Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 74-77% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Forex.com review

Overview

Our 5-step process of verification and evaluation – How do we obtain information?

General inspection – 30%

Trading experience – 30%

Technical audit – 20%

Collective experience from collaborations with the broker – 10%

Interviews with real traders – 10%

See the entire process here.

Pros

-

Top-Tier Regulation

-

Low Forex Fees

-

No Withdrawal Fees

-

Diverse Research Tools

Cons

-

High Stock CFD Fees

-

Limited Product Portfolio

-

User Interface Could Be More Intuitive

General details

Customer reviews

score

Read real reviews from traders all over the world:

Share Your Experience

Help others by sharing your review

Accounts

Type of Trading Accounts on Forex.com

Forex.com broker offers four trading account types: Standard, MT4, Commission, and STP Pro. They also offer a corporate account for trading companies.

Standard Account

The standard account is perfect for traditional traders. It offers competitive Forex.com spreads (starting from 1.0) and no extra commissions. You can use the standard account via the Forex.com platform. It offers advanced charting tools and up to 15% cash rebates.

MT4 Account

The MT4 account is a version of the standard account designed for those who want to trade via the MT4 platform. Unlike the regular standard account, the MetaTrader account offers cash rebates of up to $10 per million traded, fully integrated Reuter news and technical analysis tools.

Commission Account

The commission account offers increased flexibility in terms of commissions. It has low spreads (starting at 0.2) and a $5 commission per 100k traded. The reduced spreads and commissions are what differentiate it from the standard account. However, you can only use the Commission account via the Forex.com trading platform.

STP Pro Account

This account is designed for experienced traders who want to trade large volumes regularly. It offers a tiered commission structure. The minimum trade size is 100,000 (one standard lot), and the platform recommends having at least $25,000 in your trading wallet. The key benefits include interest on your average daily available margin balance and one-on-one support, priority service, waived bank fees, and access to deep F.X. liquidity pools. This account is only available on the Forex.com trading platform.

Corporate Account

The Corporate account is a feature for businesses to manage multiple traders within a single account. It is ideal for clients that want to trade under a corporate identity. Clients can fund the account via a company account, make trades using a business name and grant multiple traders simultaneous access to the account.

Tradable instruments

Tradable instruments on FOREX.com trading platforms include:

Frequently asked questions

Find the right answer to your question below.

