Whether a broker sends trades to the Interbank Market is a question of interest to many traders. Fewer than all understand, what the Interbank Market is, why trades should be sent there and how traders benefit from it, as well as whether a Forex broker can avoid sending trades directly to the Interbank Market and why it is important to know this. In this article, we will give answers to these questions.

What is the Interbank Market?

The Interbank Market is a global network, where banks and other major participants trade currencies. However, traders have a little changed this term and the Interbank Market means not only the network but its participants – banks, investment exchanges, large brokers, and other large financial organizations. Nevertheless, it’s more accurate to say that they are liquidity providers.

The liquidity providers have enough capital and can process almost any number of orders. Due to this, trades are processed quite quickly and executed at the price, that is closest to the market price, that is to say with high liquidity.

Why does a broker send trades to the Interbank Market?

We know now, who the liquidity providers are, so let’s proceed. Why does the broker need to use liquidity provider services and what would be the point for a trader?

Honest brokers trading in the Forex market earn exclusively on spreads and commissions, so they are most interested in traders dealing with them more and longer. That’s why brokers strive to offer the best trading conditions for traders.

To do this by own force is almost impossible. If only because when accepting orders from traders, the broker has to make the same order to the Interbank Market, wait for an answer, and then transmit it to a client. This causes delays in opening transactions and not just that. By sending a trade directly to the liquidity providers, the broker avoids all these problems.

Moreover, since there are many participants in the Interbank Exchange Market, which offer different prices and process orders at different rates, the trader has a greater choice. Due to that, he gets favorable trading conditions:

- The best purchase and sale prices

- Minimum spreads

- High speed of order processing

- No slippages and requotes

As a result, everyone gets a boost. Brokers retain and increase a customer base, and customers have favorable trading conditions.

How can we check, whether a broker sends trades to the Interbank Market?

The main problem is that almost all companies say that they send orders from traders to liquidity providers. Nevertheless, it is quite difficult to determine whether it is true with the help of the request for data concerning a counterparty of the trade.

Firstly, brokers can say that this information is a trade secret. Secondly, they can provide such information if they want but it doesn’t mean that trades were sent to the Interbank Market.

Therefore, it’s important to choose a reliable broker such as AMarkets that does not hide its liquidity providers and furnishes the information needed without any problems. Moreover, such brokers have official documents that confirm their cooperation with specified suppliers or liquidity providers and certify that all trades are sent to the Interbank Market rather than moved around the company.

If the company cannot provide such data for any reason, it is possible to determine whether the broker sends trades to the Interbank Market by indirect indications.

The Company Regulation

If the broker has a license from a serious regulatory authority, all orders must be sent to the Interbank Market unconditionally. It is written in the Annex to the Conflict of Interest Agreement. But it is worth considering that there may be a license, for example from Mauritius, where a regulatory authority does not control companies in any way and they can do anything they like. Therefore, pay attention not only to the availability of the license but also to its quality. For example, there are regulators like the Financial Commission, which, due to its impeccable reputation, regulates the activities of only those brokers who are responsible for sending trades on the interbank market.

Quote Provision Technologies

Often, traders complain that broker prices are very different and the point is said to be in a supplier of quotes. But chances are better than even that quotes are cheated as companies using the ECN technology do not have such a problem.

The ECN brokers provide quotes and spread them to their users without any changes. Moreover, they give the best buying and selling quotes to traders from the entire stream of quotes from liquidity providers. For example, the bid price can be provided by one bank and the asking price by another one. As a result, the client has the best prices and a minimum spread.

Order Execution Quality

As a rule, normal companies have no requotes or slippages. The ECN brokers process orders at very high speed, which completely excludes slippage, and deals are made instantly.

Timely Withdrawal

As cliché as it may sound, bucket shops usually keep withdrawals, which are higher than certain amounts, they gather money for payout or may not pay anything at all. A broker sending trades to liquidity providers does not have such problems. As mentioned above, if there is an imbalance against the company in the market, the difference is covered by a liquidity provider and there are no problems with paying out both $1000 and $ 100,000 within the period prescribed on the website.

Interest in Successful Traders

This item includes the above-mentioned facts and more. For example, the AMarkets Company not only sends trades to the Interbank Market but has also developed the orders’ routing technology to provide successful trading for its clients. Thus, the Company clients get quotes more quickly and by 10-30 points better than competitors.

In addition, AMarkets offers many additional opportunities to its customers, which help them trade better, for instance, AutoChartist system signals, unique financial indicators, high-quality VPS service, and much more. As a result, AMarkets is in the top 3 international brokers with the highest percentage of successful customers.

If a broker does not meet at least one point, one should entertain doubts about opening an account. And if a broker hides liquidity providers and does not have any licenses, then he should not be contacted at all as trades are not sent to the Interbank Market.

Which top brokers send trades to the Interbank Market

The Forex market has become more orderly and there is a fair amount of brokers, that send trades to the Interbank Market. For this very reason, there is no point in mentioning all of them. Especially since some of them have better trading conditions than others. We name only the best ones:

- AMarkets

- FXTM

- FxPro

- Exness

- AvaTrade

These companies not only send trades to the Interbank Market but also fully comply with the above-mentioned characteristics. Assuming long years of work and quality proved by thousands of traders, we can confidently say that they are the best companies.

Can Forex brokers avoid sending trades to the Interbank Market?

As has become clear from the above, there are two types of brokers in the Forex market – those, who work honestly and send trades to the Interbank Market, and those, who keep all trades in a company and usually act in bad faith with traders.

