In any form of business or investment, you have to be careful not to fall for a scam or con that rips you off your money. The easiest way to check if an investment option is legal is to simply check whether the company is registered and perhaps get a look at their books of accounts which is required for every limited company to publish.

With Forex, though, things aren’t that simple – unlike limited companies registered under the country or state’s government, the Forex market is decentralized, which means there is no single institution that oversees all Forex transactions. This presents a great difficulty for anyone interested in the Forex market because it is not as easy to establish the integrity of a Forex brokerage and avoid losing your investment.

Notice how I said ‘not easy’ but not ‘impossible’? That’s because it isn’t. Since it may be more difficult, there are certain lessons you need to learn first to protect yourself against any Forex scams and believe me, there are lots of them out there. So, when you’re wondering, how to choose a Forex broker? Here are the lessons to keep in mind:

1. Check for the financial regulator’s approval

We previously discussed how one can create their own Forex brokerage firm, and one of the requirements was to get approval from the relevant Forex regulators. Every country has an independent body that oversees financial activities, including Forex, and they ensure that the companies enabling these activities are toeing the line of financial integrity. These regulators are not just there to regulate but also to act upon cases of fraud and inform the public about the companies they regulate. As such, every Forex regulator will provide a list of Forex brokerages registered in the region either on their website or physically if you visit their offices. We can’t show all physical locations of Forex regulators, but we can provide several websites that have this information:

- Australia – Australian Securities and Investments Commission (ASIC)

- Cyprus – Cyprus Securities and Exchange Commission (CySEC)

- Russia – Federal Commission of Securities Market of Russia (FFMS)

- South Africa – Financial Services Board (FSB)

- Switzerland – Swiss Financial Market Supervisory Authority (FINMA)

- UK – Financial Conduct Authority (FCA)

- US – US Securities and Exchange Commission (SEC)

Upon visiting those websites, they all have a page with a list of all registered Forex brokers in their particular regions. To find out where to search, the Forex broker is supposed to provide information about which body they are registered to, then you can visit that regulator’s website and find out if the information is true.

2. Go through Forex broker reviews

The world is becoming a truly global community, and this has become very evident in the Forex market and other global businesses and services. Being a decentralized market, the Forex market is not limited to any region of the world, and anyone can participate provided they have an internet connection. This globalization provided an unintended consequence, a global pooling of ideas and responses from all traders.

It is human nature to want to share your ideas and listen to other people’s ideas, and the fact that there’s money involved only provides the motivation to share. At the moment, there are probably hundreds of online Forex forums open to the public and more that require registration, but they are all there so that traders can share their experiences and sometimes teach one another.

However, Forex scam artists know about these and they infiltrate these forums to increase the popularity of their brokerages, which is why we ask that you find real Forex broker reviews. The list we have put together on that page is from a Forex brokers list we have traded with or those our trusted sources have used before.

To identify other trustworthy review forums, simply check how long it has been around, and how many members participate in them. A newly created Forex forum that seems to actively promote a particular Forex company is usually a sign that the posts are not genuine. Also, a consistent outstanding review of any one broker should be a warning sign; no Forex company is perfect, and even the best brokerages will have some issues with payment systems, high commissions, etc. These may be important issues while dealing with a broker, but they are not the most important. What matters is market manipulation, speed of execution, etc., the actual factors that affect your trading, the rest are just afterthoughts.

3. Research the company

The more you know about your broker, the better off you will be. First, seek to find about the company’s origin: when the brokerage was created and subsequently how long they have been in business; have they had any problems in the past such as lawsuits alleging fraud or bankruptcy of the brokerage; the kind of stuff that tells you about the company’s integrity and stability. Some of this information can be found on the company’s website, such as its origins, but they won’t tell you about any lawsuits or bankruptcies filed since they like to keep this information under the table.

For that, you can go back to the review forums, or Google the company about any news articles. Remember when I mentioned that financial regulators are there to inform the public about brokers’ misconduct? Well, if any such activity were found in the past, the regulator would inform the public through news websites about the allegations, helping you know more about the broker.

After you know the basics, you’ve just penetrated the shell of the company, now it’s time to know the nitty gritty. This includes information about the company’s operations: how big are the commissions or do they use spreads; what types of accounts are available; how do you make deposits and withdrawals; the kind of information that will affect your trading. Knowing this not only guides you when choosing a Forex broker that meets your needs but also gives you the evidence you will need in case you have a complaint against the broker. It’s always better to be prepared for such an action, although you won’t have to if you follow all these lessons.

Once you know about their operations, always keep a journal of your trades to compare if the broker is keeping their end of the bargain. This can be a physical journal if you are comfortable with that, although this would not be possible for someone who makes money through scalping by placing hundreds of trades in a day. Use the Forex trading platforms instead; for example, MetaTrader 4 and 5 allow you to ‘Print’ every order after placing it, which means you can export the trade to a PDF file. Alternatively, export the entire list of transactions at the end of the trading session into a PDF or HTML file, or take screenshots of every trade. It’s just a contingency plan, but you will be better off with evidence than having none.

