Perdagangan Forex sangat popular, dan ia meningkat tahun demi tahun. Malah, pada tahun 2020, perdagangan forex telah meningkat sebanyak 300%. Ini juga menjelaskan mengapa terdapat begitu banyak broker forex untuk dipilih, menjadikan pilihan kadang -kadang menggembirakan untuk peniaga baru khususnya.

Walau bagaimanapun, memilih broker hanyalah sebahagian daripada teka -teki perdagangan yang berjaya. Adalah penting untuk memahami sepenuhnya petikan Forex, baik pada tahap asas dan maju. Memegang kepentingan petikan perdagangan forex adalah langkah yang kukuh ke arah kejayaan perdagangan. Panduan ini akan menyelidiki butiran yang lebih baik. Kami mempunyai banyak alasan untuk ditutup, jadi tanpa selanjutnya, mari kita mulakan.

Jadual Kandungan

- asas petikan forex

- anatomi petikan forex

- nilai pip dan pengiraan

- konsep kutipan forex maju

- kadar silang dan pasangan eksotik

- turun naik kutipan masa nyata

- kemajuan teknologi dalam petikan forex

- platform forex mudah alih

- perdagangan algoritma dan petikan

- kesan pengawalseliaan pada petikan forex

- menafsirkan petikan forex untuk strategi perdagangan

- kesan peristiwa global pada petikan forex

- teknologi baru yang mempengaruhi petikan forex

- rekap pembelajaran

asas petikan forex

Pertama, penting untuk menentukan sebut harga dalam perdagangan forex . Ini menunjukkan kadar pertukaran masa nyata antara dua mata wang yang berbeza dan membolehkan peniaga membuat keputusan yang kuat dalam membeli dan menjual. Apabila pasaran forex berubah dan perubahan, dan teknologi baru muncul, ia lebih penting daripada sebelumnya untuk mengetahui cara menggunakan petikan forex dalam strategi perdagangan yang berjaya.

| komponen | Penerangan |

|---|---|

| mata wang asas | Mata wang pertama dalam pasangan |

| quote quote | Mata wang kedua dalam pasangan |

| harga tawaran | Harga di mana anda boleh menjual mata wang asas |

| tanya harga | Harga di mana anda boleh membeli mata wang asas |

pemahaman forex quotes tokenist

anatomi petikan forex

Petikan Forex melibatkan beberapa aspek yang berbeza dan pemahaman masing -masing adalah penting. Petikan terdiri daripada mata wang asas, mata wang sebut harga, harga tawaran, dan harga Ask. Semua ini bekerja bersama-sama untuk mencipta nilai masa nyata pasangan mata wang. Mereka juga memberikan maklumat mengenai potensi kerugian atau keuntungan.

asas dan quote mata wang

Terdapat dua mata wang dalam setiap petikan forex. Yang pertama ialah mata wang asas, diikuti dengan mata wang petikan. Jika anda melihat EUR/USD, ini bermakna EUR adalah mata wang asas, dan USD muncul sebagai mata wang petikan. Ini memberitahu anda berapa banyak deposit yang diperlukan untuk membeli satu euro.

Pelbagai pasangan mata wang sentiasa berkembang. Carta Pusat mengatakan 128 pasangan mata wang akan berada pada tahun 2025. Ini adalah perkembangan positif bagi peniaga kerana ia bermakna lebih banyak fleksibiliti dalam pilihan.

