The world of cryptocurrencies is amid a second coming, with Bitcoin leading the charge. As we move further into 2023, investors and analysts alike are eyeing the next big event on the horizon – the halving (anticipated to take place in either April or May of 2024). This technical phenomenon has historically marked a sustained climb in Bitcoin's value, and all signs point to a similarly bullish outcome this time around.

At the time of writing, Bitcoin is trading shy above the $30,000 big psychological level, up an impressive 80% since the beginning of the year.

But the cryptocurrency's rise above this critical threshold may be just the beginning, as many believe that the cyclical "bottom" for Bitcoin is forming in anticipation of the halving, marking the resurrection of the crypto craze 2.0.

With economic uncertainty looming and numerous bank failures, it is evident that Bitcoin has regained its relevance once again.

So why exactly are analysts so bullish about the cryptocurrency's future prospects? We'll take a closer look at the factors driving Bitcoin's bullish sentiment and what role the 4-year halving cycle plays below.

What is Bitcoin halving?

Imagine a bakery that sells its delicious cakes for $10 each. However, the bakery has a secret rule that every time it sells 100 cakes, it will reduce the price to $5 for the next 100 cakes.

This is called the "halving" event in the bakery's pricing strategy.

Now, imagine that you're a savvy cake investor, and you know that the bakery is approaching its next halving event. You start to anticipate that demand for cakes will increase as people try to take advantage of the lower price. As a result, you start buying up as many cakes as you can before the price drops.

This causes the price of cakes to rise just like the price of Bitcoin is rising in anticipation of its halving event. When the halving event finally happens, the price of cakes drops to $5, and everyone rushes to buy them. This causes the price of cakes to rise again, and the cycle begins anew.

Similarly, the halving event for Bitcoin reduces the reward for miners, who are the people who maintain the Bitcoin network. This reduces the supply of new Bitcoins being created, which increases demand for existing Bitcoins, causing their price to rise.

This cycle is expected to repeat every four years or so, leading to a prolonged climb in Bitcoin's value, just like the cyclical rise and fall in the price of cakes in our bakery analogy.

Bitcoin Halving History: The Mysterious Event That Baffles Even The Smartest Crypto Gurus

Bitcoin halving events have always been a mystery that has captivated the attention of both crypto enthusiasts and skeptics alike. These events happen every four years or after another 210,000 blocks are added to the blockchain. And as the next halving event approaches in 2024, experts are already scrambling to predict the impact it will have on Bitcoin's value.

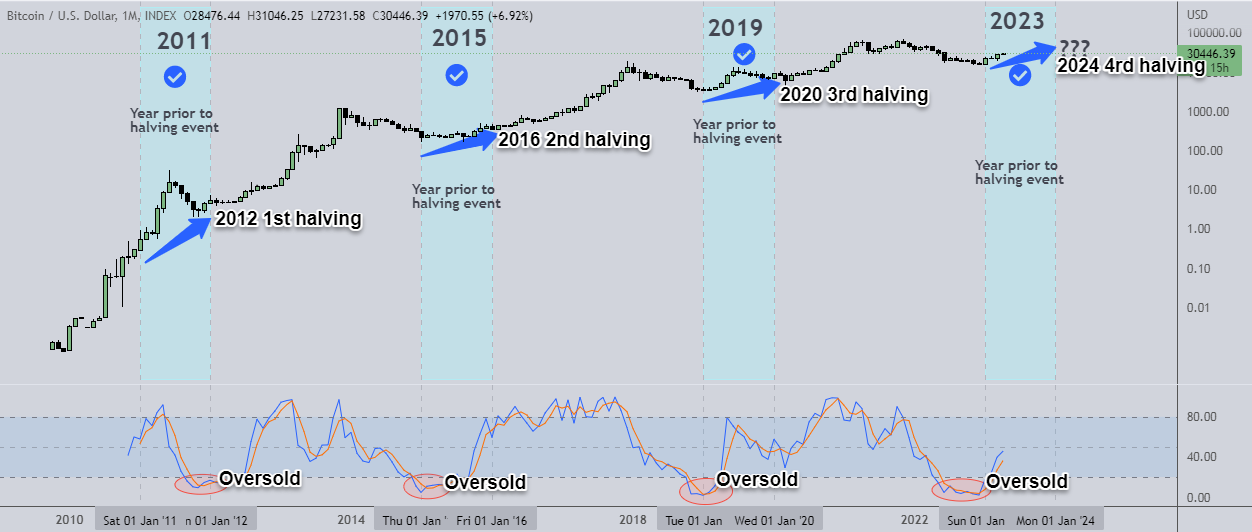

But what's truly mind-bending is the peculiar pattern observed in the years leading up to the halving events. The price of Bitcoin has consistently finished higher than it started in the years before 2012, 2016, and 2020 halving events.

