Forex trading is one of the most exciting financial markets, attracting investors from around the world. This includes Russia, with a growing number of forex brokers becoming accessible to Russian investors. Today, we’re diving deep into the top 8 Russian forex brokers, exploring what each has to offer.

In Russia, the Central Bank of Russia heavily regulates forex brokerage. Forex brokers who want to offer services in Russia are required to procure licensing from the Central Bank. In our comprehensive review, we look at all the details, such as regulatory status and others that are equally important. Let’s take a look at our picks for top Russian forex brokers.

TL;DR

- Alfa-Forex offers competitive spreads and a proprietary platform

- InstaForex is known for sports sponsorships and regular promotions

- NPBFX has roots in the Moscow Exchange and offers ECN/STP execution

- FIBO Group provides a wide range of trading platforms

- RoboForex offers a great range of account options

- AMarkets is known for its copy-trading capabilities

- Alpari is a longstanding presence in the Russian forex market

- LiteFinance is the go-to for social trading among Russian forex brokers

Comparison Table

| Broker | Regulation | Min Deposit | Spreads From | Leverage | Platforms |

| Alfa-Forex | CySEC | $0 | 0.2 pips | Up to 1:1000 | MT5 |

| InstaForex | CySEC | $1-$10 | 0.3 pips | Up to 1:1000 | MT4, MT5, InstaTrader |

| NPBFX | The Financial Commission | $10 | 0 pips | Up to 1:200 | MT4 |

| FIBO Group | CySEC | $0 – $50 | 0.0 pips | Up to 1:3000 | MT4, MT5, cTrader |

| RoboForex | IFSC Belize | $10 | 0.0 pips | Up to 1:2000 | MT4, MT5, cTrader, R Trader |

| AMarkets | The Financial Commission | $100 | 0.0 pips | Up to 1:3000 | MT4, MT5, WebTrader |

| Alpari | The Financial Commission | $50 | 0.4 pips | Up to 1:3000 | MT4, MT5 |

| LiteFinance | Marshall Islands | $50 | 0.0 pips | Up to 1:500 | MT4, MT5, Social Trading |

Criteria Breakdown Summary

Before we get into the details of the top Russian forex brokers, we want to take a minute and discuss the criteria we use in our reviews.

Regulation: This is one of the most important features for Russian forex brokers. It’s essential for investor protection that a broker be regulated by reputable authorities.

Trading Conditions: This is a measure of the various trading conditions, such as spreads and leverage.

Platforms: We research which trading platforms are used. MetaTrader 4 and 5 are industry standards, but not all brokers offer the same options.

Asset Selection: Offering a wide range of tradable assets translates to more diversification opportunities for investors.

Customer Support: Responsive customer support is important for a positive trading experience. In this review, we also considered the availability of customer support in Russian.

Education & Research: For new traders especially, educational materials can lead to more successful transactions. Robust research materials are a major benefit for all levels of investors.

Alfa-Forex

Best Known for Its Bank Association

First on our list is Alfa-Forex, Russia’s largest forex broker. This broker is associated with Alfa-Bank, which is one of Russia’s largest private commercial banks. With a connection like this, clients can feel secure in the broker’s overall financial stability. Alfa-forex also offers a substantial range of trading instruments, including forex pairs. With all its features combined, it makes sense why Alfa-Forex is the most prominent player in the Russian forex market.

Features

Backing By the Alfa Bank: the Alfa Bank founded Alfa-Forex. This connection lends strong security to client funds. Being backed by a bank that ranks among the top in the world is a major plus for Alfa-Forex.

No Minimum Deposit: Currently, Alfa Forex does not require a minimum deposit. This allows investors more flexibility in their trading decisions.

Tight Spreads: In the world of forex trading, it doesn’t get much better than tight spreads. Alfa-forex offers spreads as low as 0.2 pips.

