The Semafor indicator is one of the most popular custom indicators there is, and I’ve used plenty of them. It is also very reliable if you can understand how to use it well, which is why an entire forex trading strategy has been based on it. In this semafor forex trading system, we’re going to look at the indicator itself in detail and see how it can be used in actual forex market trading.

About the semafor indicator

First, I’d like to correct some misconceptions about the semafor indicator itself. As I mentioned before, you can only maximize the benefits of this system if you understand how it works. Let me start with how it is represented. When you add the indicator to your MetaTrader 4 platform, it is represented by three pairs of circles. These circles have different sizes, and colors and are also numbered from 1 to 3. Contrary to what people assume, the circles of the semafor indicator don’t indicate trend reversals but breakouts in market prices. (Breakout trading strategies)

Every time a new circle is generated, that indicates that there has been a new either high or low created. Depending on the intensity of the breakout, the circles are also numbered from 1 to 3 in ascending order. This is where the colors of the circles come in. In my template attached along with the indicator in the archive at the bottom of this post, I’ve set the colors as such:

- First level breakouts (minor) – blue represents the new low and brown, a new high

- Second level breakouts (medium) – pink shows a new low while yellow, a new high

- Third level breakout (major) – green represents the new low and red a new high

The colors of the circles may seem contradictory, but they are supposed to indicate which direction markets may head and how to place your trades. The colors of the circles can still be changed, though, if you are using different colors on your Forex charts. To make it easy, though, the size of the circles changes too to show the intensity of the breakout. (How to launch an expert advisor on MT4)

How to use the semafor indicator to trade

We now know what the semafor indicator is for, marking breakouts in the market, but how is that information useful? In a previous post, we looked at several breakout trading strategies. The semafor indicator just makes the process visual and easier to determine. Let’s assume, for example, that there is a major breakout to the upside and a red circle appears. This tells us that there has been a new high recorded, but it doesn’t necessarily mean that the trend is going to turn. The new high may have just been produced by a major event announced on the economic calendar forex. So, how do we use that information? (How to work with the economic calendar)

For that, we shall need an additional indicator that reduces noise and indicates clearly if there is indeed an actual trend in the works. Heiken Ashi! The Heiken Ashi indicator changes the color of the candlesticks so that they are not only visually different but also smoother. The method of calculation for HA candles ensures that fake trends are filtered out, hence why we use it. (Uncommon technical indicators)

Therefore, together, these two indicators make up the semafor forex trading system. For example, when a new high has been reached, there is a likelihood the markets have been overbought. Your first instinct may be to sell immediately, but the forex market doesn’t work that way. Famous trader, Jesse Livermore, the bear of Wall Street, once said that the markets are never too low to sell, nor too high to buy. A subsequent high may be set after the current one. (How to protect yourself from margin call)

With the HA candles, though, any fake trends are identified. Continuing with our example, if a new high is set, wait for the HA candles to turn red to make sure the bulls have exhausted their buying power. Even then, wait for a few red HA candles to form before sending the sell order to your forex trading companies.

