Risk Warning: Your capital is at risk. Statistically, 74-89% of customers lose their investment. Invest in capital that is willing to expose such risks.

CQG Trader Review

About the CQG Trader Review platform

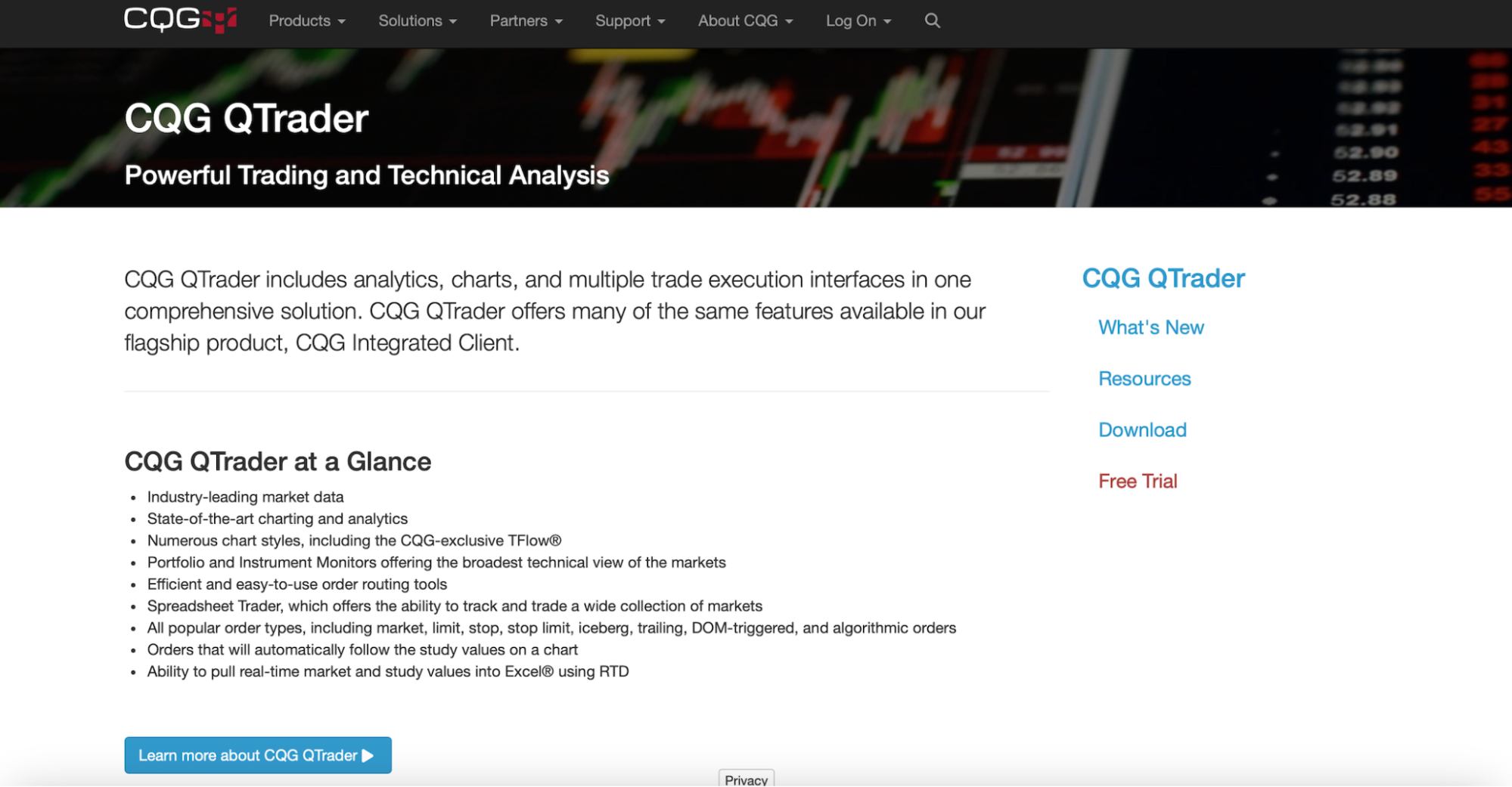

There are many forex brokers on the market, and choosing one can be a complex and time-consuming task. Also, it’s important to choose the right trading platform. One such platform is CQG Trader, popular in the futures trading industry.

