The forex market in 2024 continues to grow, with a turnover rate of daily trade worth over $7.6 trillion. The sheer size means there are countless top forex brokers to choose from, but there is no-one-size-fits-all answer.

Choosing the ideal broker can be confusing and time-consuming. However, I’ve put together this comprehensive guide to better understand how to compare the best forex brokers, taking the hard work out of the process.

Table of Contents

- Understanding the Forex Market Landscape

- Key Factors in Comparing Forex Brokers

- Advanced Features and Services

- Emerging Trends in Forex Brokerage

- Risk Management Tools and Features

- Broker Transparency and Reputation

- Regulatory Changes and Compliance

- Learnings Recap

Understanding the Forex Market Landscape

The first thing to know about forex is its size. It’s larger than most can comprehend, and within it, there is a global network of institutions and traders. Navigating such a complex landscape requires careful understanding about structure and key players.

Market Structure and Participants

The forex market operates 24/7, five days per week, worldwide. It’s a decentralized process, so there is no single exchange that controls trades. Instead, it is a large, global network of computers and traders that make simultaneous transactions.

The forex market is divided into tiers, with the interbank market at the top of the structure. Within that, retail traders can access the market through online forex brokers, who act as intermediaries. There are also several different types of brokers that have various trading models and execution models. Market makers and ECN brokers are just two examples of these.

Interbank Market

At the top of the forex structure is the interbank. This is where major banks and financial institutions can be found and they tried directly with one another. Interbank market trades account for the majority of forex trading volume, and these spreads are typically tighter. However, retail traders don’t have direct access to this market. Instead, forex brokers act as intermediaries, providing access to deep liquidity pools.

Any large transaction within the interbank market can influence exchange rates significantly.

Retail Forex Market

Over the last few years, the retail forex market has gained major traction and is now extremely popular. This is, in part, due to online trading platforms that have made trading easier and more inclusive. Within this space, brokers compete to offer trading conditions, services, and platforms. Many brokers also offer educational resources for beginner traders, and demo accounts for learning.

Retail traders can also take advantage of high leverage ratios, which enable them to control larger positions. Leverage amounts vary, which is another reason why it’s important to compare forex brokers. Overall, the retail forex market is more heavily regulated, to protect individual investors.

When exploring online forex brokers, it’s important to understand how they connect individual traders to the retail forex market. Additionally, it’s vital to explore their features and individual pros and cons.

Let’s explore a typical forex trade. This might involve buying 1 mini lot of EUR/USD, which equates to 10,000 units. With 50:1 leverage, a trader would only need $200 in margin to control the $10,000 position. Leverage can certainly amplify the chances of profits, but it also increases the chances of losses.

Currency Pairs and Liquidity

In forex, one currency is traded against another. This is called a currency pair. However, the liquidity of a pair can drastically impact the trading experience, and it can affect spreads and execution speed.

Currency pairs are categorized as major, minor, or exotic. Within currency pairs, liquidity can vary greatly, and higher liquidity usually results in tighter spreads and faster execution.

| Pair Type | Examples | Typical Spread | Liquidity |

| Major | EUR/USD, USD/JPY | 0.5-1.5 pips | Very High |

| Minor | EUR/GBP, AUD/CAD | 1.5-3 pips | Moderate |

| Exotic | USD/TRY, EUR/ZAR | 3+ pips | Low |

Major Pairs

Unsurprisingly, major pairs are the most traded currency combinations within the forex world. These typically involve the US dollar (USD) with another large currency, such as the British pound (GBP). Major pairs have high liquidity, so their spreads are tighter and execution times are faster.

The most common major pair is the EUR/USD, which accounts for 22.7% of daily forex trades. One of the main reasons for the popularity of major pairs is that they’re less volatile, so they’re ideal for beginners.

Minor and Exotic Pairs

Minor pairs are also known as cross-currency pairs, and these don’t include the US dollar, but may include either the British pound or Euro. However, exotic pairs involve currencies from emerging or smaller economies with either the US dollar, British pound, or Euro.

