We have looked at various exchanging strategies over the years here at TopBrokers – most are easy to understand and some are a bit complicated. Volume spread analysis (VSA) falls into the latter category because it is not the kind of exchanging system that one immediately masters and applies, but it instead requires a keen understanding of arena force dynamics. Despite the difficulty in learning, it is a powerful exchange strategy once mastered, and this post should help you understand all you need to know about it.

What does the VSA method entail?

The main idea behind the VSA FX exchanging strategy is to understand the relationship between the quantity of trade in the FX arenas. We all know that there is $5.1 trillion worth of trades transacted every day in the FX arenas. Yet, retail FX traders like you and I only account for a minute percentage of the total daily traded quantity. Sure, the impact of retail traders has been rising in recent years according to the Bank for International Settlements (BIS), but the major movers of the arenas are the big players who make billion-dollar trades. These include hedge funds, central banks, multinational corporations, etc. Therefore, to truly understand the exchanging quantity in the arenas, you have to think about these players and their impact in the arenas. (Everything you need to know about: The Trade Quantity Analysis FX Exchanging Strategy)

When exchanging based on VSA, you have to accept that technical analysis of the arenas alone may not be enough to understand movements in the FX arena. That is because all financial arenas are primarily driven by the laws of supply and demand. This is what VSA is all about – finding out whether major arena movers are buying or selling. Sadly, the rest of us are just small fish in the sea, and the only way to truly make a profit is to follow the arena leaders. VSA is supposed to help you achieve that, and it depends on several principles to be executed properly. (Before exchanging, try: Comparing fundamental and technical analysis)

Principles to guide you when using the VSA system

Knowing what the VSA system entails, you may think that you’re ready to jump in but remember we mentioned in the beginning that the Fore exchanging strategy is a bit complex. To properly utilize the VSA system, there are several principles you will have to combine to make full use of it.

