Risk Warning: Your capital is at risk. Statistically, only 11-25% of traders gain profit when trading Forex and CFDs. The remaining 74-89% of customers lose their investment. Invest in capital that is willing to expose such risks.

AMarkets review

Overview

Our 5-step process of verification and evaluation – How do we obtain information?

General inspection – 30%

Trading experience – 30%

Technical audit – 20%

Collective experience from collaborations with the broker – 10%

Interviews with real traders – 10%

See the entire process here.

Pros

-

High Leverage Options

-

Wide Range of Tradable Assets

-

Many Accounts to Choose From

-

Quality Trading Platforms

-

Fast Order Execution

Cons

-

Offshore Regulation

-

Limited Availability in Some Countries

-

Mixed User Reviews

General details

Customer reviews

score

Read real reviews from traders all over the world:

Share Your Experience

Help others by sharing your review

Accounts

Type of Trading Accounts on AMarkets

AMarkets has four trading accounts designed for amateurs and professional traders. These are the Standard, Fixed, ECN, and Crypto accounts. They also offer an Islamic account option for traders who adhere to Islamic rules on trading.

- Standard: The standard account is for beginning and experienced traders. It offers a floating spread (starting from 1.3 pips), zero transaction fees for FX and metals, and supports Instant and Market execution. The minimum initial deposit requirement is $100/€100, and traders can access up to 1:3000 leverage. The trading hours start Monday at 00:00 and end Friday at 23:00 Eastern European Time (EET). The account is denominated in USD and EUR. Clients also get negative balance protection.

- Zero Account: The Zero Account offers zero spreads on major currency pairs and metals 90% of the time. This account is ideal for trading strategies like scalping and day trading. It’s perfect for high-frequency trading with maximum cost-effectiveness. The order execution type for this account is Market Execution. The initial deposit is $200, with very high leverage of 1:3000. Stop out the requirement is 40%, while the margin for a hedged position is 50%.

- ECN: The ECN features direct order execution at the Prime broker. It is suitable for scalping due to its swift order execution speed. The minimum deposit is $200 €200, and the spread starts from as low as 0 pips. Users of this account will pay a commission charge of $2.5 / €2.5 per 1 lot per side. It offers all trading instruments and offers negative balance protection. Stop out the requirement is 40%, while the margin for a hedged position is 50%.

- Islamic account (swap-free): Clients who want to comply with Sharia law can ask for an Islamic account. The Islamic account is a variation of the Fixed, Standard, and ECN accounts with no swap charges or additional fees. It is not available for Crypto instruments. To use the Islamic account, open any of the supported accounts and send a request to activate the Islamic option in the Personal Area. The swap-free service does not apply to stocks, indices, cryptocurrencies, commodities, and bonds.

