In the world of forex trading, the rise of artificial intelligence (AI) is like a tsunami on the horizon – it's coming, and there's no stopping it. And at the forefront of this AI wave is ChatGPT, an advanced language model that's changing the game for traders.

With its ability to process vast amounts of data in real-time and provide customized insights, ChatGPT is like a supercharged speedboat in a sea of trading tools.

But as ChatGPT and other AI tools become more prevalent in the forex industry, a question arises: is this the end of human forex traders?

Will they be swept away by the AI tsunami, left clinging to their outdated trading strategies?

In this article, we'll explore the rise of ChatGPT and its impact on the forex industry, as well as the advantages of AI over human traders. We'll also examine the limitations of human traders in an AI-dominated world, and discuss the potential for AI and human traders to work together in a hybrid model.

So sit tight, traders – the AI tsunami is coming, but with the right tools and strategies, you can ride the wave to success.

The Bot Invasion: Is the End of Human Forex Traders Near?

Did you know that a staggering 92% of trading in the Forex market is now conducted by trading algorithms rather than human traders?

That's right – the bots have taken over.

Most retail traders don't have the coding chops to create their algorithmic trading bots. That's where AI comes in. With every passing month, new AI-powered trading tools are hitting the market, making it easier than ever for traders to automate their trades and make some serious money.

While it's true that AI and machine learning are changing the game when it comes to forex trading, there's still plenty of room for human traders to thrive. The rise of algorithmic trading has created new opportunities for traders who can adapt to the changing landscape.

The Future of Forex Trading: AI-Powered Algo Strategies for Retail Traders

As AI and machine learning continue to evolve, traders are finding new and innovative ways to incorporate these technologies into their trading strategies. One approach is to create your own AI algo trading strategy, which can be done with the help of software like chatGPT.

Traditionally, most traders would have to rely on their coding skills to create their algorithmic trading strategies. However, with the emergence of AI chatbots, traders can now generate strategies without having to write a single line of code.

While some knowledge of coding languages like MQL for MetaTrader or PineScript for TradingView may still be useful, chatGPT allows you to create algorithmic trading strategies with zero coding knowledge.

Using AI language-learning models, chatGPT can translate casual, written-word prompts into algorithmic trading strategies.

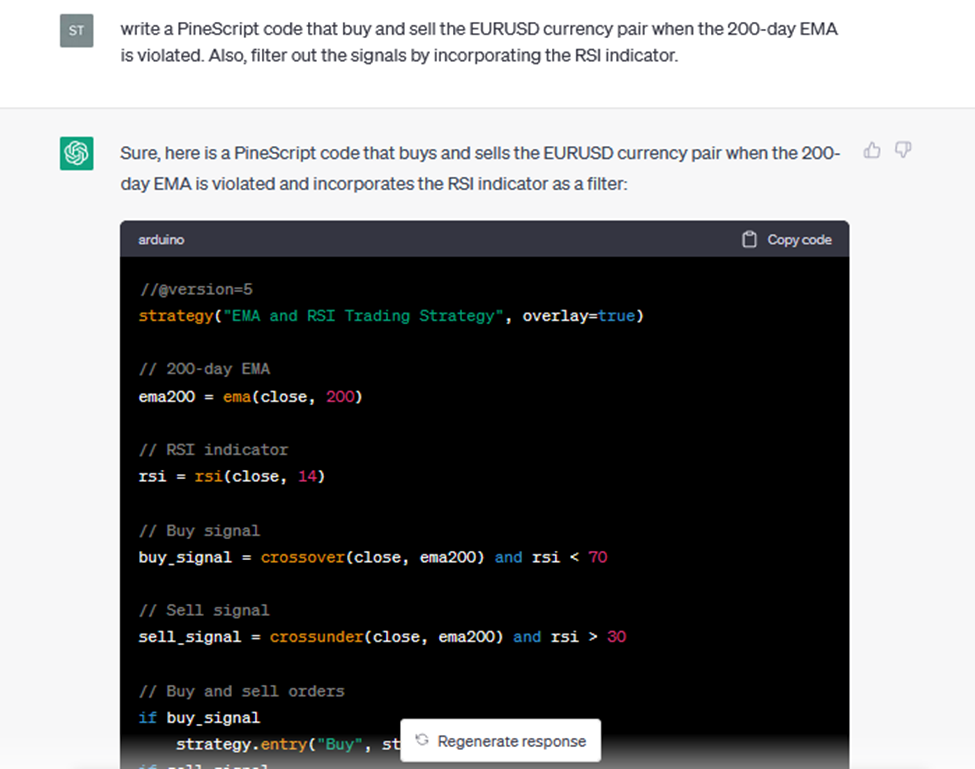

Example of chatGPT prompt: “Write a PineScript code that buys and sells the EURUSD currency pair when the 200-day EMA is violated. Also, filter out the signals by incorporating the RSI indicator.”

