Forex trading psychology refers to the study of how a trader's mindset, emotions, and behavior can impact their trading decisions. It is a crucial aspect of successful trading, as it can determine whether a trader can make rational, profitable decisions or succumbs to emotional impulses.

Psychology in forex trading is like the steering wheel of a car, without it, you are likely to end up in a ditch. In the same way, without understanding and mastering the psychological aspect of trading, you are likely going to find yourself not following your plan and that can spell disaster in terms of losses.

With the market more competitive and volatile than ever, mastering this aspect of trading will be key to success.

This guide is like a GPS, it will help you navigate the mental terrain of trading, providing you with the knowledge and strategies you need to stay on course and reach your destination, aka consistent profits.

Understanding the Mental Game of Forex Trading

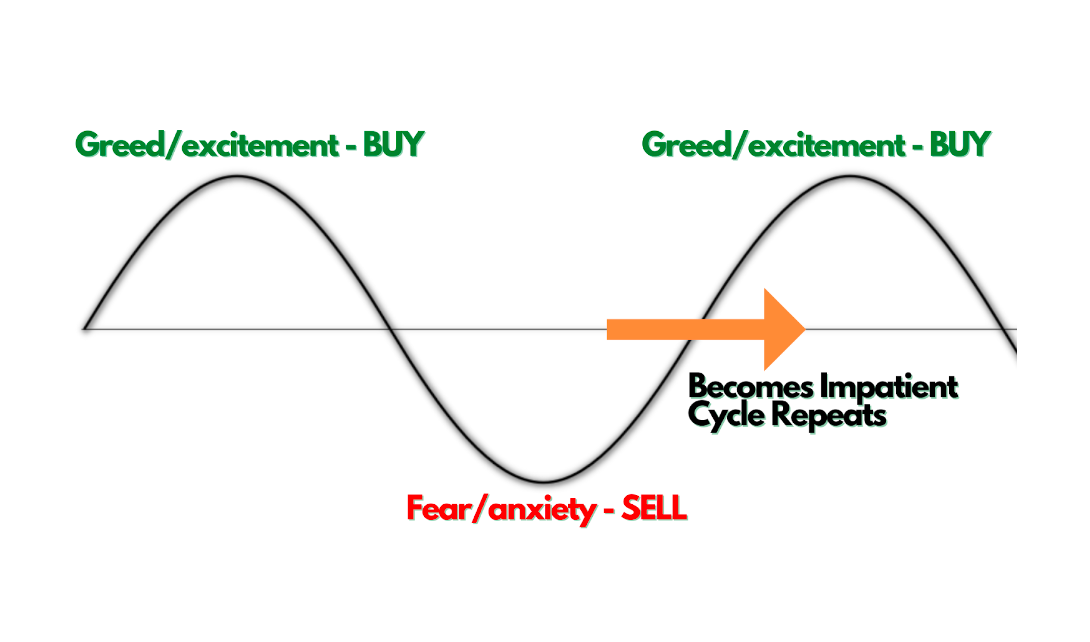

To be successful in forex trading, it's essential to have a clear understanding of the mental game and how to navigate it. The role of emotions in forex trading is significant with fear and greed being the two most common emotions that traders experience.

Fear of losing money can lead to missed opportunities and exit trades prematurely, while greed can lead to overtrading and overleveraging. It's crucial to recognize and manage these emotions effectively. Developing strategies to manage these emotions can help traders make rational decisions and avoid costly mistakes.

The Role of Fear in Forex Trading

One example of this is a trader who enters a trade with a stop loss in place. The market moves in their favor, but they exit the trade prematurely because they fear that the market may turn against them. In this scenario, the trader missed out on potential profits because of fear.

To overcome the challenge of fear, traders can use powerful techniques backed by neuroscience such as:

-

Adjust the way you trade by setting realistic goals, using proper position sizing and risk management techniques, and distinguishing between the trade and the idea behind it. This can help you stay focused on your long-term strategy and avoid impulsive decisions driven by fear.

-

Another approach is using deep breathing and visualization exercises to prepare for adverse outcomes, this can help to normalize setbacks and make it easier to accept losses as part of a bigger picture of winning.

-

Finally, adjust your attitude by using losses as learning opportunities and embracing them as teachers. This will help you to study your game in greater detail and make incremental improvements in your processes. This mindset shift will help you to focus on winning rather than avoiding losses.

The Role of Greed in Forex Trading

Greed is another common emotion experienced by traders. Greed can lead to overtrading and overleveraging, which can result in significant losses.

For example, a trader may see a potential profit opportunity and put all their trading capital into one trade, despite the potential risks. This is a typical example of overleveraging caused by greed.

To overcome greed in forex trading, it's important to first recognize when it's creeping in. One way to do this is by keeping a trading journal and noting any instances where you feel like you're deviating from your planned strategy or taking on more risk than you're comfortable with.

Once you've identified these moments of greed, it's important to readjust your mindset and focus on sticking to your trading plan. This can include setting strict take-profit limits and keeping a close eye on your risk-to-reward ratio.

Additionally, it's crucial to maintain a consistent and disciplined approach to trading. This can help you stay on track and avoid falling into emotional traps. Remember, overcoming greed is a gradual process that takes time and patience, but with the right mindset and discipline, it is possible.

Developing a Winning Mindset

Developing a winning mindset is an essential aspect of the psychology of forex trading. A winning mindset is characterized by 3 elements:

-

realistic goals,

-

a positive attitude,

-

and discipline.

These elements are necessary for a trader to make rational and profitable trading decisions.