Pros

- Strong reputation in Russia due to Alfa-Bank association

- A wide range of trading instruments is available

- High-leverage options for experienced traders

Cons

- Not regulated by authorities like FCA or ASIC

- Limited cryptocurrency offerings compared to some competitors

Criteria Evaluation

- Regulation: 3/5 – Regulated by CySEC with oversight from the Central Bank of Russia

- Trading Conditions: 4/5 – Competitive spreads and high-leverage options

- Platforms: 3/5 – The primary platform is MetaTrader 5, and is also offered in a mobile version.

- Asset Selection: 4/5 – Good range of forex pairs and CFDs, limited crypto

- Customer Support: 5/5 – 24/7 support in Russian via multiple channels

- Education & Research: 4/5 – Comprehensive materials and daily analysis

Community Reviews and Expert Recommendations

While the Alfa-Forex is one of the top forex brokers in Russia, its reviews from the community are still rather mixed. This isn’t unusual with forex brokers, so let’s take a look at what the reviews say and what they mean.

Alfa-Forex is respected for its association with the Central Bank of Russia. However, experts wish more top-tier regulators regulated it. Clients feel secure knowing their funds are kept safe in separate accounts with Alfa Bank. The main pain points from customers mostly focus on issues with withdrawals.

Experts caution new traders against using high-leverage options. Another area to consider is the platform offerings. MetaTrader 5 is the primary platform for Alfa-Forex in Russia. It’s a robust platform but also comes with a steeper learning curve.

For a more thorough account of Alfa-Forex, read our comprehensive Alfa-Forex review.

Pricing

Alfa-Forex is an attractively priced Russian forex broker. No minimum deposits and tight spreads keep the cost of trading low. Alfa Forex also offers negative balance protection, which we consider a major benefit.

InstaForex

Best Known for Sports Sponsorships

Next on our list of Russian forex brokers in InstaForex. InstaForex has gained recognition in Russia, and around the globe, for its sports sponsorships. This has included partnerships with famous athletes. InstaForex has sponsored Russian sports teams including Marussia F1 Team and former UFC champion Oleg Taktarov.

Of course, when it comes to investment power, we’re more focused on trading than athletes. InstaForex checks many of the most important boxes as a leading global forex broker.

Features

- High Speed of Execution: Transactions happen quickly with InstaForex. We’ve noted speeds as fast as 0.15 seconds.

- Extremely Low Spreads: One area where we feel InstaForex is the most competitive is the spreads. In some cases, spreads are as low as 0.0 pips.

- Diversity of Assets: InstaForex offers what we consider to be a good diversity of assets. These include CFDs on crypto, stocks, indices, forex, commodities, and ETFs.

- Contests and Promotions: InstaForex offers regular trading contests and promotions. While we don’t feel these are a necessity, they are definitely a nice perk for InstaForex clients.

Pros

- Low minimum deposit ($1-$10) making it accessible to beginners

- Wide range of trading instruments including extensive forex pairs

- Multiple account types catering to different trader preferences

Cons

- Mixed customer reviews regarding withdrawal processes

- High inactivity fees compared to some competitors

Criteria Evaluation

- Regulation: 4/5 – Regulated by CySEC and several other global regulators.

- Trading Conditions: 4/5 – Competitive spreads and high-leverage options

- Platforms: 4/5 – Offers MT4, MT5, and proprietary InstaTrader platform

- Asset Selection: 5/5 – Extensive range of forex pairs, CFDs, and cryptocurrencies

- Customer Support: 4/5 – 24/5 support in Russian via multiple channels

- Education & Research: 4/5 – Comprehensive educational resources and market analysis

Community Reviews and Expert Recommendations

Next, we looked at what the InstaForex community thinks about the broker’s services. For many, low barriers like low minimum deposits are a plus. Speed is also a feature that attracts, and keeps, happy clients. For serious investors, VIP accounts are available for those who trade in large volumes.

InstaForex attracts some new clients with its contests and promotions. However, the allure of these can encourage new investors to trade outside their experience. Experts also extend a word of caution when using high leverage. While this is a nice perk, it’s just as easy to lose big as it is to gain big.

We’ve done a comprehensive InstaForex review, which we invite you to read to learn more about this top Forex broker.

