Warren Buffett immediately springs to mind for most people when it comes to famous investors. As the third wealthiest person globally, Buffett is renowned for his long-term investments in companies like Apple and Coca-Cola. His philanthropic efforts and modest lifestyle also contribute to his public image.

Despite his impressive track record, Buffett does not exemplify my pick for the best trader of all time – Jesse Livermore. Known as the “Great Bear of Wall Street,” Livermore combined fundamental and technical analysis to make uncannily accurate market calls. His trading style still inspires imitation today.

Unlike Buffett’s long buy-and-hold approach, Livermore capitalized on fear, ignorance, greed, and hope in human nature. He believed these emotions reliably drove market manias and panics. Livermore also utilized technical patterns, discerning recurring cycles in the markets. This versatile, analytics-powered approach allowed him to prosper where others found only loss.

Though Buffett earns more public recognition today, Jesse Livermore’s trading philosophy and success showcase, for me, the most excellent trader of all time. His grasp of timeless human behaviors and market technicals delivered historic returns.

However, we’re not here today to talk about these stock traders and investors but about the best Forex traders who made it big and became millionaires. Although stories abound about the great stock traders throughout history, a couple of Forex traders have also become wildly successful. We shall focus on these in this post, looking at some of their greatest moments and trades and then trying to see what lessons we can learn from them. Because there are so many of them, we shall only focus on the top 5 for now based on their trading history and the profits they made. (Find out: Why Professional Traders Prefer Trading Stocks Rather Than Forex)

George Soros

Discussion of successful Forex traders is complete with mentioning George Soros. Though now known as “The Man Who Broke the BoE” for making $1 billion on a single 1992 trade, Soros’ backstory stretches back decades prior.

After studying philosophy at the London School of Economics, he became a humble bank clerk in finance. From these beginnings, Soros steadily built his name and fortune. Relocating to New York, he became an arbitrage trader before founding Double Eagle hedge fund with $100,000 of his savings.

Double Eagle became the renowned Quantum Fund under Soros Fund Management as it grew successful. Quantum and its successors managed billions with Soros at the helm.

But his billion-dollar Bear Raid currency trade cemented Soros’ legacy among the all-time greats of Forex. His early days as a clerk likely offered no hint of the lucrative careers in both trading and investing that would follow across over half a century. (Learn: Exness Regulatory Compliance and Security Features)

By 2011, Soros Fund Management had one of the world's most significant value assets under management (AUM) at about $30 billion and almost as much profit since it was founded. From 2011, though, the hedge fund would be turned into a family business after implementing the Dodd-Frank Act that required financial institutions to report their trades and activities to the SEC. Funds from outside investors were consequently liquidated and returned to the investors, and now the fund only holds the wealth from the Soros family. Nevertheless, the fund still regularly outperforms other hedge funds thanks to George Soros and his knowledge of the markets. (Legalization of Forex Trading in the US: Facts and Trends)

The most memorable moment of George Soros’ trading career was in 1992 when he made that short sale of the GBP to earn him his title. After joining the European Union, the UK agreed to enter the European Exchange Rate Mechanism (ERM) as a transition into a single currency, EUR. The ERM prevented the GBP from deviating more than 6% from the EUR, but the timing was wrong. Differences in inflation and interest rates between the UK, Germany, and other European nations put much pressure on the UK administration to intervene and keep the GBP within the 6% stipulation.

High inflation in the UK, despite high interest rates, forced the administration to prop up the value of the GBP. Still, George Soros and his fund sold off more currency than the administration could buy from the open market. Ultimately, the UK decided to exit the ERM, causing the GBP to crash and earning Soros a massive £1 billion profit and costing the administration £3.4 billion. (Know more about New Forex Brokers Regulations in Russia in 2019)

To this day, no other trader has made as much in a single trade in the Forex market, so Soros will probably go down in history as the person who made the most in a single trade. However, looking at how the man got to that position is essential. Since his early days as an arbitrage trader, Soros had been perfecting a theory of reflexivity to write as his thesis. He claims that individuals enter markets driven by their biases, creating a disequilibrium contrary to what economic theories dictate. This is similar to what Jesse Livermore said about the markets when he said people are driven by greed, fear, hope, and ignorance. This theory was used to explain the causes of the 2008 housing bubble that eventually led to the 2009 economic crisis. (Looking at the Growth Of The Forex Market In Africa And Other Developing Countries)

Considering Soros's success in the past and the continued growth of fortune, this is not a case of luck but a careful analysis of the markets. In the case of 1992, short of the GBP, Soros and other traders noted that the BoE could not keep up with the ERM, and they kept shorting the currency to increase the pressure. Eventually, he was proven right thanks to the careful fundamental analysis and understanding of the markets. At that time, he had committed the entire fund’s capital to this single trade, so it took a lot of guts to make the trade. We can learn from Soros that it takes time to perfect a trading strategy and that we all need to be patient. Ultimately, this persistence and resilience led to superb profits over a lifetime, as we see the hedge fund still making money to this day, far more than most other hedge funds. (After some back and forth: ESMA Finally Puts Its Foot Down On MiFID II Regulations)

