No one indeed knows what might happen tomorrow, or how every other trader in the world feels about a particular currency, and there are millions of traders. Yet Forex trading is all about making speculations about future trends in the financial world, and many tools can provide these hints.

Technical analysts tend to look at chart patterns on real-time Forex charts, while fundamental analysts wait for ‘big news’ to come down. Both of these trading strategies have their own merits, but obviously, the fundamentalists are more sure about their decisions. There are various instruments these fundamentalists use to determine market sentiment, but one of the most easily available and useful is the Commitment of Traders (COT) report.

The COT report is compiled by the Commodity Futures Trading Commission (CFTC) and published on their website every Friday of the week at around 2:30 PM EST. In the report are the overall net positions on the futures market that are either long or short on the various futures.

For a Forex trader, information about the futures market is the only concrete resource for figures of traders’ commitment as there is no centralized exchange for the Forex market, but there are several for futures. Besides, futures are not only limited to physical goods like agricultural products and precious metals like they were in the past, but also involve currencies.

The report also classifies the players involved in the trading of futures into 3 categories:

Commercial traders

You can think of these traders as traditional futures players because they have an interest in the actual commodities represented by the futures contracts. These may be manufacturing companies that need particular raw materials and would like to secure the prices of those commodities in the future. In addition to manufacturers, multinational companies like to trade futures to secure the best foreign exchange rates that help them pay their employees from all areas of the world.

As you can imagine, these companies invest substantial amounts of capital into these futures, but they don’t have much sway over the overall financial movements. Despite their huge investments, they only do it for their own goals and have no interest in the trends of the future as long as they have their positions locked down. Therefore, speculative traders do not pay too much attention to their activities.

Non-commercial traders

These are the investment banks, hedge funds, and other major investment institutions that trade futures for the sake of making money out of the price swings. They, too, are speculative traders, but their huge amounts of investment make them critical to the futures markets. If you go through the historical trends of COT reports and their impact on the futures and, subsequently, the Forex markets, you will see that activity by non-commercial traders played a huge role in the trends.

As such, information on how long or short the non-commercial traders are on particular futures helps Forex traders determine the direction of the markets.

Non-reporting traders

Listed as non-reportable positions, these are the combined positions taken, either long or short, by ‘smaller’ speculative traders. These positions are combined into one category because individual positions are less than the minimum required to report to the CFTC. That is because there is a level set by the CFTC on and above which the value of the trade must be reported to ensure integrity and transparency. Since each trader’s investment in this category does not reach this limit, all such trades are combined.

Nevertheless, once combined, the overall value becomes quite significant to the CFTC, and they publish this figure too. Traders don’t pay too much attention to these figures, though, because they are trades made mostly by individual speculative traders, and they are not the best at gauging market sentiment, often being wrong.

Again, by looking through historical data from the COT reports, the Forex markets weren’t swayed by the non-reporting traders’ positions. While it may be good to know what other traders are doing, if you are an individual, you should not put too much trust in their positions. One of the uses of this data, though, is to help you identify trends because once these individual traders catch wind of a trend, they tend to ride it.

How to make use of the COT reports

The COT report is one of the most important market sentiment indicators because it is a good source of accurate information, but it is not useful to every trader. Take a situation where non-reporting traders are heavily long on a certain currency while non-commercial traders are mostly shot on the same currency. These situations are not uncommon, and they create uncertainty in the markets, which is the recipe for rapid price changes.

Despite their relatively meager individual investments, the combined investment by non-reporting traders is enough to reverse trends and break pivot points – but only for a short while. The professional investment institutions that dedicate their business to trading are usually right about a currency’s strength, and their speculation comes true in the end especially because they make huge investments and are in it for the long term.

So, what does this mean? COT reports may be useful for short-term trading positions, but their effectiveness is most prominent in the long term. Over time, the non-commercial trader’s speculation often comes true, and this can be an advantage to the individual swing trader.