Pricing

Minimum deposits are low with InstaForex and range from $1 to $10. In our opinion, this makes InstaForex accessible to a broader range of investors. However, investors aren’t going to get much traction from such a low deposit amount. There are some fees associated with InstaForex, but they aren’t over the top. For example, there are low deposit and withdrawal fees based on payment methods.

NPBFX

Best Known for Moscow Exchange Roots

With Russian Nefteprombank’s currency market debut, we feel NPBFX deserves a spot on this list. NPBFX’s history lends itself well to credibility in the Russian exchange market. Another feature we like about NPBFX is that they are ECN/STP brokers. This means investors have direct market access, without the middle person.

Features

Transparency: An important feature of NPBFX we noticed is its transparency. The ECN/STP execution model is important for offering the most transparent pricing.

Fast Execution: Trades can be made with lightning-fast speed with NPBFX. High-tech software and hardware are the reason behind this. It includes a liquidity aggregator for processing transactions in minimal time.

Loyalty Program: We noticed that NPBFX offers a great loyalty program for active traders. Loyalty tiers are based on trading volume in closed lots. Benefits range from having $100 added to a trading account to Apple products and vehicles.

Pros

- Competitive trading conditions with spreads from 0 pips

- Fast order execution with ECN/STP model

- Roots in the Moscow Exchange lending institutional credibility

Cons

- Limited platform options compared to some competitors

- Basic educational resources may not suit absolute beginners

Criteria Evaluation

- Regulation: 3/5 – Is a member of The Financial Commission but lacks more robust regulatory oversight.

- Trading Conditions: 4/5 – Competitive spreads and leverage up to 1:200

- Platforms: 3/5 – Offers MT4, but lacks proprietary platform

- Asset Selection: 4/5 – Good range of forex pairs and CFDs

- Customer Support: 4/5 – 24/5 support in Russian via phone, email, and live chat

- Education & Research: 3/5 – Basic educational materials and market analysis

Community Reviews and Expert Recommendations

We noticed that both community and expert reviews of NPBFX are loaded with pros and cons. On the positive side, we saw plenty of mention of the tight spreads and fast execution speeds. This broker’s roots with the Moscow exchange are something many investors feel secure in.

On the other end of the spectrum is concern over regulatory oversight. A top-tier authority, which poses at least a minimum risk for investors, doesn’t regulate this broker. We also noticed a trend in the user community having difficulty with withdrawals and transactions in general. One example is a community member who deposited a small amount as a test. They then profited a small amount and attempted to withdraw the money. However, nearly a week later they were still having difficulty receiving their small profit.

We’ve also taken the time to put together a comprehensive NPBFX review. Here, we go more in-depth into what this broker offers.

Pricing

Depending on the type of account, the minimum deposit with NPBFX can be as low as $10. There are no commissions and fees are overall low. For investors looking for a low-cost forex broker, NPBFX checks the right boxes.

FIBO Group

Best Known for Long-standing Market Presence

We recommend FIBO Group for investors who prioritize the longevity of market presence in their brokers. FIBO Group has been in the market since 1998, establishing itself as one of the oldest forex brokers. In 2005, it became one of Russia’s first forex brokers. Throughout this time, FIBO Group has cultivated a strong reputation within the forex market.

The FIBO Group also has a strong global presence, with regulatory oversight provided by the Cyprus Securities and Exchange Commission. They offer a wide range of trading instruments, including forex. Let’s take a closer look at what this Russian forex broker offers.

Features

Copy Trading Capabilities: FIBO Group offers a comprehensive range of features, including copy trading. This is a top feature for beginning traders, allowing them to learn from experts. While copy trading isn’t a sure thing, it is a good feature for those who are hesitant to invest on their own.

Platform Options: FIBO Group offers an exceptional range of platform options. These include both MetaTrader 4 and 5 platforms. In addition, they offer CTrader, which also supports their copy-trading platform.

High Leverage Availability: We rank the FIBO Group among the top for high leverage options. Leverage is available up to 1:3000 in some cases. We always want to be cautious about the risks of utilizing high leverage. However, for those who are confident in their profitability, this is one of the highest options.

