Did you know that in 2023, the Financial Industry Regulatory Authority FINRA received 11,003 complaints from investors, resulting in fines worth $88.4 million? That’s not all. In fact, five companies were expelled and four suspended for non-compliance.

Although there are many reliable forex brokers in the market, sometimes traders and investors fall victim to scams. Fortunately, FINRA is on your side and can suspend and compensate you for any illegal or unauthorized activity that occurs without your permission. But how can you file a complaint against a broker? This guide will help you understand how to file a complaint against a broker and address other issues with your brokerage firm to get the best outcome. Let’s get started.

Understanding the complaints process

Understanding how to file a complaint against a broker can be a bit complicated. However, it is a crucial part of your learning process as you become a successful trader.

The number of disputes filed by clients increased to 1,891 cases in 2023, compared to only 1,693 cases reported the previous year according to FINRA. These included breach of fiduciary duty, negligence, failure to supervise and breach of contract.

Although each complaint is different, the process is more or less the same. These complaints align with your rights as an investor, protected by various securities laws, including the Securities Exchange Act of 1934. Once received, a complaint will go through an internal review, regulatory investigation, and possible legal action, depending on your nature.

Identification of valid reasons for filing complaints

In the stock market, customers are not always right.

Sometimes you may think you have good reasons to file a formal complaint against your broker. However, this may not be the case.

A disagreement or lack of communication with your broker may not qualify as a valid complaint if it does not violate FINRA Rule 2010 which requires brokers to observe high standards of business honor and fair and equitable trading principles.

Other valid reason is set forth in accordance with Securities and Exchange Commission (SEC) Rule 10b-5, which prohibits any act or omission that results in fraud or deception in connection with the purchase or sale of any security. Finally, a breach of fiduciary duty, which allows advisors to act in the best interests of their clients, established under the Investment Advisers Act of 1940, could qualify for a strong complaint against your broker.

Common Types of Broker Misconduct

Trading is a game of mathematics and feelings. That’s why understanding the value of crowd psychology in trading is a crucial part of your learning process as an investor.

Some brokers may abuse traders’ lack of knowledge to perform some illegal actions. These actions are not necessarily in the best interest of the investor or trader. Additionally, they may expose you to legal consequences.

But what are the most common types of misconduct?

Churning is definitely one of them. It occurs when brokers trade excessively to generate commissions, regardless of how this affects you.

Under FINRA Rule 2111, brokers must have a reasonable basis to believe that a recommended transaction or investment strategy is appropriate for the client. In this sense, inappropriate investment recommendations represent a serious violation.

Breach of fiduciary duty is another problem. Under the fiduciary standard, brokers must put their clients’ interests before their own, as outlined in the Investment Advisers Act of 1940.

Here is a summary of the most common types of misconduct and the red flags that might alert you.

| Type of misconduct | Description | Possible warning signs |

|---|---|---|

| Smoothie | Excessive trading to generate commissions | High account turnover, frequent transactions |

| Improper Investments | Recommending investments that do not align with the client’s objectives or risk tolerance | Investments incompatible with established objectives |

| Unauthorized trading | Perform operations without the client’s permission | Unexpected transactions on account statements |

| Misrepresentation | Providing false or misleading investment information | Discrepancies between verbal promises and actual performance |

Test Documentation

So, you found something suspicious. Now, what’s next?

The first thing you need to do is gather and organize all the relevant documents to prove that you have a valid case. Account statements, correspondence with your broker, and trade confirmations can prove that it has been manipulated. For example, time-stamped order tickets can provide crucial evidence in cases of unauthorized or mishandled transactions.

So how can you access these documents? Remember that SEC Rule 17a-3 requires brokers to maintain certain books and records, which clients can request and access. Additionally, electronic communications, including emails and text messages, are considered valid forms of documentation under FINRA Rule 4511.

Internal Complaints Procedures

So, do you think the time has come for your courtroom drama? Not so fast!

Going through your brokerage firm’s internal complaints process is usually the first step. Most companies have reliable internal complaints procedures that are usually outlined in the company’s customer agreement or on its website.

