, but a ‘good’ broker will not be too aggressive about taking the opposite side of your trades thereby limiting the amount of loss you incur. So, the main income by brokers is through their investments and trades made using your deposits.

Spreads

The spread is the difference between the asking and bidding prices (see how to find the best Forex Spreads). When a broker is connected to their liquidity provider, they receive quotes at a small spread, then they will increase the spread when transmitting the quotes to your trading platform. The difference may be small, but with enough clients and plenty of trades, it adds up to a huge sum. For example, in 2014, GAIN Capital reported an annual trading volume of $3 trillion. With such a huge volume, even very tight spreads can still bring in a lot of profits.

Commissions

These are straightforward – a percentage is charged from the profits you make on your trades. Just like spreads, the percentage can be small, but over time it adds up to a huge amount of money (see the guide on what is the financial commission).

Dealing desk

The systems described above are used by STP brokers who transfer client trades to liquidity providers. But there are also dealing desk brokers who create the market themselves. For them, they make money whenever the client loses and vice versa. The idea behind the system lies in the higher number of losers than winners there are in the markets. Statistics show that more than 90% of traders lose their investment, which is how dealing desk brokers make their money – directly from you. There’s a conflict of interest in such a setup, but that’s a story for another day.

Factors affecting a broker’s profits

Knowing how much and how they do it, let’s look at some of the factors that can affect the amount of profit the broker can make:

Regulatory requirements

As mentioned earlier, the Forex regulator will set the minimum capital required to run the Forex brokerage, which can impede the amount of capital the broker is free to trade with.

Trading platforms

Forex trading platforms cost money to ‘lease’. MetaTrader 4, for example, requires a $200,000 annual fee. The broker will probably require other platforms like cTrader to attract customers who prefer those platforms. All these will determine the amount of money they make at the end of the year. (See the: MetaTrader 4 advanced features)

Advertisement

There’s no other way of signing up clients without advertising yourself, which also costs money. For small Forex brokerages, the internet is cheaper and still effective, but larger brokers go for more explicit advertising like branding sports teams’ jerseys or sponsoring certain events. Whatever method they choose to advertise through, it certainly affects the profits realized.

Staff

Of course, a brokerage firm cannot be a one-man gig, it requires a multitude of specialists to handle everything from customer support, technical details, market analysis, management, etc. The army of people hired will all need to be paid, and that comes from the company’s earnings. (Learn more: Exness Customer Support and Service Quality Review)

For more Top Brokers make sure you check out our XM Forex Broker review and our in-depth Review of IC Markets Services.

Watch this quick video that explains the main way forex brokers make money:

RoboForex

RoboForex Exness

Exness FxPro

FxPro Alfa-Forex

Alfa-Forex Libertex

Libertex FxGlory

FxGlory XM

XM IC Markets

IC Markets Forex.com

Forex.com AXITrader

AXITrader