Did you know that in 2023, the Financial Industry Regulatory Authority FINRA received 11,003 investor complaints, resulting in $88.4 million in fines? That’s not all. As a matter of fact, five firms were expelled and four were suspended due to a lack of compliance.

Although plenty of trustworthy forex brokers are on the market, sometimes traders and investors fall victim to scams. Luckily, FINRA is on your side and can suspend and compensate you for any unauthorized or illegal activity taking place without your permission.But how can you complain against a broker? This guide will help you understand how to complain against a broker and address other issues with your brokerage firm for the best outcome. Let’s get started.

Understanding the Complaint Process

Understanding how to file a complaint against a broker can be a little tricky. However, it’s a crucial part of your learning process as you become a successful trader.

The number of disputes filed by customers increased to 1,891 cases in 2023, compared to only 1,693 cases reported the previous year according to FINRA. These included the breach of fiduciary duty, negligence, failure to supervise, and the breach of contract.

Although each complaint is different, the process is more or less the same. These complaints align with your rights as an investor, protected under various securities laws, including the Securities Exchange Act of 1934. Once received, a complaint will go through internal review, regulatory investigation, and potential legal action, depending on its nature.

Identifying Valid Grounds for Complaints

In the stock market, customers aren’t always right.

Sometimes you may think you have good reason to file a formal complaint against your broker. However, this might not be the case.

A disagreement or miscommunication with your broker might not qualify as a valid complaint if it doesn’t break the FINRA Rule 2010 which requires brokers to observe high standards of commercial honor and just and equitable principles of trade.

Another valid reason is stated according to The Securities and Exchange Commission SEC Rule 10b-5, which prohibits any act or omission resulting in fraud or deceit in connection with the purchase or sale of any security. Finally, a breach of fiduciary duty, which allows advisers to act in the best interest of their clients, established under the Investment Advisers Act of 1940, might qualify for a solid complaint against your broker.

Common Types of Broker Misconduct

Trading is a game of math and sentiment. This is why understanding the value of crowd psychology in trading is a crucial part of your learning process as an investor.

Some brokers might abuse traders’ lack of knowledge to do some illegal actions. These actions aren’t necessarily in the best interest of the investor or trader. Moreover, they can subject you to legal consequences.

But what are the most common types of misconduct?

Churning is definitely one of them. It happens when brokers trade excessively to generate commissions, regardless of how this affects you.

Under FINRA Rule 2111, brokers are required to have a reasonable basis to believe that a recommended transaction or investment strategy is suitable for the customer. In this sense, unsuitable investment recommendations represent a serious violation.

Breach of fiduciary duty is another issue. According to the fiduciary standard, brokers are required to put their clients’ interests above their own, as outlined in the Investment Advisers Act of 1940.

Here’s a summary of the most common types of misconduct and the red flags that could alert you.

| Type of Misconduct | Description | Potential Red Flags |

|---|---|---|

| Churning | Excessive trading to generate commissions | High account turnover, frequent trades |

| Unsuitable Investments | Recommending investments that don’t align with the client’s goals or risk tolerance | Investments inconsistent with stated objectives |

| Unauthorized Trading | Making trades without the client’s permission | Unexpected transactions in account statements |

| Misrepresentation | Providing false or misleading information about investments | Discrepancies between verbal promises and actual performance |

Documenting Evidence

So, you found something fishy. Now, what next?

The first thing to do is gather and organize all the relevant documents to prove you have a valid case. Account statements, correspondence with your broker, and trade confirmations can all prove that you’ve been manipulated. For example, time-stamped order tickets can provide crucial evidence in cases of unauthorized or mishandled trades.

So, how can you access these documents? Remember that SEC Rule 17a-3 requires brokers to maintain certain books and records, which clients can request and access. Moreover, Electronic communications, including emails and text messages, are considered valid forms of documentation under FINRA Rule 4511.

Internal Complaint Procedures

So, do you think it’s now time for your court drama? Not so fast!

Going through your brokerage firm’s internal complaint process is often the first step. Most firms have reliable internal complaint procedures that are typically outlined in the firm’s customer agreement or on their website.