These procedures can handle most complaints and clear up customer confusion. Once you file a complaint, firms must acknowledge receipt of a complaint in writing within 15 days, per FINRA Rule 4513. This step solves most problems quickly and efficiently.

But, sometimes, turning to external organizations is the only option. FINRA Rule 4530 requires firms to report certain customer complaints to FINRA within 30 days.

According to InvestmentNews, this case of a former Osiac recruiter who ended up withdrawing her discrimination complaint shows that going through internal channels is a necessary step before escalation.

Write an effective complaint letter

As you learn how to become a fearless forex trader, you should familiarize yourself with the process of writing clear and objective complaint letters.

This crucial step should explain your problem in detail and the desired solution. You may be angry, but you should avoid emotional language.

Stick to the facts and include specific details such as account numbers, trading dates, and amounts in your complaint letter. If possible, do your research to reference any FINRA or SEC rules that you believe have been violated. Finally, request a written response within a specific time frame, typically 30 days.

Regulatory complaints and external resources

Since complaints can be handled internally, then there is probably no need to escalate them, right?

Unfortunately, this is not true. Only some complaints can be handled internally in accordance with the broker’s regulations.

So what happens if you don’t get the help you need?

If the internal process fails, you should raise your complaint to a regulatory body or seek external professional assistance. In other words, a regulatory complaint against a broker is your second option if the company’s internal process does not do you justice.

The SEC and FINRA have established processes to handle investor complaints and can provide valuable resources and support. Although they have separate jurisdictions, they sometimes overlap in handling investor complaints.

File a complaint with the SEC

The Securities and Exchange Commission (SEC) plays a crucial role in protecting investors and maintaining fair, orderly and efficient markets. Its Compliance Division handles investor complaints and conducts investigations if you suspect illegal activity or manipulation of your investments. This division initiated 760 enforcement actions in fiscal 2022, an increase of 9% from the prior year, according to the U.S. Securities and Exchange Commission.

However, understanding the correct process for doing so is paramount, as some information is mandatory. Complaints you file may lead to a variety of outcomes, including formal investigations, civil actions, or referrals to other agencies, depending on their nature.

SEC Online Complaint Center

Digital tools and new technologies play an important role in trade. And complaint management is no different.

To make things easier, the SEC has established an online complaint center, which allows you to file a complaint with the SEC electronically. It is also known as the suggestion, complaint and referral system or TCR.

The system classifies complaints into several types, including corporate disclosure, insider trading, and market manipulation. This categorization ensures that your complaint will be handled by the appropriate experts. Users can submit different types of information anonymously, with contact information to facilitate the research process.

Follow-up procedures

After you submit your complaint, the SEC will not provide status updates on individual complaints due to confidentiality requirements. However, you may file a FOIA request under the Freedom of Information Act to obtain information about the status of your complaint.

In some cases, the SEC may refer your complaint to other agencies or self-regulatory organizations if it aligns with their scope. You should expect the SEC to contact you for additional information or clarification during the follow-up stage.

FINRA Arbitration and Mediation

FINRA operates the largest securities dispute resolution forum in the United States. According to FINRA, 70% of arbitration cases filed in 2022 were resolved without a hearing, either through settlements or other means.

FINRA Arbitration and mediation processes offer alternatives to traditional litigation. They generally provide faster and more cost-effective resolutions to negotiate disputes.

While you are here, check out this link to learn more about creating and managing a forex trading strategy.

