In recent years, the Forex market has been moving away from the past financial hubs like New York and London. From the previous report by the Bank of International Settlements, daily turnover from these hubs decreased slightly between 2013 and 2016. One of the countries that had received an increase in daily turnover for Forex transactions was Singapore, indicating a rising number of daily transactions emanating from the country. The fact is that Forex trading in Singapore has become very common, and it is important to understand how this growth came about, the laws governing the trade, and some popular Forex brokers available for residents of Singapore.

Why is Forex trading in Singapore on the rise?

According to the BIS report of 2016, daily turnover from Singapore rose from $383 in 2013 to $517 billion per day, a 35% increase in three years. Even though the growth was impressive, it is far from the figure recorded from London and New York at $2,406 billion and $1,272 billion per day in 2016. However, daily turnover decreased in London while that of New York only increased by a small margin. These numbers point to only one conclusion, that there is a diversification of trade volume happening around the world. More specifically, Singapore seems to be getting more attractive by the day among financiers including Forex brokers, fund managers, and bankers. (If you want to succeed, learn: How Not To Be Added To The 95% Of Losing Traders)

Various reasons have placed Singapore on this trajectory, one of them being the booming state of the economy. For one, it is one of the few countries that still hold a triple-A credit rating from Moodys. This makes it extremely attractive for investors who would like to invest in a stable economy with a strong potential for growth. Another reason is the presence of a skilled workforce and excellent living conditions as reported by PwC. If you remember our previous article about starting one’s brokerage, we mentioned that it is important to locate your offices within a region with a skilled workforce. (This is: How to create your own Forex brokerage firm)