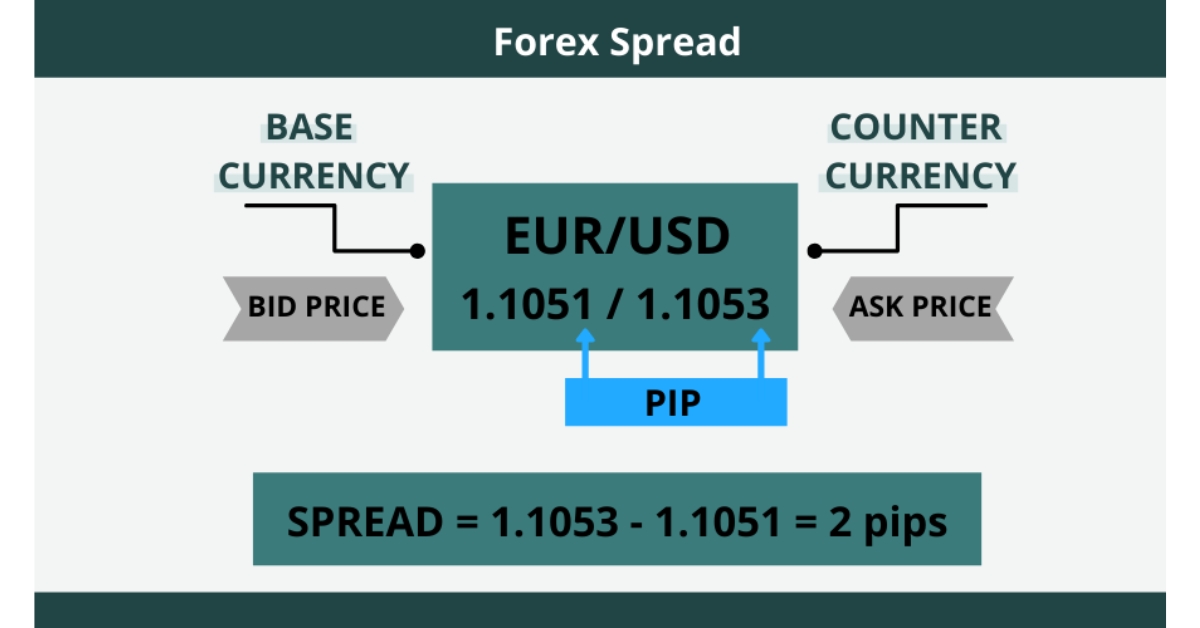

bida dan tanya harga

Dua bahagian lain kadar forex hidup adalah tawaran dan meminta harga. Ini menggambarkan kos memasuki atau keluar dari kedudukan perdagangan. Harga tawaran adalah apa yang majoriti pembeli senang membayar pasangan mata wang. Sebaliknya, harga tanya adalah apa yang ingin diterima oleh penjual. Penyebaran adalah perbezaan antara kedua -dua jumlah ini, dan mencipta kos perdagangan.

Adalah penting untuk memahami sepenuhnya penyebaran forex secara langsung, terutamanya tawaran dan meminta harga, kerana mereka membantu menguruskan kos perdagangan keseluruhan.

belajar membaca carta forex membolehkan pengguna membuat keputusan perdagangan yang kukuh. Sumber: investopedia

