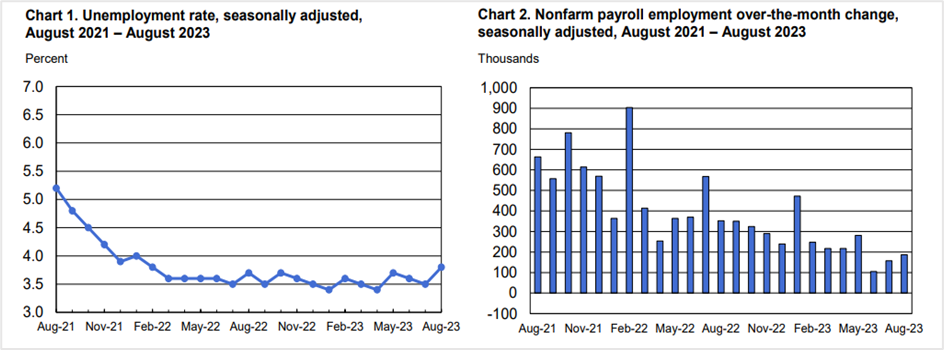

The unemployment rate jumped to 3.8% amid a cooling labor market

US nonfarm payrolls rose by 187,000 in August, up from a downwardly revised 157,000 the previous month, the US Bureau of Labor Statistics reported on Friday. Job gains were seen in healthcare, leisure & hospitality, construction, and the social assistance industries, while people from the transportation and warehousing sectors lost jobs. Economists polled by The Wall Street Journal expected the labor market to add 170,000 new jobs and the unemployment rate to remain unchanged at 3.5%.

Meanwhile, the household survey data comprising the unemployment rate climbed to 3.8% in August from 3.5% the month earlier as the number of people without jobs surged by 514,000 to 6.4 million, the most in one and a half years. According to analysts, the headline labor market numbers in August could have been complicated by factors such as the Screen Actors Guild strike in Hollywood and the bankruptcy of trucking company Yellow Inc.

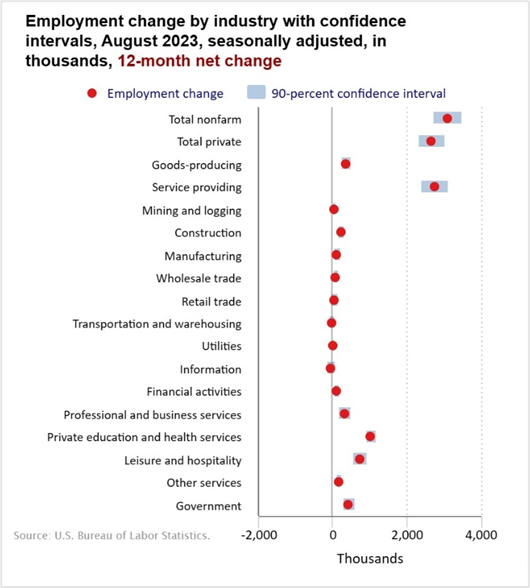

Whatever the reason for the current surge in unemployment levels, the labor market is losing some of its sheen as the number of industries hiring this year has fallen substantially. Still, Fed officials believe hiring should slow to 75,000-100,000 new jobs a month to ease labor shortage and help slow inflation.

The second part of the survey, which is the establishment survey, showed that the average hourly earnings of people employed on private nonfarm payrolls ticked higher by 8 cents or 0.2% to $33.82 in August, with the average wage growth up 4.3% over the last 12-months. Also, the average workweek for employees coming under the private nonfarm payrolls increased by 0.1 hours to 34.4 hours, with the average workweek for employees in the manufacturing sector at 40.1 hours for the fifth successive month. Lastly, the labor force participation rate rose by 0.2 percentage points to 62.8% after being unchanged from March this year, while the employment-population ratio was unchanged from July at 60.4%.

Analysts' views on the nonfarm employment

George Mateyo, the chief investment officer at Key Private Bank, is confident that the unemployment rate reported by the Bureau of Labor Statistics will be music to the Fed's ears since wage gains didn't rise at an alarming rate. He expects policymakers to pause in September and remain cautious for the rest of the year as they gauge further increases in the unemployment rate.

Bryce Doty, the senior portfolio manager at Sit Investment Associates, believes that the unemployment rate climbing from 3.5% to 3.8% is a Goldilocks moment and will take the pressure off the Fed. He expects the yield curve to un-invert, with the yield on the 2-year Note falling as investors price in a shift in the Fed policy.

The chief economist of the Mortgage Bankers Association, Mike Fratantoni, said that although nonfarm payrolls increased in August, the markdown in job growth over June and July suggests a slowdown in the job market. According to him, the unemployment rate climbing to 3.8% in August was due to the growth in the labor force participation rate as more people were actively looking for jobs without much luck since businesses paused or stopped hiring.

Market reaction to the labor market news

US equities reversed most of the early morning gains to end mixed on Friday. The S&P 500 and the Dow Jones Industrial Average closed in the green, while the tech-heavy Nasdaq finished with small losses as investors booked profits ahead of the extended Labor Day weekend.

