Online sales shine, equities slide while long-term Treasury yields climb

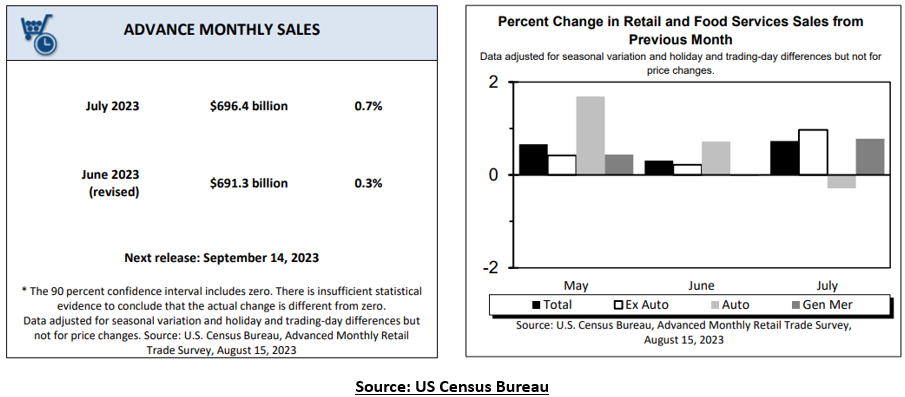

Advance sales estimates of US retail and food services climbed 0.7% month-on-month in July to $696.4 billion from an upwardly revised 0.3% or $691.3 billion in June, data released by the US Census Bureau showed. The economic activity in the US, led by consumer spending, has remained strong over the past few months, with the July figures beating Street estimates of a 0.4% increase to register the fourth consecutive monthly rise in the sales of goods and services. This, despite high prices and borrowing costs.

Economists' Views & Forecasts

Economists believe that retail spending was boosted by Amazon Prime Day, although it is impossible to quantify the extent since the initial data published by the US Census Bureau is sketchy regarding Prime Day sales numbers. On the whole, nonstore retail sales surged 10% in the last one-year and have climbed by more than a percent for four consecutive months. This week should also throw up more information on consumer spending, with big-ticket retail stores, such as Home Depot Inc (THE), Target Corp (TGT), Walmart Inc (WMT), and Ross Stores Inc (ROST) reporting quarterly results.

According to the Senior Economist from Nationwide, Ben Ayers, the solid consumer spending figures in the third quarter resulted from the rapid wage increases, and as spending expands, inflation will surge higher too. He forecasts the overall spending momentum to run out in due course amid significant loosening in the labor market conditions.

Interpretation of the monthly retail trade survey-

The US Census Bureau publishes the Advance Monthly Retail Trade and Food Services Survey, providing early estimates of monthly sales by retail and food service firms in the US. The questionnaires are mailed monthly to a probability sample of about 4,800 employer firms selected from a more extensive Monthly Retail Trade Survey.

The advance retail sales estimates are a subsample of the full retail and food services sample by the Census Bureau. The sampling method comprises around 4,800 retail and food services firms, with the sales weighted and benchmarked to represent over three million US retail and food services firms.

Sectors reporting positive and negative sales figures in July-

Retail sales rose at nonstore retailers (1.9%), sporting goods, hobby, musical instrument, and bookstores (1.5%), food services & drinking places (1.4%), and clothing & clothing accessories stores (1.0%). Besides, sales at general merchandise & food & beverage stores rose 0.8% each, while building materials & garden equipment & supplies dealers and health & personal care stores reported sales of 0.7% each. Monthly sales at gasoline stations, too, rose by 0.4% but tumbled 20.8% from July 2022. On the contrary, sales fell by 1.8% at furniture & home furniture stores, 1.3% at electronics & appliance stores, and 0.3% at miscellaneous store retailers and motor vehicles & part dealers individually.

US equities dive while long-term bond yields climb-

In the current setting, robust economic data might not really benefit US equities. While the better-than-expected consumer demand boosts the view of a resilient US economy, eliminating the fear of a recession, market participants remain concerned that a surge in consumer spending could lead to higher prices and further Fed rate hikes. The worries were reflected in US equities, which slid following the advance retail sales figures, with the benchmark S&P 500 settling at 4437.86, down 1.16%, while the tech-heavy Nasdaq 100 fell 1.10% to close at 15037.65, and the 30-share Dow Jones Industrial Average fell 1.02% to end Tuesday’s session at 34946.39.

