Risk Warning: Your capital is at risk. Statistically, only 11-25% of traders gain profit when trading Forex and CFDs. The remaining 74-89% of customers lose their investment. Invest in capital that is willing to expose such risks.

FxPro review

Overview

Our 5-step process of verification and evaluation – How do we obtain information?

General inspection – 30%

Trading experience – 30%

Technical audit – 20%

Collective experience from collaborations with the broker – 10%

Interviews with real traders – 10%

See the entire process here.

Pros

Regulated by Multiple Tier-1 Authorities

Competitive Trading Conditions

Wide Range of Trading Platforms

A Range of Tradable Instruments Available

Excellent Customer Support

Cons

Higher Commissions on Certain Platforms

Limited Educational Resources Compared to Other Brokers

Not Available Worldwide

General details

Customer reviews

score

Read real reviews from traders all over the world:

Accounts

TYPE OF TRADING ACCOUNTS ON FXPRO

Fx Pro Broker offers four trading account types: Standard, Pro, Raw+, and Elite.

Standard Account

The initial FxPro minimum deposit for this account is $100, and it offers up to 1:500 leverage. The charges for trading with this account come from an all-inclusive spread. If you are trading EURUSD, GBPUSD, or USDJPY, expect the spread to be 1.2 pips and above, while the average spread is 1.5. This account has no rebates; the minimum trade size is 0.01 lots. A swap-free option is available for Islamic investors.

Pro Account

The initial FxPro minimum deposit for the pro account is $1000, offering up to 1:500 leverage. The charges for trading with this account come from an all-inclusive spread. If you are trading EURUSD, GBPUSD, and USDJPY, the spread starts from 0.6, and the average spread is 1 pip. This account has no rebates; the minimum trade size is 0.01 lots. A swap-free option is available for Islamic investors.

Raw+

The FxPro minimum deposit requirement is $1000, and traders get up to 1:500 leverage. There is a 3.5$ fee, but the broker offers spreads starting from 0 pips. The average spread is 0.2 pips. There are no rebates, but your lot size has to start from 0.10. A swap-free option is available for traders on religious grounds.

Elite

The Elite Fx Trading Pro account has the highest deposit requirement ($30k in 2 months) and offers the same leverage, charges, and spreads as the Raw + account. Rebates for this account start from $1.5 per lot, and the minimum trade size is 0.10. A swap-free option is available for Islamic accounts.

Tradable instruments

Tradable instruments on FxPro trading platforms include:

- Energy

Frequently asked questions

Find the right answer to your question below.

FxPro is a well-regulated broker that enjoys robust oversight from several tier-1 authorities. These include the Financial Conduct Authority (FCA) in the UK, and the Cyprus Securities and Exchange Commission (CySEC). Additionally, it is regulated by the Securities Commission of the Bahamas (SCB). This high regulation gives extra peace of mind that your money is secure and the broker adheres to strict practices.

Before choosing any broker, checking regulation should be the first item on your list. Doing so protects you from unnecessary losses. It’s also important to remember that FxPro doesn’t cater for US clients