Last week's pullback pushed the S&P 500 and the Nasdaq 100 to a more than 1.5% loss in August, its first monthly decline in six. On the other hand, the Dow fell 2.36% in August, registering its first monthly drop in three.

The weaker-than-expected unemployment data is positive for US equities until the release of the next significant market-moving economic indicator, the August consumer price index (CPI), on 13th September. So, until then, the expectation is for the equities market to continue climbing higher.

US Treasury yields were mixed on Friday as comments from Fed official Loretta Mester overshadowed the positive unemployment news. The yield on the 2-year T-Note ended lower by 0.6 basis points at 4.87%, while the 10-year Note climbed 7.5 basis points to 4.186%, and the 30-year bond jumped 8.3 basis points to 4.297%.

The rebound in the yields followed remarks by Cleveland Fed President Loretta Mester at a conference in Europe, where she said that inflation is still too high. She also told the gathering that Fed policymakers are trying to determine if the current Fed Funds Rate is sufficiently restrictive and the duration until which they should continue with the restrictive policy to lower inflation.

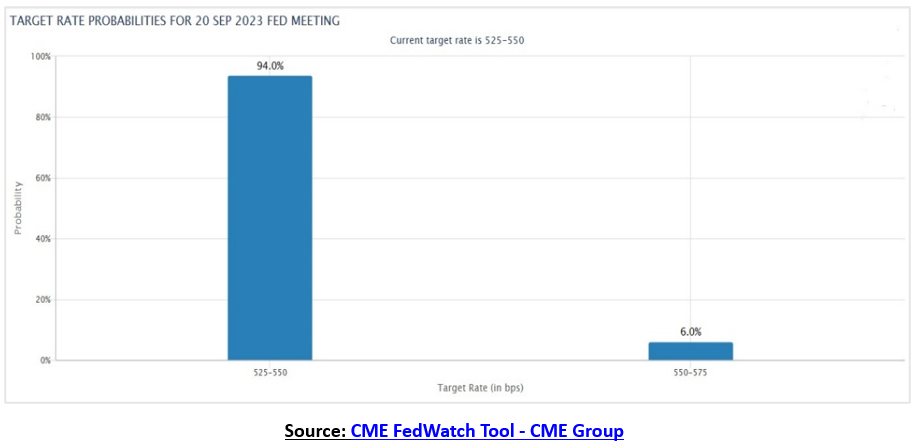

Meanwhile, Fed Funds futures traders are pricing in a 94% probability that the US central bank will not hike on 20th September. That number is up from 80% last week.

In the currency markets, the US dollar index futures (DXY) rose for the second consecutive day against its key counterparts, settling at 104.236 on Friday to register the highest close in 3-months. The greenback rose against all the currencies in the basket to close above the long-term primary downtrend for the second straight day. However, the index will likely face pressure at 104.60, the top end of the blue line, and a close above this barrier will confirm a bullish trend reversal.

Technical View

The Dow Jones Industrial Average (September futures) ended Friday's session at 34882, surging 0.26% for the day and 1.47% week-on-week. The index futures are in a primary uptrend, with the near-term support at 34300 (the lower blue trendline) and resistance at 35130 (indicated by the orange trendline). There could be fresh efforts to break through the resistance after multiple failed attempts.

Wait for the DJIA futures to close above 35130 or surge above 35200 before initiating long positions. Have a stop loss @ 35050 and exit trades @ 35900. On the other hand, if the index futures drop from the current levels, you can also go long @ 34300-34350 with a stop loss @ 34200 and exit @ 35100.

Dow Jones Industrial Average futures- Daily chart

US 10-year Treasury yields have been gaining steadily since hitting all-time lows in March 2020 and currently stand at 4.186%. Bond experts are mixed about the Fed's future interest hiking spree after the recent inflation and labor market news pointed to inflation stagnating around the 4% mark while the pace of hiring is likely to have slackened, at least for now.

In addition, the Chinese economy, the world's second-largest, delivered mixed signals in August, with inflation plunging into negative territory y-o-y, surging international trade, y-o-y drop in industrial production and retail sales in July, the unemployment rate holding firm around 5.2%-5.3%, a sharp decline in FDI, services PMI expanding even as the manufacturing PMI remains below 50 for the fifth straight month. How the Chinese economy performs from here could determine inflation and the future performance of US Treasury instruments.

On charts, the 10-year yield is supported at the 4% mark (the lower blue trendline), while the resistance is at around 4.35% (represented by the red horizontal line). If the yield settles above the resistance, go long on the 10-year T-bill futures with a stop loss of 4.10% and a profit target of 5.00%.

10-year T-bill- Weekly chart

RoboForex

RoboForex Exness

Exness FxPro

FxPro Alfa-Forex

Alfa-Forex Libertex

Libertex FxGlory

FxGlory XM

XM IC Markets

IC Markets Forex.com

Forex.com AXITrader

AXITrader