CQG Trader is an advanced trading platform that is favored by experienced traders for its powerful analytical tools. Since it was established in Denver, United States in 1980, it has grown in popularity. The platform now has offices in several countries, including London, Singapore, Tokyo, Moscow, and Sydney. In addition, there are other US-based offices in New York and Chicago.

For peace of mind, CQG Inc. is registered with the National Futures Association (NFA).

This platform is favored for its depth of market execution, but there is no one-size-fits-all answer when it comes to choosing the ideal option. For that reason, I’ve reviewed CQG Trader in detail, identifying its pros and cons, features, and customer reviews. In the end, it will be much easier to make an informed decision.

Table of Contents

- TL;DR

- Criteria Breakdown

- CQG Trader: What It’s Best Known For

- CQG Trader Features

- Pros of CQG Trader

- Cons of CQG Trader

- Criteria Evaluation

- Community Reviews and Expert Recommendations

- CQG Trader Pricing

- Where to Find CQG Trader

- Alternatives to CQG Trader

- FAQ

- Final Thoughts

TL;DR

- CQG Trader excels in efficient Depth of Market (DOM) execution for futures trading.

- The platform offers robust features for futures and options trading, including a configurable DOM and precise account balance summaries.

- Notable drawbacks include lack of built-in charting and limited customization outside of DOM.

- Best suited for experienced futures traders who prioritize execution speed and efficiency.

- Pricing information is not readily available, requiring contact with CQG or authorized brokers.

Criteria Breakdown

To help me create this CQG Trader review, I created a set of criteria and rated the broker out of five for each element. A rating of one means a poor outcome, however five means the broker performs excellently in this area.

This platform performed very well in many areas, however it did fall short in some. In particular, I was unable to gain much insight into the pricing of its services.

Below, you will find my ratings for each specific area:

- Execution capabilities: 4.5/5

- Platform features: 4/5

- User interface: 3.5/5

- Account management: 4.5/5

- Trading instruments: 4/5

- Charting capabilities: 1/5

- Compatibility: 3/5

- Cost: N/A (insufficient information)

- Customer support: 3/5

CQG Trader: What It’s Best Known For

The DOM Dominator

The standout feature of CQG Trader is its Depth of Market (DOM) execution. Compared to many other platforms specializing in the future arena, CQG is fast and extremely efficient.

It’s extremely easy to see the market depth clearly, allowing for fast and accurate order placement. Additionally, CQG Trader is known for its strong features and options trading capabilities.

It’s clear that this platform has considered traders’ needs in detail. In particular, the SPAN-based margins and ability to trade futures spreads as one symbol stands out. Yet, rather than trying to do everything all at once, this platform focuses on its strengths, which I believe makes it stand out from its competitors. In this case, it focuses on futures and options trading in particular.

Traders that want an all-in-one platform may find CQG Trader lacking, yet I believe that by excelling in its niche, it adds quality. Ultimately, it’s better to choose a trading platform that is an expert in one area, than one that is mediocre in several.

Features

CQG doesn’t have an extensive set of features like other platforms. However, it does have a quality range that suits its specialist approach to options and futures.

A standout feature is the quote board, which gives real-time data on the instruments. In this case, I found it easy to identify the instruments I wanted to trade in and then keep a close eye on them before making a move. I also appreciated the working order and open positions tracking. This made it easy to track my trades and manage risk.

Additionally, the purchase and sale processes are clear and efficient, making it easy to trade quickly. The account summary feature links in to this, giving a clear breakdown of my account balance. I always knew exactly what funds I had, without any confusion or calculations needed.

However, CQG Trader’s main feature is the configurable DOM. This adjusts order placement according to price input, and it’s a positive addition for fast trading. Finally, CQG has a Key Action Help feature. This allowed me to set keyboard shortcuts so I could speed up my trading.

One missing feature is built-in charting, which could help take this platform to the next level.

Pros

To give a balanced view of CQG Trader, let’s first explore the advantages of choosing this platform.