Pros

- Long track record in the industry, established in 1998

- Regulated by a reputable EU authority (CySEC)

- Multiple trading platforms offered (MT4, MT5, cTrader)

Cons

- High leverage may be risky for inexperienced traders

- Some account types have high minimum deposits

Criteria Evaluation

- Regulation: 4/5 – Regulated by CySEC, a respected EU authority

- Trading Conditions: 4/5 – Competitive spreads and high-leverage options

- Platforms: 4/5 – Offers MT4, MT5, and cTrader platforms

- Asset Selection: 4/5 – Wide range of forex pairs, CFDs, and cryptocurrencies

- Customer Support: 4/5 – 24/5 support in Russian via multiple channels

- Education & Research: 4/5 – Comprehensive educational resources and regular market analysis

Community Reviews and Expert Recommendations

With such a long-standing presence in the market, FIBO Group has built a reputation for itself. Overall, we noticed the sentiment toward this broker is positive, coming from both the community and the experts. Some highlights include the fast execution speeds compared to industry averages and fee transparency. Combining both its longevity and CySEC regulation, most users and experts feel FIBO Group is a safe, reliable Russian forex broker.

Considering the high-leverage options and top-tier platforms, many experts tend to recommend FIBO Group to more experienced traders. That’s not to say new traders can’t be successful here. It’s just that they would experience a steeper learning curve compared to some other Russian forex brokers. For those who would like to know more, we dive deeper into our FIBO Group review.

Pricing

Pricing for FIBO Group really depends on which account and type of investment. For example, spreads start as low as zero pips on main forex pairs, but can go higher. The same is true for commissions. Some account types are zero, while others range from 0.003% to 0.012%. Minimum deposits are set at $50 for all account types, except for MT4 Cent accounts, which don’t have a minimum.

RoboForex

Best Known for Its Wide Range of Account Types

RoboForex offers investors a wide range of options with multiple account types. Source: RoboForex

RoboForex is on our list for the broad range of account types it offers. Currently, there are five main account types, each catering to different trading styles. In our opinion, this makes RoboForex a good option for every level of trader. It’s common for a beginner to choose the simplest platform and then move to another as they gain more experience. RoboForex is a good platform to grow with, while still offering robust capabilities for more advanced traders.

Besides a wide range of account types, RoboForex offers multiple features that make it an attractive option. High leverage options up to 1:2000 and spreads that start at 0.0 pips are just a few examples.

Features

Account Types for All Investors: RoboForex offers five different account types. These include Prime, ECN, R Stocks Trader, ProCent, and the Pro account. These offer great flexibility, with options for beginners and advanced traders. Beginners will likely choose the Pro account or the ProCent account. Meanwhile, advanced traders will appreciate the features of the Prime and ECN accounts.

Copy Trading: RoboForex offers a great copy trading platform with thousands of options. Investors can choose without additional usage fees.

8 Asset Classes: We appreciate the options RoboForex offers its clients, this includes its asset offerings. The eight asset classes include forex, stocks, indices, futures, ETFs, energies, metals, and soft commodities.

Pros

- Wide range of account types, including cent and ECN accounts

- High leverage options up to 1:2000 for experienced traders

- Comprehensive educational materials and automated trading options

Cons

- Regulated by IFSC Belize, not considered top-tier regulation

- Limited cryptocurrency offerings compared to some competitors

Criteria Evaluation

- Regulation: 3/5 – Regulated by IFSC Belize, not considered a top-tier regulatory authority

- Trading Conditions: 4/5 – Tight spreads, high leverage, and diverse account options

- Platforms: 4/5 – Offers MT4, MT5, cTrader, and R Trader

- Asset Selection: 4/5 – Good variety of forex, stocks, and CFDs; limited crypto

- Customer Support: 5/5 – 24/7 support in Russian and other languages

- Education & Research: 4/5 – Offers a comprehensive range of educational resources and daily market analysis

Community Reviews and Expert Recommendations

As with most forex brokers, we found both positive and negative feedback from the RoboForex community. The main point we noticed was issues with withdrawing funds. In our opinion, this is an issue that is not just limited to this broker. It’s a common customer concern throughout the industry as a whole. Forex traders in Russia appreciate the range of account types and competitive trading conditions. Of course, the high leverage limits are also a strength for those who have used this broker.