4. Make comparisons

Forex scams come in many forms, and some will manipulate the markets by providing quotes that are different from the market. This is especially common among STP brokers because they act as market makers and you are essentially trading against them. Therefore, when you make a profit, they lose, giving them the incentive to make sure you lose.

Even the most experienced traders sometimes fall for this market manipulation because they are so focused on the Forex charts online resented by their broker that they don’t even look at other Forex charts. To avoid being a victim of this, compare the quotes on your chart to at least one other broker’s chart. They should all be the same, so if you see any differences, you’re probably dealing with a Forex scam.

If you have already fallen for the scam and only realize that the markets were skewed against you, take screenshots and details of the trade and launch a complaint immediately. Often, the broker will refund your account quickly to stop you from spreading the word, and given that they may have scammed hundreds of traders, your discovery won’t affect their bottom line because most traders won’t notice.

Finally, don’t settle for just one broker, even after you completely trust them. This kind of complacency can tempt the broker to try and rip you off, so you should always be skeptical and on the lookout for greener pasture.

5. Watch out for signals of a scam

Have you ever been a victim of a con or scam? Let’s be honest, most of us have, including me, and we learn from these mistakes. Some of the lessons I’ve learned from my own and others’ experiences include:

When the deal is too good…

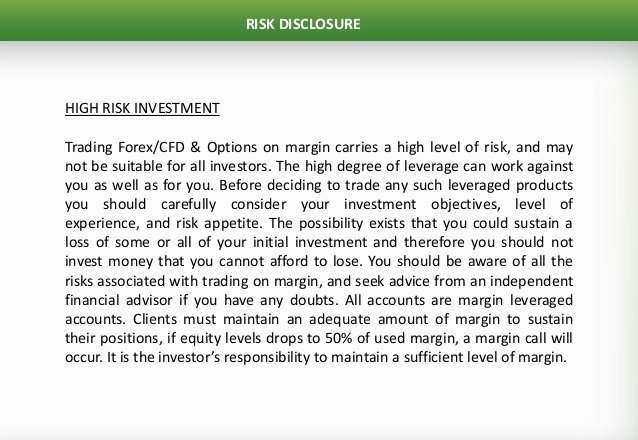

Forex trading is a risky business, and you are always presented with the banner below whenever you open a Forex trading account with a good broker. An unscrupulous broker, on the other hand, will promise you huge returns and only minimal risks, talking about how they are going to double or triple your investment. This is most common in managed accounts.

To be clear, Forex trading is very risky if you don’t follow the necessary steps to trading success in which case it would be the same as gambling. Anyone who claims that their brokerage provides risk-free Forex trading is either lying or, at least, overselling their services; either way, stay away from such brokerages.

Bombardment of offers

It is true, that Forex brokers make most of their money through their client’s investments and trades by deducting commissions or spreads, but the best Forex brokers don’t hunt for new clients too aggressively. To gain customers, they must advertise their services and advertise their brand through the various marketing strategies available. However, if you are constantly bombarded with emails and phone calls, it might be a scam or maybe it’s just a ‘new’ Forex brokerage looking for clients. Either way, it’s a warning sign of the potential of a scam, and you should be very careful if you finally choose to take their offer.

The urgency of a deposit

A good broker is the one who presents you with options and gives you time to think about it, not the one who asks that you make the deposit right away, regardless of the reason. For example, I once faced such a situation with a particular broker who insisted that I deposit money immediately because in a few days, the Brexit vote would be cast and that would affect Forex trading in a major way. This was true, yes, and they insisted I could make a lot of money that way.

First, this is the same as the ‘deal is too good’ promise discussed earlier, and second, this is not what Forex trading is all about – making lots of money on one day and leaving the trade. Forex trading is a form of investment that requires dedication and patience, not a ‘get rich quick’ scheme. Such brokers only ask you to make the deposit immediately because they don’t want you to do your research, and by the time you realize you’ve fallen for a scam, it’s usually too late to back out.

6. Start with a mini or micro account

Mini and micro accounts are types of Forex accounts that allow you to trade only 10% and 1% of a standard 100,000-unit lot size. With the reduced lot size comes reduced risk and potential earnings, but it ensures you can’t lose a lot of money on a single trade, even if the broker is a scam. Experienced traders begin by opening mini or micro accounts when first trying out a new broker to look for any signs of a scam. You too should try this because it’s a surefire way of observing a broker’s activities in real time. These accounts don’t even require a huge initial deposit, just about $50 to $100 would do it, and you will become more confident when you finally move to a standard or VIP account.

To warn traders of these Forex scams, the US Commodity Futures Trading Commission (CFTC) released this video:

RoboForex

RoboForex Exness

Exness FxPro

FxPro Alfa-Forex

Alfa-Forex Libertex

Libertex FxGlory

FxGlory XM

XM IC Markets

IC Markets Forex.com

Forex.com AXITrader

AXITrader