- Lightning-Fast DOM Execution

The stand-out feature of this platform is its extremely fast DOM execution. This made it easy for me to identify a potential trade, place it, and know I didn’t have to wait. Additionally, the platform made it very easy for me to clearly understand the market and the best trades for my needs.

With a strong focus on DOM as its main feature, I would recommend CQG for anyone who enjoys this trading tool.

- Precise Account Balance Summary

I appreciated the account balance summary because it allowed me to comprehend my funds without any confusion. It was also very accurate, and updated in real-time.

Some platforms do not show account balance very clearly and it can cause confusion and undue delays with trades. That isn’t the case with this platform, and it was easy to have a clear overview of my current financial situation.

- Configurable DOM

The DOM feature can be configured to specific needs. This allows for personalized trading and ensures that particular markets are identified on the news feed, without having to search through unnecessary entries. Again, this creates a fast and efficient trading picture, and allows for opportunities to be seized quickly, without delay.

- Futures Spread Trading as One Symbol

Futures trading is simpler thanks to this feature. Rather than spending time deciphering symbols separately, one symbol means identifying trades fast and effectively. Overall, CQG Trader makes it easy to trade quickly and accurately, which again means less missed opportunities.

Cons

While CQG Trader has many positive aspects, it does have some disadvantages that need to be shared.

- No Built-in Charting Capabilities

The biggest downside of CQG Trader is its lack of built-in charting capabilities. This is something which many other comparable platforms do have, and where CQG falls short. Many users mention this as a big disadvantage and would prefer to have some capabilities included within the platform.

For traders who prefer built-in charting, it may be best to look at other alternatives, such as MetaTrader 4. However, if charting isn’t a particular priority, the DOM focus may make up for it.

- Limited Customization Outside of DOM

While it’s possible to customize the DOM feature within this platform, there are limited options within other areas. While this isn’t a huge let-down, it does make the platform slightly less user-friendly than it could otherwise be.

- Lack of Global Cancel Button for Open Orders

A global cancel button is a fast and effective way to remove open orders, however CQG Trader lacks this function. Again, this is something which other comparable platforms do have. High-volume traders in particular may find the lack of this feature unappealing.

Criteria Evaluation

- Execution Capabilities: 4.5/5

- Platform Features: 4/5

- User Interface: 3.5/5

- Account Management: 4.5/5

- Trading Instruments: 4/5

- Charting Capabilities: 1/5

- Compatibility: 3/5

Community Reviews and Expert Recommendations

CQG Trader receives generally positive reviews from the trading community. Many traders particularly praise the fast execution speeds and strong futures trading capabilities. Most users find the interface easy to use and intuitive, however some feel that it is a little outdated in some respects and could be modernized. Some also express frustration over lack of built-in charting features.

“CQG software is good. It’s no Sierra Charts but it will get you by if you only need the basics in your futures trading or as a good order entry companion software if you are using something else for advanced charting.” – Chris via AMP Futures

“Everything is excellent at CQG, the data and the platform. For real traders choosing CQG is the best choice.” Bechir via AMP Futures

Industry experts generally agree with the trading community and believe it is a good choice for professional traders. They particularly rate this platform for its speed and reliability in future trading. However, experts also agree that the platform could be improved with a charting tool for a more comprehensive approach.

