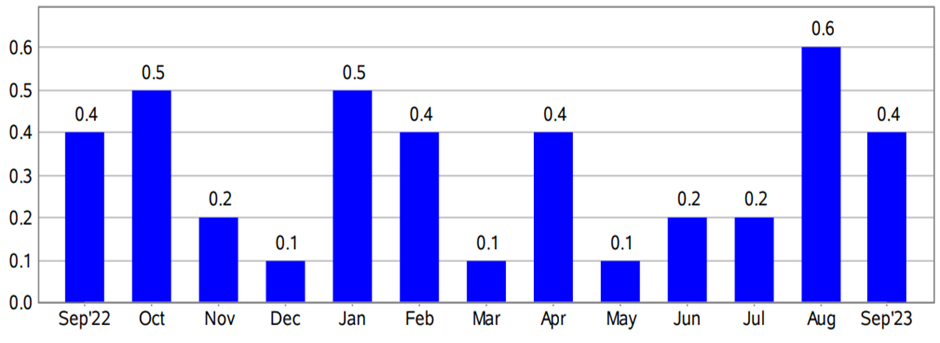

Inflation climbs 0.4% on the month, remains flat at 3.7% y-o-y

Seasonally-adjusted consumer price index (CPI) in the US rose 0.4% in September, slightly below the 0.6% increase the previous month, the US Bureau of Labor Statistics reported. Over the last 12 months, household inflation stood at 3.7%. A poll of economists by The Wall Street Journal estimated the US CPI to increase by 0.3%. Meanwhile, the index for all items less food and energy or core consumer price index climbed 0.3% in September, unchanged from the previous month, while it edged lower from 4.3% to 4.1% annually.

In a separate report, the Labor Department announced a 0.2% drop in the real average hourly earnings of urban wage earners for the month, largely from the difference in the inflation rate and the 0.2% gain in nominal earnings.

The higher-than-expected CPI report comes at a time when central bank officials are deliberating their next policy move. According to the Fed’s September meeting minutes, released Wednesday, while a majority supported another rate hike this year, there were divisions within the rate-setting committee. Members opted not to raise interest rates, but there were lingering concerns about the upside risks to inflation.

CPI – Monthly percentage change: US Bureau for Labor Statistics

The consumer price index (CPI) for all urban consumers advanced in September primarily due to a surge in the shelter index, which accounted for about half the increase. The index rose 0.6% in September from 0.3% the prior month. Also, the index gauging rent gained 0.5%, while the index measuring owners equivalent rent advanced 0.6% month-on-month. The shelter index surged 7.2% for the year, accounting for more than 70% of the growth in all items, less food and energy.

The other contributors were the energy index, gaining 1.5% in September from 5.6% the previous month, with the gasoline index contributing 2.1% to the advance after increasing 10.6% in August, the index for electricity rose 1.3% from 0.2%, while the index for fuel oil jumped 8.5%. Meanwhile, the food index rose by 0.2%, unchanged from July and August, and the index for motor vehicle insurance climbed 1.3% in September from 2.4% the month earlier.

On the contrary, the natural gas index fell 1.9% month-on-month in September from a 0.1% increase in August, while the index for used cars and trucks plunged 2.5% on the month, extending August’s 1.2% decline.

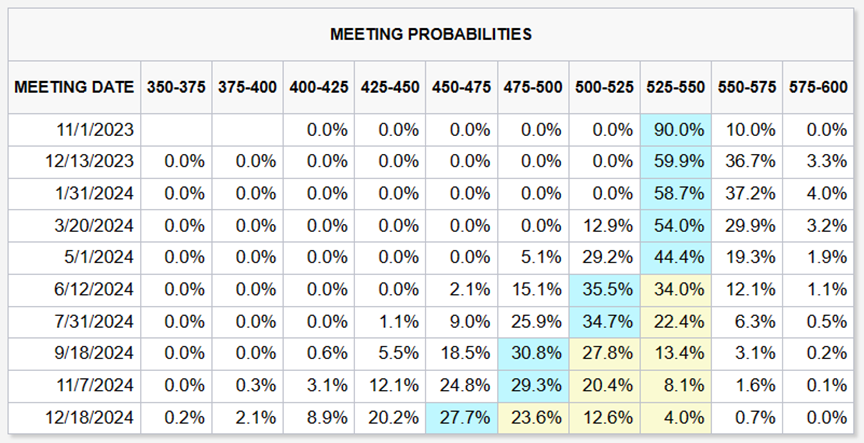

According to analysts, while the inflation rate has fallen drastically from last year’s multi-decade highs, the final leg toward the Fed’s 2% target might be rough. Meanwhile, the hotter-than-expected headline consumer prices boosted the likelihood of a quarter-point rate hike in December to 36% from 26.3% a day earlier, the CME FedWatch Tool showed. While most traders- over 90% expect the US central bank to maintain the status quo in November, a small percentage anticipate a 50-basis point hike in December.