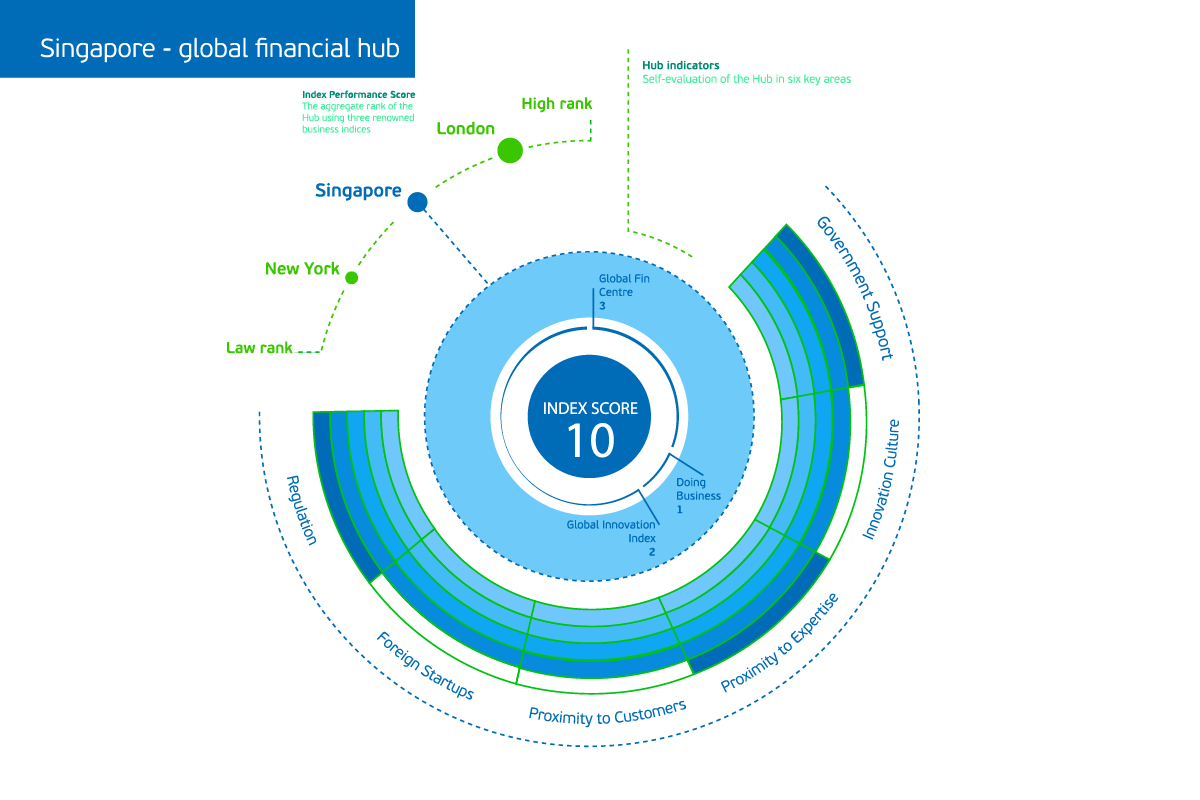

In 2018, Singapore joined the Global Financial Centres Index (GFCI) 24. Before this, the index was still at GFCI23. The GFCI Index is created by interviewing bankers from all over the world about the attractiveness of the various global financial centers. This places Singapore third behind New York, and London after unseating Hong Kong. Also just like the daily FX turnover, Singapore’s index registered a significant rise while the rest only had meager gains. (Do you know: How much money Forex brokers make?)

Forex brokers have thus been attracted to the region for these reasons, and one more that is even more specific to the FX industry – infrastructure and technology. Singapore is regarded as the most ‘tech-ready nation’ because it embraces new technology. For an FX agent looking to set up reliable and effective servers for their ECN networks, this is something extremely valuable. To process millions of trades a day, it is important to have advanced and stable network connections, and the city-state provides just that. Add to that, the presence of a vast community of financial institutions means that there is no shortage of liquidity providers and connections to the interbank market. This all means that there is deep liquidity among the many participants and thus excellent services all around. (Remember: When Choosing A Forex Agent, Pick The One With Winning Clients)

With all of this going on in the country, it should therefore not be a surprise that the FX arena is growing fast, not only among institutional traders but also among individual traders themselves. Apart from being a great economy, Singapore has very friendly laws for investors and traders without leaving room for corruption or other problems that negatively affect investment. We shall look into more detail the laws that govern FX trading in Singapore, but suffice it to say that residents of the country have no problem accessing multiple agents from all over the world. (Learn more about the: Growth Of The Forex Market In Africa And Other Developing Countries)

As a testament to the city state’s position in the FX industry, various FX events and expos are often held there. One of the most popular and annual events is FX Week Asia which was previously usually held in Hong Kong but now has been replaced by Singapore. Another event held in 2018 was the Traders Fair and Gala Night, which will still be repeated this year in October. Plenty of other independent training events are carried out, showing that the country’s residents are also eager to learn more about the industry. (These are: The Best Forex Events And Expos To Attend Every Year)

What are the laws governing FX trading in Singapore?

Financial regulation in Singapore is conducted by the Monetary Authority of Singapore (MAS). Its mandate covers financial markets like stocks, options, futures, etc. as well as insurance. Don’t forget it is also the country’s central bank and the issuer of banknotes and coins, making it one of the few countries whose central bank also acts as the financial regulator. The institution was created in 1971 through the Monetary Authority of Singapore Act as an act of parliament. That was done to consolidate the various monetary functions that were being carried out by multiple government agencies and departments. Today, MAS oversees more than 600 financial institutions in the country among them Forex and CFD agents. (Do you know: What Is The Financial Commission And Can It Be Trusted?)

Singapore is already well known for being a very strict country against corruption and other malpractices. In this manner, MAS continues to maintain this high degree of ethics among FX agents by being a very tough financial regulator. Being a government agency makes it even less compressible by the agents of the government. For example, a regulator like the IFSC of Belize is a separate, independent institution that relies on fees from brokers to pay its staff. This might create a bit of a conflict of interest because the institution can soften its requirements to license a particular broker and receive the licensing fee. As for MAS, there is no such conflict and thus making it a more reliable regulator than others. (These are: The 3 Most Trusted Exchange Authorities in The World)