Source: OpenAI’s chatGPT

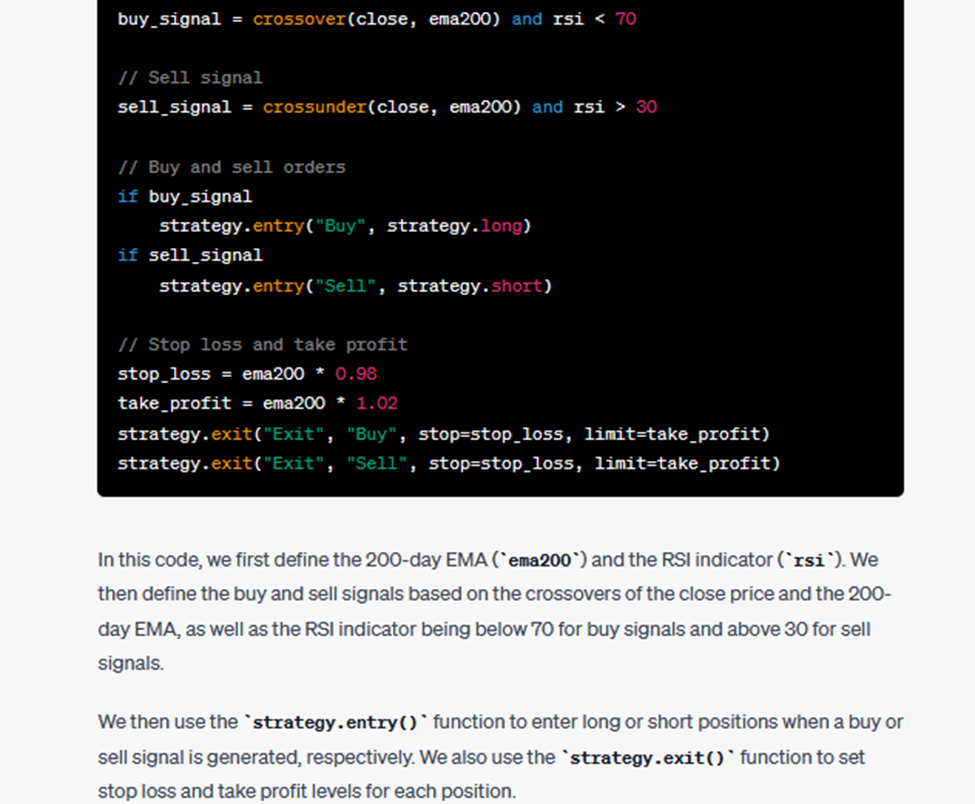

Even if we didn’t specify the trade condition for the RSI indicator, chatGPT intuitively added the right parameters.

Source: chatGPT

But creating a forex trading strategy is only the first step as backtesting and live account integration are also critical components of successful trading.

AI and Forex Trading: The Perfect Match for Profitable Trades

As the technological leaps of artificial intelligence continue to push the envelope, the impact of AI on forex trading is undeniable. AI has the power to connect forex traders with predictive analytical tools that can provide deep insights into the market. These intuitive software pieces can inform trades, optimize execution and minimize the risk of emotive or impulsive trading.

But it doesn't stop there.

AI technology can unlock the potential of previously inaccessible and unstructured data sources such as social media sentiment analysis. Sophisticated tools can collect and analyze unstructured datasets to identify viable patterns and trends, making it easier for traders to gauge what the crowds are doing.

By enabling subtle improvements in decision-making and trade execution, AI can help traders unlock higher and more sustainable profits over time. This has the potential to impact the statistic that 80% of forex traders lose money on average each year.

The Downsides of Relying on AI Chatbots like ChatGPT for Forex Trading Strategies

Although ChatGPT has the potential to revolutionize the way traders approach algo trading, it's not a perfect replacement for traditional algo trading software. As with any new technology, there are limitations that traders should keep in mind.

Traders have already reported inaccuracies while testing the software, and even OpenAI's CEO, Sam Altman, has cautioned against relying on ChatGPT for anything important.

You need to feed chatGPT the right data

Keep in mind that ChatGPT was not originally intended for trading purposes, and it wasn't created by traders either. As a result, several issues can arise when using AI to create algo strategies. An instance where ChatGPT falls short is in its understanding of the forex market. So, traders must input all the necessary information into the chatbot to ensure that they get a trading strategy that works.

ChatGPT's knowledge is still limited to 2021 data

Another limitation is that ChatGPT cannot conduct quality assurance on the strategies it develops, since the AI does not have access to recent market information.

No integration into trading platforms

Furthermore, there is currently no easy way to integrate ChatGPT into trading platforms, which means traders will have to completely transfer over any programming code that is generated by the chatbot.

Restricted access

OpenAI has launched a subscription plan for ChatGPT, which suggests that free users may not have complete access to the AI software in the future.

Final Thoughts

As the adoption of AI becomes more widespread, even retail traders are starting to recognize its value. The ability to leverage the power of AI to develop and implement trades has become an invaluable tool for traders. And with further advances in AI technology, it's only a matter of time before we see even more innovative uses of chatGPT in the forex market.

It's an exciting time to be in the forex market, and the future looks bright with AI leading the way.

Find the right forex broker in 2023 for your needs and start taking advantage of the power of AI in forex trading today with our multi-functional table. Our table ranks brokers based on a variety of factors, including fees, trading platforms, customer support, and more.

RoboForex

RoboForex Exness

Exness FxPro

FxPro Alfa-Forex

Alfa-Forex Libertex

Libertex FxGlory

FxGlory XM

XM IC Markets

IC Markets Forex.com

Forex.com AXITrader

AXITrader