Equities and bond yields end mixed on Friday; the US dollar slides

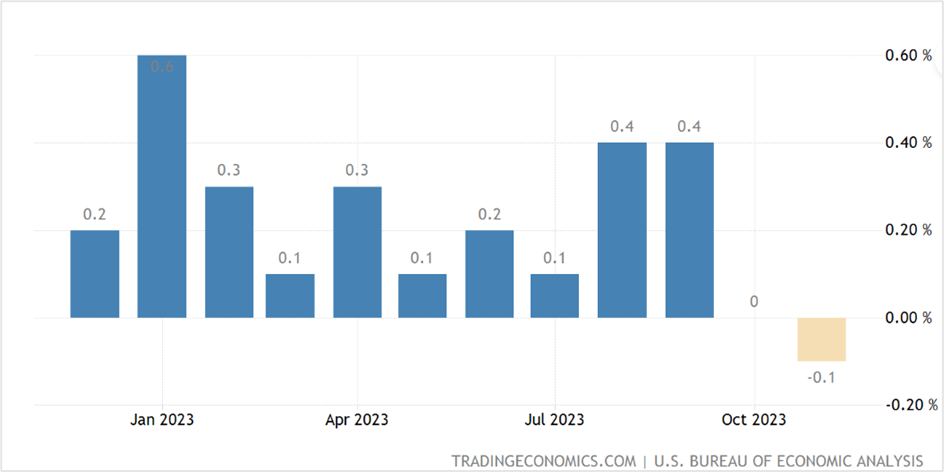

Consumer price inflation categorized by the personal consumption expenditures (PCE) fell by minus 0.1% in November, the first drop in more than 31/2 years, and after a flat reading the previous month, data released by the US Bureau of Economic Analysis showed. The drop in the month-on-month PCE drove the annual headline figure to 2.6% last month from 2.9% in October, lifting market expectations that the US central bank will start cutting interest rates from March 2024. A poll of economists by Reuters forecasted the monthly PCE price index to remain unchanged in November and rise 2.9% over the last 12 months. On the other hand, the core PCE price index, which excludes food and energy prices, rose by a smaller 0.1% last month from 0.2% in October, while annual core PCE slid from 3.4% to 3.2% during the same period.

Personal consumption expenditures (PCE) represent the value of the goods and services purchased by people or on behalf of those residing in the United States.

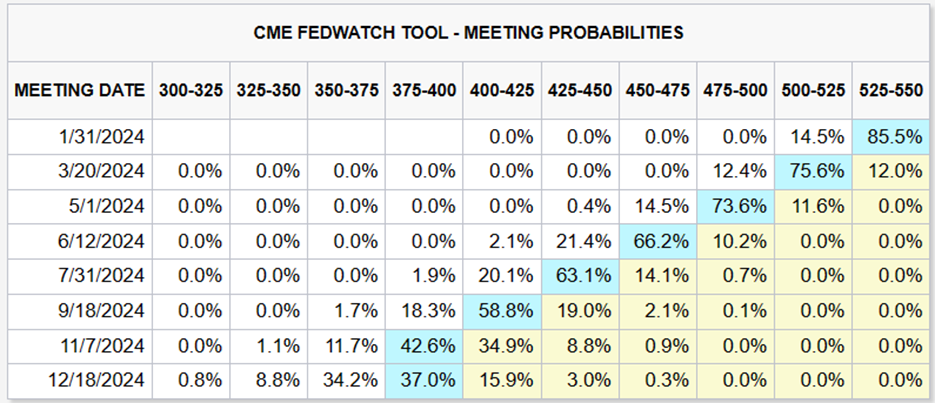

With inflation cooling faster than expected despite a solid job market and the economy expanding at a consistent pace, the odds of a soft landing seem more of a reality at the moment. In addition, consumer spending, which accounts for more than two-thirds of economic activity, climbed 0.2% last month, signaling that the US economy was gaining momentum after an uncertain start to the fourth quarter, driving market expectations of a Fed pivot toward rate cuts beginning in Q1, 2024. According to the CME FedWatch Tool, traders are pricing in a 76% chance that central bank officials would lower rates by 25 basis points following the March 19-20 FOMC meeting. In addition, most traders are also forecasting at least five rate cuts next year.