These procedures can handle most complaints and clear confusion for clients. Once you file a complaint, firms are required to acknowledge receipt of a written complaint within 15 days, as per FINRA Rule 4513. This step resolves most issues quickly and efficiently.

But, sometimes, escalating to external bodies is the only option. FINRA Rule 4530 requires firms to report certain customer complaints to FINRA within 30 days.

According to InvestmentNews, this case of a former female Osiac recruiter who ended up dropping her discrimination complaint shows that going through internal channels is a necessary step before escalation.

Writing an Effective Complaint Letter

As you learn how to become a fearless forex trader, you must familiarize yourself with the process of writing clear and factual complaint letters.

This crucial step should explain your inconvenience in detail, and a desired solution. You might be angry but emotional language should be avoided.

Stick to the facts, and include any specific details, such as account numbers, trade dates, and amounts in your complaint letter. If possible, do your research to reference any FINRA or SEC rules that you believe have been violated. Finally, request a written response within a specific timeframe, typically 30 days.

Regulatory Complaints and External Resources

Since complaints can be handled internally, then there’s probably no need to escalate, right?

Unfortunately, this isn’t true. Only some complaints can be handled internally according to the broker’s regulations.

So, what happens if you don’t receive the help you need?

If the internal process fails you, you should escalate your complaint to a regulatory body or seek external assistance from a professional. In other words, a regulatory complaint against a broker is your second option if the firm’s internal process doesn’t do you justice.

The SEC and FINRA have established processes for handling investor complaints and can provide valuable resources and support. Although they have separate jurisdictions, they sometimes overlap when handling investors’ complaints.

Filing a Complaint with the SEC

The Securities and Exchange Commission SEC plays a crucial role in protecting investors and maintaining fair, orderly, and efficient markets. Its Division of Enforcement handles investor complaints and conducts investigations if you suspect an illegal activity or manipulation with your investments. This division initiated 760 enforcement actions in fiscal year 2022, a 9% increase from the previous year, according to the U.S. Securities and Exchange Commission.

Nevertheless, understanding the right process of doing so is paramount, as some information is mandatory. The complaints you file can lead to various outcomes, including formal investigations, civil actions, or referrals to other agencies, depending on its nature.

SEC’s Online Complaint Center

Digital tools and new technologies play a significant role in trading. And handling complaints is no different.

To make things easier, the SEC has established an online complaint center, which allows you to file a complaint with the SEC electronically. It’s also known as the Tips, Complaints, and Referrals or TCR system.

The system categorizes complaints into various types, including corporate disclosure, insider trading, and market manipulation. This categorization guarantees that your complaint will be handled by the right experts. Users can submit different types of information anonymously, with contact information to facilitate the investigation process.

Follow-up Procedures

After submitting your complaint, the SEC won’t provide status updates on individual complaints due to confidentiality requirements. However, you can file a Freedom of Information Act FOIA request to obtain information about the status of your complaint.

In some cases, the SEC might refer your complaint to other agencies or self-regulatory organizations if it aligns with their scope. You should expect the SEC to contact you for additional information or clarification during the follow-up stage.

FINRA Arbitration and Mediation

FINRA operates the largest securities dispute resolution forum in the United States. According to FINRA, 70% of arbitration cases submitted in 2022 were resolved without a hearing, either through settlements or other means.

FINRA’s arbitration and mediation processes provide alternatives to traditional litigation. They usually provide faster and more cost-effective resolutions to broker disputes.

While you’re here, check this link to learn more about creating and managing a forex trading strategy.

