Whenever you’re choosing a Forex broker, the decision is often difficult because of the numerous types of accounts on offer nowadays. It’s remarkable, when you think about it, that we have come from a time when the Forex industry was so limited until now when we’re spoilt for choice.

In any case, understanding the differences in the types of Forex trading accounts is the first step to becoming a successful trader, because your account will either enable or disable your trading career. When choosing account types, the main difference, and also the most significant is in the amount of capital you’re willing to invest.

Differences in account size

We know that Forex trading as a practice has been around for decades, but the Forex market only became as robust as it is by including more traders from around the world. In the past, trading was restricted to high net-worth investors because of the minimum quantity of a commodity one could trade.

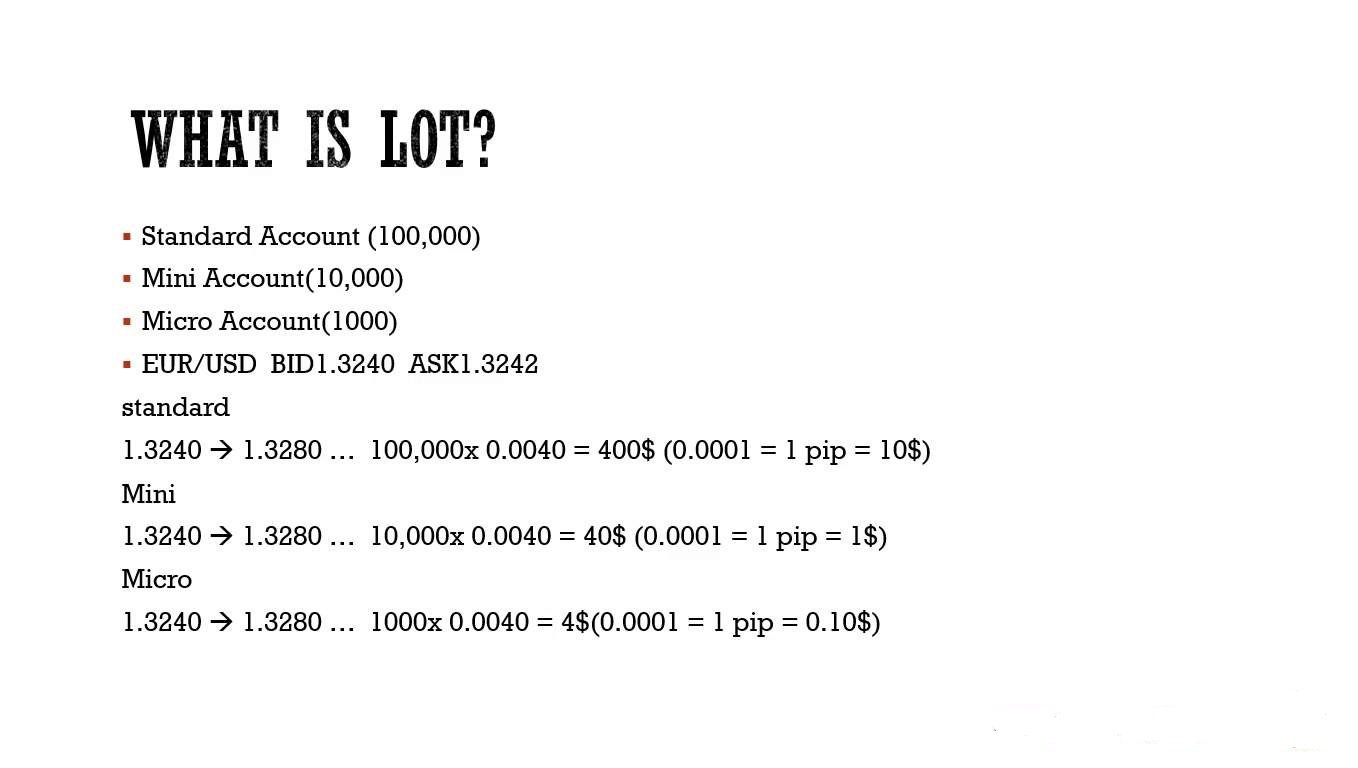

The standard quantity to trade is 100,000 units, and this is referred to as a lot size. Such a huge quantity certainly locked a lot of traders out of the markets if you think about it – for example, to buy the EUR/USD pair which is trading at around 1.10314, you would need to invest $110,314. This was not in the reach of many traders until Forex brokerages began offering leverage.