Source:cmegroup website

Key highlights of the November PCE price index

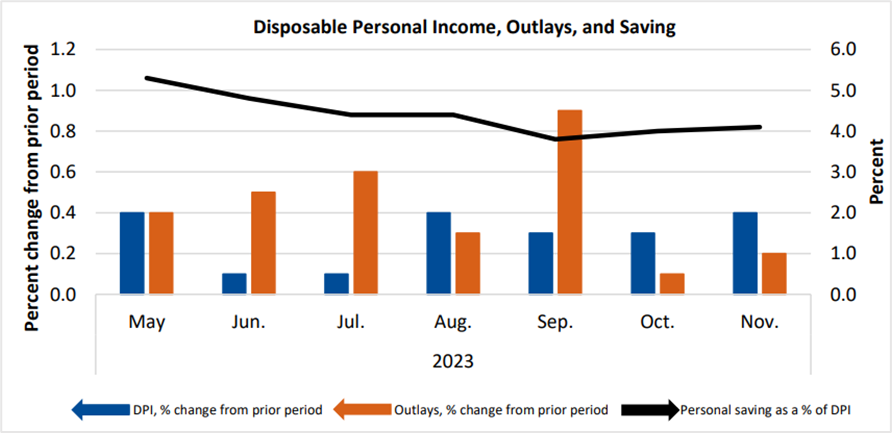

Real PCE on the chained dollar measure for 2017 rose 0.3%, while it increased by 0.2% based on the current dollar value. Personal income rose $81.6 billion or 0.4% month-on-month, disposable personal income (DPI) rose $71.9 billion or 0.4%, and personal consumption expenditures climbed $46.7 billion or 0.2%. The PCE price index for goods surged by 0.5%, and services increased by 0.2%. The personal consumption expenditure measured in current dollars included a $58.8 billion surge in spending for services and a $12.1 billion drop for goods.

Housing and utilities, food services, and accommodation were the most significant contributors to the increase in spending in the services sector. In the goods sector, recreational goods and vehicles, durable household equipment, clothing, and footwear were the primary contributors to the increase, while the decline in spending was led by gasoline and other energy products, such as motor vehicle fuels, lubricants, and fluids.

Source: US Bureau of Economic Analysis website

Economists’ review of the PCE price index report

Gus Faucher, the chief economist at PNC Financial Services, said that while the inflation outlook is better than a few months ago, the Fed is wary of affirming victory over inflation. With core inflation cooling, it opens the door for Fed rate cuts next year, although the timing will depend on the core PCE reading over the next few months.

Tom Hainlin, the global investment strategist at Ascent Private Capital Management, believes the markets are ahead of the Fed for now and need to be reconciled closer to where the Fed is or market expectations are. He has a cautiously optimistic outlook, which is closer to the Fed’s view, and is waiting for further data on consumer behavior.

According to Sal Guatiri, the senior economist at BMO Capital Markets in Toronto, the finale is turning out to be better than what US central bank officials or anyone else forecasted at the beginning of the year. He further said that the US economy is in better shape than Fed Chair Jerome Powell had projected, and it’s only a matter of time before the Fed starts cutting rates.

Market reaction to the personal consumption expenditures report

The US stock markets reversed most of the morning session gains to end mixed on Friday. The S&P 500 rose 0.17% to 4,754.63, the Nasdaq 100 gained 0.12% to settle at 16,777.40, while the Dow Jones Industrial Average closed about 18 points lower at 37,385.97, primarily from a 12% plunge in the shares of Nike Inc.