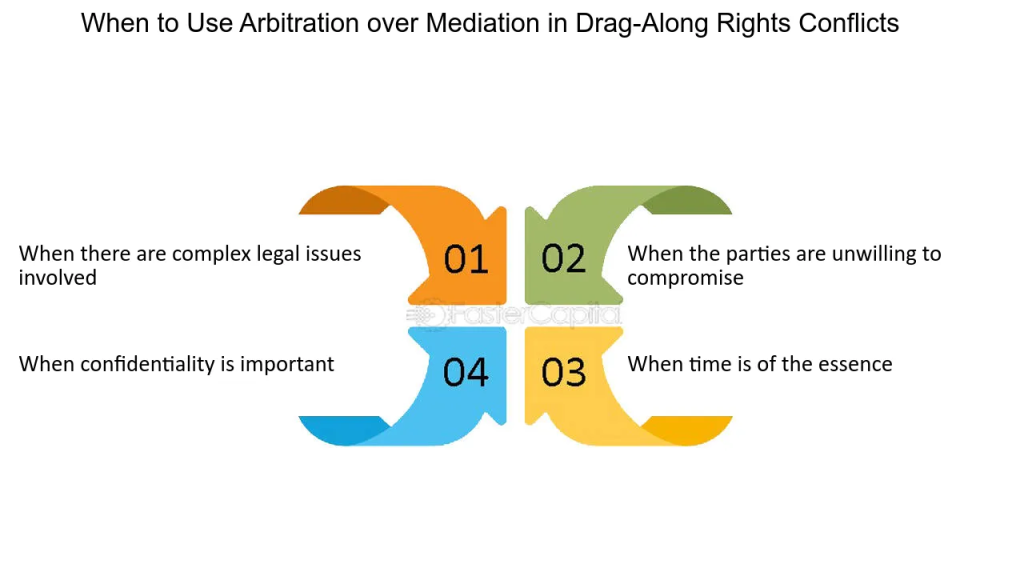

Arbitration versus mediation

So what is the difference between arbitration and meditation? Arbitration involves a neutral third party making a binding decision, while mediation facilitates negotiation between the parties to reach a mutually acceptable solution.

FINRA can do both to provide solutions. FINRA arbitration panels typically consist of one or three arbitrators, depending on the amount of the claim.

Mediation success rates are high. Furthermore, arbitration decisions are final and binding, with limited grounds for appeal.

The following table summarizes the difference between these options, to help you choose the correct route based on the nature of your complaint.

| Appearance | Arbitration | Mediation |

|---|---|---|

| Decision making | Referee(s) | Parties involved |

| Result | Binding decision | Voluntary agreement |

| Formality | More formal | Less formal |

| Duration | Normally longer | Often shorter |

| Cost | Generally superior | Generally lower |

| Appeal Options | Limited | N/A (based on agreement) |

Preparing for FINRA Procedures

So how can you get FINRA on your side?

Regardless of your decision, you should carefully prepare to present your case. This involves collecting and documenting your evidence, selecting an arbitrator or mediator, and understanding the procedural rules.

Proper documentation is key. This may take some time, but it is crucial.

FINRA provides a neutral list selection system to choose arbitrators for maximum transparency. This way, you can ensure a fair trial and the best outcome. Discovery in FINRA arbitration is governed by the Discovery Guide, which describes presumptively discoverable documents.

It is also worth mentioning that parties to FINRA arbitration may file motions, including motions to dismiss, under specific circumstances described in FINRA rules.

Legal Options and Considerations

Remember that although the SEC and FINRA can resolve most disputes, sometimes it is imperative to take the legal route. This is especially true in cases of serious broker misconduct.

The statute of limitations for securities fraud claims is typically two years from discovery of the violation. Therefore, you have a very good case if you notice that your investment is being manipulated.

Although not so fast. Many brokerage agreements include mandatory arbitration clauses, which may limit your ability to initiate litigation. Remember that reading the fine print is essential if you decide to become a trader.

Due to the complexity of these cases, seeking legal advice from a securities law attorney can be invaluable. Securities attorneys often specialize in specific areas, such as broker-dealer regulation, investment advisor compliance, or securities litigation. Therefore, it is essential to do your research to find someone who can handle your complaint.

The Public Investors Advocate Bar Association PIABA is a professional organization of lawyers representing investors in disputes with the securities industry. A securities attorney can evaluate your case, explain your legal options, and guide you through the often complex legal landscape of broker-dealer disputes.

Many securities attorneys offer free initial consultations to evaluate the merits of your case. They will explain the complexity of seeking legal punishment and its implications.

Cost-Benefit Analysis of a Legal Action

So is it worth taking legal action? This is where the importance of a cost-benefit analysis shines.

Legal proceedings can be expensive and time-consuming, so you must weigh the potential gains against the costs and risks involved.

Legal fees in securities cases can be structured as hourly fees, contingency fees, or a combination of both. Additionally, some attorneys may advance case costs, which are then reimbursed from any recovery or win.

