Food and clothing sales drive recovery, while fuel sales fall amid surging prices

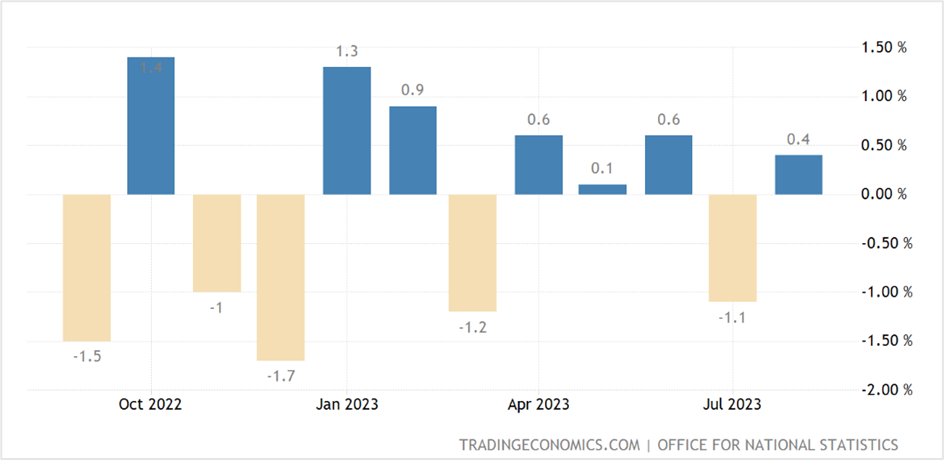

Retail sales volumes in the UK climbed 0.4% higher in August, rebounding from the upwardly revised 1.1% decline in July, data published by the Office for National Statistics (ONS) showed. For the three months ending August 2023, sales rose 0.3% compared to the previous three months.

The growth in sales volumes was led by a 1.2% increase in food store sales compared to a 2.6% decline in July as rains washed out clothing and food sales at supermarkets. Meanwhile, sales at non-food stores rose by a modest 0.6% in August, up from a minus 1.2% the previous month as footfalls fell due to bad weather. On the contrary, volumes from non-store sales comprising online retailers fell 1.3% after surging 1.9% in July as wet weather and discounts boosted sales.

UK Retail Sales- Month-on-month

Key highlights of the UK retail sales report

August retail sales growth in the UK was primarily led by food and non-food stores, with food stores contributing 0.4% and non-food stores 0.2%. On the contrary, non-store retailing and fuel sales declined by 0.2% and 0.1%, correspondingly. Automotive sales volumes slid 1.2% in August amid a sharp increase in petrol and diesel prices. Overall, the percentage of online retail sales compared to total sales dropped to 26.9% in August from 27.4% the previous month.

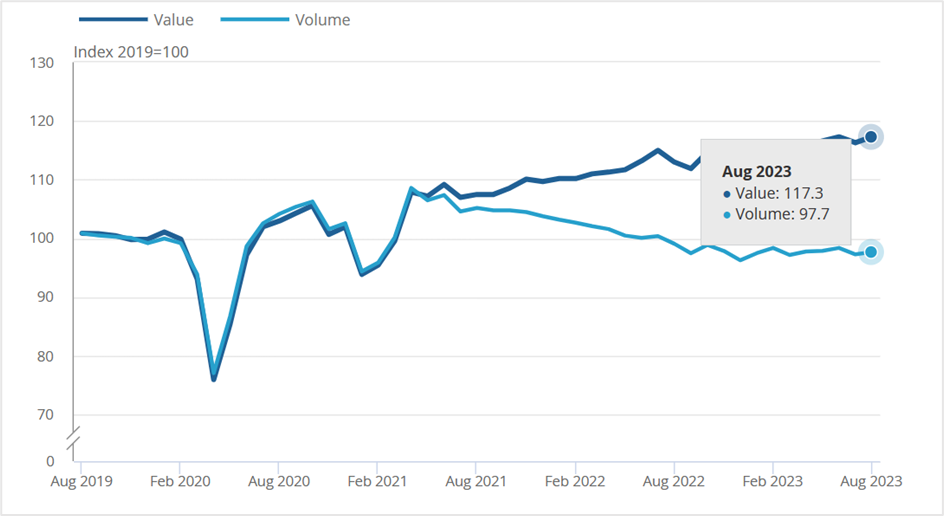

As reported earlier, sales at food stores recovered partially in August, but volumes remained 4.1% below the pre-coronavirus levels in February 2020 as rising cost of living and food prices impacted sales volumes.

In the non-food group, clothing volumes registered a 2.3% jump in August, registering a sharp rebound from the 2.9% drop the month earlier. Meanwhile, household goods stores reported a monthly increase of 1.1% in sales volumes in August, mainly due to an uptick in hardware and furniture stores. On the other hand, department stores and other non-food shops, such as bookshops, reported a 0.4% drop in sales volumes amid a change in consumers’ preferences due to a surge in the cost of living.

The divergence between retail sales volumes and values

According to Heather Bovill, the deputy director for surveys and economic indicators at the Office for National Statistics, sales remained subdued to a large extent, with food and clothing sales driving the partial recovery. However, they were offset by internet sales as people returned to stores following a wet July. However, fuel sales dropped as rising costs hit demand.