Experts generally speak favorably about RoboForex, although there are a couple of areas of concern. The first is RoboForex’s regulatory status. IFSC regulates them, but this is not a top-tier regulator. Currently, this has not presented a security issue for this broker’s clients. However, we agree with the other experts that this is something to be aware of.

Additionally, experts caution new traders about taking advantage of the high leverage limits. The range of accounts is definitely a perk offered by RoboForex. Still, it’s important that those new to trading take the time to understand their options.

For those wanting to know more about the pros and cons of RoboForex, we’ve already done the research. We invite you to check out our RoboForex review.

Pricing

The minimum deposit is $10 in most cases. The exception to this is the R Stocks Trader, which has a $100 minimum deposit. This broker doesn’t charge separate commissions with each order. However, markup is included in the spread. Spreads on Prime and ECN accounts start as low as 0.0 pips. On other accounts, the floating spreads start at 1.3 pips.

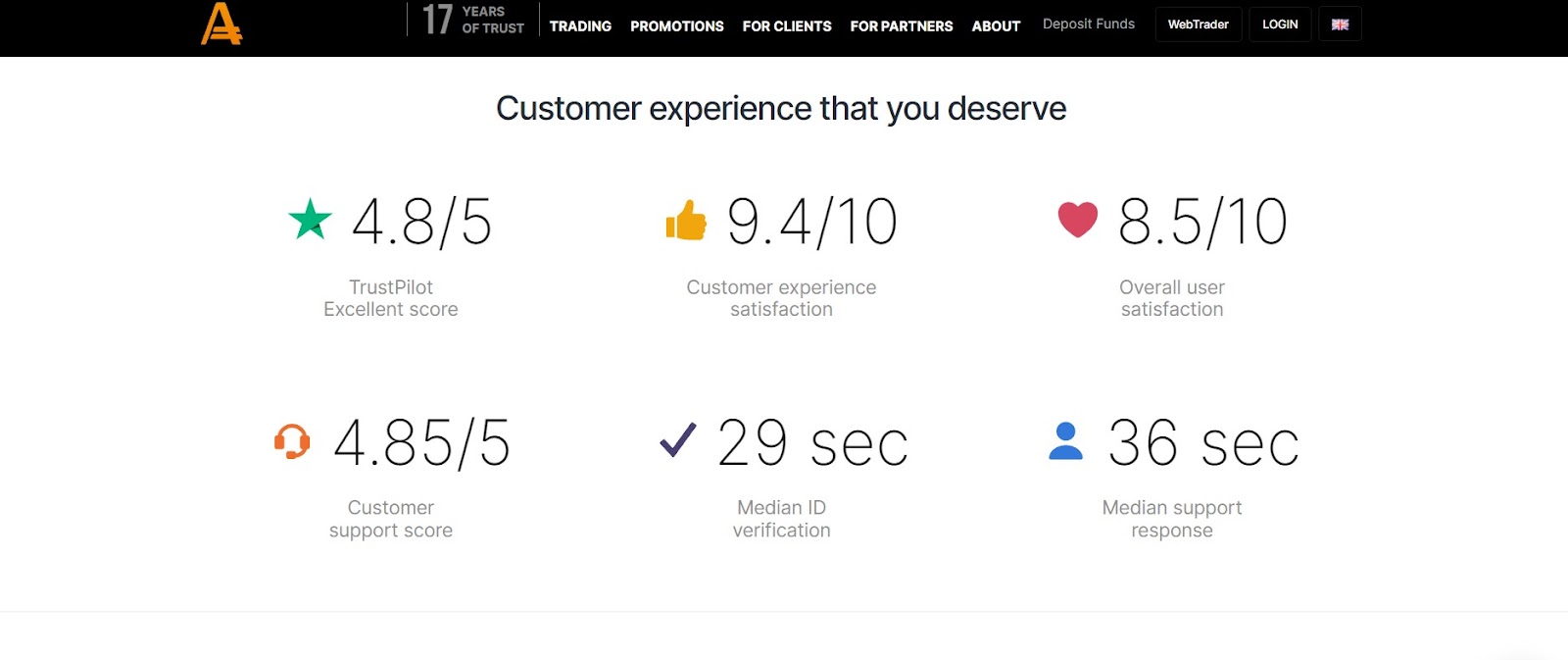

AMarkets

Best Known for Its Copy Trading Service

We’ve reviewed many brokers that offer copy trading services. For a copy trading broker in Russia, AMarkets stands out above the rest. Its copy trading program makes it easy for investors of all levels to copy the strategies of successful traders. As we’ve mentioned with the other brokers above, copy trading isn’t without risks. Still, AMarkets has a reputation for positive outcomes with its copy trading program. AMarkets has also introduced a new Zero Account, with floating spreads starting at zero pips. There’s always something exciting with AMarkets, so let’s take a closer look.

Features

Copy Trading Capabilities: In our book, this is really where AMarkets shines. This broker has a proven strategy for helping clients connect with top-performing trading strategies. All strategies have a proven track record of profitability that spans at least 30 days. Filters allow clients to choose strategies based on short and long-term returns, age, investor, and drawdown.

Range of Account Types: We found four different account types offered by AMarkets. These go beyond the standard types of accounts offered by other Russian brokers. Accounts include the Standard, offering the lowest deposit of $100, no commission, and spreads starting at 1.3 pips. The Zero account requires $200 and has a low commission rate of $0.01 per side. With this account, spreads begin at 0.0 pips. Other account options include ECC and the Fixed account.

Wide Range of Assets: The range of assets offered by AMarkets lends itself well to portfolio diversity. Options include forex, crypto, indices, stocks, bonds, commodities, and meta.s

