The central bank expects to hike again this year, while it lowered its rate cut forecast

The Federal Reserve left interest rates unchanged following its two-day monetary policy meeting but signaled that there would be another 25-basis point rate hike this year. The decision to maintain the status quo on interest rates leaves the benchmark Fed Funds rate at 5.25%-5.50%. However, the Fed continued to reduce its bond holdings, permitting around $95 billion in proceeds from maturing bonds to roll off each month instead of reinvesting them, cutting the central bank’s balance sheet by about $815 billion since June 2022.

In the press conference following the FOMC meeting, Fed Chair Jerome Powell said policymakers recognize the adversity caused by high prices and are firmly committed to bringing inflation down to their 2.0% goal. He, however, said that the Fed is in a place to proceed prudently in deciding the scope of additional policy tightening.

Markets had fully priced in a no-rate hike move by the Federal Reserve. The Fed Funds rate, which the central bank targets, is the overnight lending rate banks charge each other, which also spills over to other forms of household debt, such as home loans, auto loans, student loans, credit card debt, etc.

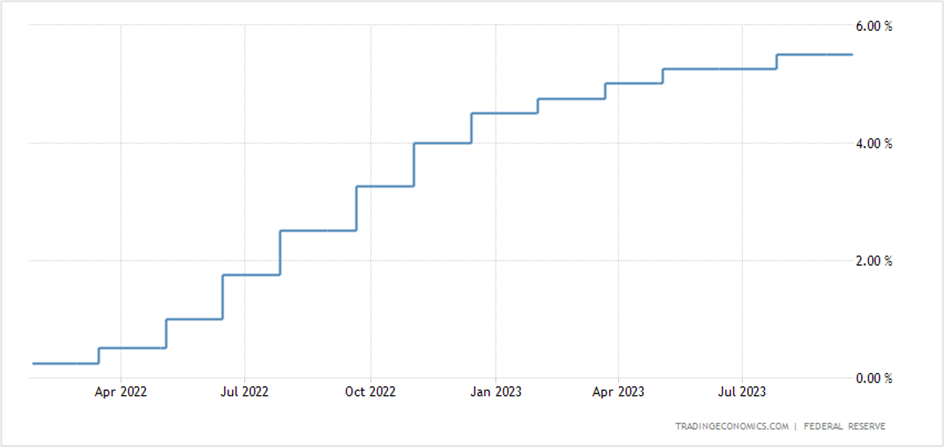

The rate currently stands at 5.25%-5.50%, the highest in 22 years after Fed officials raised interest rates eleven times since March 2022. High inflation has impacted many Americans, especially in the low-income group, since wage growth has not kept pace with inflation, and households are getting squeezed and going into debt at a time when borrowing rates are also surging.

The key takeaways from the September Federal Open Market Committee (FOMC) meeting-

The Fed left interest rates unchanged in September, but policymakers expect to raise interest rates once this year. In addition, they expect interest rates to remain higher for longer.

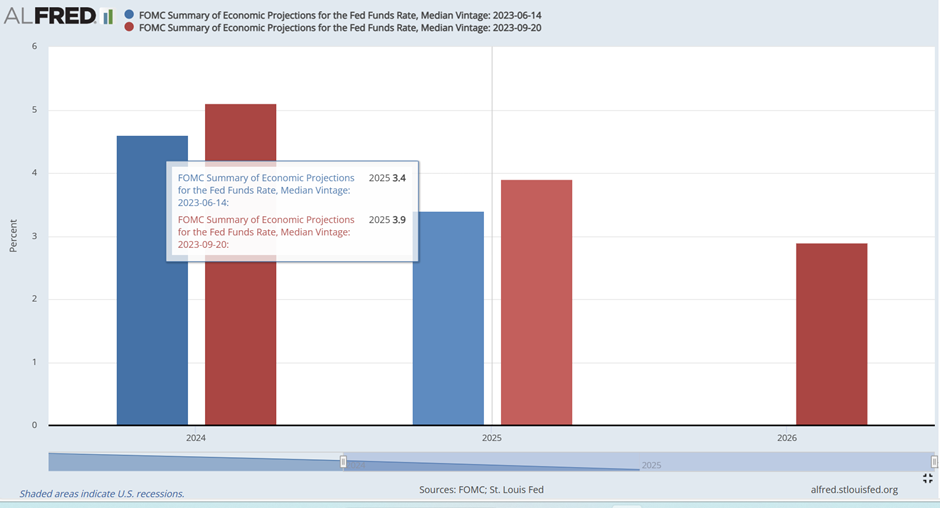

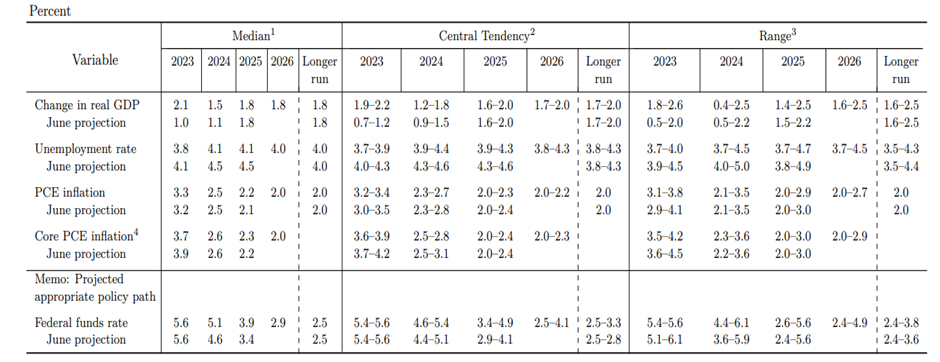

The summary of economic projections released by the Fed showed the likelihood of one more rate increase this year followed by two cuts of 25-basis points each in 2024, two less than what it signaled in June, which means interest rates would remain above 5.0% until the end of next year. Meanwhile, the forecast for the Fed Funds rate in 2025 also rose, with the median outlook at 3.9% compared to 3.4% earlier, while the rate was expected to drop to 2.9% in 2026.