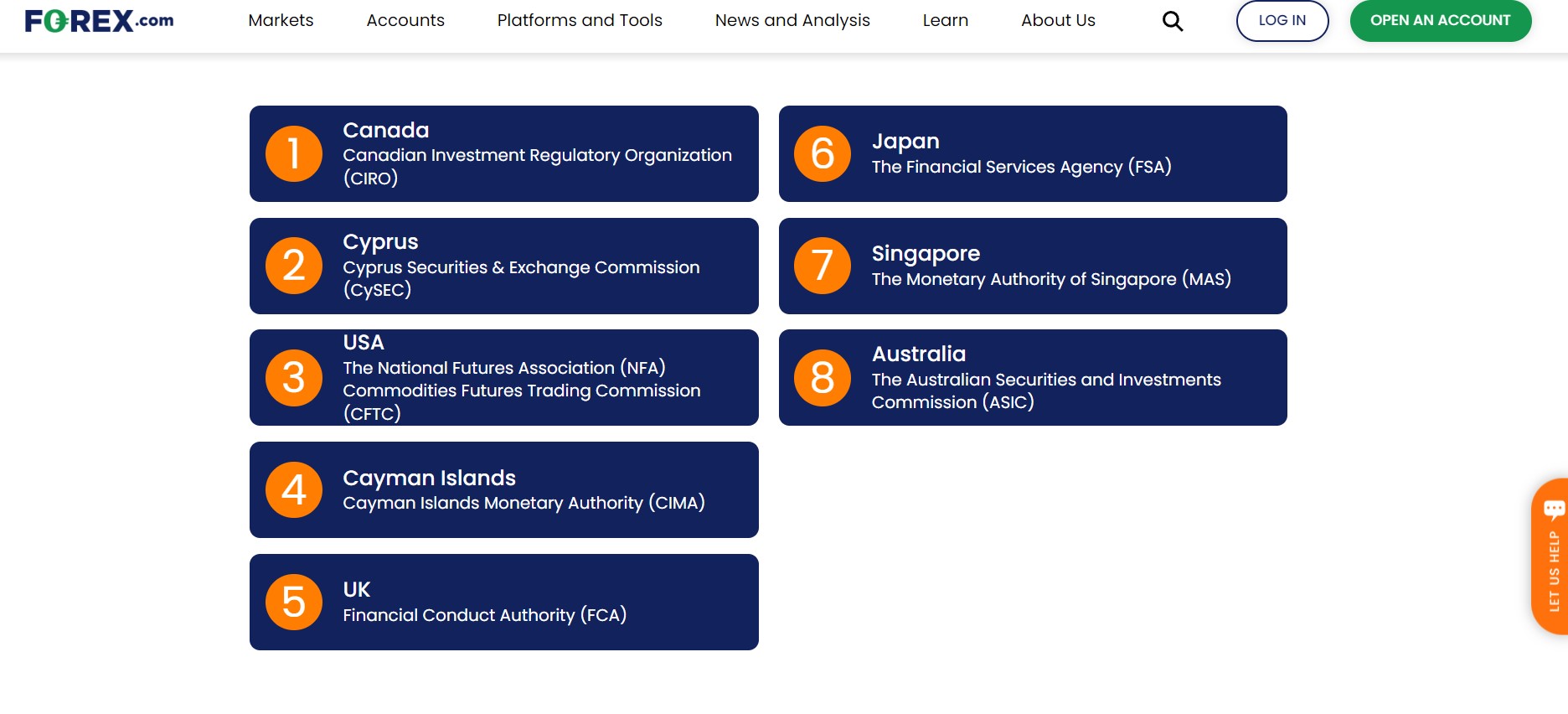

From a security standpoint, Forex.com is one of the safest online forex brokers there is. Top-tier authorities regulate them around the globe and offer their clients robust security and protection. However, that doesn’t mean it’s impossible to lose money with Forex.com. Trading forex can be risky, and even more so with CFDs. Always do your due diligence in understanding the market and never be willing to risk more than you can afford to lose.

Forex.com offers a range of trading platforms for diverse trading needs. These include MetaTrader 4 and MetaTrader 5, which are widely popular and well-respected. Additionally, Forex.com offers its own proprietary platform, which might not be as robust as MetaTrader, but it is user-friendly. Fans of mobile trading will also appreciate Forex.com’s mobile app with full trading and account management capabilities.

Compared to similar online forex brokers, Forex.com fees are considered low except for CFD stock fees. Clients can choose between spread only and RAW pricing accounts. This provides the flexibility to choose between zero commission/higher spreads or commissioned trades with lower spreads. On the RAW pricing account, spreads are as low as 0.0 pips. Spread-only pricing starts at 1.2 pips. Either way, the spreads are tight. Other fees are minimal with Forex.com. With few exceptions, there are no deposit or withdrawal fees. An inactivity fee may be charged, but only after a full year on an inactive account.

Forex.com offers customer support 24/5 customer support from Sunday 10AM to Friday 5PM. Help is available via chat, phone, and email. In the past, Forex.com customer support reviews were mixed, with many customers reporting less than positive outcomes. Today, it seems the broker has addressed many of those issues, with more positive experiences being reported.

Forex.com is suitable for all levels of traders, including beginners. To help new traders along, they offer valuable educational resources covering many trading topics. Articles, webinars, and tutorials provide information in an easy-to-understand format. Forex.com also offers a demo account, which is a good introduction to forex trading for beginners. However, Forex.com isn’t the most user-friendly platform we’ve seen, and there is a bit of a learning curve. This could cause some frustrations for new traders. They also don’t provide a social trading option. Social trading is a really good way for new traders to learn from experts while trading with confidence.

This is an independent review and has not been influenced by the broker. FOREX.com has only provided general information about its services and offerings to ensure factual accuracy. All opinions expressed in this review are solely those of the reviewer.

Forex.com compared with alternative brokers

To see the full broker review click “See review”, to see the complete table and compare more brokers visit our Comparison page.

- Overall verdict

- Trading

- Minimum deposit

- Maximum leverage

- Fees

- Withdrawal fee

- Deposit fee

- Safety

- Top-tier regulators

- Investor protection

-

Specialized trading accounts

-

24/7 instant money withdrawal

-

4.6/ 5

-

4.2/ 5

- $100

- 1:50

-

4.7/ 5

- $0

- $0

-

5/ 5

- FCA, CFTC, NFA, CIRO, CIMA, CySEC

-

See review

-

24/7 instant money withdrawal

-

Specialized trading accounts

-

Free VPS hosting

-

High leverage

-

4.7/ 5

-

4.7/ 5

- $100

- 1:10000

-

4.7/ 5

- $0

- $0

-

4.7/ 5

- FCA

-

See review

-

24/7 instant money withdrawal

-

Specialized trading accounts

-

4.8/ 5

-

4.8/ 5

- $1

- 1:3000

-

5/ 5

- $0

- $0

-

4.8/ 5

- No

-

No

No

-

See review

-

4.4/ 5

-

4.4/ 5

- N/A

- N/A

-

4.6/ 5

- N/A

- N/A

-

4/ 5

- No

-

No

No

-

See review

-

4.3/ 5

-

4.4/ 5

- N/A

- N/A

-

4.4/ 5

- N/A

- N/A

-

4.7/ 5

- ASIC, FSC, CYSEC, SIBA

-

See review

RoboForex

RoboForex Exness

Exness FxPro

FxPro Alfa-Forex

Alfa-Forex Libertex

Libertex FxGlory

FxGlory XM

XM IC Markets

IC Markets Forex.com

Forex.com AXITrader

AXITrader