Arbitration vs. Mediation

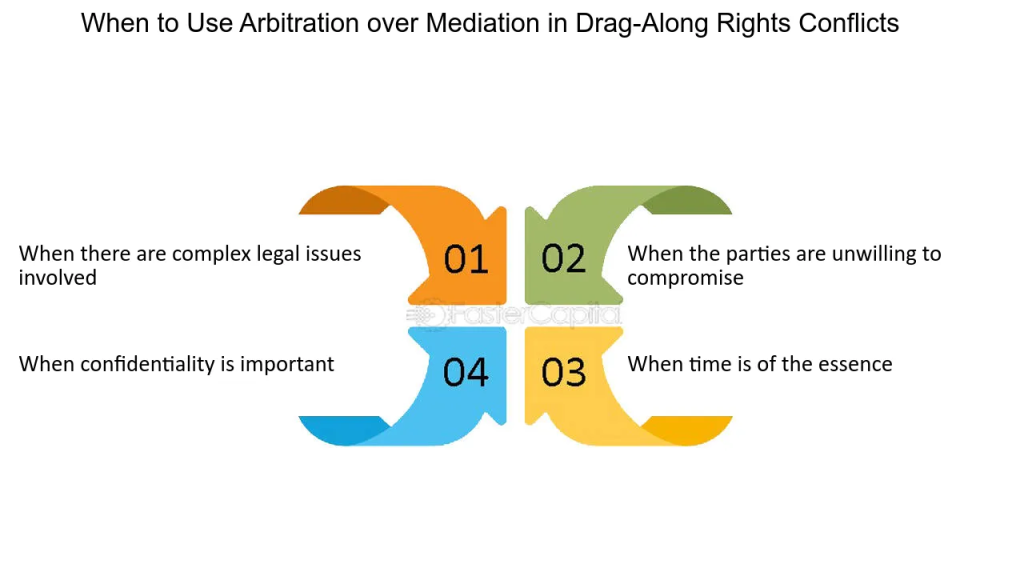

So, what is the difference between arbitration and meditation? Arbitration involves a neutral third party making a binding decision, while mediation facilitates negotiation between parties to reach a mutually agreeable solution.

FINRA can do both to provide solutions. FINRA’s arbitration panels typically consist of one or three arbitrators, depending on the claim amount.

Mediation success rates are high. On the other hand, arbitration decisions are final and binding, with limited grounds for appeal.

The following table summarizes the difference between these options, to help you pick the right route based on the nature of your complaint.

| Aspect | Arbitration | Mediation |

|---|---|---|

| Decision-maker | Arbitrator(s) | Parties involved |

| Outcome | Binding decision | Voluntary agreement |

| Formality | More formal | Less formal |

| Duration | Typically longer | Often shorter |

| Cost | Generally higher | Usually lower |

| Appeal options | Limited | N/A (agreement-based) |

Preparing for FINRA Proceedings

So, how can you get FINRA on your side?

Regardless of your decision, you should carefully prepare to present your case. This involves gathering and documenting your evidence, selecting an arbitrator or mediator, and understanding the procedural rules.

Proper documentation is key. This steo might take some time but it’s crucial.

FINRA provides a neutral list selection system for choosing arbitrators for maximum transparency. This way, you can guarantee a fair judgment and the best outcome. Discovery in FINRA arbitration is governed by the Discovery Guide, which outlines presumptively discoverable documents.

It’s also worth mentioning that parties in FINRA arbitration can file motions, including motions to dismiss, under specific circumstances outlined in FINRA rules.

Legal Options and Considerations

Remember that although the SEC and FINRA can resolve most disputes, sometimes taking the legal route is a must. This is especially true in cases involving serious broker misconduct.

The statute of limitations for securities fraud claims is typically two years from the discovery of the violation. So, you have a very good case if you notice that your investment are being manipulated.

Not so fast, though. Many brokerage agreements include mandatory arbitration clauses, which may limit your ability to pursue litigation. Remember that reading the fine print is essential if you decide to become a trader.

Because of the complexity of such cases, seeking legal counsel from an attorney specializing in securities law can be invaluable. Securities attorneys often specialize in specific areas such as broker-dealer regulation, investment adviser compliance, or securities litigation. So, doing your research to find someone who can handle your complaint is paramount.

The Public Investors Advocate Bar Association PIABA is a professional organization of attorneys representing investors in disputes with the securities industry. A skilled securities attorney can evaluate your case, explain your legal options, and guide you through the often complex legal landscape of broker disputes.

Many securities attorneys offer free initial consultations to evaluate the merits of your case. They will explain the complexity of seeking a legal punishment and its implications.

Cost-Benefit Analysis of Legal Action

So, is pursuing legal action worth it? This is where the importance of a cost-benefit analysis shines.

Legal proceedings can be expensive and time-consuming, so you should weigh the potential wins against the costs and risks involved.

Legal fees in securities cases can be structured as hourly rates, contingency fees, or a combination of both. Moreover, some attorneys may advance case costs, which are then reimbursed from any recovery or winning.

