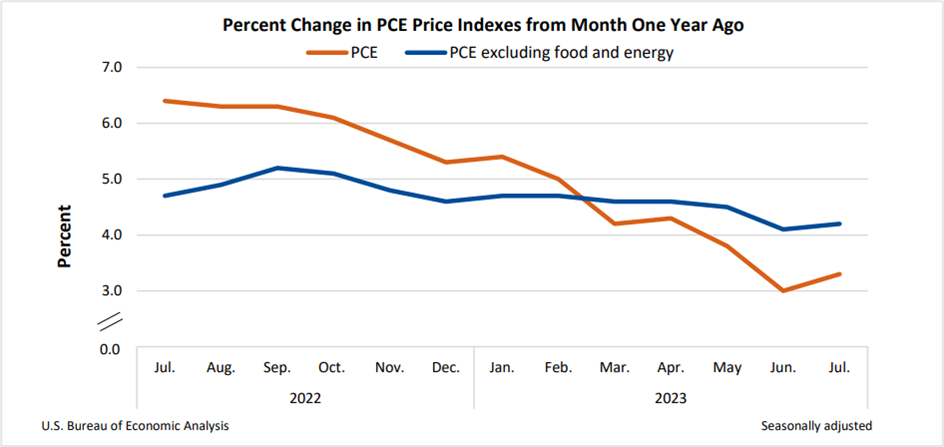

Inflation rose 0.2% on the month and 3.3% from the same time last year

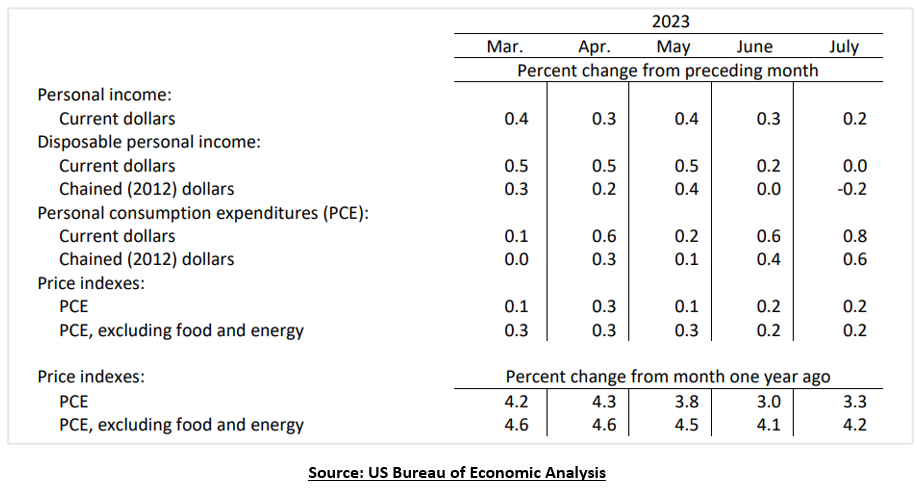

Personal consumption expenditure (PCE), the Fed's preferred inflation gauge, rose 0.2% in July and 3.3% year-on-year, data published by the Bureau of Economic Analysis (BEA) showed. Excluding food and energy prices, the core PCE price index edged 0.2% higher on the month and 4.2% on the year. While the month-on-month headline and core inflation figures were unchanged from June and aligned with Street expectations, the annual inflation numbers climbed from 3.0%, and core inflation rose from 4.1% the previous month.

Month-on-month and annual price increases in goods, services, food, and energy

Compared to June, prices of goods slipped by 0.3%. On the other hand, prices paid for services jumped by 0.4%, food prices rose by 0.2%, and energy prices ticked higher by 0.1%. Year-on-year, the prices of goods dropped 0.5%, and energy prices plunged by 14.6%. Contrarily, prices for services surged 5.2%, while food prices climbed 3.5%.

Meanwhile, the real PCE price index reflected a 0.9% increase in spending on goods and 0.4% on services. The most significant contributors in goods were the other nondurable goods, comprising games, toys, and hobbies. In addition, consumers also spent on recreational goods and vehicles. The biggest contributors to the PCE in the services sector were food services, financial services, insurance, housing, and utilities.