Both minor and exotic pairs are less liquid so they have wider spreads, but they can be more volatile. Additionally, economic and political issues can affect exotic pairs the most. However, minor pairs are a good diversification strategy provided careful research is done before making a choice.

Key Factors in Comparing Forex Brokers

Choosing a broker for forex trading is not a decision that needs to be rushed. There are many key factors that should be weighed up carefully, including regulatory compliance, trading costs, tradable platforms, and educational resources. It’s important to consider personal trading goals and then compare forex brokers based on key criteria.

For instance, regulatory compliance is vital because it ensures reliability and protection of funds. A regulated forex broker will give peace of mind throughout the trading journey, and acts as a safety net in the event of a problem.

Trading costs, including spreads and commissions, also need to be considered, as these have a direct impact on profitability. Additionally, look at each broker’s key features and tools. For example, advanced traders may need more in-depth analytical tools and charting capabilities, which some brokers provide. However, beginners may prefer the availability of a demo account and educational resources.

Taking the time to find a broker that provides all the desired features will improve the chances of trading success.

Regulatory Compliance and Safety

I mentioned regulation briefly, but it’s important to understand this topic in detail. A well-regulated broker must follow strict financial guidelines and fair trading practices. Strong regulatory oversight adds extra protection to your funds and ensures that the trading environment is secure.

However, not all regulators are created equally. Top tier, or tier-1 regulators include the FCA in the UK, CySEC in Cyprus, and ASIC in Australia. These are considered to be the most reputable regulatory entities in the forex market and must adhere to strict practices. This includes ensuring that client funds are kept in segregated accounts.

In comparison, offshore regulators may have less protection, and it’s important to assess each point very carefully.

A recent study by the Financial Conduct Authority highlights this importance. They found that 80% of retail forex traders lose money, so choosing a broker with proper risk management tools is critical. At Top Brokers, we have a useful resource on FCA regulated forex brokers, which gives plenty of quality recommendations.

Segregated Accounts

The best regulated forex brokers must have segregated accounts. This ensures that client trading funds are separate from the broker’s business/operational funds, and that they cannot be used by the broker. This is a crucial security feature in case of broker insolvency, as funds are then returned to clients and not lost.

Negative Balance Protection

Another key safety feature is negative balance protection. This is something to look for when performing a forex brokers comparison.

Negative balance protection ensures that a trade cannot lose more than what is in their account. This is a vital aspect of leverage trading in particular. Not all regulators require brokers to offer this protection, so it’s important to check before making a final choice.

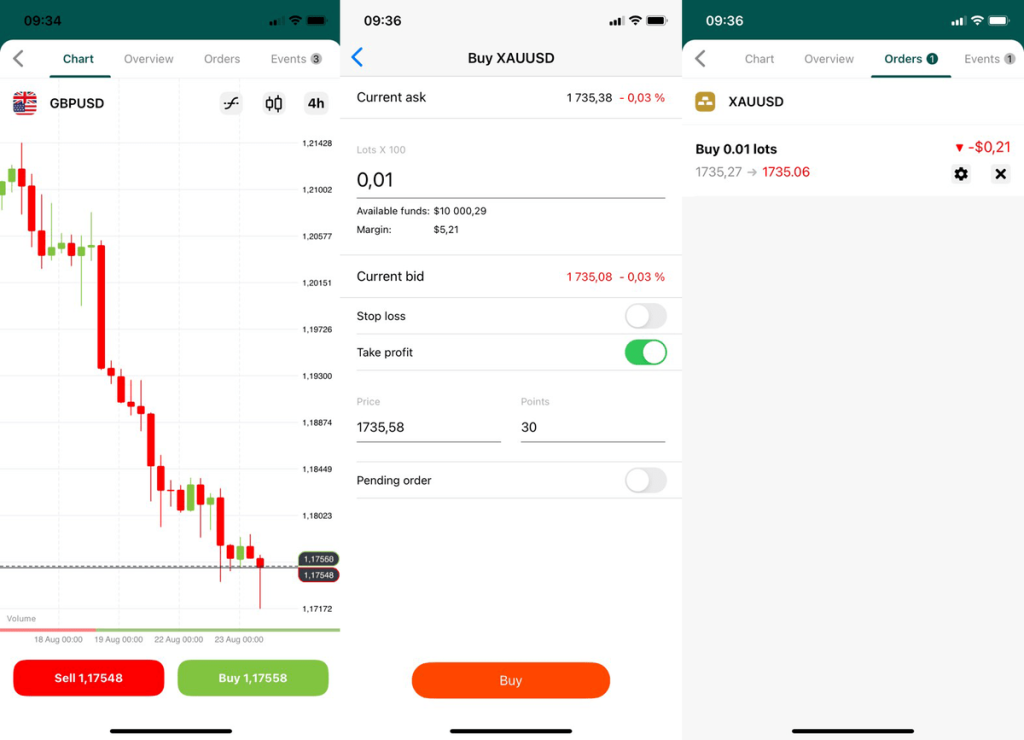

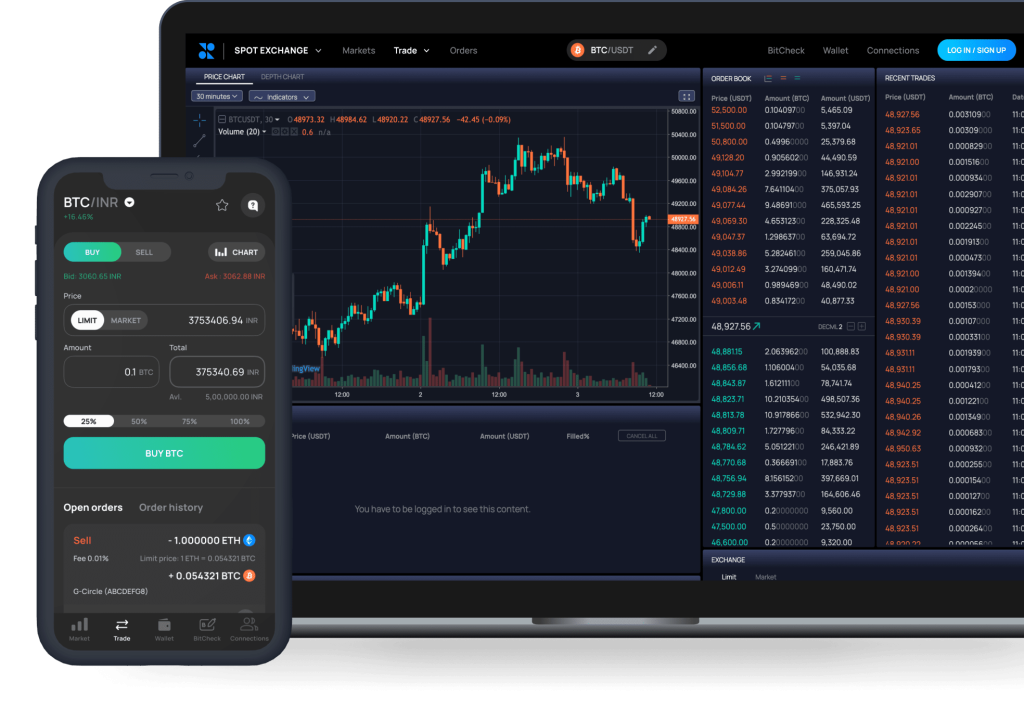

Trading Platforms and Technology

Forex brokers comparison isn’t just about the broker themselves but the trading platforms they offer. There are several major platforms, with MetaTrader 4 and 5 being the most popular. Platforms have their own range of features, including analytical tools, copy trading, and automatic trading. The right platform can take a trading experience from zero to one hundred very quickly.

When exploring the different forex trading platforms, it’s important to look at elements such as customization, mobile compatibility, and advanced charting tools availability. At Top Brokers, we have a number of reviews, including the CQG Trader review. These give more information and help with sound decision-making.

Reputable forex brokers often provide a range of platforms, including MetaTrader and their own proprietary platforms. There is also a strong focus on mobile-friendly platforms in the forex industry for on-the-go trading.

MetaTrader 4 and 5

MetaTrader 4, known as MT4, and its updated version, MetaTrader 5 (MT5) are the most commonly used platforms for forex trading. These have a range of features, including charting tools, customization options, and automated trading capabilities.

Out of the two, MetaTrader 4 is slightly more popular, due to its simplicity and focus on forex features. According to industry data, 85% of traders use MT4. As a result, it is the most popular platform worldwide.However, MetaTrader 5 is growing in popularity, with more asset classes and advanced trading capabilities. However, both MT4 and MT5 offer Expert Advisors (EAs) for automated trading. Our MetaTrader 4 review details this platform.

Proprietary Platforms

Many of the best forex brokers also have their own trading platforms, known as proprietary platforms. These also have unique features that are tailored to the broker itself. For instance, they may have specialized tools or offer a streamlined trading experience for the broker’s target client base.

The downside of proprietary platforms is that they’re often harder to learn compared to MetaTrader, and require more time and effort.

This video shows an overview of the best forex trading platforms, showing both MetaTrader and proprietary options.

Account Types and Minimum Deposits

Reputable forex brokers typically offer different account types to suit different needs and experience levels, including varying spreads, commissions, and features. Within this, minimum deposit requirements appy, and they can range from $0 to thousands of dollars. For this reason, doing careful research is vital.

| Account Type | Typical Minimum Deposit | Spread Type | Best For |

| Standard | $100-$500 | Fixed | Beginners |

| ECN | $1000+ | Variable | Experienced traders |

| VIP | $10,000+ | Ultra-low | High-volume traders |

Micro and Nano Accounts

Two common account types are micro and nano. These both allow traders to use small position sizes and they’re ideal for beginners who want to test strategies with minimal risk. Overall, these types of accounts give a feel for live trading without the commitment.

Micro accounts typically allow trading in 0.01 lot sizes and nano accounts may offer small sizes, sometimes as low as 0.001 lots.

Demo Accounts

A demo account is a risk-free strategy that is ideal for beginner traders. These enable novice traders to practice using virtual money in real market conditions. It’s a great option for learning new skills and testing out strategies.

Most demo accounts expire after a set amount of time, usually around 30 days. However, some forex brokers offer unlimited demo accounts. Our resource on non-expiring forex demo account brokers offers useful suggestions.

It’s important to spend as much time as necessary using a demo account before transitioning to live trading. Often, demo trading doesn’t give the same psychological aspects and emotional input as risking real money and this can be an adjustment.

Spreads and Commissions

Another vital aspect of choosing a broker for forex trading is spreads and commissions. Fees can easily eat into potential profits, so understanding a broker’s fee structure is vital for assessing the true cost of a trade.

There are two types of spreads: fixed and variable. Our resource on the best fixed spreads forex brokers is a useful read. However, each type has its pros and cons. Some brokers charge omissions in addition to or instead of spreads.

When you start to compare forex brokers, focus on their spread and commission structures. The best forex brokers offer transparent fees and competitive spreads.

ECN vs. Market Maker Models

Brokers usually operate under two specific models: Market Maker, and Electronic Communication Network, better known as ECN.

ECN forex brokers connect traders directly to liquidity providers, with tighter spreads with commission. On the other hand, market makers create a market for traders to operate within. These trades are usually commission-free but have wider spreads.

Ultimately, the choice between the two depends on personal training styles and preferences.

Advanced Features and Services

Top forex brokers typically offer advanced features and services to help them stand out from the crowd. Assessing these can make a large difference to the overall trading experience.

Educational Resources and Market Analysis

For beginner and advanced traders, knowledge is vital in the forex world. Many reputable forex brokers offer extensive libraries of educational resources, including beginner guides and advanced strategy webinars. Some brokers also offer coaching or mentoring programs.

Not only do these resources help traders develop their skills but they also inform about market trends. Carefully considering the range of educational tools on offer can be a vital part in choosing the best forex broker.

Trading Signals and Copy Trading

During a forex brokers comparison, look for the availability of trading signals and copy trading features. These are both advantageous options for all traders.

Trading signals give suggestions for potentially successful trades based on market analysis. Additionally, copy trading allows traders to emulate successful trades from other users.

A recent study discovered that 90% of successful traders use robots/expert advisors to help them trade. This highlights the growing use of automated tools in the modern forex industry. However, while these are certainly useful additions, it’s important not to rely upon them entirely.

Economic Calendars and News Feeds

It’s vital for all traders to stay up-to-date about market news and economic events. These can affect the performance of forex pairs significantly. Many forex brokerage firms now offer economic calendars and integrated news feeds that highlight important events. These tools help traders understand market developments in real-time, without delay.

Algorithmic Trading and APIs

Technology moves at a fast pace and the forex world is no different. Algorithmic trading is a very popular feature and several of the best forex brokers incorporate it into their platforms. This tool allows traders to automate trading strategies, executing trades faster than if they were done manually. Another advantage is that it removes the emotional decision-making factor from trading.

API (Application Programming Interfaces) are another tool that allow custom trading applications to be created. Within that, backtrading capabilities allow traders to test strategies with historical data. Our resource on Algo Trading gives more details.

VPS Services

The final feature to look for comparing the best forex trading brokers is a VPS service. This stands for Virtual Private Server, and it can be very useful for algorithmic traders. A VPS allows traders to run trading algorithms 24/7, whether their computer is turned on or not. This reduces the chances of missing a potentially profitable trade.

Many forex brokers in the US and beyond have this feature, either free or for a small fee. Our resource on the best forex VPS brokers gives more details.

Customer Support and Service

The final important aspect to consider when searching for an FX brokerage firm is customer support. Reliable and fast customer support is vital, especially in the fast-paced forex world.

Overall, 25/7 customer support is the industry standard, but some forex brokers offer 24/7 support. It’s also important to check which channels support is available through, such as live chat, phone, email, and/or social media. Additionally, check whether multilingual support is offered.

The quality of technical support can often be crucial when dealing with an issue, such as a trade dispute or a platform technical issue.

Account Managers

Some online forex brokers also offer account managers, usually for VIP clients or traders with large account balances. This feature is useful because managers offer personalized support, which sometimes includes preferential trading conditions. However, remember that sales managers may have sales targets, so advice shouldn’t be taken without careful consideration.

Emerging Trends in Forex Brokerage

I’ve mentioned that the forex industry is huge, and that means it’s constantly shifting and changing. This evolution means new technologies and market demands appear all the time.

It’s vital to stay informed about upcoming and current trends, not only for trading decisions but also to choose the best forex broker at the start. Remember, the industry’s top forex brokers often adopt new technologies and features before anyone else.

Cryptocurrency Integration

The cryptocurrency world has gained significant popularity over the last few years and forex brokers have adopted these services. Now, many reputable forex brokers offer cryptocurrency trading alongside other forex pairs.

However, cryptocurrency trading usually has higher spreads and leverage restrictions, due to the increased volatility and uncertainty in the market. This is highlighted by events in 2022, when the total value of the global cryptocurrency market dropped from $2.9 trillion in 2021 to $798 billion.

Crypto-Fiat Pairs

Some forex brokers offer crypto-fiat pairs, which combine cryptocurrencies with regular currencies. For example, Bitcoin/USD or Ethereum /EUR. Traders interested in cryptocurrencies should explore brokers with a large section of these pairs, bearing in mind that regulatory treatment can vary by jurisdiction.

Blockchain in Forex

Blockchain technology has been around for a while but it has improved considerably over the last few years. This technology has the potential to revolutionize different areas of forex trading. In fact, some brokers already incorporate blockchain for transparent and fast settlements. It is certainly early days currently, but this trend is worth observing closely.

Social Trading and Community Features

A popular addition to the forex brokerage world is social trading, along with other community features. This allows social media elements to be combined with trading, allowing traders to interact and share strategies. Social trading is a good option for beginners and can be used as a learning tool. However, the social element can help some traders stay engaged.

Performance Tracking

Some social trading platforms offer performance tracking tools that allow traders to analyze their performance with others on the same platform. Again, this allows users to learn from each other and identify areas for improvement.

Common performance metrics include win rate, risk-adjusted returns, and average profit/loss. Additionally, some platforms allow traders to filter others users based on their performance statistics.

Discussion Forums

Another key aspect of social trading is the ability to interact in discussion forums. These are useful for sharing market insights and strategy ideas. They allow traders to connect with one another and share ideas, providing diverse perspectives and opinions. However, it’s important not to take all forum advice to heart, and to verify anything that seems inaccurate

Mobile Trading Advancements

Many users prefer to trade on-the-go, encouraging the best forex trading platforms to introduce mobile versions. These often rival desktop versions in terms of functionality and convenience. Some apps include advanced charting capabilities and real-time notifications, along with enhanced log-in security features, such as biometric login. This is often confirmed through facial recognition or fingerprints.

Risk Management Tools and Features

Forex trading is not without its risks and managing risk is a vital part of the puzzle. The best forex brokers have a range of tools to help protect traders’ capital and trade more confidently. As a result, large losses are less likely.

Stop Loss and Take Profit Orders

Key risk management tools include stop loss and profit orders. These protect against unexpected market moves and when used carefully, they can reduce the amount of risk involved in a trade.

Stop loss orders automatically close a trade whenever the price reaches a level the trader has previously specified. Alternatively, take profit orders close a trade whenever profit reaches a predetermined level. There are also trailing stops, which can help lock in profits as the market moves favorably.

For example, a trader opens a long position on EUR/USD at 1.1000, setting a stop loss at 1.0950 and a take profit at 1.1100. This creates a 1:2 risk-reward ratio. If the market moves against them, the most they can lose is 50 pips. If it moves in their favor, they stand to gain 100 pips. This predefined risk management strategy helps the trader maintain discipline and avoid emotional decision-making.

Guaranteed Stop Loss

The next risk management tool to look for is a guaranteed stop loss. This ensures the position closes at the exact price the trader specifies. This happens even during extreme market volatility. This tool often comes with a fee but it offers peace of mind and can reduce risk during major market upheaval.

However, not all online forex brokers offer guaranteed stop loss, so this is something to explore when comparing brokers.

Risk-Reward Calculators

A risk-reward calculator helps identify the potential outcome of a trade. While they’re not 100% accurate, they do give a clear idea of what a trader is likely to lose or gain. This tool is often used alongside stop loss and take profit order placement. Some advanced calculators can even consider factors like win rate and expectancy.

Margin and Leverage Controls

Leverage is a useful tool, but it has a negative side too. It can amplify profits significantly in some cases, but it can also magnify losses to the same significant level. Within leverage trading, it’s important to use leverage controls to harness its power carefully.

Tiered Leverage

Some brokers offer tiered leverage structures that can be adapted to individual trading volume or experience level. Over time, brokers usually offer higher leverage ratios, therefore encouraging responsible trading with room for development.

It’s important to remember that a high leverage ratio isn’t always required, as a lower ratio on larger positions can help manage risk for larger trades. Some forex brokers require traders to demonstrate experience to access higher leverage, or even pass a test. This shows just how risky high leverage levels can be, however, regulatory restrictions on maximum leverage often vary by jurisdiction.

Margin Call Policies

A margin call is given by a broker and it informs traders that it’s time to add funds or close positions. Other brokers may initiate automatic liquidation to protect trader accounts from negative balances.

Generally, margin call levels range from 50% to 100% of used margin. Some brokers give multiple warning levels beforehand, yet others may not. It’s vital to assess these policies when choosing the best forex broker.

Portfolio Diversification Tools

Spreading investments and trades over a range of assets and currency pairs is a positive strategy. This ensures that in the event of adverse market conditions, traders don’t lose everything. It can be compared to “not putting all your eggs in one basket.”

Some of the best forex brokers offer tools to help traders manage portfolio diversification.