CME FedWatch Tool

Analysts' response to the consumer prices data

Krishna Guha, economist at Evercore ISI, thinks the consumer inflation rate in September is not favorable from the Fed’s point of view but expects policymakers to remain in a wait-and-watch mode. He doesn’t see anything in the data that would compel the US central bank to hike in November.

Meanwhile, Lindsay Rosner from Goldman Sachs Asset Management believes the September CPI data has reinforced the view that the Fed is near the end of its rate hiking cycle. With the US economy on a disinflation path, the recent Fed speech and the tight financial conditions point in this direction.

Andrew Hunter, the economist at Capital Economics, believes that the Fed will not hike interest rates on November 1st. He also expects a sharp drop in inflation and economic growth to weaken, driving the Fed to cut rates more aggressively next year than markets anticipate.

Market Reaction to the Consumer Price Index Report

US stock benchmarks reversed early gains to end Thursday’s session in the red, giving back some of the multi-session gains after rising Treasury yields from the higher-than-expected consumer price index report pressured equities. All the major stock indices ended Thursday’s trading session with losses, with the Dow Jones Industrial Average (DJIA) falling 173.73 points or 0.51% to close at 33,631.14, while the S&P 500 slid 0.62% to 4,349.61, and the Nasdaq 100 lost 0.37% to settle at 15,184.

The pullback in US stocks also coincides with the quarterly corporate earnings season, which gets underway with some major banks announcing results on Friday. However, despite Thursday’s losses, all the major indices are poised for weekly gains, with the tech-heavy Nasdaq on course to end the third successive week in the positive.

Nancy Tengler, the chief investment officer at Laffer Tengler Investments, predicts a year-end equities rally led by stocks from the technology and industrial space.

Citigroup, JP Morgan Chase, and Wells Fargo will report quarterly earnings on Friday.

In the currency markets, the greenback rebounded from a seven-session losing streak against its key counterparts in the US dollar index to settle at six-day highs of 106.599 on Thursday. The gains were primarily led by a stronger-than-expected September CPI report, raising hopes of another rate hike in December, causing a selloff in the US Treasury markets and driving yields of the benchmark 10-year Note and the 30-year bond to 16-year highs.

The US currency surged 0.86% against the euro in the spot markets to close at 1.0528, 1.13% versus the pound sterling, and 0.43% vs. the Japanese yen to settle at 1.2174 and 149.80, respectively.

US dollar index futures (DXY)- Daily chart

US Treasurys sold off on Thursday as the higher-than-expected consumer prices raised expectations of another rate hike in December, driving yields higher. The 10- and 30-year yields registered the sharpest one-day rise in more than a week to end the New York session at 4.71% and 4.87%, respectively, while the 2-year Note closed at four-day highs of 5.073%.

According to Marc Chandler, the chief market strategist at Bannockburn Global Forex, the broad selloff in the US Treasurys is steering the US dollar higher and helping it recoup some of the losses accumulated earlier in the week. He’s unsure how the longer-term rates will impact Fed policy but believes that the bond market’s response to the consumer price index report is undercutting the recent statements by Fed officials calling for an end to rate hikes.

Technical View

Netflix (NFLX)

Netflix settled at $361.20 on Thursday, slightly below the key Fibonacci level at $361.60. The stock is in a primary uptrend after closing below crucial support at $421.00 (lower green trendline) on September 13th. There are two possibilities- First, prices will continue sliding toward the next support at $354.00 (red horizontal line) and lower, or second, prices will rebound to test the higher end of the bearish channel (upper red trendline) and continue further toward $455.00 (lower green trendline).

Strategy: Go long if prices close above $368.00 with a stop loss at $350.00 for a profit target of $420.00. If prices continue sliding from Thursday’s close, initiate long positions at $354, with a stop and reverse at $350 for a profit target of $367.00.

Netflix- Daily chart

Crudeoil November futures

Crude oil prices plunged after hitting 13-month highs of $95 a barrel in late September. Prices are holding near crucial levels at $82.80, bouncing off the support (green trendline) on multiple occasions. A close below the support could push prices toward two-month lows of $75.00 (lower purple trendline). On the other hand, if prices close above $85.50, the rally could extend to $95-$97.

Strategy: Buy crude oil in November futures at $82.80 with a stop and reverse at $81.50 for a profit target of $85.50. If the stop losses are hit on the downside, hold on to the short positions at $81.50 with a stop at $84.00 for a profit target of $75.00.

Crudeoil November futures-Daily chart