Gap trading is a common trading strategy that has been widely used in the stock markets. Because of the after-hours and pre-market trading sessions, gaps were a common phenomenon in the stock markets, but not so much with forex.

Since the past few years, however, gaps especially over the weekends have become a common occurrence in the forex markets as well. This is likely to do with the fact that the currency markets these days tend to follow political developments as well as economic developments.

These factors have become a contributing factor to the increased frequency of gaps seen in the forex markets over the weekends.

A gap goes by many different names including trading gaps or area gaps.

When it comes to gap trading methodologies, there are many different approaches. The most common is based upon the premise that 'gaps are meant to be filled.' Gap trading can be used both within the long-term trading strategy as well as for short-term scalping or day trading as well.

The Monday gap trading is something that is widely talked about in the forex markets. It is also one of the simplest ways to trade the currency markets.

What causes gaps in prices?

Gaps in prices are formed when there is a lack of liquidity in the markets. A gap is formed when the current day’s opening price is significantly different (can be higher or lower) from the previous day’s closing price.

A gap is often said to be an important level as it indicates that something significant has occurred in the markets. In the context of the stock markets, the price gaps are formed on earnings release or ex-dividend dates.

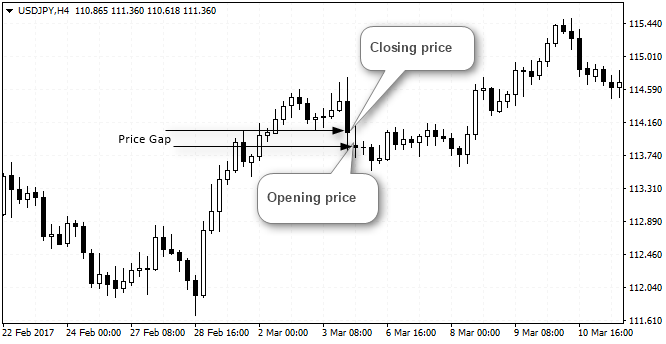

The chart below gives an example of a gap in the USDJPY markets. You can see in Figure 1 that the closing price on Friday was 114.038 and Monday’s opening price was 113.870. The price difference of 16.8 pips is the gap that was formed in prices.

Fig 1: Price Gap in USDJPY (Weekend Gap on H4 chart time frame)

Gaps are formed because of illiquid market conditions, meaning that when there are no buy or sell orders at the nearest price. Thus, price gaps to the best available price. Going back to the above example, the best price was available at Monday’s opening price of 113.870 which is where the price eventually opened the week at.

Types of gaps

Gaps are classified into three types:

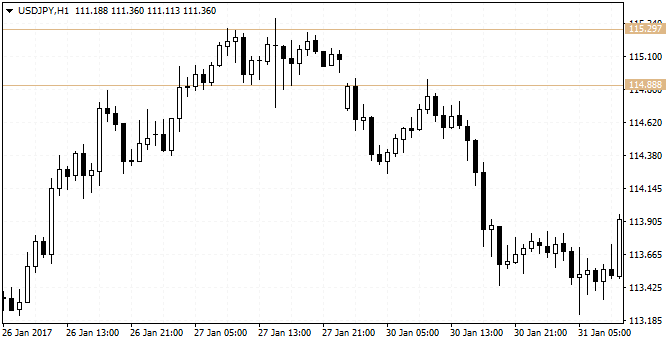

A breakaway gap is said to begin at the start of a new trend (it can be a downtrend or an uptrend) and as the name suggests it occurs when the price is trading within a range for a prolonged period. The breakaway gap signals the new trend depending on which way price gaps out.

Fig 2: Breakaway gap example

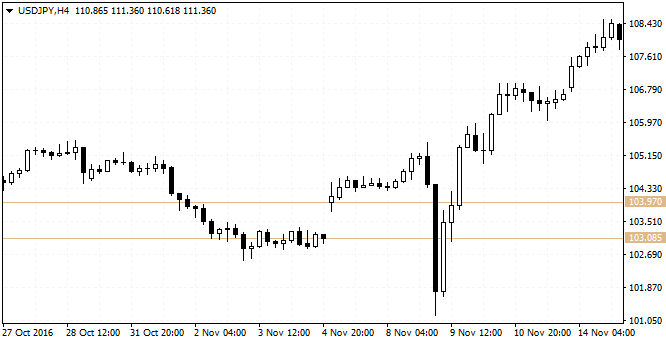

Runaway gaps are formed within the trend and are ideal in terms of trading with measured moves. The runaway gap comes amid increased interest in the asset and traders need to first ascertain the prevailing trend before trading the runaway gap. It is often said that price will move the same distance as the gap that was formed at the very minimum.

Fig 3: Runaway gap example

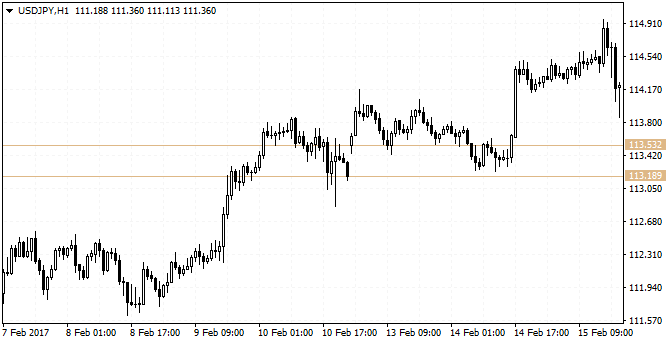

Common gaps as the name suggests are the most common type of gaps that are formed. The common gaps occur frequently and the Friday-Monday gaps are often known as the common gaps at least as far as the stock markets are concerned.

Fig 4: Common gap example

From a forex perspective, depending on where the gap occurred in the trend or the price action, the appropriate type of gap can be assigned.

Why trade Monday gaps?

The gaps that are formed on Mondays in the forex markets are one of the easiest ways to day trade the currency markets in the short term. Gaps formed on JPY currency pairs exhibit higher volatility and make for a better choice of currency pairs to trade.

Although gaps are meant to be filled, this is not always the case and at times price can take months, if not years for the unfilled gap to be filled eventually.

For traders who want a reasonably sound trading strategy, a gap-based trading approach can be easily understood and simple to trade as well.

Written by AllFXBrokers.com

SpainUS

SpainUS