Understanding these fees will help you make an informed decision about whether legal action is the right choice for your situation. In the meantime, the FINRA Dispute Resolution Task Force has recommended exploring ways to increase the use of mediation in small claims to reduce costs.

Class Action Lawsuits

In some cases, a broker’s misconduct affects multiple investors. If this happens, a class action lawsuit might be the appropriate response.

Class action lawsuits in securities cases are governed by the Private Securities Litigation Reform Act of 1995 PSLRA. They enable a group of investors with similar grievances to collectively pursue legal action, potentially increasing the impact of the lawsuit and sharing the associated costs.

The lead plaintiff in a securities class action is typically the investor or group of investors with the largest financial interest in the case. However, class certification requires meeting specific criteria, including numerosity, commonality, typicality, and adequacy of representation.

Identifying Existing Class Actions

Think you’ve been affected by widespread broker misconduct? Researching and joining existing class action lawsuits might help you.

The Stanford Law School Securities Class Action Clearinghouse maintains a database of federal securities class action lawsuits. This information might help you see if you can participate in one.

Class members typically receive notice of the lawsuit and have the option to opt-out if they wish to pursue individual claims. Nevertheless, this might come at an additional cost.

Settlement distributions in securities class actions are typically based on a plan of allocation that considers factors such as the timing and amount of trades. So, while you might not receive the same settlement, your case will be handled as part of a whole.

Prevention and Best Practices

Is there a way to prevent brokers’ misconduct? Can you protect your investment upfront?

In fact, yes you can. Implementing preventive measures and following best practices can help you avoid issues in the first place, reducing and even eliminating the risk of disputes.

By taking proactive measures to protect your investments and maintain a healthy relationship with your broker, you can significantly reduce the likelihood of needing to file a complaint. Don’t forget that regular account reviews and open communication with your broker will prevent misunderstandings and catch potential issues early.

While you’re here, check out this article to learn how to read forex charts like a pro.

Due Diligence in Broker Selection

Before you start trading, do your homework to choose a reliable broker. In fact, it’s the most important step in preventing future complaints.

So, how can you do this? FINRA’s BrokerCheck tool provides free access to brokers’ professional backgrounds, including any disciplinary actions. So, check their regulatory status, read user reviews, and assess their financial stability.

The SEC’s Investment Adviser Public Disclosure IAPD website offers information on firms and individual investment adviser representatives. State securities regulators also maintain databases of licensed brokers and advisers operating in their jurisdictions.

While doing this research takes time and effort, it’s a crucial step in protecting your investment.

Regulatory Background Checks

Doing some background checks is essential because you want to ensure that you’re working with a trustworthy broker. BrokerCheck reports include information on a broker’s qualifications, registrations, and employment history for the past 10 years. Disciplinary events reported in BrokerCheck include criminal matters, regulatory actions, civil judicial proceedings, and customer complaints.

In fact, your brokerage firm is required to help you with this process. FINRA Rule 2267 requires brokerage firms to provide customers with information about BrokerCheck. This information can provide valuable insights into a broker’s reliability and ethical standards.

Understanding Fee Structures

Misunderstandings about fees make up most disputes between investors and traders. This is why it’s crucial to understand your broker’s fee structure to avoid surprises and potential conflicts.

Common fee structures include commission-based, fee-based (percentage of assets under management), and flat-fee models. You won’t be surprised by the fee charged because FINRA Rule 2264 requires brokers to provide retail customers with a fee schedule and disclose potential conflicts of interest related to compensation.

By law, brokers won’t engage in activities that might not be in your best interest to charge you higher. Under the SEC’s Regulation Best Interest Reg BI, brokers and dealers should act in the best interest of retail customers when making recommendations, including disclosure of all material facts relating to conflicts of interest associated with the recommendation.

Maintaining Accurate Records

Having accurate and detailed records of all interactions, transactions, and communications with your broker is crucial for protecting your interests. It’s also the number one requirement if you need to file a complaint against your broker.

Although SEC Rule 17a-4 requires brokers to maintain certain records for specified periods, investors should keep their own records as well. These records will come in handy when you’re monitoring your investments.