Understanding these fees will help you make an informed decision about whether legal action is the right option for your situation. Meanwhile, the FINRA Dispute Resolution Working Group has recommended exploring ways to increase the use of mediation in small claims to reduce costs.

Class actions

In some cases, the misconduct of one broker affects several investors. If this happens, a class action lawsuit could be the appropriate response.

Class action lawsuits in securities cases are governed by the Private Securities Litigation Reform Act of 1995 PSLRA. They allow a group of investors with similar complaints to take collective legal action, potentially increasing the impact of the lawsuit and sharing the associated costs.

The lead plaintiff in a securities class action lawsuit is typically the investor or group of investors with the greatest financial interest in the case. However, class certification requires meeting specific criteria, including numerosity, similarity, typicality, and adequacy of representation.

Identification of existing class actions

Do you think you have been affected by widespread broker misconduct? Researching and joining existing class action lawsuits could help you.

The Stanford Law School Securities Class Action Clearinghouse maintains a database of federal securities class actions. This information could help you see if you can participate in one.

Class members generally receive notice of the lawsuit and have the option to opt out if they wish to file individual claims. However, this could incur an additional cost.

Settlement distributions in securities class actions are generally based on an allocation plan that considers factors such as the timing and amount of transactions. Therefore, although you may not receive the same settlement, your case will be handled as part of a whole.

Prevention and Best Practices

Is there a way to prevent runner misconduct? Can you protect your investment in advance?

Actually, yes you can. Implementing preventive measures and following best practices can help you avoid problems in the first place, reducing or even eliminating the risk of disputes.

By taking proactive steps to protect your investments and maintain a healthy relationship with your broker, you can significantly reduce the likelihood of having to file a complaint. Don’t forget that regular account reviews and open communication with your broker will avoid misunderstandings and detect potential problems in time.

While you’re here, check out this article to learn how to read Forex charts like a pro.

Due Diligence in the selection of brokers

Before you start trading, do your homework to choose a trustworthy broker. In fact, it is the most important step in preventing future complaints.

So how can you do this? FINRA’s BrokerCheck tool provides free access to brokers’ professional backgrounds, including disciplinary actions. Therefore, check its regulatory status, read user reviews and evaluate its financial stability.

SEC’s Investment Adviser Public Disclosure IAPD website provides information on companies and representatives of individual investment advisors. State securities regulators also maintain databases of licensed brokers and advisors operating in their jurisdictions.

While conducting this research takes time and effort, it is a crucial step in protecting your investment.

Regulatory Background Checks

Doing some background checks is essential because you want to make sure you are working with a trustworthy broker. BrokerCheck reports include information about a broker’s qualifications, records, and work history over the past 10 years. Disciplinary events reported on BrokerCheck include criminal matters, regulatory actions, civil court proceedings, and client complaints.

In fact, your brokerage firm should help you with this process. FINRA Rule 2267 requires brokerage firms to provide clients with BrokerCheck information. This information can provide valuable insight into a broker’s trustworthiness and ethical standards.

Understanding Fee Structures

Misunderstandings about fees make up the majority of disputes between investors and traders. That’s why it’s critical to understand your broker’s fee structure to avoid surprises and potential conflicts.

Common fee structures include commission-based models, fees (percentage of assets under management), and flat fees. You won’t be surprised by the fee charged because FINRA Rule 2264 requires brokers to provide retail clients with a list of fees and disclose potential conflicts of interest related to compensation.

By law, brokers will not engage in activities that may not be in your best interest in order to charge you more. Under the SEC’s Best Interest Reg BI, brokers and dealers must act in the best interest of retail clients when making recommendations, including disclosure of all material facts related to any conflicts of interest associated with the recommendation.

Maintain accurate records

Having accurate and detailed records of all interactions, transactions and communications with your broker is crucial to protecting your interests. It is also the number one requirement if you need to file a complaint against your broker.

Although SEC Rule 17a-4 requires brokers to maintain certain records for specific periods, investors must also maintain their own records. These records will be useful when it comes to monitoring your investments.

Electronic records are generally acceptable, but it is important to ensure that they are stored securely and remain accessible. Remember that the IRS recommends keeping investment records for at least three years after you sell the security.

