Risk Warning: Your capital is at risk. Statistically, 74-89% of customers lose their investment. Invest in capital that is willing to expose such risks.

Octa FX review

Overview

Our 5-step process of verification and evaluation – How do we obtain information?

General inspection – 30%

Trading experience – 30%

Technical audit – 20%

Collective experience from collaborations with the broker – 10%

Interviews with real traders – 10%

See the entire process here.

Pros

-

Competitive Spreads and No Commissions

-

High Leverage Options

-

Fast Withdrawal Processing

-

Low Minimum Deposit

Cons

-

Limited Range of Tradable Instruments

-

Not Regulated in Top-Tier Jurisdictions

-

Limited Educational Resources

General details

Customer reviews

score

We’re always thorough in our broker reviews. Still, we feel it’s necessary to consider what the Octa community and other experts have to say. After all, we’re one review in a sea of many. Considering what others have said provides a more well-rounded perspective on Octa’s services.

We want to begin by saying that Octa has many positive community reviews, especially on sites like Trustpilot.

Here’s an example of what we found.

“I have been using Octafx for at least the last two years. It’s been a great journey till now with exciting events and prizes Octa offers on a regular basis. The amount of bonus I get for each deposit is exceptional! I once personally got a nice gift( Waist bag with Octa logo) for the volume I traded on the platform. And I am pretty much amazed by the level of leverage Octa has been offering recently. I expect Octafx to provide even better spread conditions and higher leverage for the assets available. Really Octa is worth sharing with friends and family. Thanks.” – Trustpilot Review

Here’s an example of a review with only three stars.

“Overall I like the platform but lately I got twice account liquidated when positions have been hedged. The account stopped out just before the BTC turned around to go up. Also, the spreads keep increasing. Customer service didn’t offer a convincing explanation. I felt like being stop hunted many times. I have noticed similar with my other broker so will keep looking until I find better broker conditions” – Trustpilot Review.

We also noticed on Trustpilot that many of the newer reviews, regardless of their rating, are labeled as “invited”. This means that Octa invited or encouraged the reviews that might not have otherwise been made.

As far as what the professionals have to say, the reviews are a bit more mixed. Most share the overall sentiment that Octa is a reliable, reputable broker. However, some caution of the high-leverage options, and make note of rather limited trading instruments. Read real reviews from traders all over the world:

Share Your Experience

Help others by sharing your review

Frequently asked questions

Frequently Asked Questions

In our research, we’ve found Octa to be a reliable forex broker. Being regulated by CySec, FSCA and MISA lends credibility. If they were regulated by authorities such as ASIC or FCA, this would further enhance their reliability. It’s also important to look at longevity and track record. Octa has been in the forex trading game for well over a decade and has built up a solid reputation for reliability. We have noticed some occasional issues with withdrawals and technical issues. But, this is something every online broker seems to occasionally struggle with.

