Most FX traders try to make as many trades in a week as possible, gathering several pips and waiting for the next week. Then there are a few who hold on to their trades for weeks, months, and even years. No, we’re not talking about the big hedge fund managers or billionaire investors, you can do it too even with small capital. This type of strategy is called POS trading and even though it is more common in the stock arenas, can be used in the FX arena too. In this post, we are going to look at how anyone can practice the POS system in their trading careers.

How to identify good POS trades

When looking for trade opportunities based on POS trading, there are three main ways of identifying them.

Observing macroeconomic factors

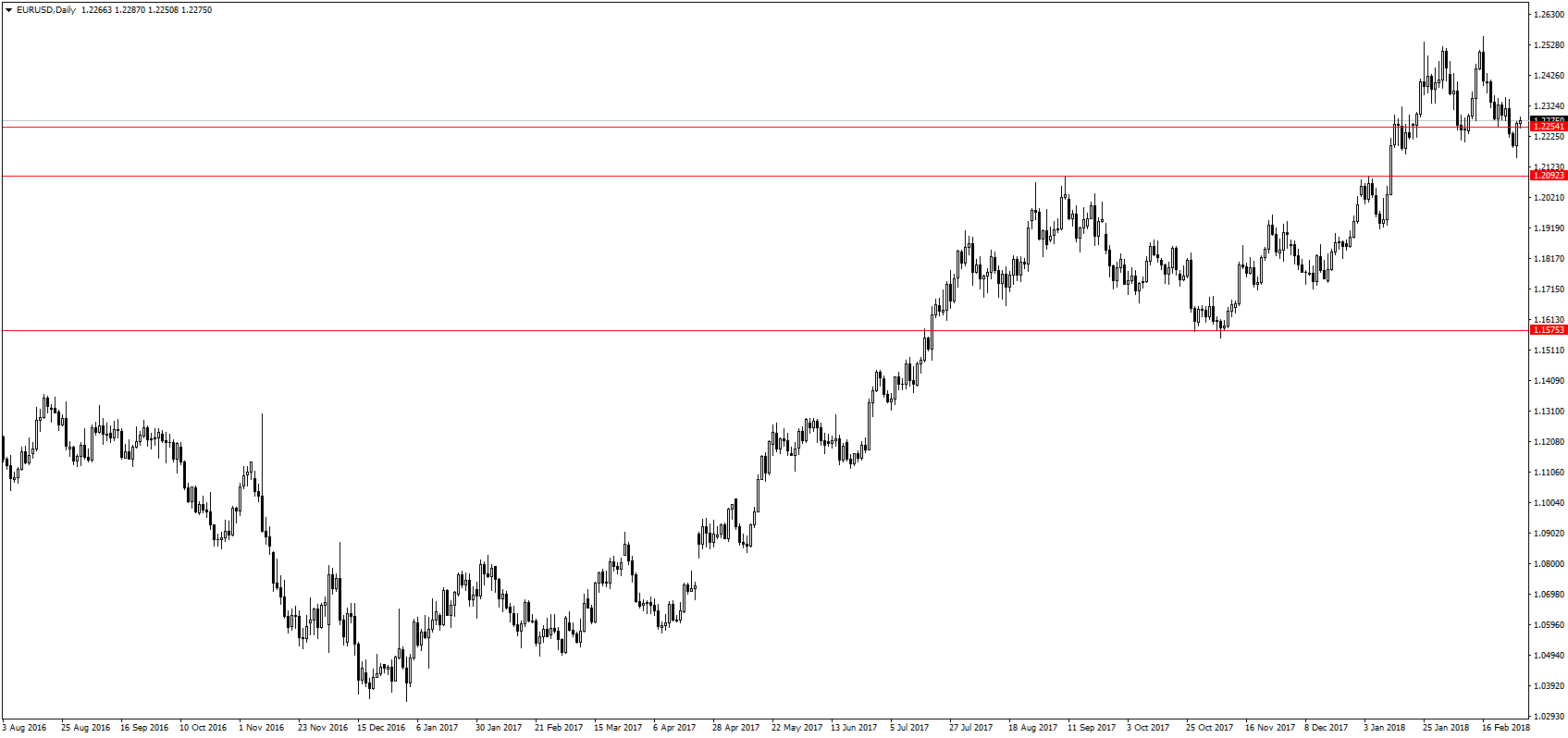

Since POS trading means holding on to trades for many weeks and even months or years, it is not enough to look at the day-to-day announcements on the Forex calendar. These news announcements only affect the FX arenas for a few hours to days, which means they can’t be of use to the POS trader. Instead, it is more pertinent to focus on major economic factors that have an impact on the arenas over longer periods. Take the example of the EUR/USD chart below where the arenas were in a consistent uptrend all through the year 2017.

Throughout the year, there have been many announcements regarding inflation rates (CPI), unemployment rates, etc. None of these affected the overall trend because those were just microeconomic factors. What kept the uptrend going all through the year was the general state of the European and US economies. Although the US economy was also on the rise, the Eurozone had better growth, thus making the euro stronger than the dollar. Had a trader been keen on these major economic factors, a long POS trade on the EUR/USD pair could have resulted in gains of over 15,000 pips in just one year. (Differences between Long-term vs. short-term trading)

To identify the major factors that may affect a country’s economy and, subsequently, its currency, you first need to know what drives that country’s economy. For Europe, this is usually its industrial performance and exports while the US relies on its stock arena as an indicator of economic performance. Countries like Australia and New Zealand will be affected by agriculture, China with exports and commodity prices, and Japan through interest rates since it is the most common funding currency for carry trades. (Do you know: What is carry trade?)

Knowing what makes a country’s economy tick will be the key to successful POS trading in the FX arena. Then once you observe a change in these factors, you can open a POS in the direction that you believe the arenas are going to shift.