Trade Confirmation Reviews

SEC Rule 10b-10 requires brokers to provide customers with written notice of the details of a securities transaction upon or before completion of the transaction. These trade confirmations must include specific information such as the date, time, price and quantity of the transaction.

Additionally, FINRA Rule 2232 requires firms to provide clients with account statements at least quarterly, detailing securities positions, monetary balances, and account activity .

Reviewing your trade confirmations and account statements can help you detect and address any discrepancies quickly. Always check and examine these documents as soon as you receive them to act promptly.

International Considerations

Dealing with international brokers can complicate the process of filing a complaint, as most cross-border financial transactions are typically subject to multiple regulatory jurisdictions. The regulations are different and multifaceted. Therefore, it is essential to understand cross-border regulations and complaints processes to effectively protect your interests in a global financial environment.

While you are here, check out our complete guide on emotion management in Forex.

Navigating international regulatory bodies

So how do you work with international regulatory bodies if you are involved in a cross-border broker misconduct incident?

The International Organization of Securities Commissions IOSCO promotes global regulatory standards for securities markets. We recommend you consult its Investor Protection section, which has a special education center to help investors know their rights.

Fortunately, many countries have signed memorandums of understanding to facilitate cross-border cooperation in securities regulation. In addition, the Financial Stability Board (FSB) coordinates national financial authorities and international standards bodies to promote financial stability.

Although the process may seem a little complicated, this knowledge is crucial to protecting your investment and addressing any issues that may arise when investing or working with brokers outside of your home country.

Country Specific Regulations

Different countries have different approaches to handling complaints against brokers. The European Securities and Markets Authority (ESMA) coordinates regulation in all EU member states and helps investors investing in these countries.

In the United Kingdom, the Financial Conduct Authority (FCA) regulates financial services firms and financial markets. If you invest in Japan, the FSA Financial Services Agency oversees the banking, securities and foreign exchange and insurance sectors.

These regulators may be relevant, depending on where you invest your money. That is why it is essential to become familiar with their regulations and operations.

Regulatory cooperation agreements

The different regulators do not always work independently. In most cases, regulators from different countries establish cooperation agreements to improve investor protection across borders.

The SEC has signed bilateral and multilateral memoranda of understanding with numerous foreign regulators. In this way, it can provide better protection to US investors investing abroad.

In addition, the International Forum of Independent Audit Regulators IFIAR facilitates cooperation between audit regulators globally to detect any foul play. Finally, the Financial Action Task Force (FATF) sets global standards to combat money laundering and terrorist financing, impacting broker regulations around the world.

These agreements can significantly affect the process and outcome of cross-border complaints by helping investors stay protected wherever they are.

Learning summary

We have reached the end of our guide and have covered all the aspects you need to understand if you want to file a complaint against a broker.

It is important to understand how the process works, whether you are investing at home or abroad. Here are some important tips to protect your investment:

- Always document all interactions with your broker and keep detailed records of your investments.

- Familiarize yourself with your brokerage firm’s internal complaints procedures before escalating to external bodies.

- Understand the roles of regulators such as the SEC and FINRA in handling investor complaints.

- Consider alternative dispute resolution methods, such as arbitration and mediation, before taking legal action, as they are often less expensive and time-consuming.

- Perform due diligence when selecting a broker to minimize the risk of future problems.

- Stay informed about international regulations and cooperation agreements when dealing with offshore brokers.

At TopBrokers, we care about providing you with the knowledge necessary to help you become a better trader. That’s why we created this guide to help you compare forex brokers to choose the best one.

We make sure you have access to FCA regulated forex brokers to ensure your money is regulated by a top-tier regulatory body.

Since we understand that the convenience of depositing and withdrawing your money can ruin your trading experience, we prepared a special list of the best PayPal forex brokers out there.

A safe and profitable investment is just a click away with TopBrokers – we have the latest on your top brokers. For smart investments!

RoboForex

RoboForex Exness

Exness FxPro

FxPro Alfa-Forex

Alfa-Forex Libertex

Libertex FxGlory

FxGlory XM

XM IC Markets

IC Markets Forex.com

Forex.com AXITrader

AXITrader