The pullback comes amid a choppy week for stocks following a phenomenal rally, which saw the major benchmarks notch up eight consecutive weekly gains. According to Dow Jones Market Data, the S&P 500 registered its longest weekly winning streak since the first week of November 2017, leaving it within striking distance of its all-time high of 4818.62 recorded on January 4th, 2022. On the contrary, the Dow Jones Industrial Average and the Nasdaq 100 surpassed their all-time highs earlier this month.

With the markets closed for the Christmas weekend, traders anxiously await the Santa Claus rally to drive stock market gains further. The Santa Claus rally occurs during the last five trading days of the current calendar year and the first two trading days of the following year.

In the currency markets, the US dollar slid for the second consecutive day on Friday to close at the lowest in nearly 5-months. The US dollar index, a measure of the dollar’s strength against six major currencies of leading economies, slipped 0.14% to 101.698, registering the lowest close since July 31st. The dollar edged 0.03% lower to 1.1014 against the euro, slipped 0.05% to 1.2696 versus the pound sterling, and fell 0.20% to 142.39 vs. the yen.

On Thursday, the trade-weighted index broke out of a key short-term bearish continuation chart pattern and could slide below 100 in the coming days.

Click the link to view the chart- TradingView — Track All Markets

Treasury yields ended mixed on the preholiday-shortened session on Friday after the Fed’s preferred inflation measure showed price pressures abating. The yield on the 2-year Treasury Note slid 1.1 basis points to 4.338%, the yield on the 10-year T Note climbed 1.4 basis points to 3.907%, and the 30-year Treasury bond yield rose 2.5 basis points to 4.059%.

In a choppy Friday session, yields initially rose following the PCE price index report and then pulled back before drifting higher toward the end of the session. Meanwhile, the spread between the 2-year and 10-year yields remained inverted. As of Friday’s close, the yields on the two maturities were inverted by 43.1 basis points, narrowing by almost half from earlier this year.

Technical View

S&P 500 March index futures

The S&P 500 futures broke through all-time highs of 4808.25 on Friday for the fourth time during the week before pulling back modestly to settle at 4805.25. The stock market rally that began in the last week of October has driven the index to its eighth consecutive weekly gain, not seen in a long time.

The primary trend remains bullish, and a close above 4820 or a break of 4840 should drive the index toward 4920, the channel line of the primary bull trend. On the downside, the near-term support is at 4760, which will likely hold for now. The RSI is above 70, slightly in the overbought territory, but should not be a cause for concern.

The strategy is to go long on the index futures if it closes above 4820 or at the break of 4840. Place a protective stop at 4790 for a profit target of 4920. Long positions can also be initiated if the S&P 500 futures slip to 4760. Have a stop loss at 4730 and exit at 4810.

E-mini S&P 500 March index futures- Daily chart

Click the link to view the chart- TradingView — Track All Markets

Gold February futures

Gold futures settled 0.87% higher at $2069.1 on Friday to register the highest close in three weeks. Prices closed slightly below key short-term resistances and Fibonacci levels at $2070, pulling back modestly from the session highs amid profit booking ahead of the long holiday weekend. The yellow metal has been rallying since early October, and although it is down by about 4% from the all-time highs of $2152 earlier this month, there’s still plenty of juice in the rally.

Gold broke out of a bullish symmetrical triangle pattern late last month, and more recently, prices surged out of a flag pattern with a near-term target of $2130 and a medium to long-term target of $2225-$2250. On the downside, the near-term support is in the $2025-$2040 range, and as long as prices do not close below the levels, the trend remains intact.

Go long on February gold futures if prices close above $2070 or at the break of $2085, with a stop loss at $2060 for a profit target of $2125. You can also initiate long positions if prices drop to $2025, with a stop at $2010 for a profit target of $2070.

Gold February futures- Daily chart

Click the link to view the chart- TradingView — Track All Markets

RoboForex

RoboForex Exness

Exness FxPro

FxPro Alfa-Forex

Alfa-Forex Libertex

Libertex FxGlory

FxGlory XM

XM IC Markets

IC Markets Forex.com

Forex.com AXITrader

AXITrader