Even as the markets were digesting the retail sales data, banking stocks registered some heavy selling on Tuesday, with JP Morgan Chase (JPM), Wells Fargo (WFC), and Bank of America (BAC) all down between 2.3%- 3.2% amid reports that Fitch will likely downgrade some banks. Besides, the Federal Deposit Insurance Corp.’s recent proposal for regulatory overall underpinned the regional banking sector. While First Republic Bank (FRC) tumbled 43.30%, Western Alliance Bancorp (WAL), PacWest Bancorp (PACW), and Zions Bancorporation (ZION) plunged to close lower by 3.7%- 4.5%.

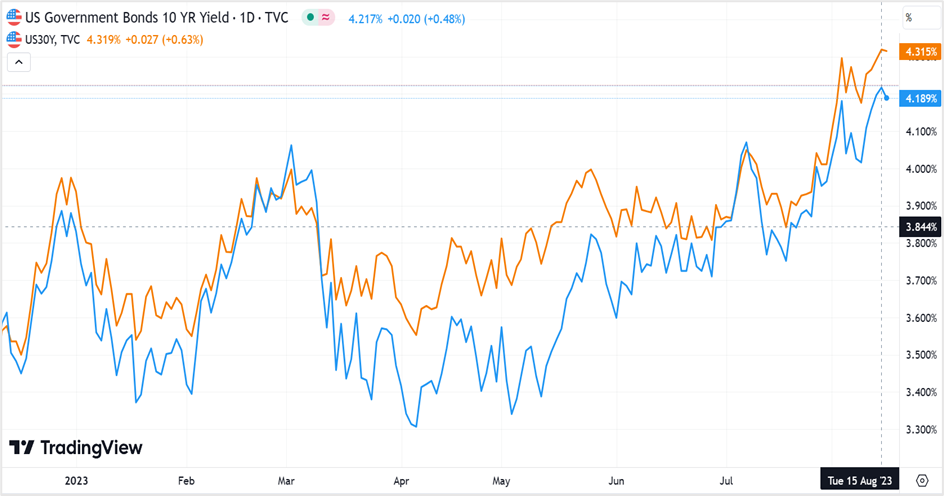

In the fixed-income markets, the better-than-expected US retail sales numbers drove the 10-and 30-year Treasury yields to the highest since last year. The yield on the 10-year T-note closed at 4.218%, up 2.3 basis points, the highest settlement since October 24th, 2022. Meanwhile, the 30-year bond yield rose 2.9 basis points to end Tuesday’s session at 4.319%, the highest close since November 7th, 2022.

Note: The figures might vary slightly from the ones available on MarketWatch.

Comparison of the 10-year & 30-year US Treasury yields

Technical View-

On charts, the S&P 500 held near crucial support levels (indicated by the red horizontal and the green trendline) of 4430 after settling at 4437.86 on Tuesday. The key trendline support provides buying opportunities, with near-term targets of 4500-4510 and a longer-term range of 4650-4675.

On the downside, if the spot index closes below the support at 4430, it could slide to the 26th June lows of 4328 and further toward the long-term support at 4175-4200.

The near-term strategy will be to initiate long trades on the S&P 500 index futures or the SPDR S&P 500 ETF Trust (SPY) if the spot index hits 4430. Place a stop loss at 4405 with a profit target of 4500. However, if the index closes below 4430, short the futures or SPY with a stop loss at 4455 and exit as prices approach 4330.

S&P 500- Daily chart

US Treasury yields have continued to gain since the July CPI data, with the 10-yeat Note settling above 4.21% for the first time since 7th November 2022. This indicates further upside, with the gains likely to extend to 4.35%.

Initiate long positions on the 10-year Treasury futures @ 4.21% with a stop loss at 4.15% for a target of 4.35%. You can reverse your trades if the yield hits 4.35% with a stop @ 4.45% for a pullback toward 4.21%.

US 10-year Treasury yield- Daily chart

The advance retail sales figures for August will be released on September 14th, 2023, a week before the Federal Reserve announces its interest rate decision.