A practical example in an actual forex trading event

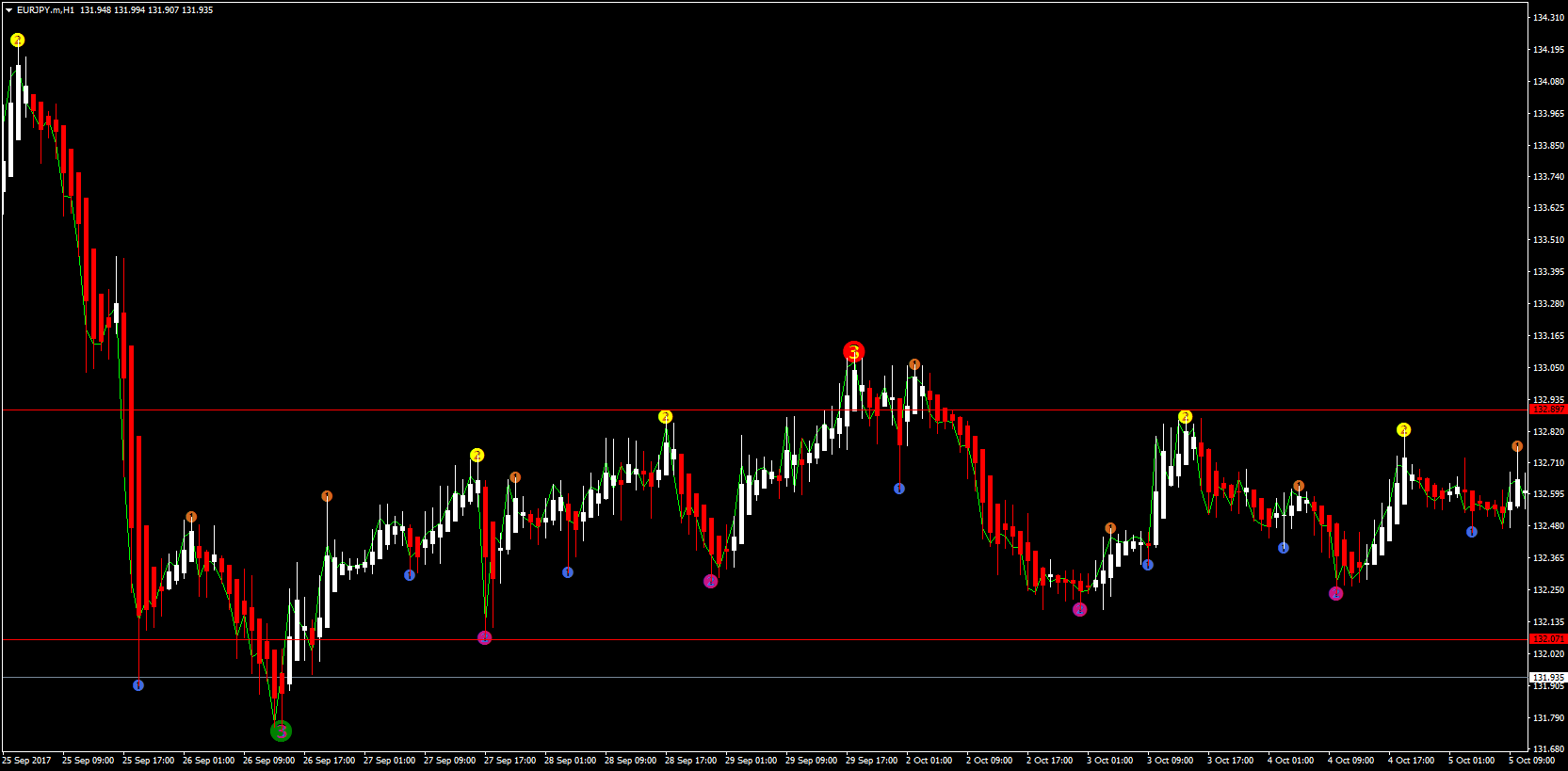

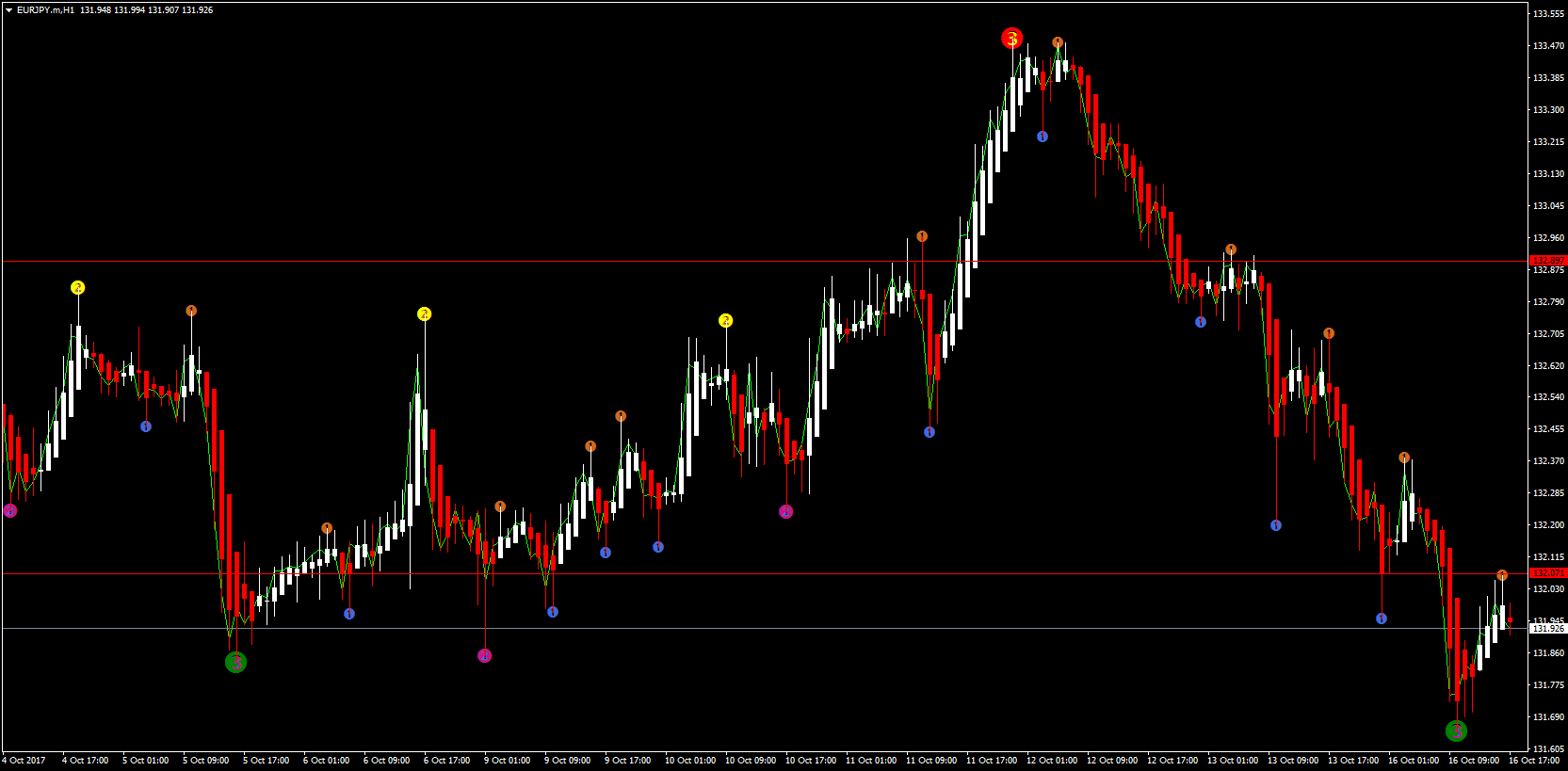

The market situation represented below is a good example of how the semafor forex trading system identifies breakouts for trading opportunities. In the particular case below, the markets remained within range all through even though the semafor indicator kept recording new highs and lows.

Every time there was a breakout, a circle would be generated by the semafor indicator, marking either a new high or low. Nevertheless, the support and resistance levels held strong and markets were unable to break past. Fast forward a few days later and there was an actual breakout. (Identifying the false breakout trading strategy)

Prices had already reached the resistance level that had held strong for days, but this time only a first-level breakout circle had appeared. That meant that the resistance level was no longer the absolute high and that higher highs were to come. The bulls were clearly in control, and we should have been looking for buying opportunities. For that, we would rely on the HA candles – waiting for them to turn white and show that there was a clear uptrend. As soon as that happened, there was a breakout to the upside, gathering hundreds of pips. (The Elliot wave theory and how to use it)

The ideal entry point would have been a few candles after the blue semafor circle on the forex trading platforms. If you were not at your trading station, though, a pending order to buy at the resistance level would also be ideal so that you would catch the breakout. Now that you’re in the trade, wait until the semafor indicator shows you that there has been a new high. In our case, it was a third-level breakout that confirmed the end of the downtrend. (How to draw S/R levels like a pro)

We can also see how the semafor trading system would have worked during a downtrend in the same image above. The support level was only a first-level breakout, indicating more downward movement.

That’s it for the semafor trading system; go thee and gather yourselves some pips and come back only when you’re richer.

Download the indicator and template

If you would like to see this tutorial explained in the video, watch it here: