Analysis & Forecast

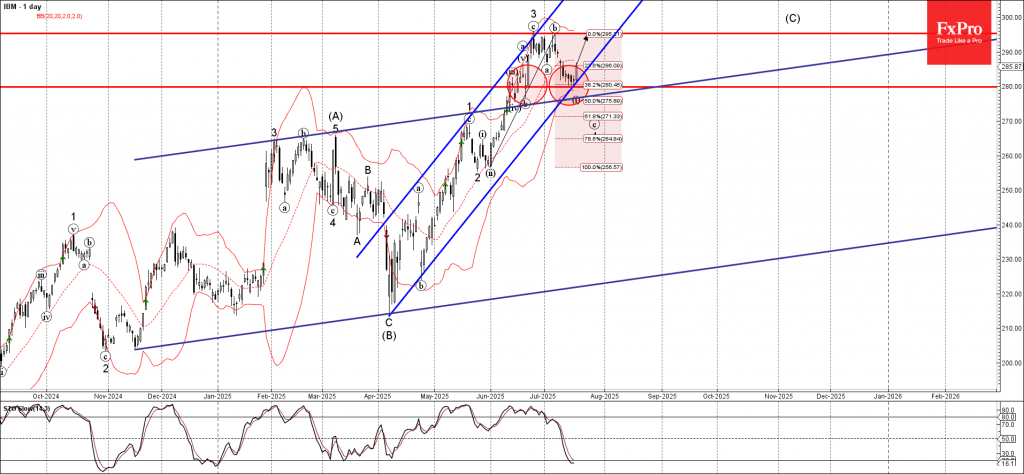

IBM: ⬆️ Buy– IBM reversed from support zone– Likely to rise to resistance 295.40IBM recently reversed up from the support zone between the support level 280.00, upper trendline of the recently broken weekly up channel from 2024 and th...

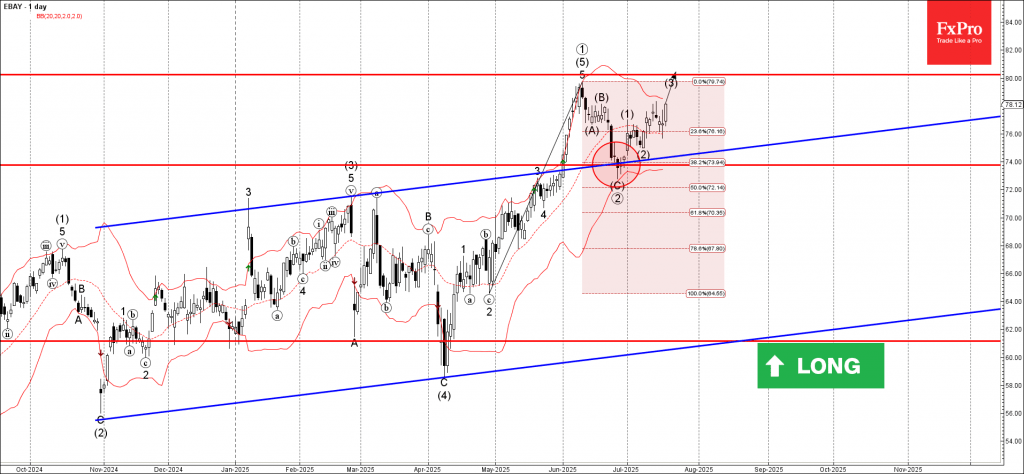

Ebay: ⬆️ Buy– Ebay rising inside impulse wave (3)– Likely to rise to resistance 80.00Ebay continues to rise inside the impulse wave (3) of the long-term upward impulse wave 3 from the end of June.The active long-term impulse wave 3 st...

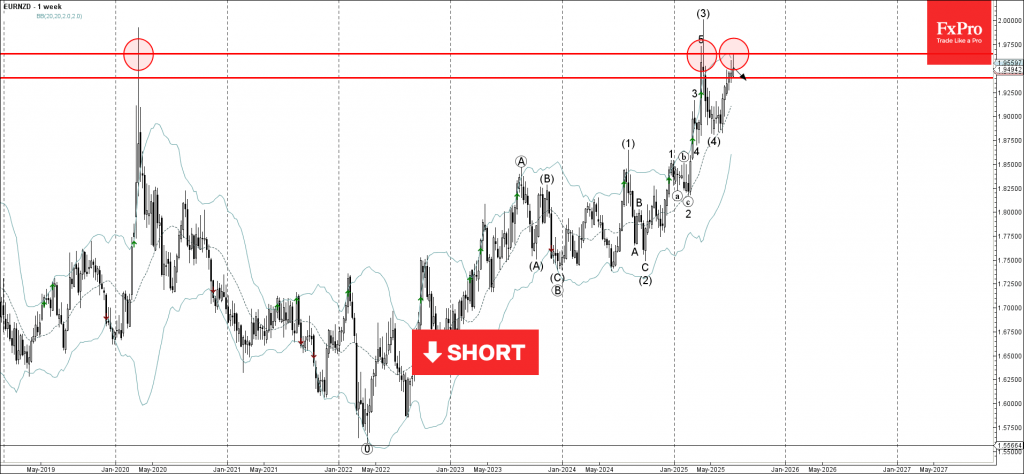

EURNZD: ⬇️ Sell– EURNZD reversed from the resistance area– Likely to fall to support level 1.9400EURNZD currency pair recently reversed down from the resistance area between the major long-term resistance level 1.9655 (which has been ...

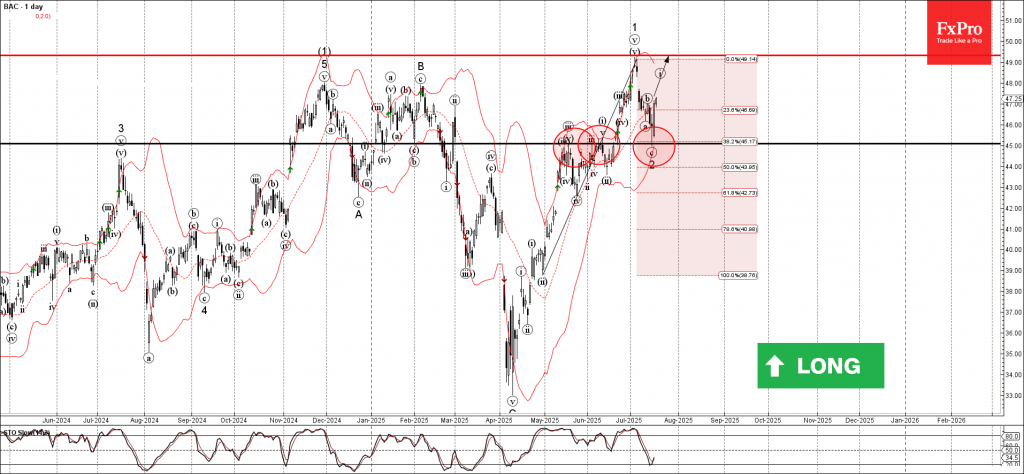

Bank of America: ⬆️ Buy– Bank of America reversed from support area– Likely to rise to resistance level 40550.00Bank of America recently reversed up with the daily Morning Star from the support area located between the support level 4...

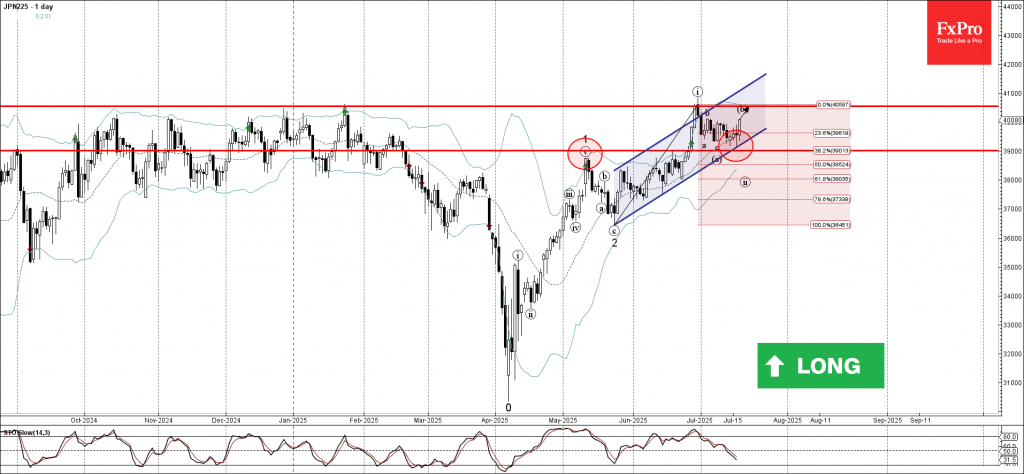

Nikkei 225: ⬆️ Buy– Nikkei 225 reversed from support area– Likely to rise to resistance level 40550.00Nikkei 225 index recently reversed up with the daily Doji from the support area located between the key support level 39000.00 (form...

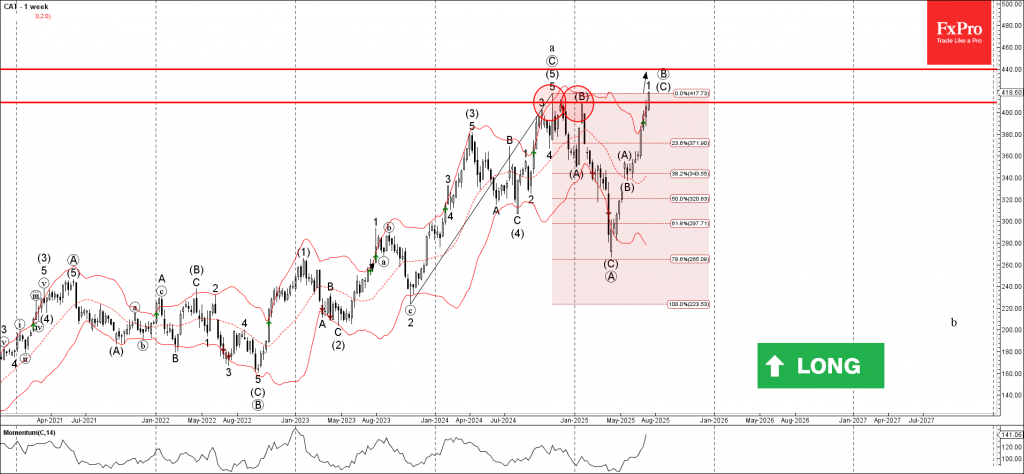

Caterpillar: ⬆️ Buy– Caterpillar broke long-term resistance level 410.00– Likely to rise to resistance level 440.00Caterpillar recently broke above the major long-term resistance level 410.00, which has been reversing the price from t...

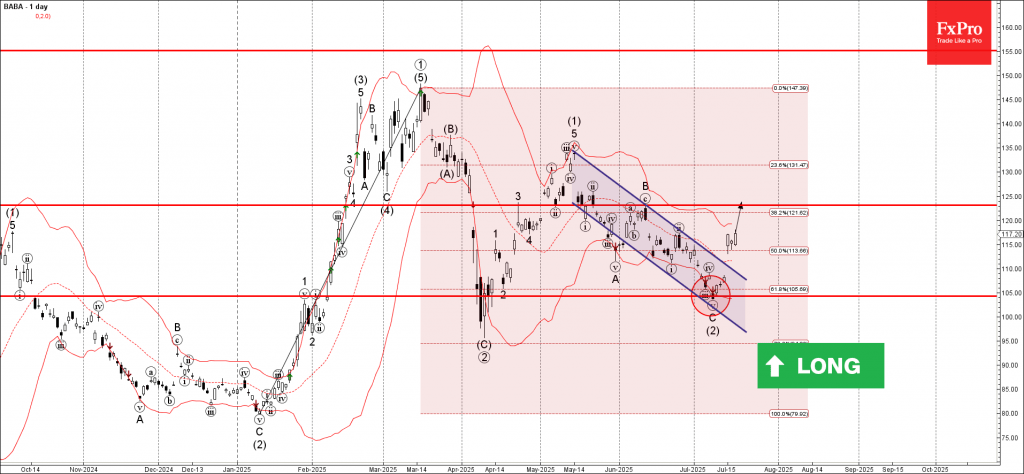

Alibaba Group: ⬆️ Buy– Alibaba Group rising inside impulse wave (3)– Likely to reach resistance level 123.10Alibaba Group recently rose with a sharp upward gap, breaking the resistance level 110.00 and the resistance trendline of the ...

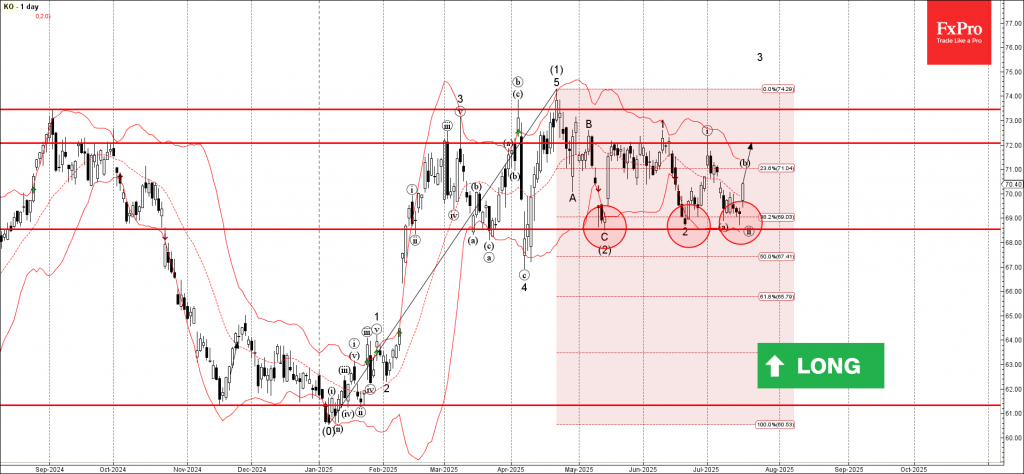

Coca-Cola: ⬆️ Buy– Coca-Cola reversed from the support area– Likely to rise to resistance level 72.00Coca-Cola recently reversed from the support area between the key support level 68.55 (which has been reversing the price from May), ...

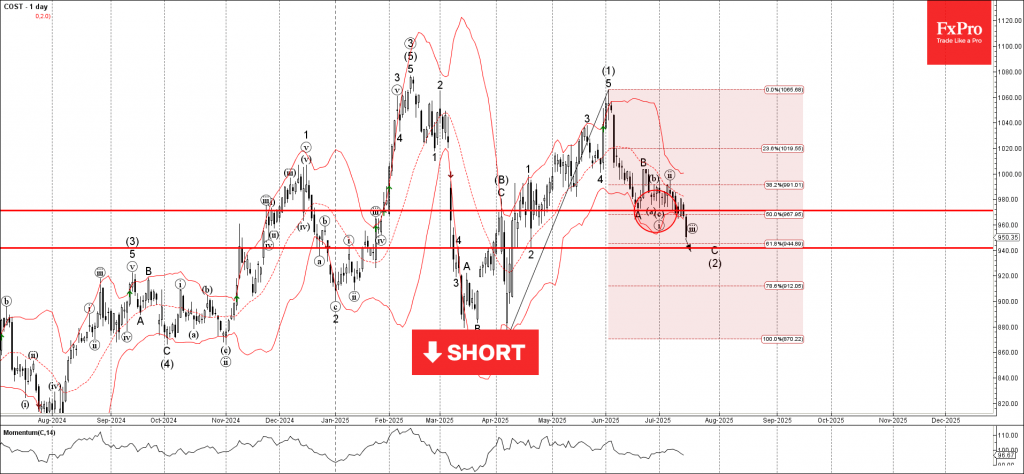

Costco: ⬇️ Sell– Costco broke the support area– Likely to fall to support level 940.00Costco recently broke the support area located between the pivotal support level 970.00 and the 50% Fibonacci correction of the upward impulse from ...

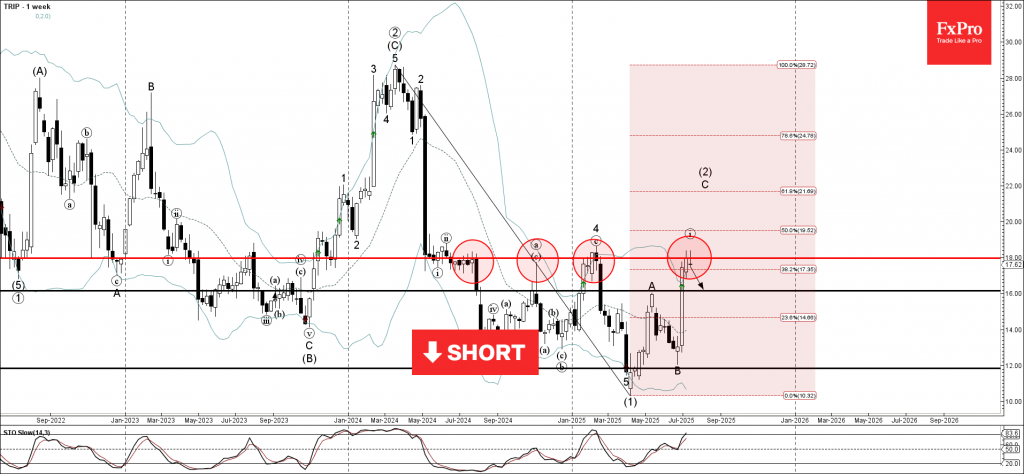

Trip: ⬇️ Sell– Trip reversed from resistance area– Likely to fall to support level 16.00Trip recently reversed down from the resistance area located at the intersection of the strong resistance level 18.00, upper weekly Bollinger Band...