Like any other financial regulator, the role of MAS is to ensure that all market participants are protected from any shenanigans the FX agents may be cooking up. To ensure all traders are safe and their capital secure, Forex brokers should first obtain a license from MAS. To be granted a license, the broker must go through an examination process. Among the checks conducted during the examination process is determining whether the broker has adequate capital. Every agent must have sufficient capital to cover any losses by the company to prevent bankruptcy. If you remember back in 2015, even major agents like FXCM went bankrupt after losing a lot of money during the Black Thursday event of 2015. Many of the bankrupt brokers’ clients lost their investments, which is why MAS has a specific requirement before being granted a license. (Read more on the: Bankruptcy of Forex brokers)

The broker must also create a separate, segregated account for their clients separate from the company’s account. This is required to protect clients’ funds from any proliferation by the company staff and for extra security in case the company is hacked or whatever. Even after passing the test, a broker must still produce regular audit reports to show they have been adhering to the financial compliance dictates. If MAS spots any irregularities, they can prosecute the agent and even revoke their license. Being created as an act of parliament, MAS can carry out disciplinary measures without having to go to court. (Have you ever wondered whether: Can You Get Your Money Back From A Fraudulent Broker?)

What are some of the Forex brokers regulated by MAS?

To date, MAS has regulated 9 Forex brokers, some local and others international with a local branch in Singapore. Among the international brokers licensed by MAS according to alphabetic order are:

- CMC Markets Singapore Pte. Ltd.

- IG Markets Singapore

- OANDA Singapore

- Phillip Futures Singapore

- Saxo Capital Markets Singapore

The local operations also licensed by MAS, again in alphabetic order, are:

- KGI World

- Maybank Kim Eng Securities Pte. Ltd.

- OCBC Securities Private Limited

- UTRADE FX

If you want to choose one of the above brokers, it’s important not to get hung up on the location or popularity of the brokers. Sure, major brands like IG Markets may have plenty of clients all over the world, but even smaller outfits like OCBC Securities Private can be just as good. Perhaps they could even be better than the major brands because they provide specialized services to Singapore residents. (Investor Tips 2019: What To Include In Your Portfolio)

Although these are the only MAS-regulated Forex brokers, the institution does not expressly ban unregistered companies. This means that Singapore residents can essentially sign up and trade with any Forex broker around the world that they like. However, it is not recommended to do so because then you lose the protection of MAS in case something goes wrong. MAS only has the authority to prosecute companies to whom it has issued a license, but it cannot cross borders. Therefore, if you get scammed by an offshore broker, there is little the regulator can do to help you. (Legalization of Forex Trading in the US: Facts and Trends)

There’s also one very good reason to work with MAS-regulated brokers – excellent trading conditions. Forex regulators like the FSA of Japan, NFA in the US, and ESMA in the EU have restrictive trading conditions. One of the main ones is a cap on leverage down to 25:1 by FSA, 50:1 by the NFA, and 30:1 by ESMA. Meanwhile, MAS-regulated brokers can go as high as they wish as long as they do not manipulate quotes or in any other way interfere with the markets. Now why would you opt for worse trading conditions when things back home were already so cozy? (Trading Stocks in Forex Brokers: Commissions, Swaps, Spreads Research)

That being said, there should be no reason for you to be wary of international brokers as long as you know how to choose a good broker. It only takes a few steps to weed out the worst characters, for example, by ensuring they are licensed by a reputable regulator. Not all regulators are the same, and MAS is right up there with the best of them. Besides regulation, confirm the agent’s reputation through user reviews, but also ensure they are the actual real reviews. (If you’re about to start trading: Think Twice When Making A Deposit In A Forex Company)

Final Thoughts

All in all, Forex trading in Singapore is very advanced and safe to participate in. We have also seen that there are plenty of options regarding ideal brokers to choose from, and indeed residents may be spoilt for choice. Nevertheless, always remember to be careful whenever you’re trading in the FX industry because there are always risks if one is not keen, even in a very effective regulatory system like this. (Learn about the: New FX Agent Regulations in Russia in 2019)

If you want to see and hear from an actual Singapore FX trader, here is a video of their trading lifestyle:

IranUS

IranUS