Studying candlestick length to acquire trade quantity

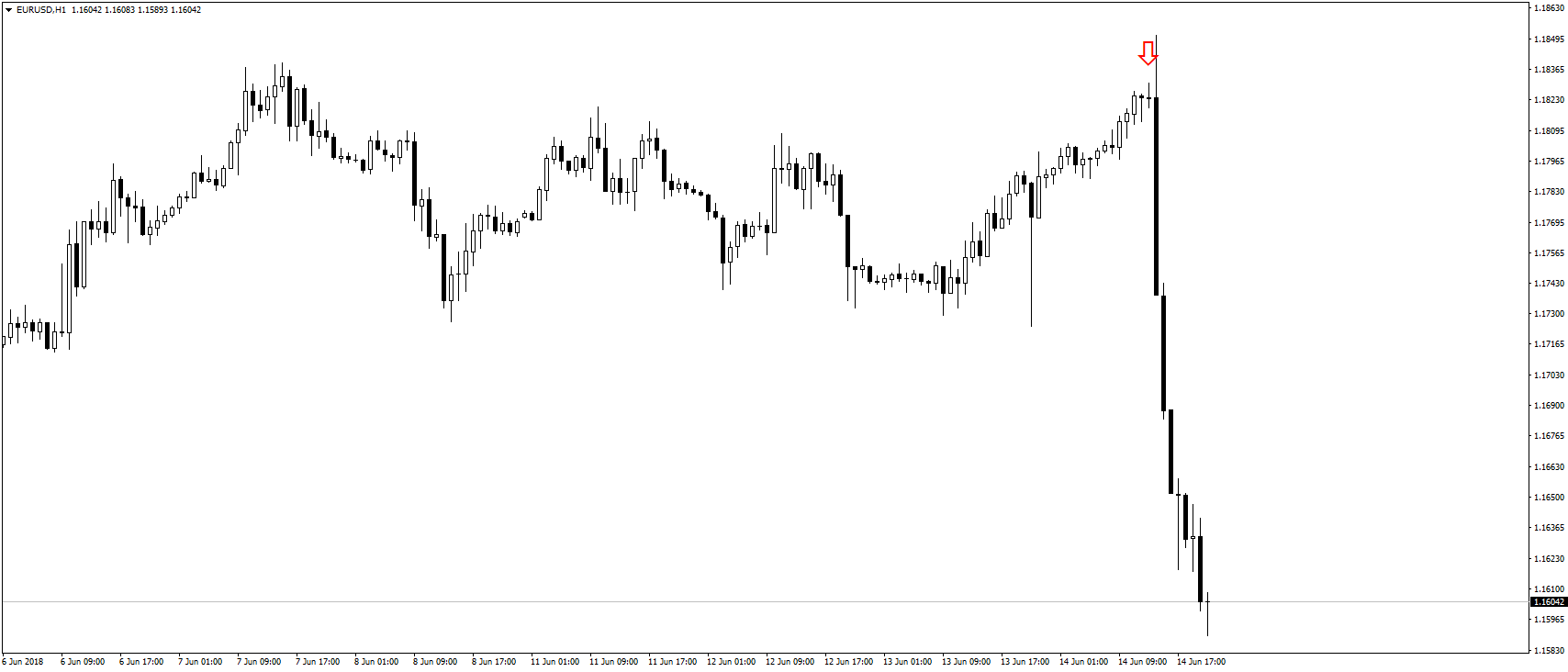

There are different ways to represent the arenas on the FX exchanging charts, yet the most common method is through candlesticks. The reason is that candlesticks reveal a lot more than just the value of the assets, but also trade quantity, among other data. Have you noticed how candlesticks are taller during and after the release of critical news announcements? The image below is a screenshot of the MetaTrader 4 platform displaying the EUR/USD pair for the week before and after the FED decided to increase interest rates on the FX calendar. You can see how the candlesticks were significantly taller than the previous ones, and this is because of increased trade quantity in the arenas. The entire arena reacted to the news, and there was a flurry of orders creating increased quantity, hence the longer candlesticks. (Are you curious about changing interest rates, These are the: Main central bank meetings)

Similarly, we can use this same principle to determine trade quantity every other day. While the difference in length between the candles may not be as dramatic, you can learn to observe the difference nonetheless. This principle is very straightforward, where quantity is directly proportional to the length of the candle. (Here are the: 7 Powerful Candlestick Patterns to Learn and Understand)

