Forex trading is not just about numbers, charts, and technical analysis. Successful traders understand that there is a human element involved in trading and that perceptions and emotions play a crucial role when it comes to taking trades.

One aspect of this is the concept of forex psychological levels.

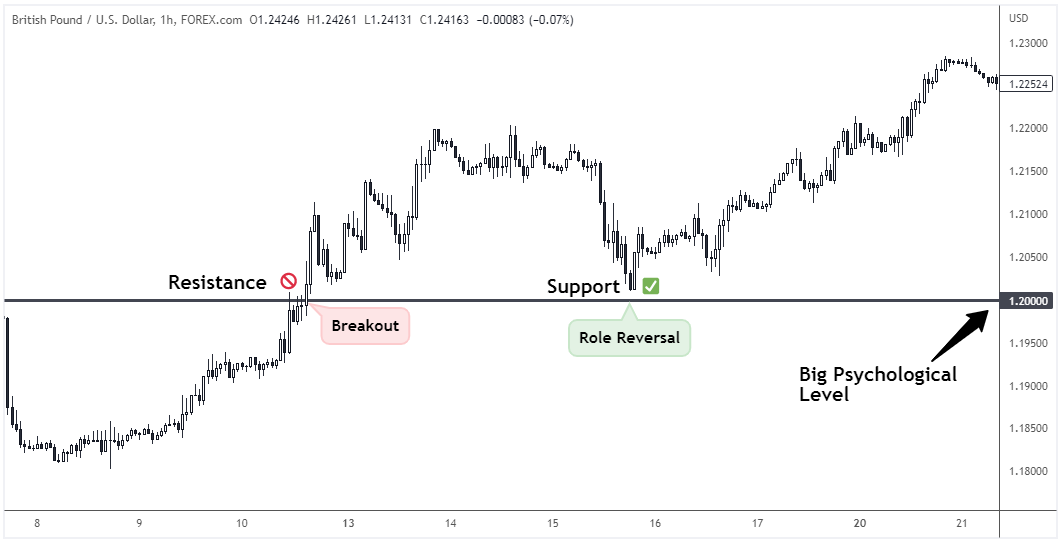

Psychological levels refer to price levels that traders and investors perceive as significant, often because they represent key round numbers or other levels that have historical significance.

Imagine you are a forex trader who is considering a long position on the EUR/USD currency pair. You notice that the EUR/USD has been trending upward for several days and is now approaching a key psychological level of 1.2000 – a level that has previously acted as both support and resistance and represents a significant round number.

Should you enter a long position now, or wait for a potential breakout above it?

Well, the answer lies in understanding the power of perception in forex trading.

Psychological levels in forex can influence a trader's perception of the market and impact their decision-making process. Traders may perceive these levels as significant based on previous price action and their trading strategy, and that perception may influence their decision to enter a long position or wait for a breakout above this level.

In this article, we'll take a deep dive into the world of forex psychological levels. What are they, why do they matter, and how can traders use them to their advantage?

What are Psychological levels in Forex

Psychological levels in the forex market are pivotal price levels that can have a significant impact on the direction and momentum of a currency pair.

These levels are denoted by round numbers, such as 1.1000 or 1.5000, or whole numbers, such as 135.10 or 1.1060, and can act as either support or resistance levels.

But why do these levels matter so much to traders and investors?

Well, it boils down to human psychology. As creatures of habit, we tend to prefer simplicity, and that means placing greater value on whole numbers. Many traders rely on these big round numbers as crucial points for determining when to enter or exit a trade, or where to set stop-loss orders.

These numbers, often referred to as support and resistance levels, can have a significant impact on the market as a large number of traders react to them simultaneously, resulting in shifts in price movements.

When a psychological level is breached, traders may expect a significant acceleration in the new trend's direction, leading to increased buying or selling pressure around that level.

However, the importance of psychological levels isn't just based on perception alone. These levels are viewed as key thresholds that buyers and sellers watch closely, and where a significant amount of trading activity can occur.

Traders may hesitate to cross these levels because they fear that the market will not sustain the momentum or that other traders may not be willing to trade at higher or lower prices. This hesitancy can create a build-up of orders on either side of the level, which can ultimately affect the price action and cause significant movements in the market.

While they can be a powerful tool for traders, they do have their limitations. For example, they can sometimes be overly simplistic and fail to consider other factors that may influence price action, and not all psychological levels are created equal as some may hold more weight than others depending on market conditions.

So keep an eye out for those round numbers and whole numbers on the chart – they may just be the key to your next successful trade.

Looking for the perfect Forex broker to match your trading style? Our team of experts has spent hours gathering and consolidating data to curate a list of the best forex brokers for you to choose from.

How to Identify Psychological Levels Forex

Identifying psychological levels on forex charts can be a useful tool in understanding market sentiment and predicting future price movements. While many factors go into identifying these levels, there are a few key steps traders can follow to increase their accuracy.

The first step is to identify important levels on both the monthly and weekly charts. This can include support and resistance levels, as well as trendlines and channels. Once these levels have been identified, traders should add Fibonacci retracement levels to their charts. This will help them identify potential reversal points and key areas of support and resistance.

Next, traders should look for round numbers on their charts. These are price levels with even numbers, such as 1.1000 on the EUR/USD or 140.00 on the EUR/JPY.

What psychological levels are there in forex other than big round numbers?

Traders should also pay attention to levels that end in "fifty," such as 1.21500 on the EUR/USD or 161.50 on the GBP/JPY. These levels are often referred to as "double-zeros" and can be significant psychological levels.

Once traders have identified these levels, they should look for areas where they overlap, or in other words, there is a confluence of multiple technical factors that align in one place. This can indicate a key area of support or resistance that is likely to hold.

It's worth noting that not all psychological levels will serve as support or resistance, but many warrant the trader's attention. These levels serve as a psychological line that acts as both support and a barrier, and traders should pay close attention to them when making trading decisions.

Also, when a breakout of a big round number occurs that price level can experience what we call in technical terms a role reversal. Role reversals occur when the previous resistance becomes support and vice versa.

In the end, identifying psychological levels on forex charts requires a combination of technical analysis and market knowledge.

– Psychological levels Forex Indicator

With the help of AI, forex traders can now use the chatGPT platform to develop their forex psychological indicators with a few commands.

Follow this guide on chatGPT and forex trading to learn more about how to code your technical indicators.

– Pros and Cons of Forex Psychological Levels

While psychological levels can be an effective tool for traders, there are also some pros and cons that should be taken into account. Despite these limitations, psychological levels can be implemented in all financial markets, including forex, stocks, and commodities.

Final Thoughts

In conclusion, incorporating forex psychological levels in your trading strategy can be a powerful tool in identifying key support and resistance levels on the chart and complement your overall approach to provide a more nuanced view of the market.

If you're ready to start implementing psychological levels in your forex trading strategy, it's important to choose a reliable broker that can provide you with the necessary tools and resources.

Check out our comprehensive comparison page of the best forex brokers in the market to help you choose one that fits your needs.

RoboForex

RoboForex Exness

Exness FxPro

FxPro Alfa-Forex

Alfa-Forex Libertex

Libertex FxGlory

FxGlory XM

XM IC Markets

IC Markets Forex.com

Forex.com AXITrader

AXITrader