The Fed also raised the US economic growth forecast, with the gross domestic product (GDP) expected to increase to 2.1% in 2023. That’s more than twice its June estimate and an indication that members do not expect a recession anytime soon. Policymakers also raised their 2024 GDP outlook to 1.5% from 1.1%.

The other economic projections include core personal consumption expenditure (PCE) moving lower to 3.7% from 3.9% in June and the unemployment rate dropping to 3.8% from the earlier estimate of 4.1%. The Monetary Policy Committee (MPC) also changed the wording of some of the statements made in June. For instance, they considered economic activity to be ‘expanding at a solid pace’ instead of ‘moderate.’ Besides, they noted that job gains ‘have slowed in recent months but remain strong’ compared to the June statement, where they stated that employment was ‘robust.’

Economists’ views of the September FOMC meeting

According to Mathew Luzzetti, the chief US economist at Deutsche Bank, the US economic growth is still strong, and there are indications that the labor market and inflation are moderating. Therefore, Fed officials are hesitating to send a clear message that they’re done with interest rate hikes.

Citigroup economist Andrew Hollenhorst, in a note, said the Fed delivered an unambiguous hawkish message about maintaining interest rates higher-for-longer. He thinks the Fed expects inflation to cool amid a tight labor market. However, he believes that the continued imbalance in the labor market will likely keep inflation above the Central Bank’s target.

Thomas Simons, the US economist at Jefferies, said that the Fed is looking to lower inflation until it reaches its target rate, thereby embracing the ‘higher for longer’ approach.

Market Reaction to the Fed interest rate decision

The US equities markets fell on Wednesday, with growth stocks tumbling, after the Fed said it would lift interest rates again this year and maintain higher rates longer. The Dow Jones Industrial Average slid 0.22% to close at 34,440.88, the S&P 500 fell 0.94% to 4,402.20, and the Nasdaq 100 tumbled 1.46% to 14,969.92, its lowest closing in nearly a month.

Markets sold off on concerns after the benchmark treasury yield rose to fresh 16-year highs after the Federal Reserve would leave interest rates at elevated levels for longer.

According to Stephen Innes, the managing partner at SPI Asset Management, the prospects of monetary policy uncertainty over the next few months are not apt for risky assets. Also, with interest rates at new multi-decade highs, there is bound to be some turbulence in the US equities markets.

In the currency markets, the US dollar index traded on the InterContinental Exchange (ICE) rose to the highest since 9th March on Wednesday before pulling back to settle almost flat at 105.12. The greenback extended gains against all the currencies in the index except the Swedish krona.

Expect the currency markets to remain volatile for the rest of the week as the UK and the Japanese Central Banks are due to announce interest rate decisions on Thursday and Friday, respectively.

In the Treasury markets, yields rose as investors absorbed the Fed’s suggestions that it would keep interest rates high going into 2024 and slow the pace of rate cuts next year.

The yield on the 2-year note rose 8.6 basis points to 5.191%, while the yield on the 10-year note rose by 5.0 basis points to 4.414%, and the 30-year bond yield edged higher by 2.2 basis points to 4.45%.

The benchmark 10-year Treasury yield rose to the highest since 2007 even as markets price in a 66% probability that the Fed will alter interest rates in November, while the chances of a rate hike in December stood at 40%.

Technical View

Spot EURUSD closed at 1.0660 on Wednesday, down 0.18% on the day, with the declines extending into Thursday’s session. The pair has been in a primary downtrend since 11th August and is currently trading close to the previous lows of 1.0632 (indicated by the blue horizontal line) after breaching the level briefly. A close below the support could push the pair toward 1.0550, the lower end of the red trendline.

The short-term strategy will be to go long on the euro at 1.0550 with a stop loss at 1.0520 and exit if prices bounce back toward 1.0700. Long positions can also be initiated if prices close above 1.0700 or breach 1.0725 with a stop at 1.0680 and a profit target of 1.0800.

Broadcom Inc (AVGO) fell 2.19% on Wednesday to end the session at $830.57. Based on the pre-market rates, the stock is poised to open sharply lower on Thursday.

Broadcom is in a primary uptrend, with long-term support at $776, indicated by the green trendline, giving traders a solid opportunity to buy the stock. However, if prices drop substantially beneath the support or close below it for five successive trading days, the stock will have reversed direction into a primary downtrend, and the declines could extend by 15-20% over time.

The strategy will be to go long on AVGO at $775-780, with a stop loss at $760 for a profit target of $830. Traders can also go long if the stock closes above $830 or breaks $850, with a stop loss at $810 for a profit target near the recent highs at $920.

ประเทศไทยUS

ประเทศไทยUS