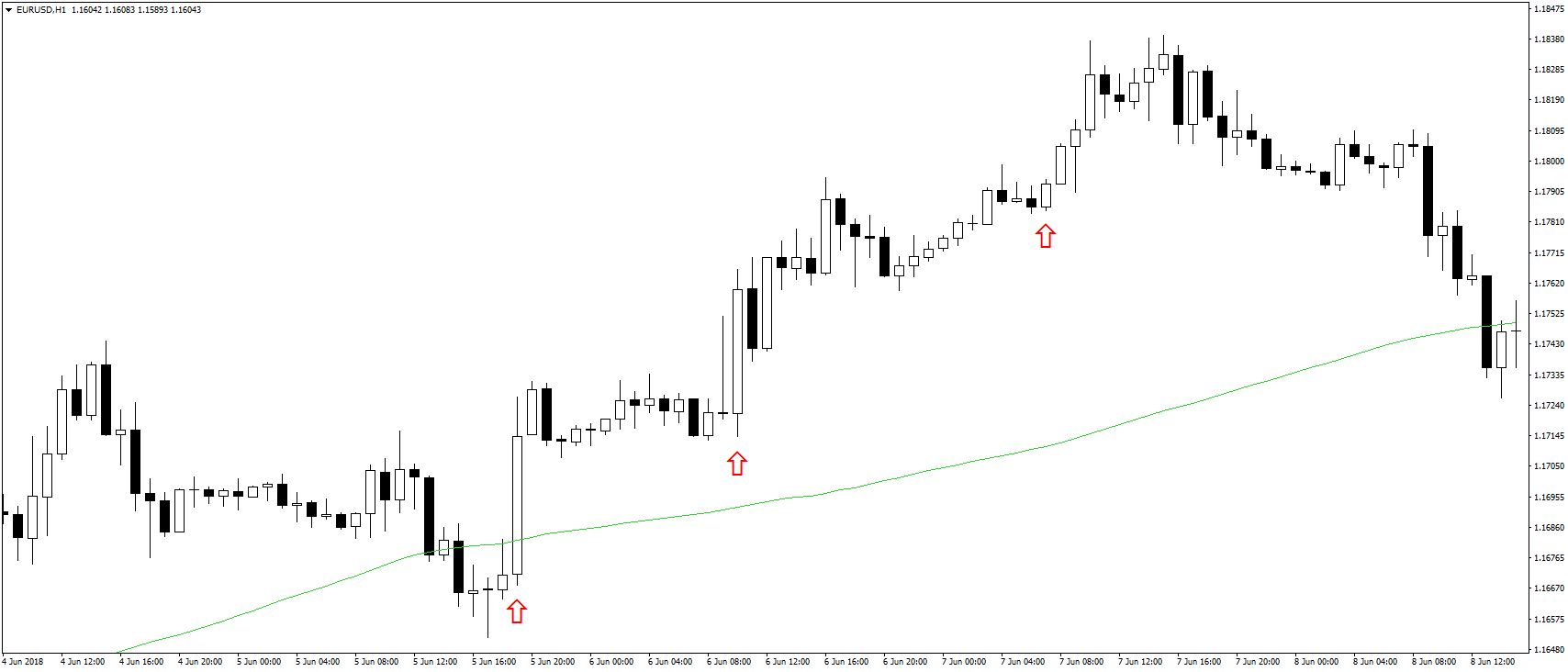

When there is momentum in the arenas, the candles will either remain the same length or increase all through the trend, whether downward or upward. Therefore, when you notice a change in the candles’ length, the trend may be on the verge of a reversal. In the image below you can see how the bullish candles in the arenas kept getting shorter and shorter at each stage of arena correction. Of course, you should not expect the arenas to move in a single direction as there has to be some value correction. Nevertheless, the fact that bullish candles kept getting shorter on each subsequent uptrend was a signal that there was diminishing buying quantity in the arenas. Simply put, the bulls were no longer pushing values upwards as much, meaning that a reversal was imminent. Thereafter, you can see that the uptrend did indeed reverse and start to move down. (Every trader should know about Looking for arena correction)

A similar situation may be observed in a bearish arena, only then the bearish candles will be the ones that will be reduced in length. In this principle of VSA, we use these candle patterns on the FX exchanging platforms to try and determine what the major players are doing. No individual trader can make a candlestick become longer, but the big traders can, and through VSA we can determine what they are doing. It also helps to add one or two complimentary technical indicators to go along with the analysis so that you can be even more sure. In this case, we used the simple moving average, which is very common across all financial arenas. (Some of the: Best technical indicators and how to use them)

Tick quantity against candlestick length

In a previous post, we looked at how a trader could derive trade quantity data just by looking at the tick quantity. Most FX exchanging brokers will provide this information on their exchanging platforms on the exchanging window. We also discovered that this information is accurate and could be relied upon, but VSA goes a step further. Not only do we need to know that there is a high exchange quantity, but also the direction of the arenas. To do so, we look at the tick quantity, the candle’s length, and also the candlestick pattern. (This is: The Trade Quantity Analysis FX Exchanging Strategy)