Pros

- Strong copy trading platform for passive investors

- Competitive spreads and high-leverage options

- Comprehensive educational resources and market analysis

Cons

- Limited cryptocurrency options compared to some competitors

- Not regulated by top-tier regulatory bodies

Criteria Evaluation

- Regulation: 3/5 – Regulated by The Financial Commission, but lacks top-tier regulation

- Trading Conditions: 4/5 – Tight spreads and flexible account options with high leverage

- Platforms: 4/5 – Offers MT4, MT5, and copy trading platforms

- Asset Selection: 4/5 – Offers forex pairs, commodities, stocks, and indices; limited cryptocurrency options

- Customer Support: 5/5 – 24/7 customer support is available in multiple languages, including Russian

- Education & Research: 4/5 – Wide range of educational materials and detailed market analysis

Community Reviews and Expert Recommendation

Community and expert reviews for AMarkets are overall positive. The community is generally pleased with this broker’s trading conditions. This includes one of the highest leverage options in the industry at 1:3000. Most feel the MT4, MT5, and WebTrader platforms offer good features. The one drawback the community mentions is the occasional difficulty with withdrawals.

Experts also speak mostly positively about AMarkets. From an expert perspective, it’s the lack of top-tier regulation that raises a red flag. Still, experts recommend this broker for investors who are interested in robust copy trading capabilities. Our AMarkets review goes into all the details.

Pricing

The minimum deposit with the Standard account is $100. All other AMarkets accounts require a minimum deposit of $200. With the Zero account, pips are as low as zero. Other accounts can begin as high as 3 pips. AMarkets doesn’t charge withdrawal fees, plus, they offer deposit commission compensation.

Alpari

Best Known for Its Longstanding Presence in the Russian Market

Alpari is a leading global forex broker with a strong reputation in Russia. Alpari began expanding globally in 2002. However, its roots are planted in Kazan Russia, where it was founded in 1998. This broker is a member of the Association of Forex Dealers, which is accredited by the Russian Central Bank. Contributors to Alpari’s success include its wide range of trading instruments and strong trading conditions.

Features

Adaptability Through Account Types: Alpari offers its clients multiple account types, allowing them to choose the one that best meets their needs. For example, there are two ECN accounts – standard ECN and Pro ECN. There’s also a Standard account that is a great base for less experienced traders. A demo account is available for those new to Alpari who want to explore a bit before committing.