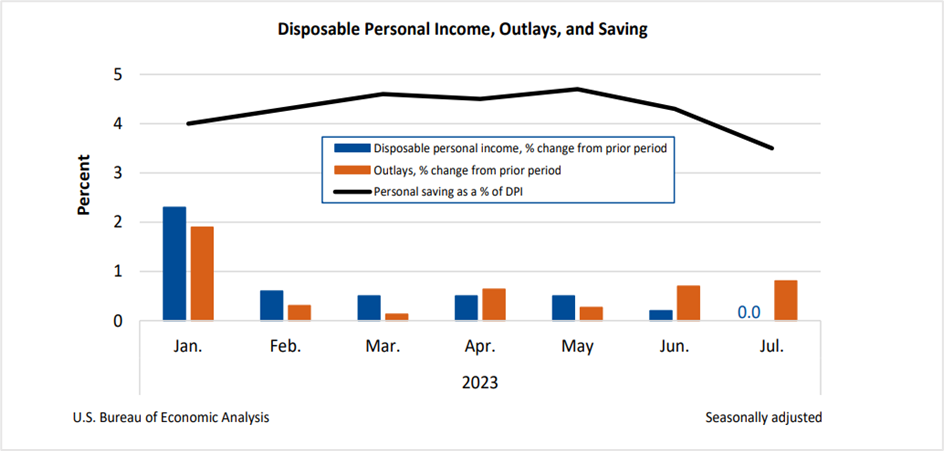

The July PCE inflation data underscores the resilience of consumers, the key drivers of economic growth. After adjusting for inflation, consumer spending surged 0.6% month on month, in line with the retail sales figures announced earlier in August, which showed sales jumped by 0.7% in July compared to the previous month. It comes in the backdrop of personal income rising by a tiny 0.2% and disposable personal income edging higher by less than 0.1% on the month.

Rising prices are a challenge faced by central banks worldwide, and the Federal Reserve was among the first few globally to embark on an interest rate hiking spree last year to curb multi-decade high inflation. Since March 2022, Fed officials have lifted rates eleven times and, in about one and a half years, pushed the benchmark interest rates or the Federal Funds Rate from 0.00%-0.25% to 5.25%-5.50% currently. But despite this, the latest inflation data shows prices have stagnated after falling markedly since peaking last summer but are still way above the 2% inflation target set by policymakers. That's because recent economic data such as GDP, retail sales, and employment have shown that the US economy is holding surprisingly well.

Earlier this week, data from the Commerce Department showed that the US economy expanded at an annual pace of 2.1% in the second quarter from 2.0% in the first three months. Also, on Friday, 31st August 2023, the Labor Department will publish the August nonfarm payrolls and the unemployment rate. According to economists, the US economy is forecasted to have added 170,000 jobs in August from 187,000 the previous month, with the unemployment rate expected to slip from 3.6% to 3.5%.

Analysts' reaction to the July PCE data

George Mateyo, the chief investment officer at Key Private Bank, thinks the PCE report did not show a significant surge in inflation for the Fed to act decisively. However, with a robust labor market and the US economy growing above trend, policymakers might want to believe that inflation is not falling fast enough.

Peter Cardillo, the chief market economist at Spartan Capital Securities LLC, is disappointed with the data, especially with the PCE rising 0.2% month-on-month. He thinks the data is negative for the fragile markets since the Fed is unlikely to change its hawkish stance on interest rates. He expects the current rally to end, and although there's a ray of hope, he anticipates the Fed to hike by 75 basis points in November unless there's a marked improvement in next month's inflation numbers.

Market reaction to the PCE data

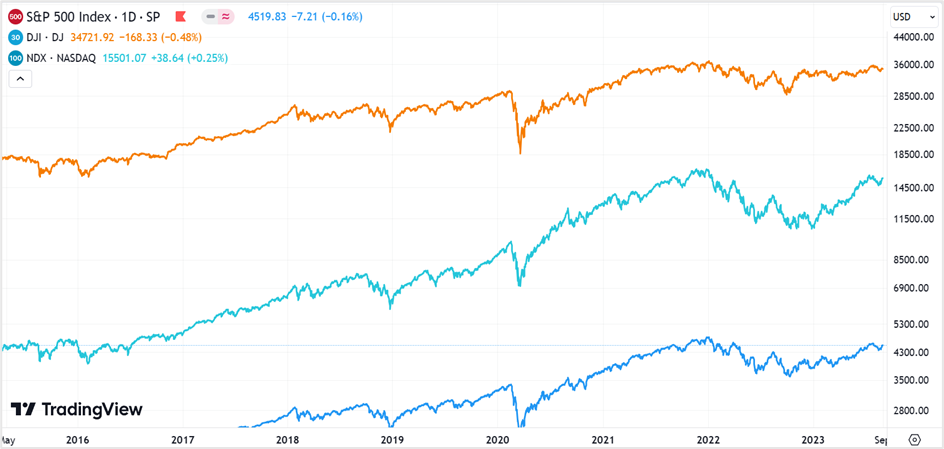

The US equities markets were mixed on Thursday as investors made sense of the PCE price index data and awaited the announcement of the August nonfarm payrolls data later today. The benchmark S&P 500 and the Dow Jones Industrial Average settled lower by 0.16% and 0.48%, capping four winning sessions. On the other hand, the Nasdaq 100 extended gains for the fifth straight day to close at 15501.07, marking the highest close since 1st August 2023.

