Risk Warning: Your capital is at risk. Statistically, 74-89% of customers lose their investment. Invest in capital that is willing to expose such risks.

Overview

To assess Forex Capital Markets, we wanted to analyze its performance and see how it scored compared to industry standards. We will break our previous table to evaluate this broker.

Regulation and Safety: 4/5

Forex Capital Markets is regulated by several Tier-1 and Tier-2 bodies. The following institutions govern it.

- Financial Conduct Authority or FCA in the UK.

- Australian Securities and Investments Commission or ASIC in Australia.

- Cyprus Securities and Exchange Commission or CySEC in the EU.

- Financial Sector Conduct Authority in South Africa.

So, what does this mean for you as a trader? These bodies ensure the platform follows adequate financial requirements. They also ensure that the company’s money is segregated from clients’ funds.

This sounds like good news. However, FXCM lost a point because it previously failed to protect the funds of American clients. While it learned from its history, some investors might still feel a little skeptical about using it.

FXCM is considered an industry leader and it offers negative balance protection except for traders registered under FXCM Markets Limited.

Trading Platforms: 4/5

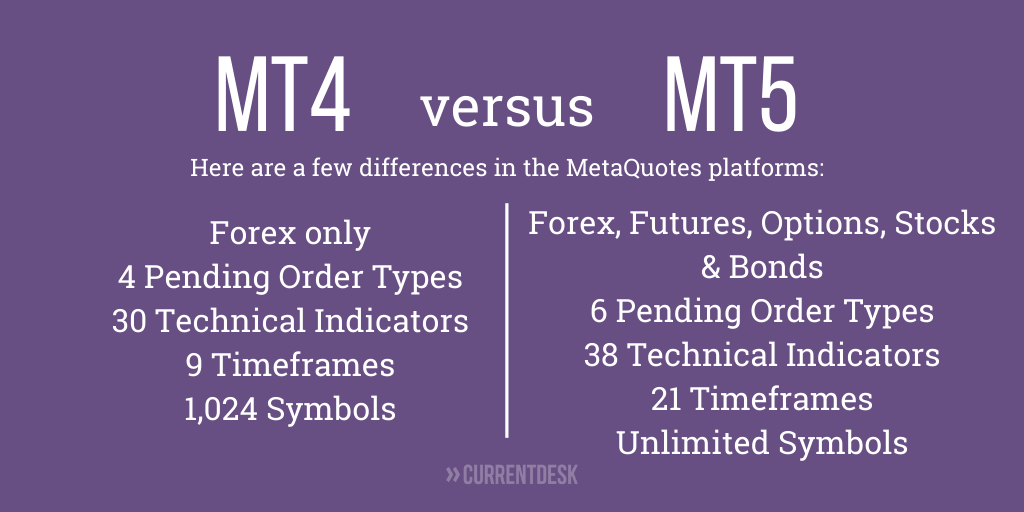

FXCM provides investors access to many trading platforms in multiple markets. You can use MT4 with its helpful trading indicators and charting tools for informed decisions. However, it lacks MT5, which provides more indicators and charting tools for seasoned traders.

TradingView Pro allows brokers to analyze the most challenging market conditions and trade according to the latest market alerts. Users can access the Essential, Plus, or Premium plans by topping off their accounts by $300, $1,000, or $5,000 respectively.

Users can also benefit from ZuluTrade, the broker’s social trading feature. Beginners learn by copying the moves of seasoned investors. Moreover, this feature allows them to reduce their risk in challenging market conditions.

At the same time, social trading represents an accessible passive income opportunity for experts. By sharing your investment decisions, you can make money every time someone gains by copying your moves.

But that’s not all. Many industry leaders consider FXCM Broker a leader in algorithmic trading solutions. Beginner users can depend on Capitalise.AI, while seasoned traders can access this feature using Python. All trading features are available on Tradu, the multi-asset all-in-one trading app.

Product Range: 3/5

FXCM is a comprehensive broker that allows investors to trade more than 400 CFDs, forex, cryptocurrencies, fractional shares, indices, and commodities.

While this sounds like a good opportunity for diversifying your portfolio, many traders would still consider another broker due to the limited alternatives available. For example, it doesn’t allow access to trading options or bonds.

Nevertheless, FXCM is the number one broker for many users as it operates in 43 exchanges in Asia, Africa, Europe, and the Americas. However, there are some restrictions. For example, UK retail traders can’t trade crypto CFDs.

Fees and Commissions: 3.5/5

Forex Capital Markets has moderate fees compared to other brokers. There are no account, deposit, or withdrawal fees if you’re using debit or credit cards, and this makes the platform appealing to beginner users and those on a tight budget.

