The collapse of Silicon Valley Bank (SVB) and Silvergate Bank dominated last week's news headlines, sending the cryptocurrency market into the weekend on a wild ride. The fate of investors was quite uncertain at the beginning of the week, with several speculations that the crypto market era had ended.

Contrary to the speculations from the previous weekend, the crypto market has weathered the recent storms of the U.S. financial market. The future of the crypto market is independent of the financial market crises in the U.S. (Check out the live price of cryptocurrency pairs)

Initial Projections of the Crypto Market After SVB and Silvergate Decline

The collapse of SVB on March 11th, 2023, caused USDC, one of the most reputable stablecoins on the market, to lose its peg to the U.S. dollar. This incident, coupled with the recent collapse of Silvergate on March 8th, 2023, caused a ripple effect in the crypto community.

Since 2016, Silvergate has played a significant role in the cryptocurrency ecosystem, serving as an entry and exit point for significant exchanges like the defunct FTX. The bank's deposits declined by 50% in Q4 2022 due to the suspension of FTX and investors' fluctuating confidence in cryptocurrencies.

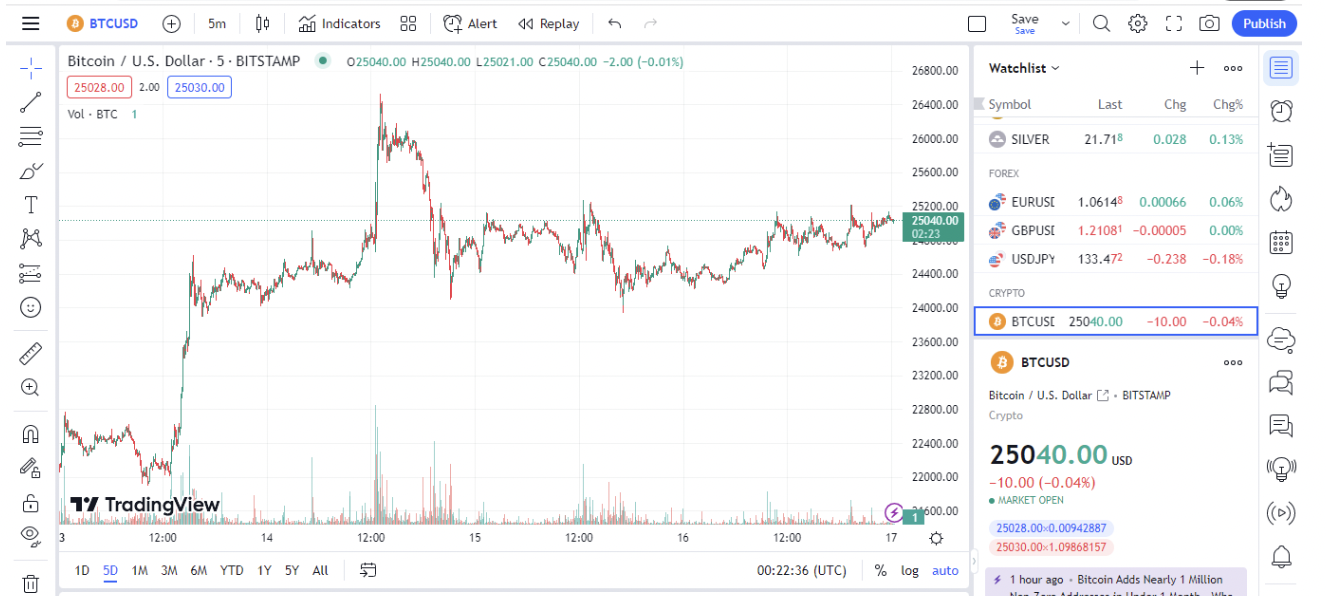

The cryptocurrency market was reportedly in chaos due to these two high-profile bank closures, with leading coins Bitcoin and Ether down almost 10% at the start of the week. Skeptics quickly blamed cryptocurrencies for these closures, stating that this marked the end of the crypto market.

Some reports suggested that investors' aversion to risk in the face of rising interest rates contributed to decreased cryptocurrency prices and associated equities.

According to Market Vectors' head of index product management, Joy Yang, "Investors and dealers have more trust in Fed actions and market outlook."

Hany Rashwan, the creator of the cryptocurrency startup 21. co, categorically stated that President Joe Biden's plan for a 30% tax on cryptocurrency mining activity is another element putting pressure on the market for digital assets. He said, "There is still potential for further harm in the larger economic, and political sector, which may continue to harm risk assets like cryptocurrencies."

What Happened to the Crypto Market After SVB and Silvergate Decline

Silvergate specialized in sending money across the crypto market and due to reduced deposits, the bank sold bonds for less than their cost price. Major investors caught wind of this and decided to secure their funds by withdrawing them. This forced the bank to announce that it was liquidating its assets.