Interpreting the COT figures

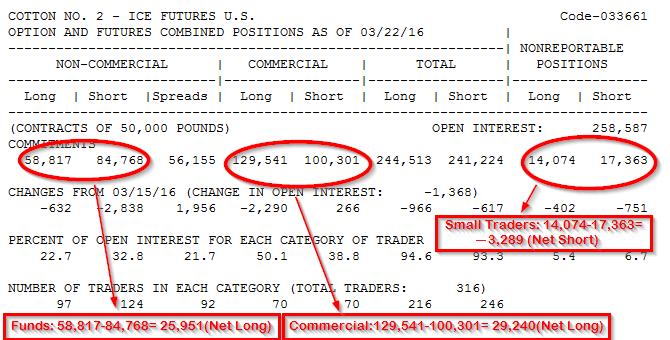

One week’s COT report on a currency may still not be enough to cause major changes on real-time Forex charts, you want to be as sure as you can about market sentiment. Look for the currencies where the non-commercial traders have been consistently bullish or bearish for at least 2 weeks and you can begin to sense where the trend is headed. To illustrate such a trend more clearly, calculate the percentages of the overall positions and add them to your trading platform.

Some Forex trading platforms will have this indicator pre-installed, but you can still download the plugin or do the calculations on your own. Simply divide the total long positions by the total number of trades, and then repeat with the short positions. These percentages quickly tell you whether the market is bullish or bearish on that currency.

A huge difference in long and short-position percentages indicates a high probability of a reversal. For example, if there are a lot more traders long on a currency, it means there aren’t enough sellers left to keep the momentum going, hence it might turn around. For the markets to work, there need to be constant buying and selling actions which can only be attained by having enough buyers and sellers.

Therefore, watch out for any significant differences between the number of long and short positions to determine the number of sellers and buyers and decide whether the asset has been overbought or oversold.

Even with the COT reports, it is still important to use other technical and fundamental tools to inform your trade. Remember, even hedge funds and investment banks also keep an eye on significant pivot points and other indicators, meaning that their positions may vary based on these indicators.

How to find the COT report

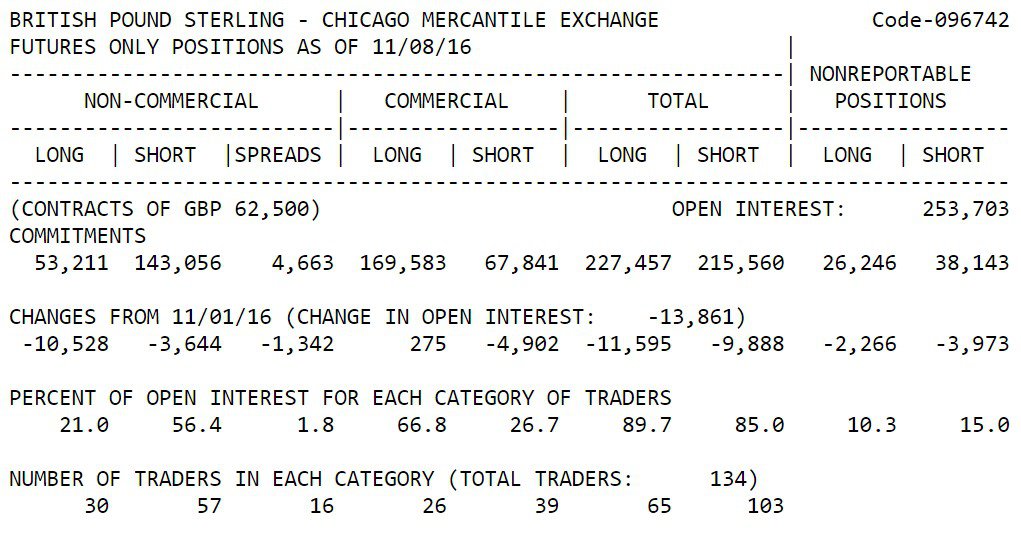

I’ve mentioned before that this report is published on the CFTC website, but you will have to find the COT reports on the ‘Market Reports’ tab and find the most recent reports. Unfortunately, this report is not found on the Forex calendar, but you should have it marked on your calendar. As you will find, there are several futures exchanges listed there, all dealing with particular futures but the Chicago Mercantile Exchange (CME) is the one that deals with currencies. Find the currency you are interested in and check out the details on that currency’s future.

The information on the website can be a bit confusing, at first, but you just need to know what to look for. The non-commercial traders’ positions are what you should pay the most attention to.

RoboForex

RoboForex Exness

Exness FxPro

FxPro Alfa-Forex

Alfa-Forex Libertex

Libertex FxGlory

FxGlory XM

XM IC Markets

IC Markets Forex.com

Forex.com AXITrader

AXITrader