Electronic records are generally acceptable, but it’s important to ensure they are stored securely and remain accessible. Remember that the IRS recommends keeping investment records for at least three years after you sell the security.

Trade Confirmation Reviews

SEC Rule 10b-10 requires brokers to provide customers with written notification of the details of a securities transaction at or before the completion of the transaction. These trade confirmations must include specific information such as the date, time, price, and quantity of the transaction.

Also, FINRA Rule 2232 requires firms to provide customers with account statements at least quarterly, detailing securities positions, money balances, and account activity.

Reviewing your trade confirmations and account statements can help you catch and address any discrepancies quickly. Always check and examine these documents as soon as you receive them to act promptly.

International Considerations

Dealing with international brokers can complicate the process of filing a complaint as most cross-border financial transactions are often subject to multiple regulatory jurisdictions. The regulations are different and multi-faceted. So, it’s essential to understand cross-border regulations and complaint processes to effectively protect your interests in a global financial environment.

While you’re here, check out our comprehensive guide about managing forex emotions.

Navigating International Regulatory Bodies

So, how do you work with international regulatory bodies if you’re involved in a cross-border broker’s misconduct incident?

The International Organization of Securities Commissions IOSCO promotes global regulatory standards for securities markets. We recommend that you check its Investor Protection section, which involves a special education center to help investors know their rights.

Luckily, many countries have signed Memoranda of Understanding MoUs to facilitate cross-border cooperation in securities regulation. Moreover, the Financial Stability Board FSB coordinates national financial authorities and international standard-setting bodies to promote financial stability.

Although the process might seem a little bit complicated, this knowledge is crucial for protecting your investment and addressing any issues that might arise when you’re investing or working with brokers outside your home country.

Country-Specific Regulations

Different countries have varying approaches to handling complaints against brokers. The European Securities and Markets Authority ESMA coordinates regulation across EU member states and helps investors who invest in these countries.

In the UK, the Financial Conduct Authority (FCA) regulates financial services firms and financial markets. If you’re investing in Japan, the Financial Services Agency FSA oversees the banking, securities and exchange, and insurance sectors.

These regulators might be relevant, depending on where you invest your money. This is why it’s crucial to familiarize yourself with their regulations and operations.

Regulatory Cooperation Agreements

Different regulators don’t always work independently. In most cases, regulators in different countries establish cooperation agreements to enhance investor protection across borders.

The SEC has entered into bilateral and multilateral memoranda of understanding with numerous foreign regulators. This way, it can provide better protection to American investors investing abroad.

Moreover, the International Forum of Independent Audit Regulators IFIAR facilitates cooperation among audit regulators globally to detect any foul play. Finally, the Financial Action Task Force FATF sets global standards for combating money laundering and terrorist financing, which impacts broker regulations worldwide.

These arrangements can significantly impact the process and outcome of cross-border complaints, as they help investors stay protected wherever they are.

Learnings Recap

We’ve reached the end of our guide, and we’ve covered every aspect you need to understand if you want to complain against a broker.

It’s important to understand how the process works, whether you’re investing back home or abroad. Here are some top tips to protect your investment:

- Always document all interactions with your broker and keep detailed records of your investments.

- Familiarize yourself with your brokerage firm’s internal complaint procedures before escalating to external bodies.

- Understand the roles of regulators like the SEC and FINRA in handling investor complaints.

- Consider alternative dispute resolution methods like arbitration and mediation before pursuing legal action, as they’re usually less expensive and less time-consuming.

- Conduct thorough due diligence when selecting a broker to minimize the risk of future issues.

- Stay informed about international regulations and cooperation agreements when dealing with offshore brokers.

At TopBrokers, we care about providing you with the needed knowledge to help you become a better trader. This is why we created this guide to help you compare forex brokers to choose the best one.

We made sure you have access to the FCA-regulated forex brokers to guarantee that your money is regulated by a top-tier regulatory body.

Since we understand that the convenience of depositing and withdrawing your money can break your trading experience, we prepared a special list of the best PayPal forex brokers out there.

A safe and profitable investment is just one click away with TopBrokers—we’ve got all the latest about your top Brokers. Here’s to smart investments!

AustraliaUS

AustraliaUS