Stanley Druckenmiller

One can only talk about George Soros if mentioning Stanley Druckenmiller, too, since the two cooperated in 1992 short of the GBP. Stanley’s history may not be as wild as Soros’s, but it is also remarkable as he has become one of the most successful traders ever. After completing his BA in English and economics, he was pursuing a Ph.D. program when he dropped out to become an oil analyst at a bank in Pittsburgh in 1977. He must have been successful because he was soon named head of the Dreyfus Fund in 1986. It wasn’t long before Soros noticed his talent and hired Stanley to work on his Quantum Fund in 1988. It was here that Druckenmiller would become famous. (Check out: Comprehensive Review of ActivTrades Trading Tools)

It has been claimed that he first noted that the UK Treasury did not have enough foreign currency reserves to buy GBPs from the open market. Armed with this insight, he convinced Soros to fund a massive shortage of currency, leading to the fund's enormous profits in 1992. But this success would only last for a while because Quantum would suffer massive losses during the Dot-Com bubble. In 1999, the Soros Fund reported that their capital had decreased from $22 billion to $13 billion because of making some wrong calls and investors pulling their money out of the fund. Druckenmiller had assumed that tech stocks like Amazon and Yahoo! Would drop in value, but their share prices rose to lead to losses and panic by investors. Druckenmiller consequently left the fund in 2000 to focus on his own Duquesne Capital. His firm performed marvelously for a decade, bringing in an annual return of 30% every year without losing in any year. Indeed, even during the 2008 financial crisis, it is reported that Stanley still added a whopping $250 million to his fortune. (Trading Stocks in Forex Brokers: Commissions, Swaps, Spreads Research)

Druckenmiller’s Forex trading career is a story of ups and downs – teaching us not to expect to make profits all the time and knowing when to take a break. When the guy made bad calls, he was not too proud to admit his mistake but refused to stay down. Then, in 2010, he announced that he was going to retire because he could not keep up with the expectations people had of him making huge returns year after year. He is still an active trader in the Forex market, but now he invests for himself without pressure from investors. Perhaps account managers running PAMM accounts can learn a thing or two from this legend. (These are: The Best Forex Events And Expos To Attend Every Year)

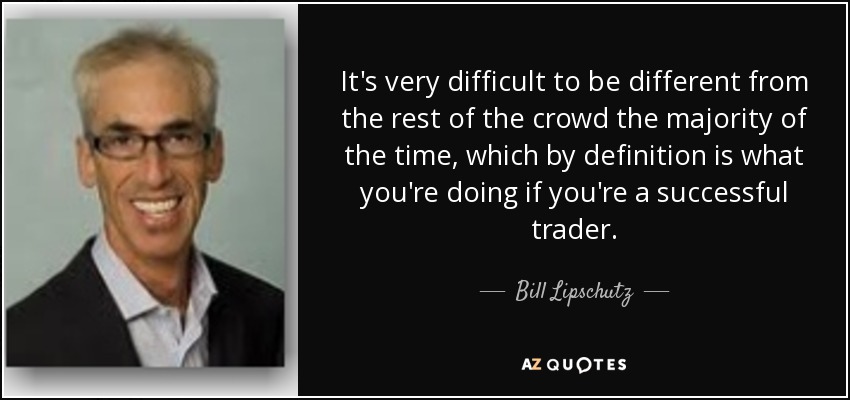

Bill Lipschutz

Unlike the previous two, who have deviated from Forex trading in their later years, Bill has always been a Forex trader and has done very well for himself. Initially, he studied architectural design at Cornell University, but little did he know he would spend time studying Forex charts instead of in front of the computer. His trading career began while studying at university when he inherited $12,000 after his grandmother died. The money came in a basket of over 100 stocks like Warren Buffett advises amateur traders. Anyway, he liquidated all the stocks and decided to create his portfolio. He had to spend a lot of time in the library studying various trading strategies and tips. This extensive research and knowledge made him successful in the markets, turning his $12,000 inheritance into a $250,000 fortune… while studying architecture. (Investor Tips 2019: What To Include In Your Portfolio)

The trading bug must have gotten into him because he interned for the Salomon Brothers and ignored his design career. He was recruited into Salomon Brothers in 1982 through a training program when the firm was looking to hire traders for the newly formed Forex trading desk. Lipschutz gladly became part of the team and would later beat many other traders. By 1985, he was considered among the top 5 Forex traders globally, churning about a $300 million profit for Salomon Brothers a year. His success would earn him various titles and positions in Philadelphia, including the development of the options market in the city. At some point, he had a 16-month positive record of making profits and accounting for more than half of the options trading volume on the Philadelphia Stock Exchange. (If you’re going to start trading: Think Twice When Making A Deposit In A Forex Company)

He would retire in 1990 while still at the top of his game from Salomon Brothers, but the trading bug was still in him. So, he created Hathersage Capital with some friends from Cornell University. The fund specializes in Forex trading, and although we don’t know the exact number of assets they have under management, it is one of the best-performing macro hedge funds in the world. He was also inducted into the Trader Monthly Hall of Fame in 2006 for his success in the Forex market and has also been featured in various investment books.