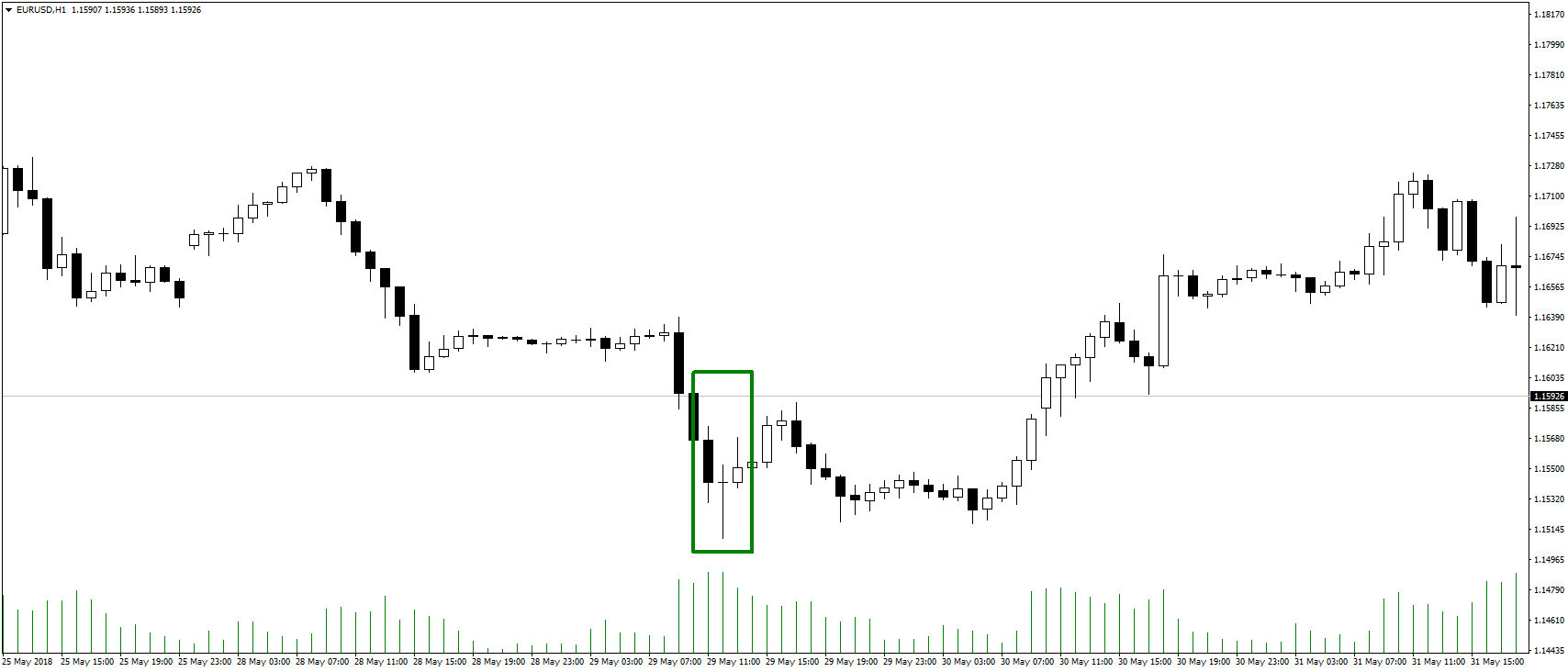

This is even more complex because you need to perceive more than what you’re seeing on the FX charts. The image below could help you, though, as you see how these three come together in VSA. Here, we see the arenas indicating a high tick quantity accompanied by a longer candle. Usually, this would show that the downtrend was continuing but the candle pattern shows the opposite. The formation of a doji candle shows that the arenas are not entirely bearish, but that there was a struggle between buyers and sellers. Therefore, it shows that the bears in this case may have been overpowered by the bulls and that the downtrend may be about to reverse. Furthermore, it indicates that the bulls are all in the arenas if they were able to absorb all the selling orders from the bears. (This is: The Elliot wave theory and how to use it)

In this principle of VSA, we use the three aspects of FX exchanging to determine both the number of trades in the arenas and their direction. This is what makes VSA so powerful that it can be used to make accurate trades in the arenas. For example, in the above example, one would have placed a buy order in anticipation of a trend reversal, which is exactly what happened. (How you should be: Using trendlines in your FX exchanging strategy)

Final Thoughts

With these two principles of VSA we have just considered, it is now much easier for a trader to use the exchange system in the actual arenas. First, a trader needs to look at the length of each candlestick on the overall trend to determine if there may be a trend reversal in the works. If so, the next step is to focus on the actual candles and the patterns they create on the charts. This will help you to determine if there is indeed a reversal and in what direction. This final step is important because it will help you avoid any false breakouts which occur often during moments of high trade quantity. The major players use them to squeeze out the competition and create a vacuum in the arenas, so it is very important to observe. (All you need to know about Identifying the false breakout exchanging strategy)

Finally, you may need to add at least one technical indicator to confirm your suspicions. Remember, the only way to succeed in the arenas is by being very cautious in your trades and minimizing any chances of losing. You don’t have to make many trades using the VSA system because it is a very accurate one. As long as you minimize losing trades and maximize profits on the winners, you won’t have any problem succeeding in the arenas. (The: 10 steps of successful traders)

Do you want to see the VSA system in action? Then watch this short video of an actual trade:

VietnamUS

VietnamUS