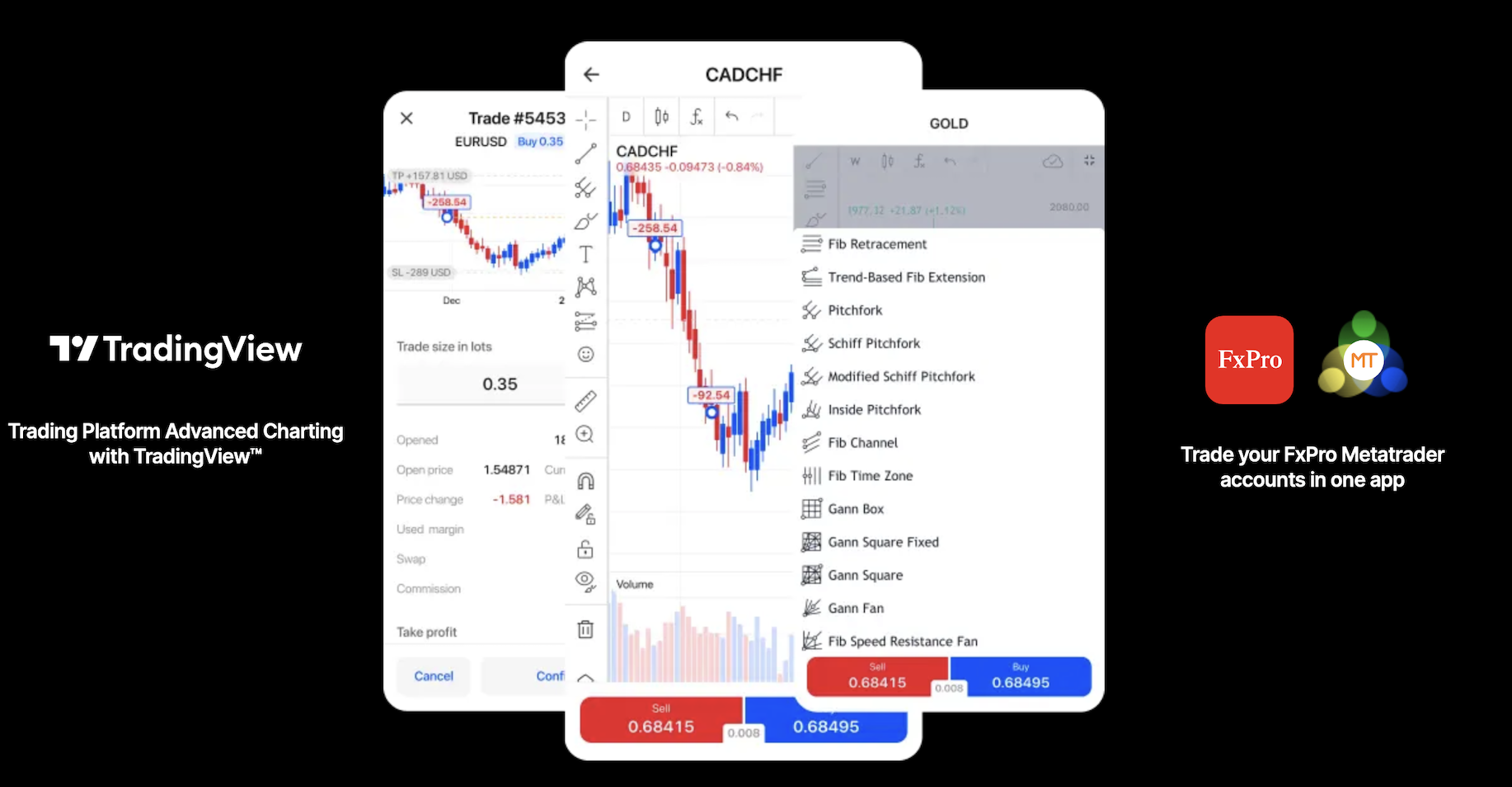

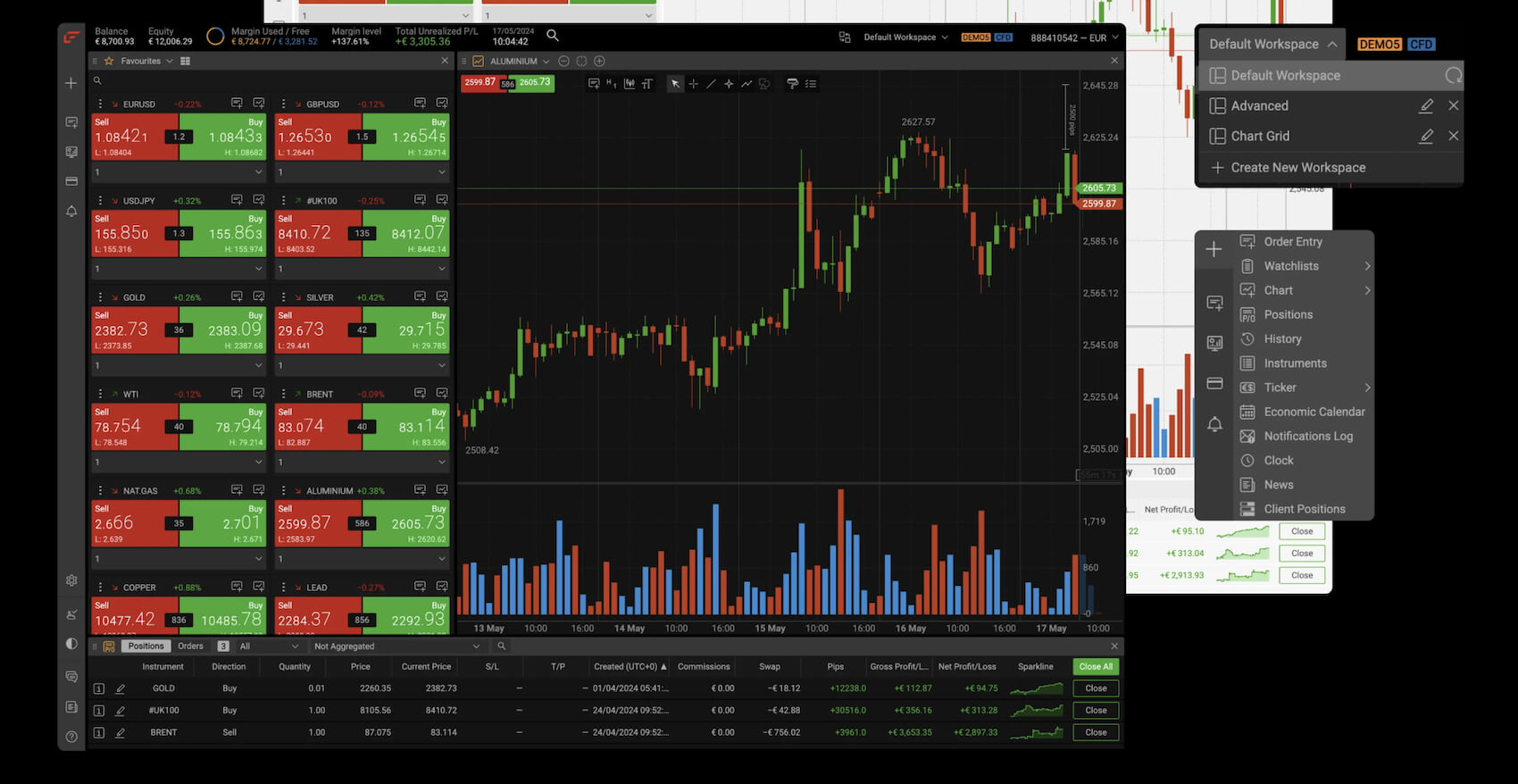

One of FxPro’s major features is its range of trading platforms. This offers a diverse experience for all levels of traders, irrelevant of experience level. FxPro offers the industry-standard MetaTrader 4 & 5, as well as a proprietary platform, FxPro Edge. Traders can also use cTrader and a mobile app, available on both Android and iOS.

Each platform has a range of unique tools and features. This allows you to choose the platform that best suits your aims, style, and needs. Therefore, it’s vital to spend some time exploring each one before making a decision.

FxPro offers several account types to cater for various needs. The Standard Account is a good choice for beginners, with a low minimum deposit amount. However, more experienced traders will benefit from the Pro, Raw Plus and Elite accounts. These have more favorable conditions and higher leverage. However, the minimum deposit amount is also higher, at $1000.

The same advice for choosing a broker and platform applies here. Spend some time exploring different accounts and choose the best one for your needs.

One of the most commonly praised aspects of FxPro’s service is its customer support. With strong guidance and advice given by representatives, you can be sure that any problems will be resolved quickly.

You can reach a customer service agent via live chat, email, or telephone, with lines open 24/5. With a strong commitment to customer satisfaction, many users and industry experts highlight this feature in particular.

FxPro undoubtedly has many strengths and it is a very popular broker. However, there are some potential drawbacks to be aware of before making a decision. Within this FxPro broker review have mentioned that some platforms, particularly cTrader, charge higher commissions. This is also higher than the industry average. For that reason, it’s important to choose your trading platform carefully, to avoid unnecessary financial costs.