Using key S/R levels

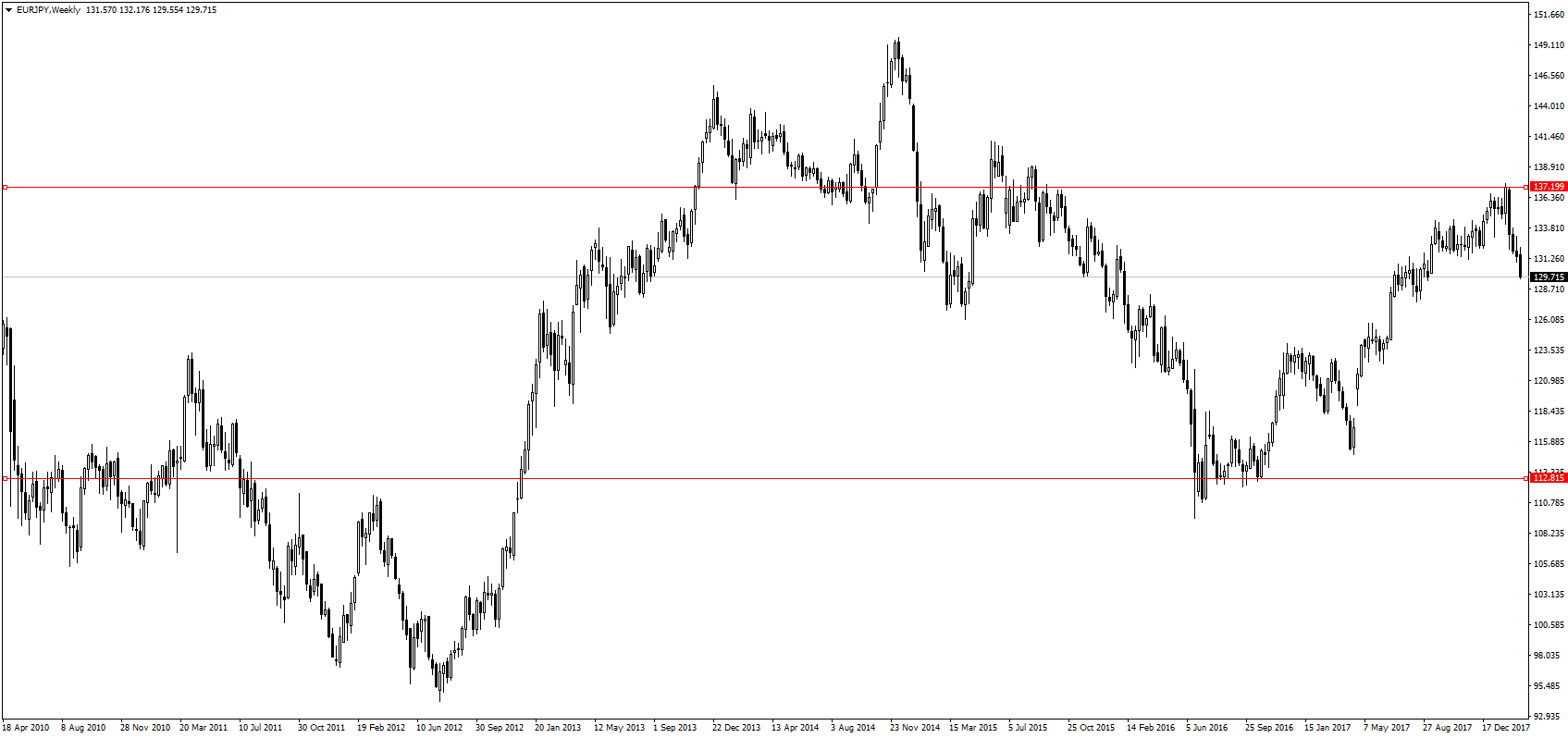

Since fundamental factors are the most useful in POS trading, even technical factors have an impact as well. The image below shows the EUR/JPY in the weekly timeframe. As you can see, the pair has been more or less within a range between 112 and 137 with a few exceptions when there was a false breakout. (Learn about Identifying the false breakout trading strategy)

Recently, as you can see, the prices hit a resistance level at the 137 mark and quickly dropped downwards over the past month. To further confirm that this is indeed an actual trend reversal and not a false breakout, the candlestick pattern formed at the resistance level was a bearish engulfing candle. This presents a good opportunity to make a short POS trade with the target at the 112 mark. If this trade is successful, you could collect more than 20,000 pips. However, the trade could take up to 2 years to actualize; and it would still rely on the macroeconomic changes in Europe and Japan that could happen within that time. (These are the: 7 Powerful Candlestick Patterns to Learn and Understand)

What to remember when using this trading system

Now that we’ve seen how profitable POS trading can be, there are still some tips you should keep in mind before jumping in. As mentioned earlier, POS trading is not just for billionaires and hedge funds, even a retail trader like yourself can do it too if you observe these lessons.

Keep your leverage low