Nilai dan Pengiraan PIP

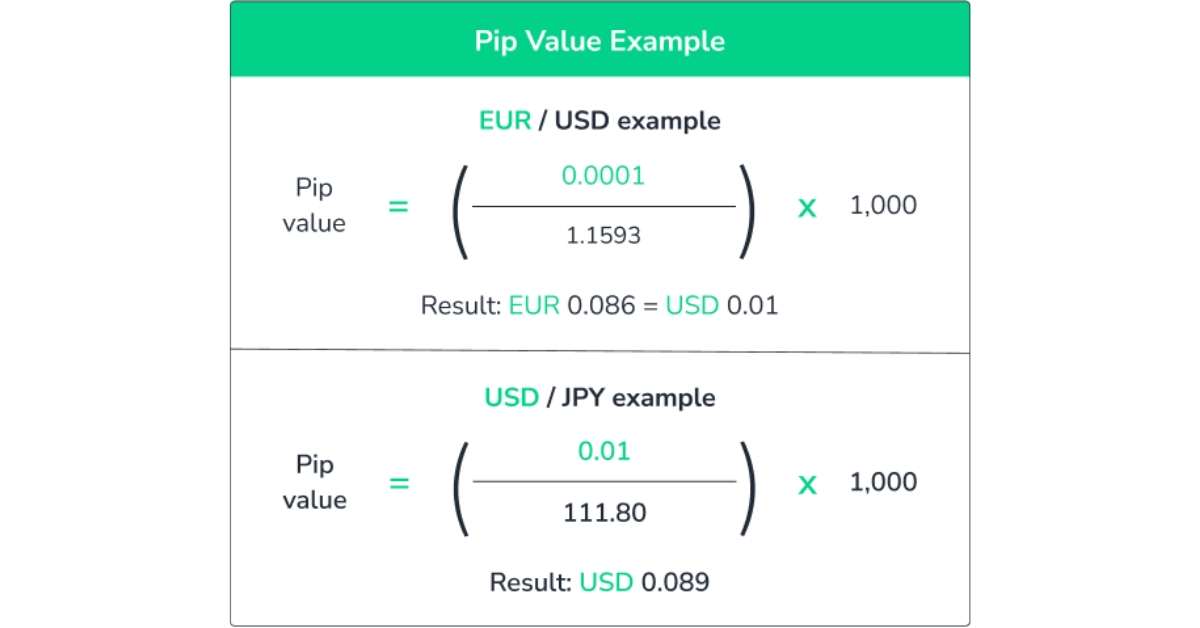

PIPS adalah unit terkecil pergerakan harga forex. Sering kali, pip muncul dalam petikan sebagai digit tempat perpuluhan keempat. Walau bagaimanapun, ini tidak selalu berlaku; Dalam sesetengah pasangan, biasanya mereka yang melibatkan yen Jepun, pip muncul sebagai tempat perpuluhan kedua.

dapat memahami nilai PIP membolehkan peniaga menguruskan risiko.

mengira nilai pip

Nilai PIP bergantung kepada beberapa faktor yang berbeza, termasuk pasangan mata wang, saiz kedudukan, dan kadar pertukaran. Apabila USD diletakkan sebagai mata wang petikan, nilai PIP adalah $ 10, atau 100,000 unit, tetapi ini sering berbeza dengan mata wang lain. Mempunyai strategi PIP yang kuat adalah penting dalam membantu mengurangkan kerugian dan meningkatkan keuntungan.

memahami nilai pip dalam live forex quotes switchmarkets

Konsep Petikan Forex maju

Sebagai perdagangan forex menjadi lebih biasa, petikan kompleks akan muncul. Ini membantu memaklumkan strategi perdagangan yang lebih maju. Memahami pasangan eksotik, kadar silang, dan turun naik masa nyata adalah kunci untuk mewujudkan kelebihan dalam pasaran forex. Di samping itu, mereka membantu dalam strategi pengurusan risiko.

Kadar silang dan pasangan eksotik

Dua aspek lanjutan Forex Trading Quotes adalah kadar silang dan pasangan eksotik. Kadar silang adalah pasangan mata wang yang tidak mempunyai USD, seperti EUR/AUD. Walaupun jenis pasangan ini membawa peluang yang menguntungkan, mereka biasanya mempunyai spread yang lebih luas. Walau bagaimanapun, pasangan eksotik adalah mata wang yang kurang didagangkan, dan oleh itu boleh menjadi lebih tidak menentu. Ini bermakna peluang keuntungan sedikit kurang mungkin tetapi, apabila mereka berjaya, mereka lebih menguntungkan.

| jenis pasangan | Contoh | Ciri -ciri |

|---|---|---|

| utama | EUR/USD | kecairan yang tinggi, spread ketat |

| cross | EUR/GBP | kecairan sederhana, spread yang lebih luas |

| eksotik | usd/cuba | kecairan rendah, spread tertinggi |

turun naik quote masa nyata

Forex Trading adalah perniagaan pantas dan Forex Live kadar boleh berubah dengan cepat dan kadang-kadang tanpa amaran. Terdapat banyak faktor yang boleh mempengaruhi perubahan ini, seperti sentimen pasaran, isu geopolitik, dan siaran data ekonomi. Untuk perjalanan perdagangan yang berjaya, penting untuk memahami pemandu di sebalik perubahan tersebut dan bagaimana untuk mentafsirkannya dengan cepat.