Super Fast Execution Speeds: One detail we noticed Alpari is known for is its fast speed of execution. According to its own website, Alpari executes orders in under a second, almost 100% of the time.

Competitive Spreads: Alpari’s spreads are competitive compared to the industry as a whole. Spreads start as low as 0.4 pips, although they can go quite a bit higher.

Pros

- One of the longest-established brokers in the Russian market

- Wide range of account types, including ECN and cent accounts

- Copy trading feature for passive traders

Cons

- Not regulated by top-tier authorities like FCA or ASIC

- Limited cryptocurrency offerings compared to some competitors

Criteria Evaluation

- Regulation: 3/5 – Regulated by The Financial Commission, but lacks top-tier oversight

- Trading Conditions: 4/5 – Competitive spreads, high leverage, and flexible account options

- Platforms: 4/5 – Offers MT4, MT5

- Asset Selection: 4/5 – Good variety of forex, commodities, and indices, but limited crypto

- Customer Support: 5/5 – 24/7 support available in Russian and other languages

- Education & Research: 4/5 – Offers comprehensive educational resources and market analysis

Community Reviews and Expert Recommendations

When researching Alpari, we found that its longevity is a major selling point in the user community. Longevity and a strong reputation lend to clients’ feeling this broker is trustworthy and secure. Although, this is balanced by a lack of top-tier regulatory oversight.

Experts mimic the community with their own opinions. Additionally, they feel the customer support is reliable, and high-leverage options are appealing to more advanced traders.

There is much more to discuss about Alpari. We’ve covered all the details in our Alpari review.

Pricing

Alpari sets the minimum deposit at $50 for its Standard account. However, there are higher minimum deposits with the ECN accounts. The base ECN account requires a minimum deposit of $300, while the Pro ECN requires $500. Spreads are competitive, lending to Alpari’s overall reputation as a cost-friendly broker.

LiteFinance

Best Known for Its Social Trading Feature

The last Russian forex broker on our list is LiteFinance. We chose this broker for its exceptional automated social trading feature. Through this platform, investors can duplicate trades or trade independently. There’s also the opportunity to communicate with other traders, contributing to a true, social community environment. Aside from LiteFinance’s social trading, there’s also the fact that this is a broker with longevity. LiteFinance has been serving the world successfully for over 19 years.

Features

Webinars for Forex Beginners: LiteFinance is a broker we consider to be beginner-friendly. They offer an expansive collection of webinars, covering just about every trading topic imaginable. This includes copy and social trading.

VPS Available: For an added level of security, LifeFinance does offer a VPS service. This gives investors a more stable, secure connection.

Competitive Trading Conditions: Investors will find that LiteFinance offers trading conditions that are competitive with the top brokers in the industry. This includes spreads that begin as low as 0.0 pips and zero commission accounts.

Pros

- Popular social trading platform for copying successful traders

- Tight spreads and flexible account types, including ECN

- Wide range of trading instruments, including cryptocurrencies

Cons

- Regulated by the Marshall Islands, not a top-tier regulatory body

- Withdrawal process may take longer compared to some brokers

Criteria Evaluation

- Regulation: 3/5 – Regulated by the Marshall Islands, which is not a top-tier regulator

- Trading Conditions: 4/5 – Tight spreads, high leverage, and multiple account options

- Platforms: 4/5 – Offers MT4, MT5, and social trading platform

- Asset Selection: 4/5 – Offers forex, commodities, indices, and cryptocurrencies

- Customer Support: 4/5 – Available 24/5 in multiple languages, including Russian

- Education & Research: 4/5 – Provides comprehensive educational materials and market analysis

Community Reviews and Expert Recommendations

Our assessment of the LiteFinance community is that they are overall pleased with this broker’s service. On community review sites like TrustPilot, the overwhelming number of reviews are 5 stars. Low spreads, fast withdrawals, and of course social trading capabilities are highlighted. There are also multiple mentions of the broker’s professionalism.

