Energy index jumps 5.6% as all the major energy components indexes soar

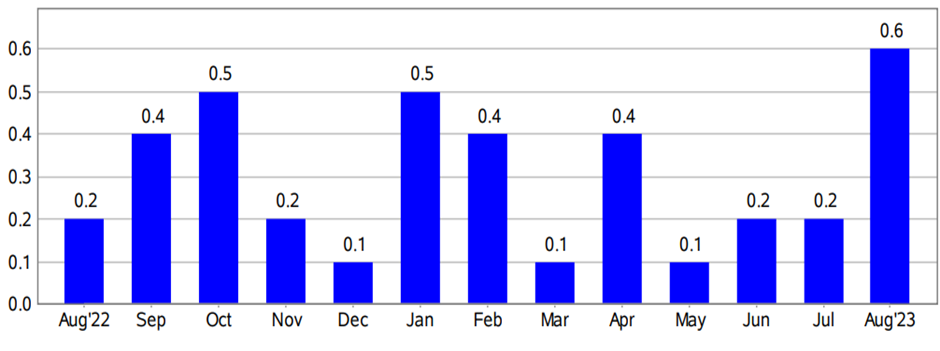

The headline consumer price index, which measures costs across a broad category of goods and services in the US, rose by a seasonally adjusted 0.6% in August from 0.2% the previous month and at an annual pace of 3.7% from 3.2%, the US Bureau of Labor Statistics reported on Wednesday, 13th September 2023. On the other hand, core CPI, which excludes the volatile food and energy prices, advanced 0.3% in August from 0.2% the previous month and at an annual rate of 4.3% from 4.7%. However, despite inflation rising in August, it more or less aligned with Wall Street expectations.

The month-on-month increase in consumer inflation is the most in 14 months as energy prices rebounded in August and continue to hold near 10-month highs after Saudi Arabia and Russia decided to extend their crude oil output cuts for the rest of the year. Meanwhile, the 12-month core inflation rate slipped to the lowest since September 2021 as prices of shelter, new and used vehicles, medical care services, recreation, and apparel pulled back.

July CPI report shows inflation gauge rose 3.2%, less than expected

The inflation Rate in the United States is expected to be 3.50 percent by the end of this quarter, according to Trading Economics global macro models and analysts' expectations. In the long-term, the United States Inflation Rate is projected to trend around 2.50 percent in 2024 and 2.40 percent in 2025, according to our econometric models

Key highlights of the Consumer Price Index (CPI) data-

The gasoline index was the most significant contributor to the increase in the all-urban consumers (CPI-U) report in August, accounting for about half the price surge. The other major contributor was the shelter index, which rose for the 40th straight month. Food prices, represented by the food index, rose by a tiny 0.2%, unchanged from the previous month.

The indexes that registered an increase in August include rent, motor vehicle insurance, medical, and personal care. On the contrary, indexes measuring used cars & trucks and recreation slipped in August. So, to summarize, higher energy prices were the primary reason for the jump in the US August CPI numbers.

Impact of the US August CPI on the Fed's monetary policy decision next week-

After a series of eleven rate hikes in twelve meetings, the benchmark Fed Funds rate is at the highest in 22 years, and many Fed officials believe that inflation is gradually coming under control, although it is still above the central bank's 2% target. But with the headline CPI figure surging to 14-month highs, is inflation slowing down, and how will Fed policymakers react to the news?

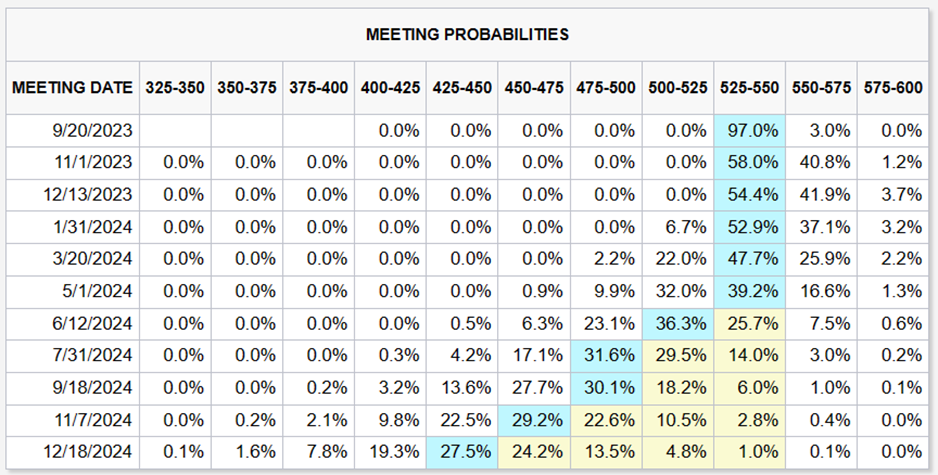

Here's what we know- Oil prices drove the August consumer inflation, so economists are mostly undeterred about the Fed hiking interest rates on 20th September. Also, the CPI data failed to dent the no-rate-hike forecast of Fed Funds futures traders, who overwhelmingly expect policymakers to pause this month, while about 50% anticipate rates to go higher in November and December.

Also, in his speech at Jackson Hole, Fed Chair Powell said that the US central bank would tread cautiously regarding further rate hikes, which many economists saw as an opening that policymakers will hold off on rate increases next week.

However, traders expect annual headline inflation to hold above 3% between now and January, which is not bad, considering oil prices are up about 6% this month and could climb higher amid a surge in winter demand globally. If anything, higher headline inflation will compel the Fed to keep interest rates at elevated levels for longer, and the odds of significant rate cuts next year could be mispriced.