petunjuk ekonomi

Petunjuk ekonomi adalah penting dalam perubahan petikan forex, termasuk inflasi, keputusan bank pusat, dan data pekerjaan. Pelepasan petunjuk sedemikian boleh dengan cepat menjejaskan sebut harga perdagangan , kadang -kadang agak drastik. Memahami bagaimana penunjuk ini boleh menjejaskan pasangan mata wang biasa adalah penting dalam menjangkakan pergerakan pasaran dan mengubah strategi dengan cepat.

peristiwa geopolitik

Aspek lain yang boleh menjejaskan Forex Quotes adalah peristiwa geopolitik yang besar, sering membawa kepada perubahan harga yang besar. Peristiwa sedemikian termasuk perjanjian perdagangan, pilihan raya, perubahan dasar, atau konflik, dan bagaimana ia mempengaruhi harga boleh menjadi tidak dapat diramalkan. Walau bagaimanapun, tetap terkini dengan berita antarabangsa adalah salah satu cara untuk sekurang-kurangnya mempunyai ‘kepala’ mengenai isu-isu yang berpotensi yang mempengaruhi mata wang yang paling anda minati.

Kemajuan Teknologi dalam petikan forex

Teknologi di seluruh dunia bergerak pantas, dan tidak hairanlah yang sama berlaku dalam perdagangan forex. Dunia Forex telah menjadi teknologi yang sangat tinggi sejak beberapa tahun kebelakangan ini, dan trend ini kelihatan diteruskan. Bukan sahaja perubahan seperti AI dan perdagangan mudah alih yang dibuat lebih mudah diakses oleh lebih banyak orang tetapi mereka juga menjadikannya lebih cekap.

Oleh itu, penting untuk memahami bagaimana teknologi boleh digunakan untuk meningkatkan peluang perdagangan forex yang berjaya.

Platform Forex Mobile

Lebih banyak orang menggunakan platform forex mudah alih untuk perdagangan on-the-go berbanding sebelum ini. Melakukannya bermakna perdagangan yang berpotensi menguntungkan jarang terlepas. Aplikasi sedemikian sangat canggih dan memberi akses kepada Forex Quotes Live , pelaksanaan perdagangan, dan pengurusan kedudukan. Banyak platform juga mengintegrasikan alat analisis dan ciri -ciri tambahan. Semua ini bermakna mudah untuk terus terkini dengan perubahan dan menyesuaikan perdagangan dengan sewajarnya.

pemberitahuan push

Bahagian penting dari platform forex mudah alih termasuk pemberitahuan push. Ini adalah makluman yang boleh disesuaikan oleh setiap peniaga untuk memaklumkan tentang perubahan penting, seperti siaran data ekonomi, perubahan kutipan, atau harga pratetap. Adalah idea yang baik untuk mengaktifkan pemberitahuan push dan menyesuaikannya dengan keutamaan peribadi. Kemudian, apabila perubahan berlaku, pemberitahuan akan muncul, membolehkan perubahan strategi cepat.

Perdagangan dan Petikan Algoritma

Aspek utama dalam dunia forex moden adalah perdagangan algoritma. Ini telah menjadi sangat popular pada tahun -tahun kebelakangan ini dan sesuai untuk peniaga yang sibuk. Ini adalah sistem automatik yang dapat dengan cepat menilai sejumlah besar data dalam beberapa saat. Akibatnya, risiko kesilapan manusia dikurangkan dan perdagangan yang menguntungkan lebih cenderung.

perdagangan frekuensi tinggi (HFT)

Dalam kategori perdagangan algoritma, perdagangan frekuensi tinggi berdiri tinggi. Ini membolehkan banyak perdagangan dilaksanakan dengan pantas. Sistem dengan cepat menganalisis data semasa, termasuk Live Forex Quotes , dan bertindak balas dalam beberapa saat. Malah perubahan harga terkecil dikenalpasti.