Setting realistic goals

Setting realistic goals and expectations is a crucial first step in developing a winning mindset. Traders should set measurable and achievable goals that align with their overall trading strategy. These goals should be specific, time-bound, and realistic. Having clear goals in mind can help traders stay focused and motivated.

Positive Attitude

Traders should strive to maintain a positive outlook, even in the face of losses and setbacks. Here are a few practical steps that can help you develop a positive mindset:

-

Identify negative thoughts – Keep a journal and take note of any negative thoughts that come to your mind before, during, and after trading. This will help you identify patterns and triggers that lead to bad trading decisions.

-

Replace negative thoughts with positive affirmations – Once you have identified negative thoughts, make a conscious effort to replace them with positive affirmations. For example, instead of thinking "I will never make a profit in this market," try thinking "I am a successful trader and I will make a profit in this market."

-

Surround yourself with positive influences – Spend time with people who have a positive attitude and who inspire you to be your best. Avoid traders that complain all the time as much as possible.

Discipline

Discipline is also a key element of a winning mindset. Developing self-discipline in trading requires a combination of self-awareness, goal-setting, and consistency. Here are some practical steps to master self-discipline:

-

Start outside of trading by building disciplined routines in your everyday life. This could include things like waking up at a consistent time, maintaining a healthy diet, or exercising regularly.

-

Define and write out your trading rules, and refer to them while you trade. These rules should protect your trading account from blowing up and allow your strengths to flourish.

-

Focus on the process of trading, not just the outcome. Study your trading results carefully, note the patterns of behavior that are bringing you the most success, and eliminate those that are not working that well.

-

Plan, tweak, execute, and repeat. This process of constant improvement will help you develop the discipline you need to develop a winning mindset.

How Do You Win Trading Psychology?

Unfortunately, many traders struggle with psychological barriers that can have a significant impact on their performance. Some of the most common psychological barriers that traders face include:

-

Overconfidence and self-doubt,

-

FOMO (fear of missing out),

-

and revenge trading.

We will also discuss the impact of these barriers on your trading PnL and offer practical solutions on how to overcome them.

Overconfidence

Overconfidence in trading is when a trader has an excessive belief in their ability to predict market outcomes and make profitable trades. Traders that believe that they have a better understanding of the markets than they do, often fall victim to this trap.

To master overconfidence in trading, traders can implement strict risk management rules so they can avoid taking on too much risk. This includes setting stop-loss orders and adhering to a positive risk-reward ratio.

Recognizing that no one has a crystal ball and that the market is unpredictable can help traders stay grounded in reality and avoid overconfidence.

FOMO (Fear of Missing Out)

FOMO or Fear of Missing Out refers to the feeling of anxiety or panic that arises when a trader fears they may miss out on a profitable opportunity. This can manifest in several ways, such as constantly checking the market, making impulsive trades, or overtrading.

To overcome FOMO, it is important to remind yourself that there is always going to be another opportunity around the corner. Additionally, traders should educate themselves on the psychology of forex trading, understand their own biases, and identify their triggers for FOMO.

Revenge Trading

Revenge trading is the act of making impulsive trades in an attempt to recoup losses from previous trades. This can lead to taking on too much risk and ultimately, significant losses. To overcome revenge trading, it is important to practice self-reflection and journaling which can help to identify patterns of behavior that may lead to revenge trading.

Implementing Effective Trading Strategies

An effective forex trading strategy is crucial for trading success. A clear strategy can guide decision-making and promote discipline, preventing going down the slippery slope of emotional trading.

A well-defined strategy can help traders stay disciplined and stick to a plan, even in the face of market volatility and unexpected events. Additionally, traders with a well-defined trading strategy can anticipate and better prepare for different market conditions, rather than reacting impulsively to them.

Overall, having a trading strategy in place can provide a sense of structure and control in the fast-paced and unpredictable world of forex trading, which can greatly benefit a trader's psychology.

Implementing Risk Management

Risk management is a crucial aspect of trading psychology in forex, as it helps traders manage their emotions. The ability to define a target and stop loss in advance can allow traders to have a clear understanding of their risk tolerance which in turn can provide a sense of security and control.

By controlling the size of each trade, traders can reduce the emotional impact of their trades. This is because a smaller position size means that a single trade will have a smaller impact on the overall account balance. So, proper position sizing can prevent emotional reactions such as over-leveraging or panic selling during losing trades.

Many forex brokers offer tools and resources, such as trading platforms, risk management tools, and educational materials, to help traders create and refine their trading strategies. It is important to make use of these resources and to constantly evaluate and adjust your trading strategy as market conditions change.

Final Thoughts

In conclusion, forex trading psychology plays a vital role in the success of a trader. Developing a trading plan and sticking to it is key to pushing aside fear and working through it. Practice, research, and making mistakes are all part of the learning curve in forex trading.

Emotions such as fear of loss, anger, impatience, and greed can cloud a trader's judgment and lead to rash decisions.

To combat this, traders should sort out their emotional state, develop a plan, be patient, and adapt to new occurrences. It's important to detach oneself from the situation during times of uncertainty and to trade with intent rather than ego. Overall, the key to success in forex trading is to manage emotions and trade with the big picture in mind.

Don't forget to visit our topbrokers best forex brokers page to compare and find the best forex brokers for your trading needs. After all, mastering the art of trading psychology forex begins with selecting a reputable and trustworthy top forex broker as your partner.

RoboForex

RoboForex Exness

Exness FxPro

FxPro Alfa-Forex

Alfa-Forex Libertex

Libertex FxGlory

FxGlory XM

XM IC Markets

IC Markets Forex.com

Forex.com AXITrader

AXITrader