SVB also announced its plan to sell its securities to increase its liquidity. Customers, investors, and regulators were shocked by SVB's announcement, judging by its possession of over $209 billion in assets at the end of 2022.

Being the 16th-largest bank in the U.S., the closure of SVB is second only to Washington Mutual's demise during the 2008 financial crisis. The bank's sudden announcement forced the Federal Reserve Board of Governors to hold an emergency meeting.

SVB primarily served startups with venture capital backing in the technology industry. As a result, cryptocurrency has nothing to do with its downfall. To offset the value of investor withdrawals, SVB, like Silvergate, liquidated assets from its balance sheet at a discount. Yet, in both instances, these assets were U.S. Treasuries, not risky cryptocurrency tokens.

While deposits flooded in during financial boom years, both banks purchased T-bills as collateral. But, as the U.S. Fed implemented its post-pandemic monetary strategy, the value of these bonds rapidly decreased, and the crypto market had no impact on this.

CNN reports that Treasury bonds are causing U.S. banks to experience unrealized losses of $600 billion. Conor Ryder, a research analyst at Kaiko, corroborates CNN's reports. He said, "SVB is a good indication that this wasn't necessarily a crypto-specific issue, but rather a case of traditional banks taking on too much risk with their long-duration bonds, which have been hit hardest by rising rates."

On the other hand, the irregularities in the cryptocurrency market directly result from trading records and losses from the previous year. The pushback from Washington against the absence of investor coverage for digital currencies also affects the market. In Ryder's opinion, "bigger banks now have a disincentive to take on the deposits of crypto companies due to the degree of concomitant risk they entail."

How Recent Bank Failures May Affect the Crypto Market

The news from the previous week did not dramatically impact the price and stability of the cryptocurrency market. Still, financial market regulators will continue to pay attention to the crypto market. The SVB's hitch and the $3.3 billion in Circle USDC cash reserves are of particular concern to the watchdog.

Despite being contrary to the prediction that recent events would destroy the second-largest stablecoin by market value, these incidents are sufficient to move cryptocurrencies up the regulatory agenda. According to Marcus Sotiriou, crypto market analyst at digital asset broker GlobalBlock, "the events of last week may have pushed the time when the Fed will need to pause and then pivot closer."

Nonetheless, Circle has enough support to pay for all necessary redemptions, unlike Celsius or FTX. By stating that "USDC would remain redeemable one for one with the U.S. dollar as a regulated payment token," the corporation was able to soothe the market on Saturday. It continued stating that Circle would use company funds to make up any gap if SVB didn't repay all deposits. This news sparked an immediate market reaction, and USDC showed signs of a significant comeback.