There are not-so-positive reviews as well. Among these, lack of communication and unclear practices appear to be at the center of most issues.

Experts are fond of this broker’s social trading capabilities, especially for new traders. The concern point for experts centers on the broker’s offshore regulation and sometimes slower withdrawal times.

Pricing

LiteFinance is considered a cost-conscious broker. The minimum deposit is $50, however, copy trading requires a minimum of $300 to participate. Spreads and commissions are low, making this a good broker for investors who don’t want to lose money to fees.

Notable Mentions

FxPro

FXPro has been helping new and seasoned investors trade forex like a pro since 2006. This broker offers longevity, competitive trading conditions, and advanced trading technology. This broker offers four trading platforms, including its proprietary FxPro platform, which supports one-click trading. We have a comprehensive FxPro review outlining all the details.

Forex.com

Forex.com is one of the most regulated forex brokers in the industry. Low commissions, tight spreads, and no withdrawal fees make this a well-liked broker. Compared to other brokers, Forex.com also offers more robust analytic and trading tools for making the most informed decisions. We suggest reading our complete Forex.com review to learn more.

FAQ

Are these brokers safe for Russian traders?

The most important factor to consider when looking at safety for Russian traders is regulation. Top-tier regulatory authorities like CySEC, ASIC, and FCA offer the strongest investor protection. A number of the brokers on this list fall short of this, with third-tier regulation being common. All brokers on this list have a history and reputation of safety in protecting investor funds. All brokers operating in Russia are required to be regulated by the Central Bank of Russia.

What trading platforms are commonly offered by Russian forex brokers?

Most global forex brokers, including those offering services to Russia, use the MetaTrader platforms. These include MetaTrader 4 brokers and MetaTrader 5. These platforms are considered the gold standard due to their advanced features, usability, and familiarity. However, each broker may offer other platform options, like WebTrader or cTrader. Some brokers have also invested in promoting their proprietary platforms, which are often geared toward new traders due to user-friendliness.

What payment methods are typically available for Russian traders?

Russian forex traders typically have a wide variety of payment options, based on local preferences. Wire or bank transfers and credit/debit cards are generally accepted by every forex broker. Additionally, eWallets are often accepted. For Russia, popular ones like Yandex Money and QIWI might be offered. It’s important to check funding options with each broker.

How do Russian forex brokers handle customer support?

Customer support for Russian forex traders is handled in much the same way as support for other regions. Most Russian forex brokers offer customer support in Russian, along with other major languages. Support is usually available via multiple channels, like phone, chat, and email. Some brokers offer 24/7 support, however, for Russia, 24/5 (Mon – Fri) is more common.

What should Russian traders consider when choosing a forex broker?

There are multiple factors to consider when choosing a Russian forex broker. In our reviews, we look at details like regulatory status, trading conditions, trading platforms, instruments, and customer support. However, we don’t want to discount a broker’s reputation in the Russian forex market. It’s always smart to research community and expert reviews when considering a forex broker.

Final Thoughts

Now that we’ve taken a dive into the world of Russian forex brokers, we’ve seen what each broker offers and where they might fall short. Here are a few key takeaways:

- Regulatory status should always be paramount. Brokers with top-tier regulations are considered to be the most secure.

- High leverage is a nice perk, but it’s not the only feature that matters.

- Fees, platforms, and educational tools are also important.

- Most brokers offer demo accounts to test the platforms before committing.

- Understand what the restrictions are for Russian forex traders and how each broker addresses those needs.

- Ensure the broker chosen offers customer support in Russian.

At the end of the day, choosing the right Russian forex broker depends on each person’s individual trading needs and goals. Most of the brokers on our list are suitable for those just starting out but also offer advanced features. For those new to forex trading we suggest reading How to Read Forex Charts. Another great resource is How to Create and Manage a Forex Trading Strategy. For those who are more advanced, What is Gartley and How to Trade With It is a good read.

At TopBrokers, we’re committed to providing the tools, resources, and reviews to make the most of each investment experience. We invite you to check back with us regularly for our latest broker reviews and forex trading industry news.

AustraliaUS

AustraliaUS