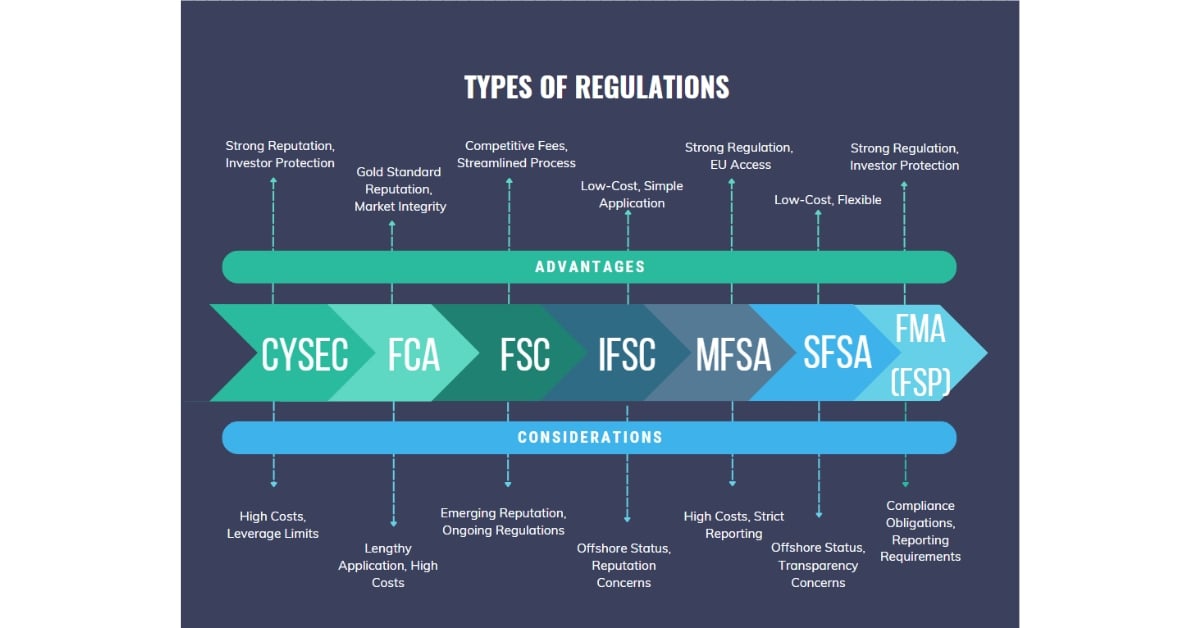

kesan pengawalseliaan pada petikan forex

pengawal selia forex berfungsi untuk memastikan pasaran yang adil dan telus untuk peniaga. Walau bagaimanapun, perubahan dalam landskap pengawalseliaan boleh menjejaskan bagaimana sebut harga di Forex ditunjukkan dan didagangkan. Terdapat dorongan ke arah piawaian paparan paparan sejak beberapa tahun kebelakangan ini, bersama -sama dengan banyak perubahan kepada keperluan margin dan leverage. Adalah penting untuk terus terkini dengan perubahan pengawalseliaan untuk memastikan pematuhan, terutamanya apabila memilih atau memindahkan broker forex.

Terdapat banyak pengawal selia forex yang berbeza dengan tahap perlindungan yang berbeza -beza. Sumber: protonixltd

standardisasi paparan kutipan

Pengawal selia telah lama berkempen untuk paparan seragam sebut harga perdagangan di semua platform. Matlamatnya adalah untuk mengurangkan sebarang kekeliruan dan memberi akses kepada peniaga kepada maklumat yang sama di seluruh lembaga. Broker Forex yang paling terkenal kini menunjukkan petikan forex dalam format yang sangat serupa, yang membolehkan peniaga membandingkan harga dengan mudah.

leverage dan keperluan margin

Leverage dan margin adalah dua bidang lain yang memberi tumpuan kepada pengawal selia. Peraturan dilaksanakan untuk mengawal jumlah modal yang diperlukan untuk membuka dan mengekalkan kedudukan perdagangan. Memahami peranan leverage dan margin membantu memaklumkan strategi pengurusan risiko yang kuat.

menafsirkan petikan forex untuk strategi perdagangan

Memahami Forex Quotes adalah satu perkara, tetapi penting untuk dapat mentafsirkannya dengan berkesan dan tepat. Ia lebih daripada membaca digit; Ia juga mengenai trend dan corak yang mengesan, dan dengan tepat meramalkan pergerakan masa depan. Akhirnya, Strategi Perdagangan Trend adalah penting untuk bergerak yang berjaya.

analisis trend menggunakan sejarah kutipan

Menggunakan data kutipan sejarah tidak ternilai dalam mengenal pasti trend masa depan. Dengan berhati -hati menilai pergerakan harga yang lalu, mudah untuk melihat corak yang boleh menjejaskan trend masa depan. Ini penting untuk keputusan perdagangan yang kuat.