In the past, we saw that it was possible to make even 20,000 pips in 2 years. Knowing this, it can be very tempting to use high leverage in hopes of making millions from just a small capital. It may indeed be possible, but only if you use a small leverage on your trade. As we saw in a previous post, leverage can be a double-edged sword that can work in your favor or destroy you. To be safe when holding on to a POS trade, keep your leverage small so that you avoid being stopped out when the arenas shift against you. (Learn: How to protect yourself from margin call)

As you can see from all the above charts, even when the trend was moving in a particular direction over the long term, there were still some moments when it seemed to be that the trend had turned. Using a huge leverage of, say, 1:500 could have led to a margin call in these instances. A 10:1 leverage, though, would have still kept you in the game through it all. (Find out about Looking for arena correction)

Use a small POS size

If you’re using POS trading to diversify your trades across short and long-term periods, then your POS trade should only take up a small portion of your trading capital. A 1% allocation is usually recommended so that you’re still left with enough capital to make your short-term trades in tandem.

Do not place the stop loss too close

As long as your leverage is low and the scale of the POS is limited, you should be comfortable enough to give your trade room to fluctuate. If the stop loss is too close, you might be stopped out accidentally when the prices shift sharply against the direction you were anticipating.

All these lessons can also be summed up into this quick video for further clarification:

SingaporeUS

SingaporeUS