Correlation Matrices

Correlation matrices show how different currency pairs move relative to each other. Understanding this can help traders avoid correlated risks. For example, a trader may regularly choose GBP/USD pairs without realizing that they often move similarly, therefore not achieving diversification.

Correlation values range from -1, which shows perfect negative correlation, to +1, showing perfect positive correlation. It’s also important to regularly review correlations as they can change back and forth over time.

Multi-Asset Trading

Many of the best forex brokers offer a range of tradable assets, such as stocks, commodities, or indices. Having a multi-asset approach allows traders to diversify portfolios beyond forex. This means risk is spread more evenly, but traders can also take advantage of opportunities across different markets.

Broker Transparency and Reputation

When performing a forex brokers comparison, transparency and reputation are vital elements to assess. Brokers must be willing to be open and transparent about their operations, and that signal reliability and fair trading practices.

Showing transparency means disclosing trading costs and execution policies in their entirety. Additionally, both regulatory status and financial stability highlight a broker’s reputation, along with customer reviews and any industry awards they have won.

Execution Quality and Speed

Fast and reliable execution are two things that are vital for any traders. The forex world is fast-paced, and even the slightest hesitation can affect trading outcomes.

Execution speed in particular is very important for short-term trading strategies that move at a faster pace. However, there are several elements that can impact execution speed, including server location, network latency, and order routine. For that reason, look for brokers that publish execution statistics to give important information before making a decision.

Slippage Statistics

Slippage happens when a trade executes at a different value to the one requested. It’s normal for a small amount of slippage to occur in fast-moving markets, but excessive slippage is damaging to profits. It’s a good idea to look for online forex brokers that are transparent about their slippage statistics. Some brokers also offer “no slippage” on limit orders.

For example, a trader places a market order to buy EUR/USD at 1.1000. Due to rapidly changing market conditions, the order is filled at 1.1002. This 2-pip slippage might seem small, but on a standard lot (100,000 units), it represents an additional cost of $20. Over many trades, such slippage can significantly impact profitability.

Order Execution Reports

In-depth execution reports are an excellent tool to understand a broker’s order filling process. These show how frequently orders are filled at the requested price, average execution speed, and price improvements. Additionally, these reports may change over time, so it’s important to review them regularly.

Financial Stability and Ownership

The financial stability of a broker impacts how safe its traders’ funds are. It’s a good idea to delve into the financial background and ownership structure of a broker to find out about their true reliability.

Generally, publicly traded brokers give more financial transparency, and the size of a broker’s client base and trading volume often indicates stability.

Annual Financial Reports

A broker’s annual financial reports may be long and complicated but they give a lot of information about financial health. Key areas to look for include consistent profits, strong capital reserves, and sustainable growth. Most brokers are happy to share their annual reports, but if they’re not, it could be a sign to avoid them.

Ownership Transparency

Reputable forex brokers are usually transparent about their ownership and management team. Brokers that have complex or confusing ownership structures may be best avoided as it can sometimes be an attempt to evade regulatory oversight.

Additionally, understanding the corporate structure of a broker can give information about their global operations.

Industry Awards and Recognition

While not all top forex brokers win awards, they can be a sign of quality and innovation. It’s important to remember that some awards are more prestigious than others, so look carefully at the credibility of the award-giving organization. Additionally, look for awards that focus on a specific element of a broker’s service, and be wary of any that seem to be given to many brokers simultaneously.

Innovation Awards

A good award to seek is related to innovation. These awards show brokers that are pushing the boundaries and are eager to adopt new technology. Such awards may recognize trading platform advancements, risk management tools, or services to clients. However, some of these awards may be more marketing-focused than showing true benefit to traders.

Customer Satisfaction Awards

A good award to look for is a customer satisfaction accolade, especially if it’s based on verified client feedback. These can provide accurate insights into a broker’s service quality and show customer service responsiveness, platform reliability, and overall trading experience.

However, as with all awards, it’s important to cross-reference them with other sources of client feedback to develop a balanced opinion. Also remember that awards given several years ago may not reflect the level of service today.