Memahami corak forex yang menonjol dan menurun adalah kunci untuk membuat keputusan yang kuat. Sumber:

corak carta

Corak carta, terutamanya corak candlestick, adalah imej visual yang menunjukkan pergerakan harga. Ini boleh menandakan trend dan tingkah laku pasaran masa depan untuk memaklumkan keputusan. Walaupun ia memerlukan masa, belajar mengenali corak carta kutipan Forex penting adalah penting. Sesetengah yang biasa termasuk puncak dan bahagian bawah, kepala dan bahu, dan segitiga.

bergerak purata

Selain itu, purata bergerak adalah penunjuk utama lain dalam mengenal pasti trend dalam sebut harga perdagangan . Ini digunakan dalam analisis teknikal dan menunjukkan kemungkinan rintangan dan tahap sokongan.

petunjuk volatiliti

memberi tumpuan kepada penunjuk volatiliti adalah strategi utama untuk mencari turun naik harga yang berpotensi dalam kadar forex hidup . Ini memberi tumpuan kepada keadaan pasaran dan boleh digunakan untuk membuat keputusan yang cepat untuk menyesuaikan strategi perdagangan. Sebagai contoh, tempoh turun naik yang tinggi sering membawa lebih banyak peluang tetapi mereka juga mencipta risiko yang lebih tinggi.

purata julat sebenar (ATR)

Akhirnya, ATR, atau purata jarak sebenar, adalah satu lagi penunjuk volatiliti kritikal. Ini mengukur turun naik pasaran dalam tempoh berdasarkan julat harga purata. Ia adalah alat yang baik untuk menetapkan tahap berhenti, dan mengenal pasti saiz kedudukan.

Kesan peristiwa global pada petikan forex

Dunia tidak dapat diramalkan dan sering kacau. Banyak peristiwa boleh membentuk Forex Quotes segera dan dari masa ke masa. Perubahan dasar ekonomi adalah satu aspek utama, tetapi konflik dan ketegangan serantau juga boleh memberi impak yang besar. Peristiwa sedemikian menyebabkan perubahan besar dalam nilai mata wang dan ini boleh berlaku dengan cepat.

Adalah penting untuk memahami hubungan antara Forex Live kadar dan acara global untuk membantu menguruskan risiko dan membuat keputusan yang cepat dan berkesan. Di samping itu, tetap terkini dengan acara-acara di seluruh dunia adalah kunci.

dasar bank pusat

Salah satu aspek yang mempunyai kesan yang besar terhadap petikan forex hidup adalah dasar bank pusat. Contohnya, perubahan kadar faedah, panduan ke hadapan, dan program pelonggaran kuantitatif semuanya berkaitan di sini. Peristiwa sedemikian boleh menyebabkan perubahan pesat dan besar dalam nilai mata wang.

dinamik perdagangan global

Apabila hubungan perdagangan antarabangsa beralih dan berubah, sangat penting untuk memahami dinamik utama mereka. Ini secara drastik boleh menjejaskan nilai mata wang yang berkaitan dan Forex Quotes dari masa ke masa. Perkara -perkara seperti sekatan ekonomi, tarif, dan perjanjian perdagangan semuanya memainkan peranan dalam bagaimana pasaran forex berfungsi.

Atas sebab ini, terus mengikuti berita antarabangsa, terutamanya apa -apa maklumat yang berkaitan dengan perdagangan, dan membuat keputusan yang teliti berdasarkan sewajarnya.

Teknologi Muncul yang Mempengaruhi Petikan Forex

Ia bukan sahaja berita dan peristiwa yang mempengaruhi seluruh dunia forex tetapi juga teknologi baru. Saya telah menyebut sebelum ini bahawa teknologi beralih dan berubah dengan sangat cepat, dan terdapat banyak perkembangan baru di cakrawala yang secara drastik boleh mempengaruhi bagaimana live forex petikan muncul.