Depending on the type of account you choose, minimum deposit amounts are also high. This is particularly the case with the Pro, Raw Plus, and Elite accounts, with $2000 required.

Some users also point out that FxPro doesn’t offer as many educational resources as some other similar brokers. While this broker covers the basics, such as how to read forex charts, it doesn’t delve into trading strategies. This could be useful while learning and for more experienced traders who want to diversify their skills.

FxPro compared with alternative brokers

To see the full broker review click “See review”, to see the complete table and compare more brokers visit our Comparison page.

- Overall verdict

- Trading

- Minimum deposit

- Maximum leverage

- Fees

- Withdrawal fee

- Deposit fee

- Safety

- Top-tier regulators

- Investor protection

-

24/7 instant money withdrawal

-

Specialized trading accounts

-

Free VPS hosting

-

High leverage

-

4.8/ 5

-

4.9/ 5

- $100

- 1:10000

-

4.7/ 5

- $0

- $0

-

4.8/ 5

- FCA

-

See review

-

Free VPS hosting

-

24/7 instant money withdrawal

-

Specialized trading accounts

-

4.9/ 5

-

5/ 5

- $10

- 1:2000

-

4.8/ 5

- 1%

- $0

-

4.9/ 5

- No

-

See review

-

Specialized trading accounts

-

24/7 instant money withdrawal

-

Free VPS hosting

-

4.9/ 5

-

4.9/ 5

- $10

- 1:2000

-

4.8/ 5

- $0

- $0

-

4.6/ 5

- FCA, CYSEC

-

No

No

-

See review

-

Specialized trading accounts

-

Free VPS hosting

-

24/7 instant money withdrawal

-

4.5/ 5

-

4.5/ 5

- $5

- 1:1000

-

4.5/ 5

- $0

- $0

-

4.5/ 5

- No

-

No

No

-

See review

-

Specialized trading accounts

-

Free VPS hosting

-

24/7 instant money withdrawal

-

4.5/ 5

-

4.6/ 5

- $5

- 1:888

-

4.3/ 5

- $0

- $0

-

4.7/ 5

- ASIC, FSC, CYSEC

-

See review

United KingdomGB

United KingdomGB

United StatesUS

United StatesUS