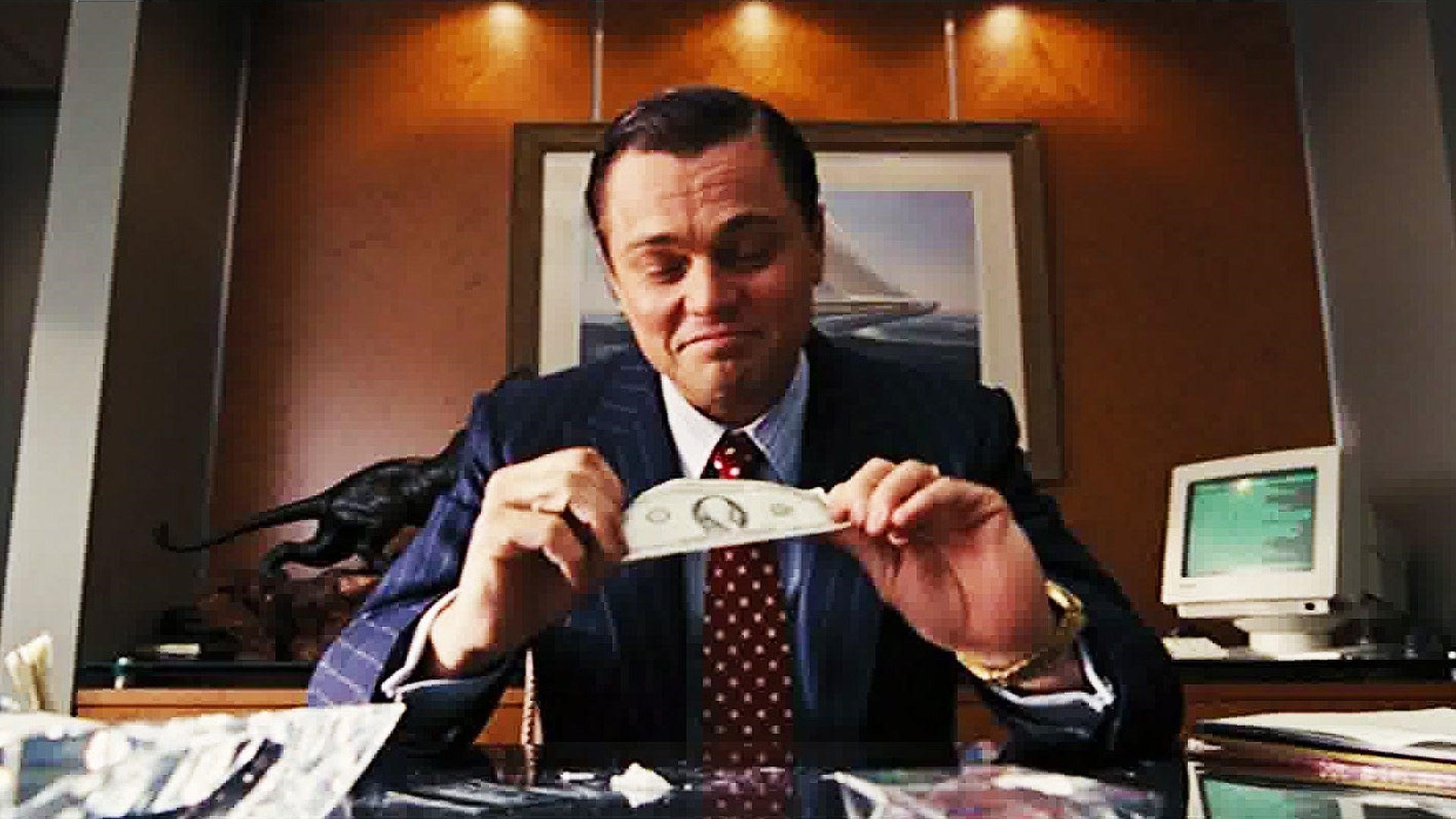

Working where trades are not sent to the liquidity providers, traders deal against brokers as the company has no money to cover income if most traders make a profit, or they just don’t want to do this and then start cheating.

Receiving a request for an opening order at the specified price, such brokers make the same request to their liquidity provider. After getting an answer, they cheat quotes for their benefit, and real prices are not sent to traders.

Subsequently, the last ones have problems. Since the dishonest broker has an extensive set of tools for manipulation (for example, requotes and slippages), orders are waived, not opened for a long time, or opened by a few points worse. During the news, a gap against the trader can reach 30-50 points for four-digit quotes. For five-digit quotes, this number reaches 300-500 points.

Spreads can expand to 9-12 points for four-digit quotes, which disadvantages a trader at once. Even worse, the so-called “tails” can appear, when the candlestick shadow comes and cuts stop-loss traders.

Is it so important to send trades to the Interbank Market?

Taking into account the difference between an ECN broker and the consequences of trade with companies, that do not send trades to the Interbank Market, it becomes clear – it is important to choose a trading floor, where one can be calm for own funds and can get the best trading conditions.

Unfortunately, many traders take it carelessly. They think that all brokers are similar and send trades to the Interbank Market (if they do) only as a collective position of many traders for an amount less than $1 mln. Consequently, they take problematic trading for granted and say that normal execution and timely money withdrawal are more important.

This approach is wrong. The companies, that do not send trades to the Interbank Market, have normal execution only as long as the number of loss traders is high. The money withdrawal is normal only as long as a trader withdraws small amounts. Challenges appear if amounts become more than $3.000 and there is no guarantee that the trader gets his money. That is why we strongly encourage choosing only those brokers, who send trades to liquidity providers.

RoboForex

RoboForex Exness

Exness FxPro

FxPro Alfa-Forex

Alfa-Forex Libertex

Libertex FxGlory

FxGlory XM

XM IC Markets

IC Markets Forex.com

Forex.com AXITrader

AXITrader