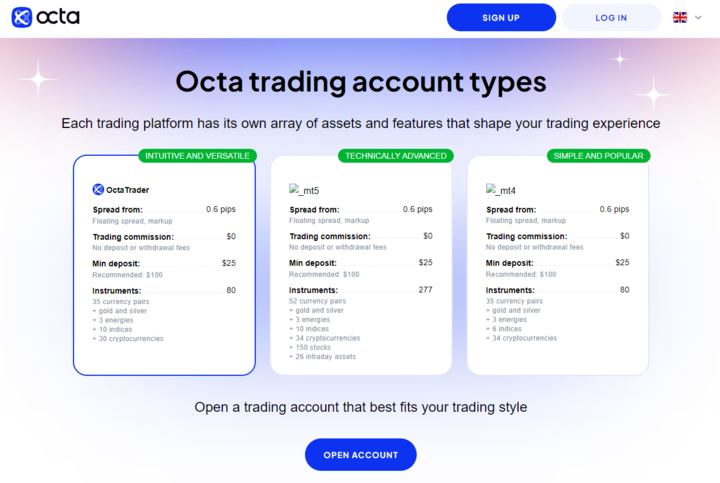

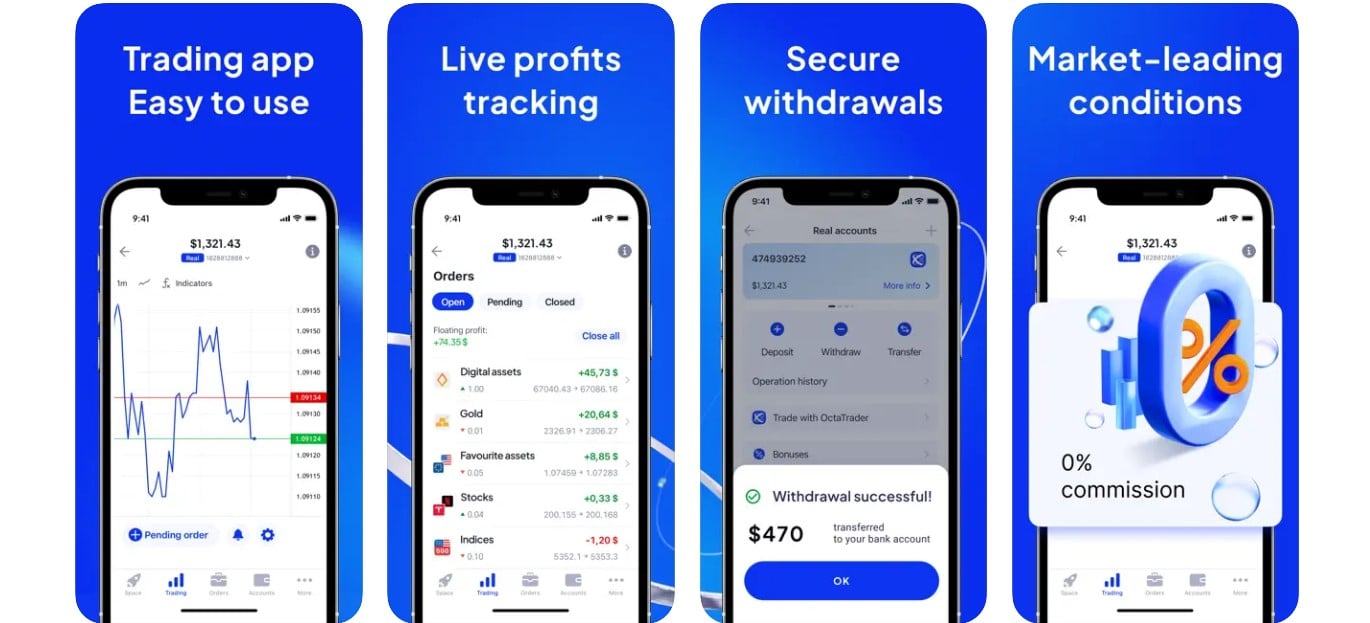

Octa’s lineup of platforms features the gold standard MetaTrader. This includes MetaTrader4 and MetaTrader5. The MetaTrader platforms offer robust features and usability that appeal to a wide market.

Besides the MetaTrader platform, there is also Octa’s proprietary platform called OctaTrader. Of all the platform options, this is the most user-friendly and intuitive to use. More advanced traders might not be the biggest fans, but novice or occasional investors will find it easy to navigate.

All of these platforms are available in web and mobile applications, including both Android and iOS.

For those wanting to learn more about MetaTrader platforms, we recommend reading our MetaTrader 4 review.

With forex brokers, minimum deposits can be all over the board. Some don’t have minimum requirements or set an extremely low limit, like $1. Others set limits that are much higher. Octa falls somewhere in the middle of the spectrum, leaning more toward the low end.

Octa’s minimum deposits start as low as $25. This is a good level for new traders who want to start small and experiment with little financial investment. Forex traders who already have their toes wet will likely want to exceed the minimum deposit level. The minimum is definitely budget-friendly, but there’s only so much that can be done with $25.

There are online brokers that don’t require a minimum deposit at all. We recommend our review on No Deposit Forex Brokers.

Leverage is a tool that allows investors to borrow funds to increase the potential for higher returns. In other words, a trader can control larger positions with a much smaller amount of investment. High-leverage options can definitely maximize profit potential. Octa plays into this by offering a leverage of 1:1000, which is high when considering the industry as a whole. It’s not uncommon to see leverage capped at a level of 1:30 or 1:50.

While there are definite advantages to Octa’s high-leverage options, there are also some drawbacks. Just as profits can be amplified, so can losses. For this reason, it’s best to proceed cautiously with leverage, even if the allowed levels are high. It’s always smart to experiment with leverage by using smaller amounts until experience is gained. In our opinion, leverage is also safest when trading with one of the best forex brokers.

Octa offers 24/7 customer support but doesn’t provide an option for phone support. Its customer support team can be reached using the platform’s live chat option, email, or social media. Customer support is offered in multiple languages.

The overall quality of Octa’s customer support is good. We do wish they’d offer phone support, but they are quick to respond through the channels offered.

Octa FX compared with alternative brokers

- Overall verdict

- Trading

- Minimum deposit

- Maximum leverage

- Fees

- Withdrawal fee

- Deposit fee

- Safety

- Top-tier regulators

- Investor protection

-

Social trading

-

Auto trading

-

Swap-free accounts

-

3.8/ 5

-

3.7/ 5

- $10

- 1:1000

-

3.7/ 5

- $0

- $0

-

4.5/ 5

- CySEC

-

No

No

-

See review

-

Specialized trading accounts

-

24/7 instant money withdrawal

-

Free VPS hosting

-

4.9/ 5

-

4.8/ 5

- $10

- 1:2000

-

4.8/ 5

- $0

- $0

-

5/ 5

- FCA, CYSEC

-

No

No

-

See review

-

24/7 instant money withdrawal

-

Specialized trading accounts

-

Free VPS hosting

-

High leverage

-

4.7/ 5

-

4.7/ 5

- $100

- 1:10000

-

4.7/ 5

- $0

- $0

-

4.7/ 5

- FCA

-

See review

-

Specialized trading accounts

-

Tight Spreads

-

Low commissions

-

4.6/ 5

-

4.6/ 5

- $200

- 1:500

-

4.5/ 5

- $0

- $0

-

4.2/ 5

- ASIC, CySEC

-

See review

-

Free VPS hosting

-

24/7 instant money withdrawal

-

Specialized trading accounts

-

4.9/ 5

-

4.9/ 5

- $10

- 1:2000

-

4.8/ 5

- 1%

- $0

-

4.8/ 5

- No

-

See review

RoboForex

RoboForex Exness

Exness FxPro

FxPro Alfa-Forex

Alfa-Forex Libertex

Libertex FxGlory

FxGlory XM

XM IC Markets

IC Markets Forex.com

Forex.com AXITrader

AXITrader