Regulatory Changes and Compliance

As with the rest of the forex world, the regulatory landscape also constantly evolves. It’s important to stay as up-to-date as possible with changes and to understand how they affect trading activities with specific brokers. For instance, regulatory changes can affect asset offerings, leverage limits, and trader protection.

By understanding the overall regulatory environment, traders can choose a broker with the appropriate level of oversight. I’ve already mentioned that top-tier regulators give the best level of protection to traders, and it’s important to monitor this closely. The best regulated forex brokers usually have more than one license from several top-tier regulators. This gives extra protection and peace of mind to traders.

Additionally, well-regulated markets, such as the UK, Australia, Europe, and areas in the Far East hold a high concentration of forex activity. According to industry data, 78% of global forex turnover occurs in one of the five major financial centers worldwide. These are the US, UK, Singapore, Japan, and Hong Kong.

ESMA Regulations in Europe

ESMA stands for the European Securities and Markets Authority, which has made major changes over the last few years. These particularly affect leverage limits and marketing practices. The aim of these rules is to protect retail traders and to change the trading landscape for the better.

Traders in Europe, or those with a European broker, should stay up-to-date with these regulations and understand them well.

US NFA and CFTC Requirements

In the United States, the National Futures Association (NFA) and Commodity Futures Trading Commision (CFTC) oversee trading. These bodies strictly control leverage, reporting, and broker capital requirements. US traders must be aware of these regulations as they have a significant impact upon trading options.

For instance, US regulations limit leverage to 50:1 on major currency pairs and 20:1 on minor pairs. First In, First Out (FIFO) rules also apply to forex traders in the US.

Cross-Border Trading Regulations

The world may be large but it’s extremely connected, and it’s common for forex traders to explore brokers in other countries. While this is possible, there are several regulatory challenges to consider. For instance, some regulators restrict their residents from trading with foreign brokers.

Additionally, cross-border trading can sometimes impact tax obligations and reporting requirements. It’s important to work with a tax specialist to ensure taxes are reported properly.

Brexit Impact on UK Brokers

When the UK left the EU, called Brexit, a new regulatory divide between the UK and EU opened up. This has implications for UK brokers with EU clients, and EU brokers with UK clients. Traders that fall into this category must stay up-to-date with how changes may affect accounts and the protections available.

In some cases, certain UK brokers have established EU entities so they can continue serving European clients, but this isn’t the case for all. This is also a fast-moving situation and it’s vital to stay as informed as possible.

International Regulatory Cooperation

Due to the significance of the forex global market, there is a push for international cooperation in forex regulation. Many regulators are collaborating to create standardized rules and to ensure careful oversight of cross-border trading. However, this isn’t without its challenges.

Initiatives such as the Global Finance Innovation Network aims to enhance regulatory cooperation. Additionally, standardizing reporting can help regulators accurately tract forex activity, yet there are challenges in creating a harmonious atmosphere across different jurisdictions.

Learnings Recap

The forex world is large, complex, and constantly changing. However, it’s one that can bring major gains to traders who make the right moves. The key lies in choosing the right foreign exchange broker that is personalized to your specific needs, preferences, and trading goals.

To sum up, let’s recap the main points we’ve discussed:

- Regulatory compliance is non-negotiable. Always verify a broker’s regulatory status.

- Trading platforms should align with your trading style and technical needs.

- Consider the full picture of trading costs, including spreads, commissions, and other fees.

- Advanced features like social trading and mobile capabilities can enhance your trading experience.

- Robust risk management tools are essential for capital protection.

- Transparency in operations and financials is a sign of a reputable broker.

- Stay informed about regulatory changes that could impact your trading.

Ultimately, choosing the best forex broker for your personal needs takes time, research, and effort. Additionally, it’s important to fully understand the forex world.

Here at TopBrokers, we have a range of articles and comparisons to help you improve your skills and make strong decisions. Our guide on how to create and manage a forex trading strategy is an ideal starting place. Finally, as you compare forex brokers, remember that many excel in several areas. Explore different elements and choose the one that aligns best with your trading needs and risk tolerance level

United Arab EmiratesAE

United Arab EmiratesAE United StatesUS

United StatesUS