The US dollar held firm in the currency markets, surging 0.45% against its major counterparts, as the uptick in consumer spending bodes well for the US economy and the greenback, although it might have given the Fed the required ammunition to continue lifting interest rates in September. The US dollar index futures came off a three-session losing streak to close at 103.63 on Thursday. The dollar climbed 0.73% versus the euro, 0.47% and 0.38% against the Japanese yen and the pound sterling, respectively.

US dollar index futures- Daily chart

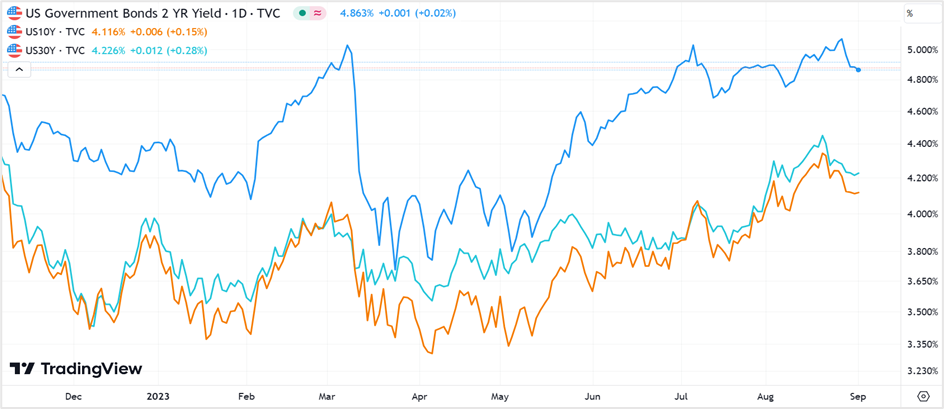

US Treasury yields were lower following the release of the PCE price index data. The 2-year Treasury Note dipped 0.5 basis points to settle at 4.871%, while the yield on the 10-year slid 0.2 basis points to 4.111%, and the 30-year bond yield dropped 1.5 basis points to end Thursday's session at 4.214%.

The slight pullback in the Treasury yields could be because traders are pricing in an 89% chance that the Fed will keep interest rates on hold on 20th September, according to the CME FedWatch Tool. However, with the nonfarm payroll data later today and the August consumer price index (CPI) due in a few days, the market outlook could change dramatically before the next monetary policy meeting.

*Note: The figures could differ slightly from the ones on MarketWatch.

Technical View

Nasdaq futures (September expiry) ended Thursday's session at 15538.50, extending gains for the fifth consecutive day. The tech-heavy index is holding near key trendline support at 15525 ahead of the nonfarm payrolls news on 1st September 2023. Depending on how markets react to the employment data, the index futures could either rally to 15900, illustrated by the green horizontal line, or pull back toward the 14800 levels, the lower end of the blue channel.

The strategy would be to go long on the index futures @ 15525 with a stop @ 15475 for a near-term target of 15850-900. However, if the support is taken out, reverse your trades @ 15475, with a stop loss @ 14560, and exit as the index futures approach 14800.

Nasdaq futures- Daily chart

Crudeoil futures for October delivery rallied 2.45% to settle at $83.63 a barrel on Thursday, the highest close since 9th August 2023. Oil prices have rebounded since hitting troughs in May this year, ending the third month with gains amid tight supply concerns. Prices remain under pressure on news reports that Saudi Arabia will likely extend its one million barrel-a-day production cut into October, while Russia is also expected to announce a deal with OPEC+ members to reduce oil supplies.

On charts, WTI crude is edging higher toward key resistance @$84.90, and a close above the levels could see oil prices rally to $96.00-96.50. However, before making the next move, we expect prices to pull back toward $80.00 a barrel ahead of the mid-September contract expiry. The near-term strategy will be to short WTI crude oil futures @ $84.50-85.00 with a stop loss @ $86.00 for a profit target of $80.00.

WTI crude oil futures- Daily chart

RoboForex

RoboForex Exness

Exness FxPro

FxPro Alfa-Forex

Alfa-Forex Libertex

Libertex FxGlory

FxGlory XM

XM IC Markets

IC Markets Forex.com

Forex.com AXITrader

AXITrader