Nevertheless, these brokerage firms still needed to minimize risk on their side by limiting the amount of leverage offered, and this led to a division in account types based on the amount of money deposited into the account:

Standard accounts

This is the most common type of Forex account and can be referred to as the ‘normal’ account. With this kind of Forex account, the trader usually can trade the standard size lots, 100,000 units. The amount of leverage on these accounts is often 1:100, although some brokers go as high as 1:200 and even 1:500 in rare cases. To be able to put this leverage to good use, the standard minimum deposit is about $500, but then again some brokers can allow as low as $200.

Standard Forex accounts also referred to as classic accounts, are ideal for the experienced trader with a clear trading strategy due to the increased risk. In the overview of Exness account types, you will find more about this topic. Remember, the ability to trade standard lot sizes is a double-edged sword in that it can lead to huge profits or losses. With a standard account, every pip movement could bring a profit or loss of about $10, and the markets can move hundreds of pips on any given day. Therefore, this account would only be suitable for someone who clearly understands the risks of Forex trading and knows how to be a successful trader to avoid losing all their money.

We already saw in the Forex banking post how brokers face a lot of risk by offering high leverages, but standard accounts, with their relatively high minimum deposits, provide the broker with huge capital. Most brokers will hedge their clients’ deposits to make bigger trades in the interbank markets, but they still need to attract the kind of customers who are willing to invest upwards of $500. This is usually done by offering several perks such as bonuses which can be as much as 100% of the deposited amount and high leverage ratios.

Standard accounts are the bedrock of any Forex brokerage because these are the most active traders with a reasonable amount of capital, so every broker will try to attract as many standard account holders as they can by offering even more perks.

Mini accounts

For the novice trader just coming out of demo trading, mini accounts offer the chance to test the waters in the Forex markets. Mini account holders don’t have access to standard lot sizes of 100,000 units but rather use mini lots of 10,000 units. With the reduced amount of lot size, traders can open such an account with a smaller minimum deposit which is usually lower than $200 and can go as low as $50 or less.

Due to this reduced risk, brokers offer plenty of perks like bonuses as high as 100% of the initial deposit to the crazy ‘no deposit bonus’ offered by XM brokers. Leverage, too, can be superfluous, rising to ratios of 1:500 and 1:1000 by some brokers. All these perks are meant to whet a trader’s appetite to either make quick money or deposit more and move up to a standard account. You can consult our IC Markets account types comparison and Forex.com broker review for more.

However, mini-accounts are not just meant for novices or those with limited capital, plenty of experienced traders use mini-accounts also. The main reason an experienced trader may use a mini account would be to check out a broker’s operations. Most people do this by browsing Forex broker reviews, which is okay, but the smartest traders choose the mini accounts to get a first-hand experience. By so doing, they can gauge several aspects of a broker such as:

- The speed of withdrawal and deposit of funds,

- Slippage and the width of spreads,

- Customer care service, etc.

Others open these accounts just to test out new strategies they learned, after all, you can hold both a mini and standard account with the same broker simultaneously. The idea of the mini account is to invest only a small amount of money that you would be comfortable losing without even breaking a sweat, hence why it is used experimentally.

Micro accounts

Yet another level lower is micro accounts which offer micro-lots of 1,000 units. These micro accounts are targeted at individuals who do not have a lot of money to spare but are still interested in Forex trading. At this level, a pip has a value of about 10 cents, so the amount of money to be gained even on a volatile market is limited, but so are the potential losses.

Such an account can be held with as low as $25 or less, so even losing this money would not be any kind of a blow to the trader’s wealth. These accounts, just like mini accounts, are also often used experimentally, but Forex micro account brokers who offer these accounts are usually not major brokers. For example, FXPro Broker Platforms and Tools Evaluation.

Cent accounts

At the lowest level is the cent account, and these accounts’ lot size is 10 units, 0.0001 times the standard lot size. The account balance is indicated in cents, so the trader gets the feeling of trading using several thousand dollars rather than their actual deposit/capital.

You should consider these cent accounts when choosing a Forex broker because they usually have a minimum deposit of only $1, offering you the opportunity to test new strategies without the stress of handling lots of real money. Find some of the Forex cent account brokers in the link provided.

VIP accounts

Also called 'Gold accounts' these are meant for high net-worth investors, though, the same perks that draw traders to mini and standard accounts don’t apply to them. Instead, they seek out the very top Forex brokers with excellent reputations and invest substantial capital, usually a minimum of $10,000. These high net-worth investors are not enticed by higher leverages or bonuses because they already have the necessary capital. Consequently, they are afforded standard lot sizes and relatively small leverage below 1:100, often 1:50, and this is enough. With this, they can trade multiple lots simultaneously without putting a strain on their account balance.

