The publicly listed forex broker Currency Management Corporation (CMC Markets) announced on January 31, 2023, that it was extending its services to Singapore under the name CMC Markets Singapore Invest. By the end of Q1 2023, the platform is anticipated to have received in-principle approval from the capital markets, after which it will hold a soft launch.

Details of CMC Markets License in Singapore

CMC Markets Singapore Invest recently received its preliminary clearance from the Monetary Authority of Singapore (MAS). With this clearance, the broker may provide mobile and online trading in shares, futures, and exchange-traded funds with international listings to its Singaporean clientele.

CMC Markets Singapore Invest customers will pay no commission and enjoy real-time pricing of the platform's offerings. However, the platform is still awaiting final regulatory clearance of its Capital Markets license.

Christopher Forbes, Head of CMC Invest Singapore, says, "this is a significant milestone and validation for CMC Markets as the company has been selling CFDs in Singapore since 2007." He added that the platform's expansion to Singapore reflects its dedication to providing top-notch services and its clientele's positive reviews.

CMC Markets Expansion

CMC Markets began operating as a CFD broker in 2000, and in 2001 it introduced an online financial spread betting service. CMC started its international expansion in 2002 with its office in Sydney, Australia. In 2003, the first office in North America was established in New York. The company also purchased the Canadian broker Shorcan Index, which became its Toronto branch in 2005.

In keeping up with this growth, CMC Markets has opened several offices in many countries around the globe. In October 2022, the company introduced CMC Invest, a distinct platform for capital markets in the UK, and it offers shares with US and UK listings and ETFs.

About CMC Market

CMC Markets started as an FX broker in London. The company introduced the first retail FX trading platform online in 1996, giving its customers access to previously exclusively open markets to institutional traders.

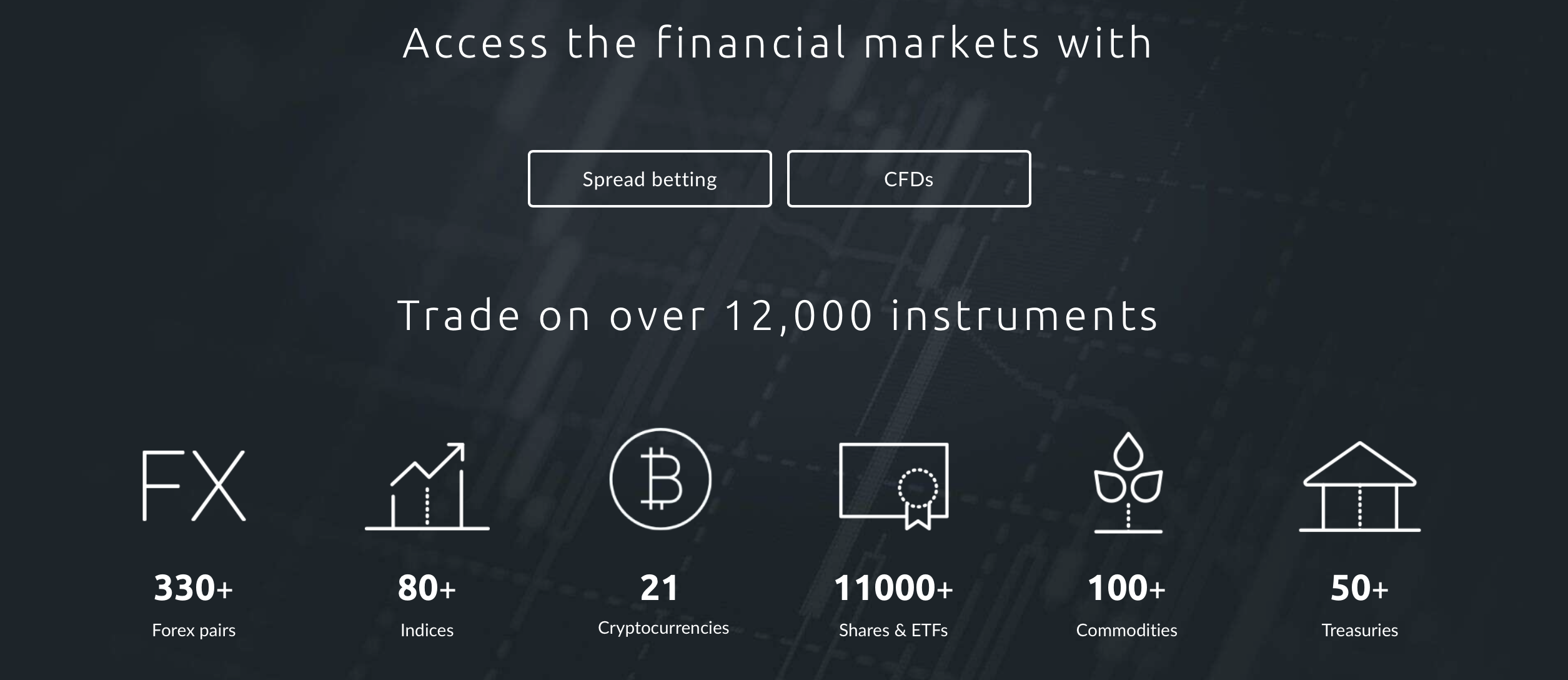

The company offers its clientele more than 12,000 CFDs, ample FX pairings, and access to global equities. The company also quotes all 158 of its currency pairing both ways; this includes the inverse USD/EUR and the EUR/USD quotes. Hence, the 316 available pairings at CMC Markets are doubled.

Several bodies license the CMC Market in different regions. These include the Australian Securities & Investment Commission (ASIC) and the Financial Markets Authority (FMA) of New Zealand.