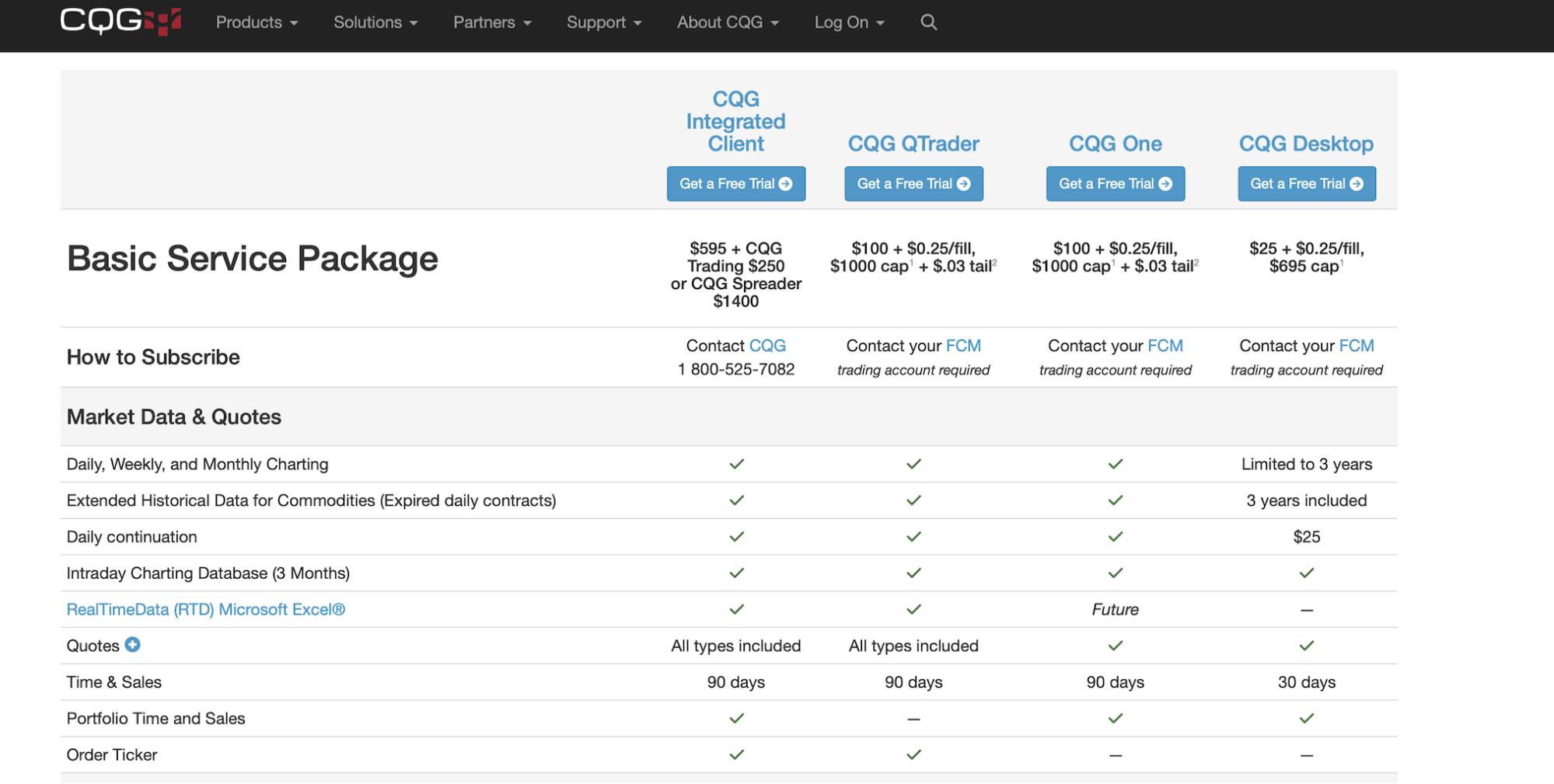

CQG Trader Pricing

Unfortunately, it’s impossible to give a thorough outline of CQG’s pricing structure as it varies according to specific needs and is quite complex. For accurate pricing details, contact CQG directly. The price varies depending on trading volume, account type, and specific features.

Alternatives to CQG Trader

CQG Trader is a high quality platform, however there are several others that deserve a notable mention. Traders who find CQG doesn’t suit their needs should explore these options.

MetaTrader 4 (MT4)

MetaTrader 4 is an industry favorite and platform that many brokers use. With a range of features, MT4 offers an easy-to-use interface with charting capabilities and market news. For more information, read our MetaTrader 4 review.

NinjaTrader

Another notable mention is NinjaTrader. This platform boasts a range of charting and analytical tools, along with an intuitive interface. Our article on the best NinjaTrader forex brokers gives more details.

TradingView

TradingView is a popular social network that was established in 2011. With an app and a desktop system, this platform boasts several features, including analytical tools and charting.

Quik

Quik is an easy-to-use trading platform that is ideal for both beginner and intermediate traders. It has powerful monitoring capabilities, along with a range of features for easy, on-the-go trades.

Interactive Brokers’ Trader Workstation (TWS)

Trader Workstation is a platform owned by Interactive Brokers, a popular trading broker for various instruments. Along with powerful charting and monitoring capabilities, this platform is easy to use and has a mobile app.