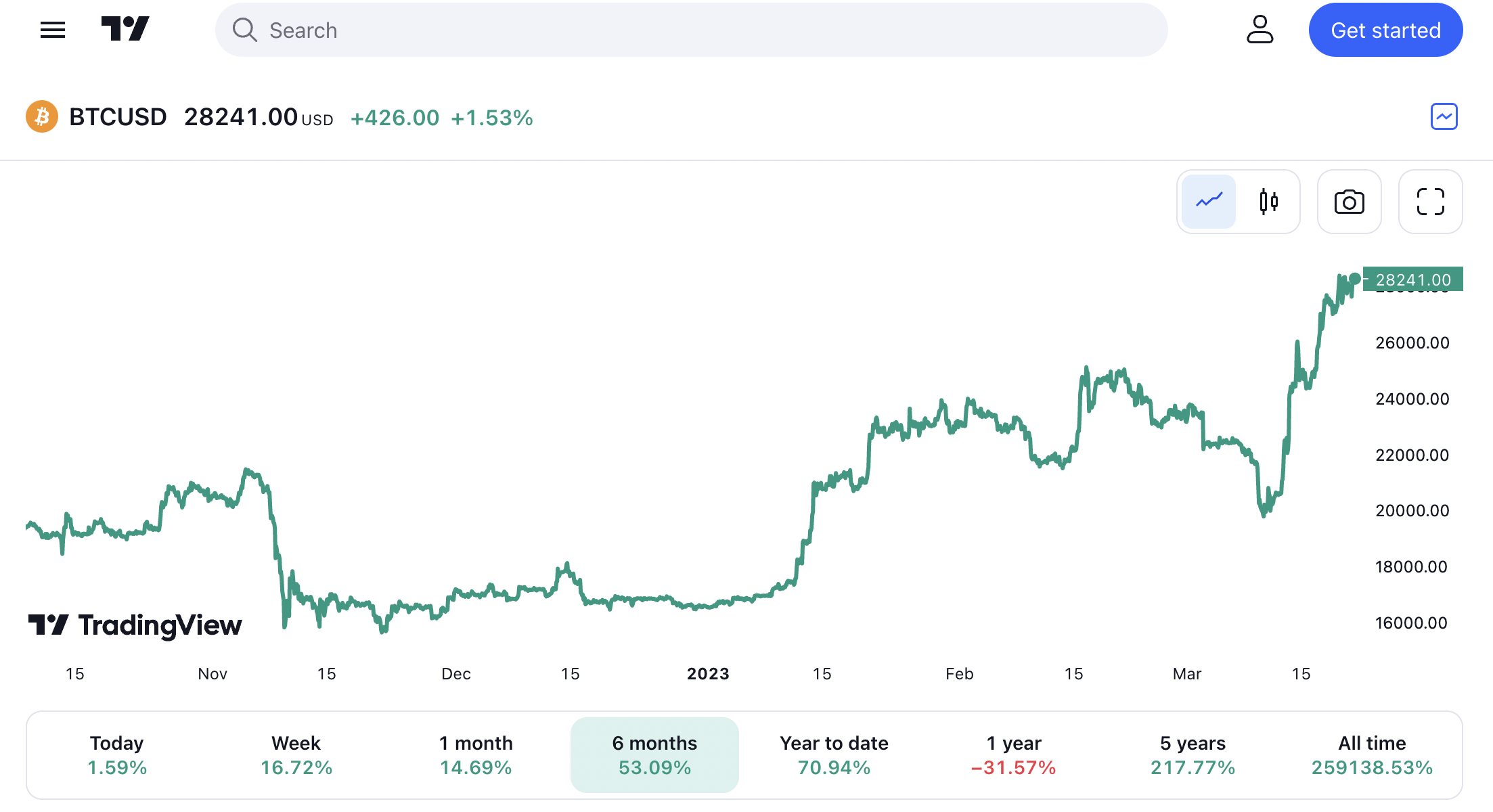

The current crypto market statistics are proof that the failure of Silvergate and SVB is not a symptom of a weak crypto market, as the skeptics have said. The market, on the other hand, is observing the resiliency of this ecosystem.

Nonetheless, these occurrences show how weak the conventional financial system is, necessitating yet another bank bailout from the U.S. government. True to this, the U.S. government declared on Monday, March 13th, 2023, that it would make sure that all SVB and Signature Bank depositors would be compensated in full.

Latest Crypto Market Updates

Since the U.S. government declared it would intervene to stop a potential banking crisis from spreading, the market for Bitcoin and other cryptocurrencies has recovered. Since Friday, March 10th, 2023, the prices of Bitcoin and Ethereum have recovered some of the ground they lost, and Circle's USDC stablecoin has reclaimed its dollar peg. (The best Bitcoin forex brokers 2023)

According to Alex Kuptsikevich, FxPro senior market analyst, "Bitcoin faces a crucial test of market sentiment." He further explained the need to "pay close attention during the day to see whether the hawks have conducted a clean sell-off." He hinted that this move indicates that the recent market rise is a hoax and that the major businesses still offer superior product prices. He advised new investors "to confirm a positive turnaround," which, according to him, is a minimum of $23,000 Bitcoin value before investing.

The announcement on Sunday by the Treasury Department, Federal Reserve, and Federal Deposit Insurance Corporation (FDIC) that all deposits at Silicon Valley Bank (SVB) would be insured in the event of the bank's failure. This announcement was a catalyst for the price recovery of the crypto market.

All depositors of SVB are insured and will be compensated, according to a joint announcement from the Federal Reserve, the Federal Depository Insurance Corporation (FDIC), and the U.S. Treasury Department. The joint statement read that the group was planning a "comparable systemic risk exemption for the recently shut down SVB, New York." According to this consensus, it will "make all depositors whole." This means that in the case of Silicon Valley Bank's bankruptcy, the taxpayer won't bear any losses."

Final Thoughts

The current issue may have long-term negative implications on the popularity of cryptocurrencies since it will erode the already shaky investor trust, still grieving from the losses of 2022. While we wait for the regulator's response to current happenings, it is evident that the U.S. will continue to enforce its stringent regulations regarding the implementation of the decentralized financial system.

Yet rather than permanently restricting Bitcoin, this will open the door for other countries. American companies who wish to participate in the decentralized financial system will find offshore alternatives. Digital currency use will increase in countries like China and the U.K. Luckily, Rishi Sunak, the U.K. prime minister, has mentioned his intention to make London a center for cryptocurrencies.

Countries that have supported cryptocurrency will be ahead when widespread adoption ultimately occurs. How quickly and widely cryptocurrencies will be adopted by the general public will only become apparent with time; the unpredictability of the world economy makes this "time" impossible to forecast. (Check out our list of the best brokers to use in 2023)

دولة الإمارات العربية المتحدةUS

دولة الإمارات العربية المتحدةUS