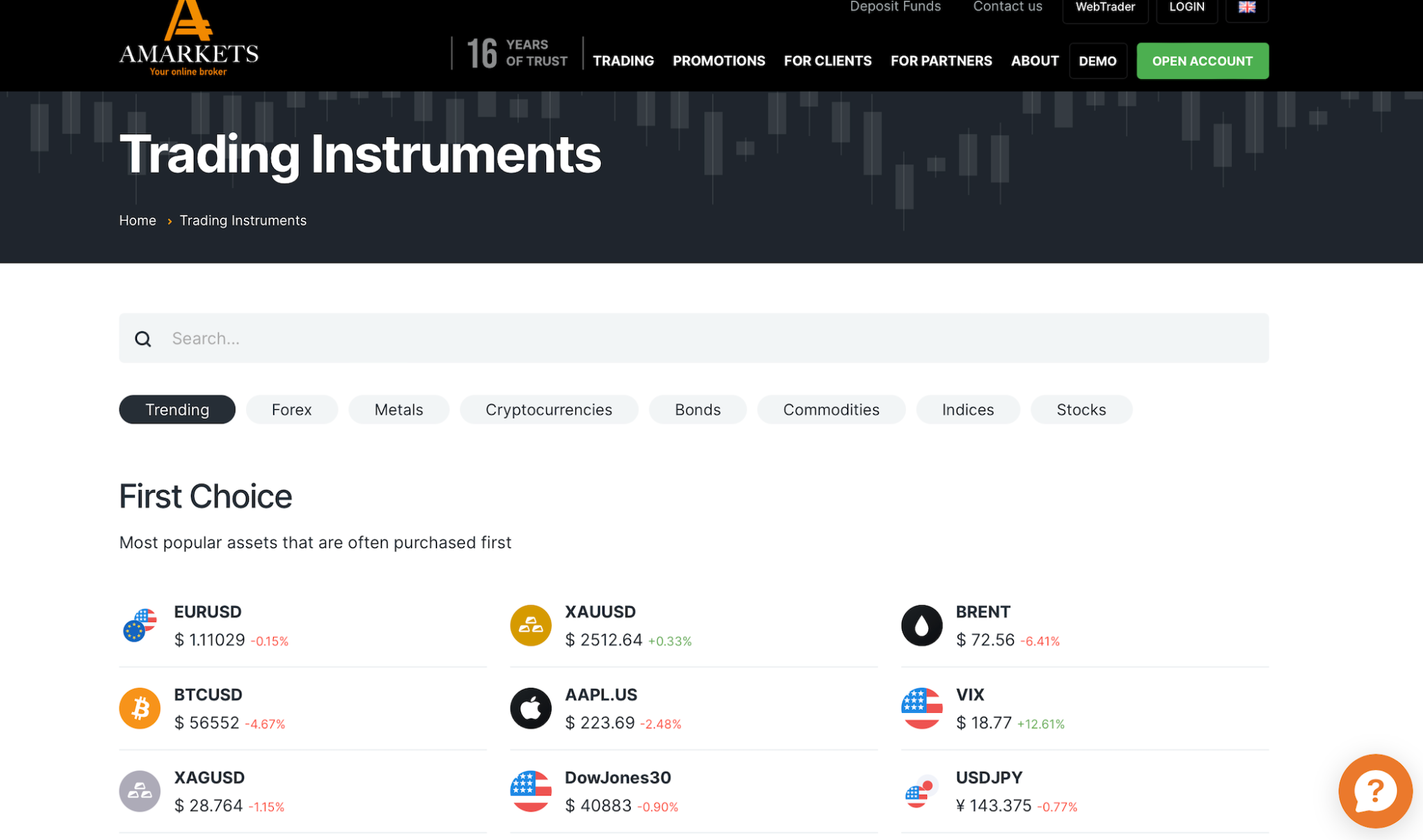

Tradable instruments

Tradable instruments on AMarkets trading platforms include:

Frequently asked questions

Find the right answer to your question below.

AMarkets has been on the market since 2007 and that should give some peace of mind. However, it does have an offshore regulator, which many users state makes them less than reassured. Despite that, this broker is a member of the Financial Commission, offering protection from there. Additionally, many accounts with AMarkets offer negative balance protection.

Overall, AMarket is a reliable choice and despite its limited reach in terms of territories, it does have many happy customers.

AMarkets offers high leverage amounts, up to 1:3000. However, it’s important to remember that high leverage can also mean high losses. For that reason, responsible trading is key. This broker offers a large number of assets, making it easy to diversify your portfolio and reduce risk. Additionally, there are a number of account types, including a demo account for practice trading. The ECN account offers tight spreads and excellent execution speeds.

Copy trading is another notable feature to mention, and several platforms to choose from. The AMarkets app makes it easy to trade on the go, so a profitable opportunity never needs to be missed. Many users mention that AMarkets has no hidden fees, and that’s another advantage to this broker. However, it’s important to weigh up the pros against the cons before making a final decision. If AMarkets turns out not to be the best fit, we have many resources on the alternative premium forex brokers.

Overall AMarkets compares well to other leading forex brokers. However, the biggest difference is customer reach. This broker doesn’t accept residents of the EU, UK, Australia, and the US. This is quite limiting to many traders, so alternative options need to be considered.

AMarkets offers some of the highest leverage on the market and has a large number of tradable assets. As far as accounts go, this broker also has a large number to choose from. One area where AMarkets doesn’t measure so well is educational resources. This broker lacks in that department and many other brokers perform much better.

It’s a good idea to explore all alternatives alongside AMarkets to make the best decision. Our feature on the MT4 forex brokers gives more information.

All trading has a certain amount of risk attached to it, including AMarkets. It’s important to assess advantages and disadvantages and make the best personal choice. With this particular broker it’s important to think about high leverage. While this is a positive aspect, it can work in the opposite direction too. The higher the leverage, the higher the risk of losses.

The other aspect is offshore regulation. This means less protection compared to brokers that are regulated by top-tier entities. However, AMarkets is a member of the Financial Commission and does offer negative balance protection on some accounts. Within that, there is still risk but not as much as we might expect. It’s simply something to be aware of.

All trading comes with the risk of market volatility and with high leverage, the results can be worsened. For this reason, always trade sensibly and with caution, and keep an eye on market movements.

Opening an account with AMarkets is relatively easy. The first step is to carefully assess all account types and choose the one that suits best. The AMarkets website is very user friendly, so the signing up process isn’t overly complicated.

Simply click the “open account” button and follow the on-screen instructions. There is a registration form that requires some personal information and you’ll need to verify your identity. This is a standard procedure and you will be asked for some documents as proof of who you are. Once the account is verified, simply deposit some money via bank transfer, card, or e-wallet. From there, the account is open and trading can begin.

It’s a good idea to start with a demo account if you’re not used to trading. That way, you can practice your skills without risking real money.

AMarkets compared with alternative brokers

To see the full broker review click “See review”, to see the complete table and compare more brokers visit our Comparison page.

- Overall verdict

- Trading

- Minimum deposit

- Maximum leverage

- Fees

- Withdrawal fee

- Deposit fee

- Safety

- Top-tier regulators

- Investor protection

-

Specialized trading accounts

-

Free VPS hosting

-

4.5/ 5

-

4.8/ 5

- $100

- 1:3000

-

4.5/ 5

- $0

- &

-

4/ 5

- FSA

-

No

No

-

See review

-

Free VPS hosting

-

24/7 instant money withdrawal

-

Specialized trading accounts

-

4.9/ 5

-

4.9/ 5

- $10

- 1:2000

-

4.8/ 5

- 1%

- $0

-

4.8/ 5

- No

-

See review

-

Specialized trading accounts

-

Free VPS hosting

-

24/7 instant money withdrawal

-

4.7/ 5

-

4.8/ 5

- $5

- 1:1000

-

4.7/ 5

- $0

- $0

-

5/ 5

- CySEC, FSCA, DFSA

-

See review

-

Specialized trading accounts

-

24/7 instant money withdrawal

-

Free VPS hosting

-

4.9/ 5

-

4.8/ 5

- $10

- 1:2000

-

4.8/ 5

- $0

- $0

-

5/ 5

- FCA, CYSEC

-

No

No

-

See review

-

Specialized trading accounts

-

4.5/ 5

-

4.2/ 5

- 0$

- 1:400 (1:30 for EU)

-

4.5/ 5

- 0$

- 0$

-

4.5/ 5

- FCA

-

See review

RoboForex

RoboForex Exness

Exness FxPro

FxPro Alfa-Forex

Alfa-Forex Libertex

Libertex FxGlory

FxGlory XM

XM IC Markets

IC Markets Forex.com

Forex.com AXITrader

AXITrader