And if that's not enough to make your head spin, check out the monthly stochastic indicator, which has been in an oversold condition leading up to every halving event. This indicator is often used as a bullish reversal signal, which could mean that the market is primed for a sudden turnaround.

These historical patterns and trends have puzzled even the smartest crypto gurus, leaving many questions unanswered.

Will the upcoming halving event follow the same pattern, or will it break the trend?

Only time will tell.

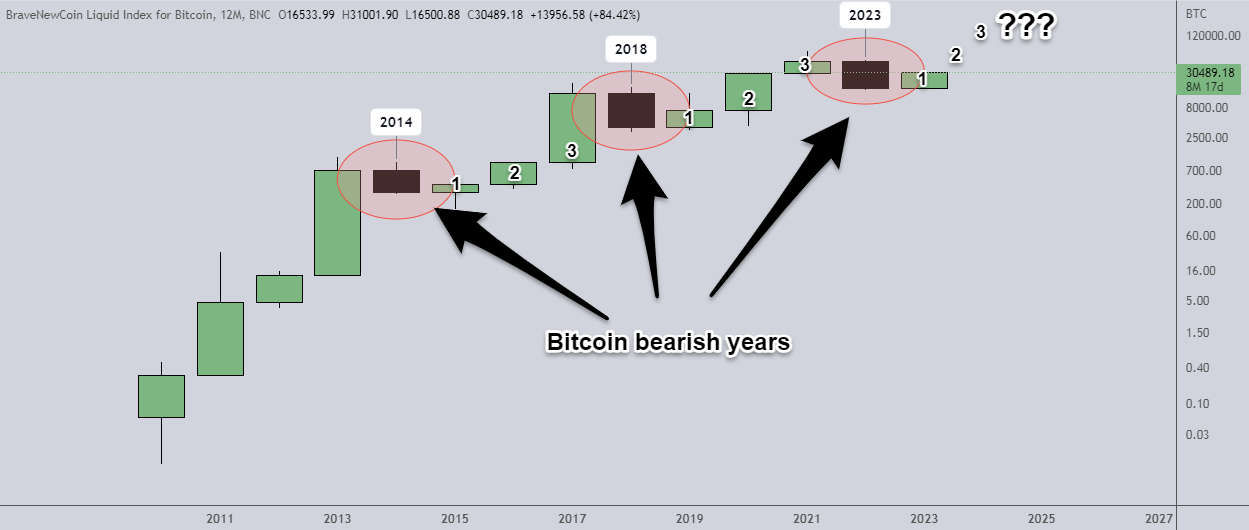

However, based on historical trends, it is possible that 2023 could be a bullish year because Bitcoin has never had back-to-back negative years in its entire history.

Since its inception, only three bearish years have been recorded for BTC, which were in 2014, 2018, and 2022. However, what's remarkable is that each of these bearish years was followed by three consecutive bullish years. This demonstrates the power of the 4-year halving cycle, which has been at play in Bitcoin's market trends.

Post-Halving Bitcoin: A Wild Ride to the Moon and Beyond

It's no secret that after the halving event, Bitcoin tends to skyrocket. Remember the last BTC halving event that took place in 2020?

Bitcoin rallied a whopping 688.31% reaching a record high of $67,549.14 on Nov. 8, 2021.

And during the previous halving in 2016, Bitcoin gained 2,824% to an all-time high of $19,065 by mid-December 2017.

Impressive, right?

Bitcoin's value also increased by over 26,000% following the first halving event in 2012.

While 2022 was a tough one for Bitcoin, marked by the downfall of major companies and projects, from stablecoin terraUSD to crypto exchange FTX, Bitcoin brushed off the FUD in 2023 and is now on track to confirm the 4-year halving cycle.

From Fossil Fuels to Renewable Energy: How Bitcoin's Transition to Green Mining Could Influence its Price

Critics love to argue that Bitcoin mining is a big, bad polluter. They say it's all fossil fuels and greenhouse gases. However, recent reports suggest that Bitcoin's energy consumption may not be as harmful as previously thought – 50% of the Bitcoin network is powered by zero-emission energy, thanks to its heavy reliance on off-grid power sources.

What's more, there are at least 29 mining companies that use 90%-100% zero-emission energy, with another 12 using emission-negative sources. By comparison, only 36.7% of the main electrical grid in the U.S. comes from zero-emission sources.

The Bitcoin network is also far more energy efficient than legacy financial systems. Less than 0.2% of global energy usage and only 0.09% of the world's carbon dioxide (CO2) emissions is produced by Bitcoin mining.

Environmentally conscious investors may view Bitcoin's green mining practices as a sign of responsible and sustainable investment.

Looking to invest in Bitcoin?

Don't settle for just any forex broker – choose one that offers reliable and secure Bitcoin trading. Visit our "Best Forex Brokers in 2023" page to find out which brokers not only meet your forex trading needs but also offer the opportunity to invest in the ever-growing world of Bitcoin.