Even though high net-worth investors don’t respond to the same incentives as regular traders, brokers provide different kinds of incentives. For example, VIP account holders may receive prepaid debit cards and even an account manager who informs them of any market moves ahead of time. Although there aren’t many VIP account holders in any given brokerage, these individuals provide essential capital to the broker for their hedging purposes and the brokers are always looking to land such big investors. We have a complete list of Forex brokers offering VIP accounts, and you can use it to open a VIP Forex account.

Managed accounts

In the case of an investor who either does not have a clue about Forex trading or doesn’t have time to do the trading themselves, they can invest with an account manager. With these managed accounts, the investor is in charge of their invested funds, but they cannot execute any trades. Some types of these managed accounts include:

PAMM (percent allocation management module)

These accounts involve a single investor acting as the account manager and sole trader to whose account money is deposited by a minimum of a single trader and no upper limit on several investors. As the account manager keeps trading, the profits or losses are added or deducted from the investors’ capital according to the percentage of their investment. You can learn more about these accounts and how to select PAMM accounts right here on our website.

MAM (multi-account manager)

A much more sophisticated system, MAM accounts do not pool investors’ funds together into a single account, but rather just use the investors’ capital as leverage. Imagine your account does not have sufficient capital to execute a particularly large order, when connected to a MAM account, you will be able to do so without having to make another deposit. These accounts don’t even have to be limited to a single broker, and investors with different brokers can still use this system to maximize profits. On the other hand, MAM accounts are risky due to their decentralized nature, so they are best suited for traders with a high tolerance for risk.

LAMM (lot allocation money management)

Instead of pooling investors’ money together like in the previously managed accounts, LAMM works like a trading signal where trades are executed by one account manager and this action triggers similar trades in all investors’ accounts. This allows investors partial control of their accounts because they can close out any open positions whenever they want, but the account manager still can execute trades at any time.

Individually managed account

If you prefer not to be involved with other traders, you can always go it alone, by investing your money with a single account manager. This is similar to private equity and mutual funds, and just like those systems it requires a substantial initial deposit. Most brokers would not assign an account manager to an account holding less than $10,000, so these accounts are limited to high net-worth investors.

When you’re choosing a managed account, it is important to keep a few things in mind:

- The account manager’s strategy – it is required that they explicitly indicate how they plan to trade so that investors know exactly what they are getting into. A long-term investor should therefore invest in the kind of account managed by a conservative trader who doesn’t take too much unnecessary risk

- Commission and other charges – of course, the account manager doesn’t do it for free, and you should know exactly how much they charge or deduct

- How to choose a Forex broker? – the account manager and managed account are both kept in check by the broker, thereby an unreliable broker would result in an unreliable account

- Length of investment – the time it takes before you can withdraw your money from the account

More Forex account types

There are still other types of accounts that are targeted at specific individuals, such as:

- Swap free Islamic Forex accounts

- Segregated Forex accounts

- IRA Forex accounts

- Non-expiring Forex accounts

These accounts are not very common, but they cater to the specific needs of certain individuals.

Other considerations

We’ve looked at how Forex trading accounts can differ from one another in terms of account size and their limitations, but even within these major account types, there are still more differences. Some of them which you should consider include:

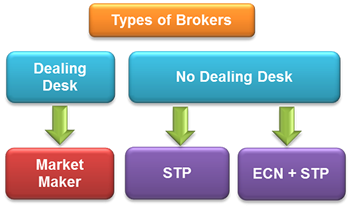

Execution

A Forex broker can either execute their clients’ trades themselves or transfer the orders to a liquidity provider. In the first case, this can either be an STP (straight-through processing) or dealing desk operation, while the second case involves ECN (electronic communications network). Either of these types of operations has its advantages and disadvantages, but you will generally find STP Forex brokers to have faster execution times and narrower spreads. On the other hand, the most popular Forex ECN brokers are more reliable since they can’t easily alter markets.

These 2 account types can be offered in any of the 5 account types above, so it’s one more thing to consider.

Charges

Brokers, operating as businesses, earn profits from the services they provide to traders. They typically do this through commissions or spreads. Commissions are fixed percentages charged on the profits made from trades, while spreads refer to the difference between the asking and bid prices of assets. Each charging system has its own set of advantages and disadvantages, depending on your trading strategy.

In the case of spreads, some brokers offer fixed spreads, which can be more cost-effective, particularly on volatile trading days. An example of such a day is November 9, 2016, when market volatility is expected due to the announcement of the US general election results.

For more Top Brokers, make sure you check out our Alfa Broker, XM review, and RoboMarkets review.

RoboForex

RoboForex Exness

Exness FxPro

FxPro Alfa-Forex

Alfa-Forex Libertex

Libertex FxGlory

FxGlory XM

XM IC Markets

IC Markets Forex.com

Forex.com AXITrader

AXITrader