It’s not all bad news for the UK economy as the August retail sales showed sales volumes rising for the sixth month this year, meaning consumer demand remains resilient. Also, on Friday, the UK’s GfK consumer sentiment survey for September rose for the second straight month to minus 21, the most since January last year, amid slowing inflation and wage growth. In the meanwhile, the expectations of households about their financial condition ticked higher to minus 2 from minus 3. At the same time last year, the reading was at minus 40 as soaring energy prices suppressed consumer confidence.

Market reaction to the news-

The Financial Times Stock Exchange’s FTSE 100, the UK’s primary stock index comprising the 100 largest companies in terms of market capitalization, ended flat after a volatile session on Friday. The index has been consolidating in the 7640-7740 range over the past few days after rebounding more than 7% from the August lows.

In the Treasury markets, the yield on the UK 3-month government bond (GILT) was at 5.37% on Friday, unchanged from the previous session, while the yield on the 6-month gilt rose 10.2 basis points to 5.537%, and the yield on the 10-year was at 4.246%, down 0.4 basis points.

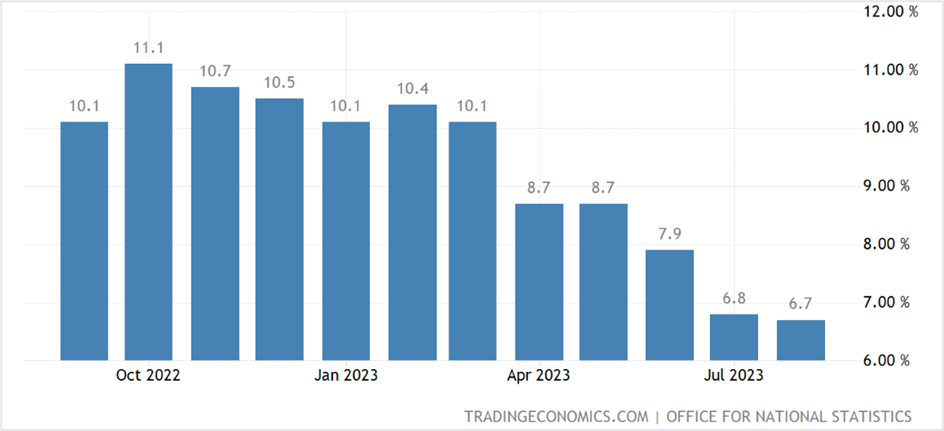

The consumer price inflation in the UK slipped 0.1% to 6.7% in August, the lowest since February 2022 and down from a peak of 11.1% in October last year, but is still among the highest compared to the large economies globally.

UK CPI

The Bank of England left the benchmark interest rate or the ‘Bank Rate’ unchanged at 5.25% by a 5-4 margin on September 21st, maintaining borrowing costs at the highest since 2008. In their statement, the monetary policy committee said they expect inflation to decline substantially in the near term but have left the window open to more rate hikes if necessary. The 3 and 6-month gilts more or less represent the current interest rates in the UK.

In the currency markets, the British pound fell against the US dollar and the euro, while it was almost unchanged against the Japanese yen on Friday.

UK’s currency slid 0.48% versus the greenback on Friday to settle at 1.2234, the lowest close since March 24th. Against Europe’s single currency, the pound fell 0.32% to 1.1492, registering the weakest settlement since May 25th. Meanwhile, the sterling held firm against the yen to end Friday’s session at 181.60, holding near one-and-a-half-month lows.

Technical View

The FTSE 100 closed at 7683.91 on Friday, almost flat for the day, but was down 0.36% week-on-week. The index has been oscillating in the 7640-7740 range (the horizontal purple lines) over the last six trading sessions, with an upside breakout likely to drive prices toward the April highs of 7940- the green resistance trendline. On the downside, the index is holding around near-term support at 7665 after breaching it briefly on Friday. A close below 7665 could push prices toward the next support at 7540-7550. Meanwhile, the RSI is pointing at negative divergence, an indication that the index might likely drop in the near term.

The strategy will be to wait for the index to drop to 7540-7550 before going long on the index futures. Maintain a stop loss at 7500 and exit as prices approach 7640. Long positions on the index futures can also be initiated if the FTSE 100 breaks 7800 or closes above 7750. Place your stop loss at 7700 and exit at 7940.

FTSE 100- Daily chart

The GBPUSD pair fell for the third consecutive day on Friday to close at 1.2234, the lowest settlement since March 24th. The UK currency has been falling incessantly against the greenback, ending the last eight out of ten weeks lower.

Despite the massive drop, expect further downside, with the pair likely to test support at 1.2190 levels- the lower red trendline, before rebounding toward the near-term resistance at 1.2310. Also, the RSI is in the oversold zone, indicating that a short-term bullish reversal might be just around the corner.

The trading strategy will be to go long on the pound sterling at 1.2190, with a stop loss at 1.2150 for a profit target of 1.2300.

GBP/USD daily chart

RoboForex

RoboForex Exness

Exness FxPro

FxPro Alfa-Forex

Alfa-Forex Libertex

Libertex FxGlory

FxGlory XM

XM IC Markets

IC Markets Forex.com

Forex.com AXITrader

AXITrader