Analysts' response to the consumer price index report

Gargi Chaudhuri, the head of iShares Investment Strategy, Americas, expects the Fed to keep rates unchanged in September. She also predicts policymakers might not resort to more rate hikes during this cycle if the trend continues.

Inflation remains above the Fed's 2% target, so expectations by Wall Street analysts that the Federal Reserve will cut interest rates aggressively next year could be mispriced. At the current rate, she expects rates to remain high for longer.

DeVeere Group's Nigel Green believes that rising consumer inflation will drive policymakers to take a hawkish stance in the future. He expects Federal Reserve officials to start preparing the markets for a rate increase in November.

Chris Zaccareli, the Chief Investment Officer at Independent Advisor Alliance, was disappointed with the 0.3% increase in August core inflation. He believes that although investors anticipated a lower core inflation number, markets will likely trade in a range. He expects high prices will keep Fed officials on their toes and doesn't see a shift in the central bank's narrative.

According to him, if the economy is resilient, inflation remains under control, and we get past the weak months in September and October, stocks could rally into the year-end.

Market reaction to the August consumer price index news

Investors reacted cautiously to the August consumer price index data, with equities mostly ending Wednesday's session with gains after a shaky start. The key US stock benchmarks oscillated in a narrow range for most of the morning as traders digested the news, with some anticipating another rate hike in November. The Dow Jones Industrial Average closed 0.20% lower at 34,575.53, the S&P 500 edged 0.12% higher to 4467.44, and the Nasdaq 100 settled with gains of 0.38% at 15,348.53. So far this month, the three indices are down between 0.40%- 1.00%, building on the previous month's losses of 1.50%-2.00%.

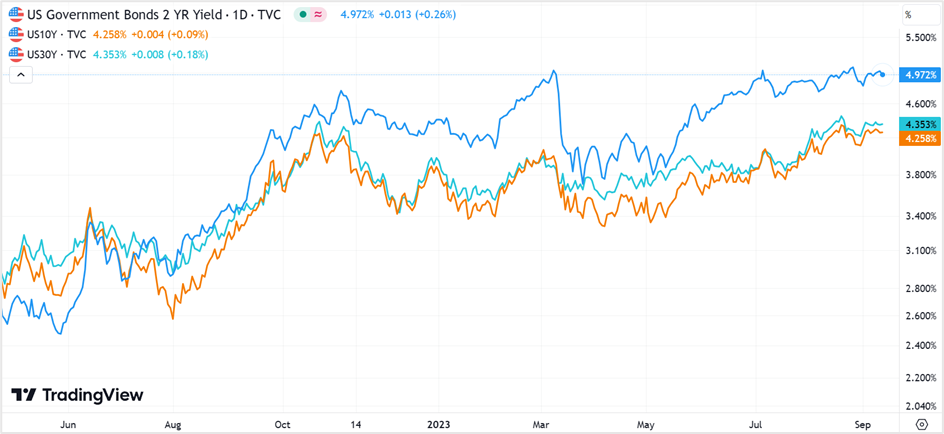

In the US bond market, the yield on the three-month to six-month T-bills edged higher, while the 2-year T-Note slipped below 5% as traders bought the policy-sensitive treasury instrument on expectations that the Fed officials will keep rates on hold in November. According to the CME FedWatch Tool, the chances of a no-rate hike in November rose to 58% on Wednesday, up from 55.8% the previous day.

The US currency ticked higher against its six counterparts in the US dollar index to end the second successive session in the positive on Wednesday. The dollar rose 0.23% versus the euro and 0.25% against the Japanese yen, while it settled almost unchanged against the pound sterling. The greenback gained against its rivals despite expectations that the Fed will pause rate hikes in September.

Technical View

After trading in a narrow $1940-1955 a troy ounce range from the second half of last week, December gold futures broke out of the narrow range on Tuesday, extending losses. The precious metal is in a secondary downtrend, and although prices have not fallen sharply, they will likely drop toward the near-term support at $1920, indicated by the red support line, before rebounding toward resistance @ $1965-1970 (upper red trendline).

The strategy will be to buy gold futures @ $1920, with a stop loss @ $1910 for a profit target of $1960-1965. On the contrary, if prices close below $1920 or slip below $1910, reverse your long positions for a profit target, as the precious metal could dive further to test the long-term support (indicated by the blue trendline) at $1890.

Gold December futures- Daily chart

Tesla rallied more than 10% on Monday, breaking out of a thin trading range after Morgan Stanley upgraded the stock from a HOLD to BUY, raising the price target from $240 to $400.

Adam Jonas, the Morgan Stanley analyst who upped the rating, believes that the Dojo supercomputer, which Tesla is developing, will become a power player in the software-as-a-service market and should easily add another $500 billion in enterprise value to the car manufacturer.

Shares of the EV-maker rallied more than 9% this week to settle at $271.30 on Wednesday after opening the week above key resistance levels at $256.00. However, given the uncertainty about the outcome of the Federal Reserve's monetary policy meeting next week, prices will likely oscillate in the $250-300 range.

Initiate long positions in Tesla @ $251-253 with a stop loss at $244 for a profit target of $290-295. But, if prices continue to rally from the current levels toward the resistance, short the stock @ $297, with a stop @ $305 for a profit target of $250-255.

Tesla- Daily chart

RoboForex

RoboForex Exness

Exness FxPro

FxPro Alfa-Forex

Alfa-Forex Libertex

Libertex FxGlory

FxGlory XM

XM IC Markets

IC Markets Forex.com

Forex.com AXITrader

AXITrader