However, this broker charges an inactivity fee of $50 after one year of not using your account. Additionally, withdrawal fees apply for bank transfers.

All forex trading fees are built into spreads, and there’s no separate commission. This also applies to CFD trading.

Research and Education: 4/5

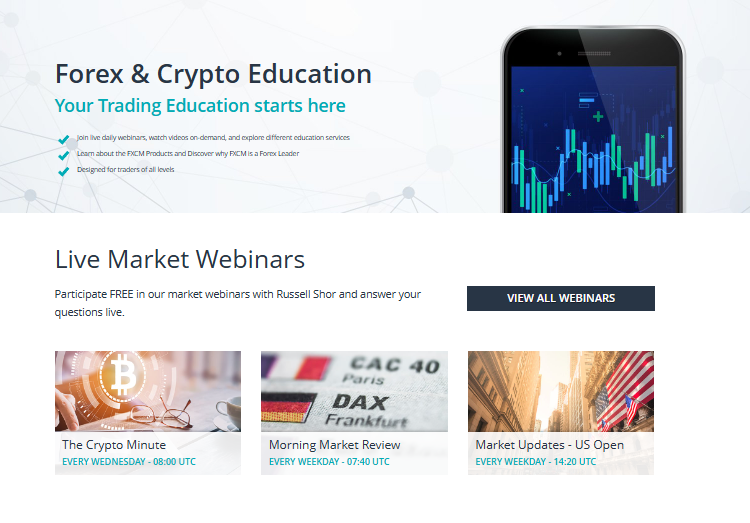

FXCM Broker is a good platform for beginners and experts, thanks to its extensive and accessible educational center. Its different trading tools and platforms provide an excellent opportunity for research with a wide range of charting and analytical tools.

Users can compare about 60 market indicators and data trends to make the best decisions in volatile market conditions. Plus, they can access the latest articles, webinars, and videos to improve their skills.

The advantages don’t stop here, as it offers live classes, regularly updated to cope with the latest market trends. Access to proprietary data and premium resources is a guaranteed way to help beginners gain more experience on the platform.

Yet, some resources like live online classes and market signals might not be available to you, depending on your location.

Customer Support: 3.5/5

The platform is available in English, Spanish, French, German, Arabic, Chinese-Mandarin, Italian, and Greek and email response is immediate. Additionally, FXCM can support telephone orders.

However, this platform didn’t score high because customer support, including live chat, is only available 24/5 —from Monday to Friday.

This can be a little inconvenient, depending on your time zone and the trading hours in your favorite market. Beginners can especially feel a little stranded in case of an emergency as they’ll have to wait for a while to have an issue sorted out.

User Experience: 4/5

Overall, it’s safe to say that FXCM’s clients enjoy a good user experience. The platform has a low account minimum required, allowing anyone to access forex and CFD trading, even those on a tight budget. Users will also enjoy one-click execution with the mobile app.

Forex Capital Markets publishes detailed monthly execution reports to improve users’ experience. These reports highlight slippage statistics and trade execution quality, further educating investors about changing market conditions.

However, the desktop app doesn’t support two-factor authentication, which is essential for online safety. Additionally, some traders feel that the product offering is limited compared to other established brokers.

Additional Features: 3.5/5

FXCM supports MT4, with convenient trading and charting tools. However, some users still need the advanced charting tools and indicators provided by MetaTrader 5.

Some investors love using Forex Capital Markets as it supports different order types, allowing for slippage and hedging strategies. Also, users can benefit from integrated tools like TradingView and Capitalise.AI for more flexibility.

Besides the rebate program, users can access different bonuses that get updated regularly. Moreover, you’ll receive a bonus if you refer family and friends.

Pros

-

Regulated by Top-Tier Authorities

-

User-Friendly Proprietary Platform

-

Competitive Spreads for Active Traders

Cons

-

Limited Product Portfolio

-

High Bank Withdrawal Fees

-

No Two-Step Authentication on Trading Platforms

General details

Customer reviews

score

It’s always a good idea to evaluate a broker by analyzing actual users’ experiences. Overall, many praised FXCM for its user-friendly platform and availability of multiple trading platforms.

N0K_24 shared their experience on TradingView, praising the platform’s interface, “Very easy to set up and I’m glad I also get an account manager that provides me with useful tips and advice. Honestly a really good forex broker.”