Bill’s career in Forex trading can teach us various things, starting with risk management. After turning $12,000 into a quarter million, Bill lost all of it in a single trade, probably because he did not observe the risk management principles. This teaches us not to become overconfident in our success and take extra risks but instead, stick to the trading plan that led us to success in the first place. The same experience also motivates us to take heart in moments of failure and not give up because it is possible to get back on our feet. (Revealing Forex Bonuses Of Brokers: How To Identify A Real Bonus)

Because of his success, Bill has also been featured in several books and interviews, and in these, he talks about some of the critical factors for every trader. One of the lessons he repeats often is to recognize market sentiment. Sometimes, a person can become overconfident in their analysis of the markets and forget that they aren’t alone in the market. In so doing, they miss some crucial market moves that traders had anticipated based on the Forex calendar. Therefore, Lipschutz encourages traders always to be aware of upcoming market events and consider their impact. Every detail counts when trading the markets, and they all have to be considered. (Save your money by knowing How Not To Be Added To The 95% Of Losing Traders)

Bruce Kovner

Bruce is the typical adventurer who also fell into the field of Forex trading but still managed to thrive in it. After completing his studies at Harvard College, he took up various activities to pay the bills, including writing. After experiencing writer’s block, he became a cab driver, and while doing this, he discovered the world of trading. He took out a loan of $3,000 from his credit card to buy copper and interest-rate futures, earning him $1,000.

That wasn’t bad, but his third trade would make him the legend he is today. Using the $4,000 capital he had, he bought soybeans and held the position for six weeks, turning the investment into $45,000. He explained to New Investment Superstars that, following this, he got cocky and discarded a hedge he had placed to limit the losses. Not long after that, the value of soybeans began to drop, leaving him only with a $22,000 capital. This wasn’t a terrible outcome, but he said he felt sick because he knew he had lost $23,000. That was the first lesson he got in risk management, and he often advises traders to use stop-loss orders and not to risk more than 1% to 2% of their capital on a single trade. (Forex Rigging And Manipulation: How The Major Investors Pull It Off)

He then joined Commodities Corporation, where he would make a name for himself and become a better trader. While working in the firm, he was under the tutorship of Michael Marcus, who is also a renowned commodities trader. Marcus taught Kovner one essential thing – that it was possible to make millions if only you applied yourself and worked hard. Another lesson he got from Marcus was that you need to be willing to make mistakes and not take them personally because you would be reacting from emotions and not objectively.

And finally, Marcus learned never to ignore other market analysis forms. He quoted saying technical analysis without understanding the fundamentals is like a doctor diagnosing a patient without taking the temperature. No form of analysis works independently, but they must complement each other. (Are you asking yourself: Should You Invest In CFDs Or Stocks To Make More Money?)

With these lessons, Kovner formed Caxton Associates in 1983, and it was so successful that they had to stop accepting funds from new investors from 1992 – less than a decade after launching. They kept buying new funds occasionally but started taking in new money in 2013, and now the firm has $3.9 billion in AUM. They were among the few firms that allowed their clients to withdraw funds during the 2008 financial crisis, but they still made 13% returns in the year. Kovner would retire from trading that year, but he still walked away with a handsome fortune of $5.2 billion, according to Forbes this year. (Concepts Every Trader Should Understand: Leverage, Margin, And Hedging)

Andrew Krieger

Krieger will forever be remembered as the trader whose short exceeded the total amount of New Zealand dollars in supply at the time – 1987. He studied Sanskrit and Philosophy at the Wharton School of Business before joining Salomon Brothers, where he worked with Bill Lipschutz for about four years. Perhaps he wasn’t comfortable there or didn’t receive the recognition he sought, so he left Salomon for Bankers Trust. Here, they recognized his talent in trading and gave him $700 million in capital instead of the typical $50 million. He would use this money to make one of the best trades in history. (Find out: LiteForex Customer Support and Broker Reliability Feedback)

Black Monday occurred on the 19th of October 1987 due to a screw-up with trading algorithms. Investors naturally dumped their US dollar holdings in favor of a haven, and Krieger saw that the New Zealand dollar was overvalued. Using his significant capital and high leverage, he shorted the currency, and sure enough, it decreased in value by 3% to 5%. The trade made $300 million for the company, now holding more NZD than was available. So much so that it is said the New Zealand government called Bankers Trust to threaten them to close the position. Krieger would later leave Bankers Trust to work with George Soros, but his excellent trade will always be remembered.

For more Top Brokers, check out our XM Forex Broker Review and IC Markets Forex Broker Review.

You now know the top 5 Forex traders; how about watching a video that shows even more incredible stories of success in Forex:

RoboForex

RoboForex Exness

Exness FxPro

FxPro Alfa-Forex

Alfa-Forex Libertex

Libertex FxGlory

FxGlory XM

XM IC Markets

IC Markets Forex.com

Forex.com AXITrader

AXITrader