Ini terutamanya termasuk bagaimana petikan dibuat, diedarkan, dan bagaimana mereka boleh dianalisis untuk tujuan membuat keputusan. Banyak peluang baru mungkin muncul dari perkembangan ini, tetapi beberapa cabaran juga.

kecerdasan buatan dalam analisis kutipan

Penggunaan kecerdasan buatan (AI) semakin meningkat setiap tahun. Algoritma AI digunakan secara meluas di seluruh dunia forex dan ini menjadi lebih canggih apabila masa berlalu. Mereka kini boleh meramalkan pergerakan petikan Forex dengan tepat, menganalisis sejumlah besar data sejarah dan masa nyata, dan mengenal pasti corak. Semua ini dilakukan pada kelajuan dan tahap terperinci yang mustahil untuk mata manusia.

Tinggal terkini dengan penggunaan AI, GPT Chat, dan Forex Trading akan memastikan peluang yang berpotensi menguntungkan tidak tersesat.

blockchain dalam perdagangan forex

Satu lagi bentuk teknologi yang biasa digunakan di dunia forex adalah blockchain. Ini mungkin menjadi lebih biasa dari masa ke masa. Ia kini digunakan untuk membuat petikan forex telus dan selamat. Dari masa ke masa, ini boleh menyebabkan risiko yang dikurangkan, penempatan lebih cepat, dan laluan audit yang lebih tepat.

kesan kewangan desentralisasi (DEFI)

Akhirnya, platform kewangan yang terdesentralisasi, yang dikenali sebagai defi, adalah alat yang berguna. Sistem ini membolehkan perdagangan menggunakan forex tanpa perantara, oleh itu berpotensi memberi akses kepada yuran yang lebih rendah dan kebolehcapaian yang lebih baik. Dari masa ke masa, kesan sistem defi akan menjadi lebih jelas.

rekap pembelajaran

Memahami Kadar forex hidup sangat penting untuk semua peniaga, sama ada pemula atau maju. Dalam panduan ini, saya telah meliputi banyak tanah, termasuk struktur asas Forex Quotes kepada bagaimana ia digunakan. Pada ketika ini, anda harus mempunyai pemahaman yang jelas dan bernuansa tentang kegunaan dan kepentingan mereka. Akhirnya, belajar mentafsirkan petikan langsung di forex mewujudkan strategi perdagangan yang lebih kuat dan lebih berkesan.

Untuk merakam, petikan forex adalah gam yang memegang perdagangan mata wang bersama -sama, dan mewakili kadar pertukaran antara dua mata wang yang boleh diperdagangkan. Petikan ini terdiri daripada asas dan mata wang mata wang, dan tawaran dan harga bertanya. Di samping itu, pemahaman faktor -faktor yang boleh mempengaruhi Forex Live kadar mewujudkan peluang perdagangan yang berpotensi menguntungkan.

Pada akhirnya, melakukan pembelajaran dan pembangunan yang berterusan adalah penting untuk perjalanan forex yang berjaya. Di TopBrokers , kami mempunyai pelbagai sumber pendidikan untuk membantu anda melakukannya. Sumber kami di Psikologi Perdagangan Forex memberikan beberapa pandangan yang menarik, dan akan membantu anda masalah umum. Kami juga mempunyai banyak sumber mengenai strategi, seperti sistem perdagangan semafor , dan artikel penyelesaian masalah, seperti bagaimana untuk mengadu terhadap broker

Mengetahui cara mentafsirkan dan menggunakan petikan forex hanyalah satu bahagian teka -teki. Dengan kemas kini yang kerap dan membuat keputusan yang teliti, anda boleh menantikan pengalaman perdagangan yang lebih menyeronokkan dan lancar.

RoboForex

RoboForex Exness

Exness FxPro

FxPro Alfa-Forex

Alfa-Forex Libertex

Libertex FxGlory

FxGlory XM

XM Pasaran IC

Pasaran IC