Inshan I. Mohammed explained on Trustpilot that after trying other brokers, they had to return to FXCM, “Returned to forex after a break and stunned by the sheer volume of material to navigate. Great service either through a proactive client support rep (Miguel) or a very helpful portal. Amazing bag of trading tools to help the beginner to expert and not to forget, free trading signals! Features you pay for on other sites, you get for free at FXCM once you’re able to open a live account. A longtime fan. Much to discover and restart my trading journey”

Nevertheless, it’s only fair to mention that some users didn’t have such smooth sailing with FXCM. A Trustpilot user named Tok didn’t like the high fees and thought that the fees system was a bit complicated to understand, “Fees and commissions are high for MT4. It is certainly not free and on the chart and graphs, commissions and swap fees are separated and it is so hard to see which one belongs to which. I do not like the way they put those fees.”

Most industry experts consider FXCM a trustworthy broker, thanks to its top-tier regulation and availability of multiple trading platforms and tools. However, for a broker that has been around since 1999, it could work on its product offerings and high withdrawal fees. Moreover, 24/7 customer support will probably make this platform more popular.

No reviews yet.

Share Your Experience

Help others by sharing your review

Accounts

FXCM has two account types that are extremely easy to open. The process is fully digital and straightforward, even if it’s your first time trading.

These two account types offer many features to appeal to beginner and expert users. However, sometimes the process takes a few days to get your account up and running.

The Standard account has a minimum deposit requirement of $50, with leverage of 1:400 and competitive spreads. On the other hand, the Active Trader account is more suitable for experienced traders with a minimum deposit of $25,000.

FXCM supports the Active Trader Rebate Program. It’s divided into five tiers and allows users to receive a rebate from $5 per million up to $25 per million traded. Note that this program has different requirements, depending on which entity holds your account. Assigning an account manager is available.

Traders can also try trading using their demo account. This is an excellent choice for first-timers who want to practice their trading skills before risking real money. All accounts are available in multiple currencies.

Tradable instruments

The following are the tradable instruments available on FXCM:

Frequently asked questions

FXCM Broker is one of the most trustworthy trading platforms in the world, as it’s overseen by top-tier regulatory bodies, including the FCA, ASIC, and CySEC. It has been around since 1999, meaning it’s one of the earliest trading platforms to be listed.

FXCM offers multiple trading platforms to appeal to different investors. First, it has a dedicated Trading Station where it provides access to MT4 with all its basic yet necessary trading indicators and charting tools. Read our MetaTrader 4 review to learn more about this amazing platform.

Traders can benefit from the TradingView integration with its Pro version, which adds more features. ZuluTrade is a must for beginner investors interested in social trading.

But that’s not all. Forex Capital Markets is a pioneer in algorithmic trading with Capitalise.AI.

In general, FXCM spreads are considered competitive compared to other trading platforms. Active Trade account users can access spreads as tight as 0.2 pips on the most common currency pairs.

However, spreads can be wider for other assets. Yet, they’re still considered low to medium compared to the industry average.

Yes, FXCM offers demo accounts for beginners and those who want to practice their trading skills before risking their hard-earned money.

Using this demo account will give you confidence in your trading skills and help you become a better investor. Check out our list of non-expiring demo account brokers for more practice.

FXCM offers multiple educational resources, including articles, tutorials, live classes, and webinars. This variety appeals to rookie and experienced users because it covers all the basics of trading. The library gets regularly updated with the latest market trends.

FXCM compared with alternative brokers

- Overall verdict

- Trading

- Minimum deposit

- Maximum leverage

- Fees

- Withdrawal fee

- Deposit fee

- Safety

- Top-tier regulators

- Investor protection

-

4.3/ 5

-

4.1/ 5

- N/A

- N/A

-

4.1/ 5

- N/A

- N/A

-

4.7/ 5

- N/A

-

No

No

-

See review

-

Specialized trading accounts

-

24/7 instant money withdrawal

-

Free VPS hosting

-

4.9/ 5

-

4.8/ 5

- $10

- 1:2000

-

4.8/ 5

- $0

- $0

-

5/ 5

- FCA, CYSEC

-

No

No

-

See review

-

Specialized trading accounts

-

24/7 instant money withdrawal

-

Proprietary platform

-

Mobile trading

-

4.7/ 5

-

4.8/ 5

- €100

- 1:600

-

4.8/ 5

- $0

- $0

-

4.5/ 5

- CySEC

-

See review

RoboForex

RoboForex Exness

Exness FxPro

FxPro Alfa-Forex

Alfa-Forex Libertex

Libertex FxGlory

FxGlory XM

XM IC Markets

IC Markets Forex.com

Forex.com AXITrader

AXITrader