Frequently Asked Questions

Is CQG Trader suitable for beginner traders?

CQG Trader is a powerful trading platform that is suitable for all trading traders. However, the specific choice comes down to trading ability and experience. Some users may find the platform a little overwhelming, especially complete beginners.

Overall, CQG Trader is designed for professional futures traders, along with several advanced features that focus on speed and efficiency. It’s an ideal choice for experienced traders, but will require a learning curve for less seasoned traders.

However, that does not mean beginners should avoid CQG Trader. It just means a dedication to learning is required. It’s best to learn the basics of forex trading for beginners before trying this platform.

Can I use CQG Trader for forex trading?

CQG Trader is designed for futures and options trading, and it does that very well. Forex trading isn’t the main focus of this platform, yet there are many others that allow this type of trading. For instance, MetaTrader 4 and 5 are very popular choices which many brokers offer within their platforms.

Ultimately, choosing the right platform for your trading style is very important. That means choosing an option that focuses on the tradable instruments you’re interested in the most. Failure to do so will cause a poor choice that must be reconsidered.

Does CQG Trader offer a demo account?

Demo accounts are ideal for beginners because they allow for practice before jumping into the world of live trades. CQG Trader does not offer a demo account itself, however some brokers that offer this platform may have their own demo options.

If this is something you are particularly interested in, our article on non-expiring forex demo account brokers will be useful.

How does CQG Trader compare to MetaTrader 4 for futures trading?

Both CQG Trader and MetaTrader 4 are ideal options for different needs. However, it’s important to assess your trading goals before making a choice.

Both these platforms have a unique approach. CQG Trader specializes in futures trading and is a fast and efficient choice in that field. Its DOM execution is excellent and it’s tailor-made for futures traders. However, MT4 is more versatile. It is a good choice for forex traders in particular but does allow for futures trading. Additionally, MetaTrader 4 has built-in charting capabilities, which CQG doesn’t have. It also has a large library of custom indicators and expert advisors.

In terms of a true focus on futures trading, CQG Trader is the better option. However, MetaTrader 4 is a flexible platform that is used very widely across the industry. That means it’s a lot easier to find support and resources. Before choosing, consider your personal needs.

What kind of customer support does CQG Trader offer?

CQG Trader offers customer support via email, telephone, and live chat. The live chat facility is available between Sunday to Friday, 2.30pm – 5pm CT. Telephone support is also available between these hours. Alternatively, email support is available and requests are handled promptly. There is also a comprehensive FAQs section on their website to answer common queries.

However, compared to some other comparable platforms, CQG’s customer support is lower in quality. There are fewer language options and some users mention slow response times.

Final Thoughts

It’s clear that CQG Traders is a strong choice for futures and options traders. Its stand-out feature is extremely fast DOM execution and customization. Additionally, this platform stands by its roots and focuses completely on futures and options, making it a professional choice for traders who prefer those routes. However, anyone who likes to diversify their portfolios, perhaps with forex, will find this platform lacking.

All trading platforms have their pros and cons, and throughout this CQG Trader review, I’ve assessed where this platform performs and where it falls short. It’s obvious that CQG Trader is a specialized choice, which reduces its reach, however it’s a solid one regardless.

The biggest downside is the lack of built-in charting capabilities, which many traders enjoy and look for in a platform. To sum up:

- CQG Trader excels in DOM execution and futures trading.

- It offers robust features for professional traders.

- The platform lacks built-in charting and has limited customization outside of DOM.

- It’s best suited for experienced futures traders who prioritize speed and efficiency.

- Alternatives like MT4 offer more versatility but may sacrifice some speed.

At Top Brokers, we’re committed to helping traders find their ideal platform. We have a range of resources aimed toward learning and development, along with comparison reviews. Be sure to read our other resources to give you a thorough overview of the trading environment, allowing you to make the best decisions possible.

RoboForex

RoboForex Exness

Exness FxPro

FxPro Alfa-Forex

Alfa-Forex Libertex

Libertex FxGlory

FxGlory XM

XM IC Markets

IC Markets Forex.com

Forex.com AXITrader

AXITrader