Everybody's been talking about Chat GPT lately, but what exactly is it, and how can it affect algo trading?

First off, let's address the elephant in the room – new technology always brings up some fears and concerns. Despite the excitement surrounding the possibilities of AI in trading, there remains a healthy dose of skepticism amongst some traders as to its true potential.

As a trader, you must be aware that automating trading can significantly improve your performance by removing emotions from the decision-making process.

However, the most challenging part is executing the automation and putting your trading strategy into an algorithm that works. If you are a trader who understands the benefits of removing emotions from trading, then you know that coding your strategy into a bot is the way to go.

But let's face it, coding can be a daunting task, especially if you're not a computer science expert.

However, with OpenAI and chat GPT, coding has never been easier. You now have an assistant who can guide you step-by-step through the process of building, executing, and optimizing your automated trading strategies.

Chat GPT And Algo Trading

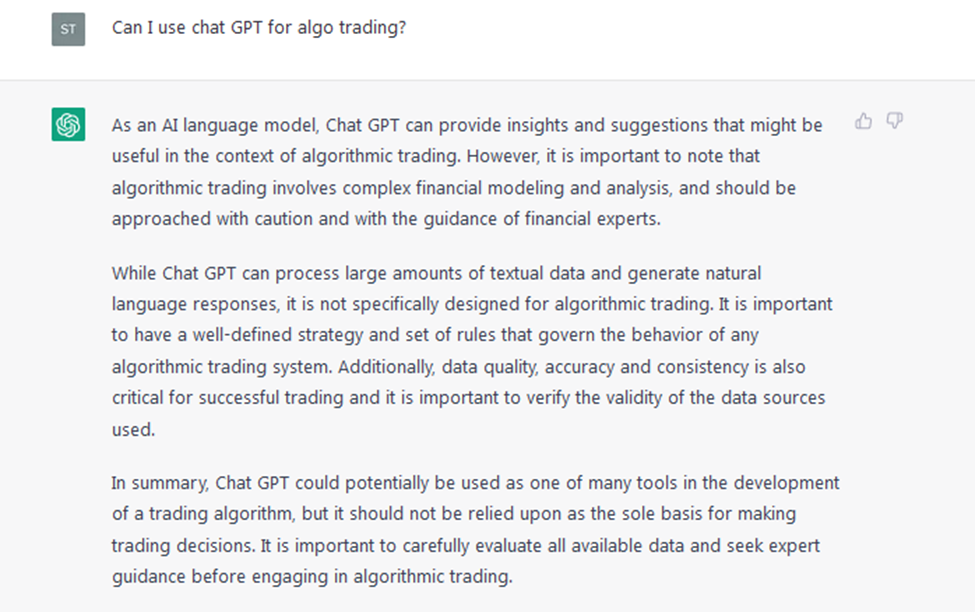

To test it out, we asked Chat GPT a few questions to gauge its capabilities, and we wanted to see what it could do for algo trading.

We were pleasantly surprised by its response when we asked, "Can I use chat GPT for algo trading?" – it was intelligent and accurate.

Based on that, we decided to ask it to build us a trading strategy.

But first, let’s define what is algo trading and how chat GPT works.

What Is Algo Trading?

Algo trading, or algorithmic trading, is the practice of using computer programs and algorithms to conduct trades on the stock market, forex market, cryptocurrency market, etc. With algo trading, traders can create a set of predefined rules, ranging from simple to complex models that analyze a wide range of market data.

But what are the benefits of algo trading?

Well, for one, it's lightning fast. Trades can be executed much more quickly than a human trader could manage. This makes algo trading especially advantageous in fast-moving markets or when there is a high volume of trading activity.

Secondly, algo trading puts the brakes on emotional biases that can throw you off your trading game.

How?

By following preset rules, that's how!

This way, impulsive decisions based on fear or greed are kicked to the curb. But, before you get too excited, let's not forget that there are some factors to consider when it comes to algo trading.

First off, there's the upfront investment and expertise required to get the necessary infrastructure up and running. You'll need high-speed computers and some fancy software – which, let's be real, can come with a hefty price tag.

And that's not all!

The accuracy of algo trading can be influenced by factors like data quality and market conditions.

So, what's the takeaway?

Well, algo traders must keep their eyes on the prize and remain ever-vigilant, continuously monitoring and adapting their strategies to get the best results. Because let's face it, with all the potential challenges, it's not always smooth sailing!

How Does ChatGPT Work?

Chat GPT works by using machine learning to analyze a trader's specific needs and objectives. Once it has a clear understanding of the trader's goals, it generates code that's tailored to its trading strategy.

This means that traders can build a bot that is customized to their unique trading approach, without requiring them to learn how to code.

However, to ask the right chat GPT questions, you have to be able to understand what the code does if you want to have an overall positive experience with the AI technology.

But, even with no coding experience, by simply following the extra explanations from chat GPT, all traders no matter their level of experience can build their algorithmic trading strategy.

Can We Use ChatGPT For Trading?

Well, it's not exactly a straightforward answer.

While ChatGPT is undoubtedly an impressive and highly intelligent tool, certain limitations must be considered. For example, it lacks access to the internet or any information that predates 2021, which severely limits its ability to provide accurate and timely trading advice.

Furthermore, as ChatGPT itself warns, it cannot provide personalized financial advice, which means that traders must exercise caution when relying on its recommendations.

Given these limitations, it is clear that ChatGPT cannot be relied on as a sole source of trading guidance, especially when it comes to making critical decisions in real time.

However, that does not mean that it is completely without value to traders.

By leveraging ChatGPT's impressive analytical capabilities and integrating them into a more comprehensive trading strategy, traders can still benefit from its insights and enhance their overall performance in the markets. As with any tool, the key is to use it wisely and in conjunction with other resources to achieve the best possible results.

That being said, traders already use AI tools specifically designed to execute trades, a process known as “algo trading.”

Looking for a reliable forex broker to support your algo trading strategy? Visit our comparing best forex brokers page and find the perfect match for your needs.

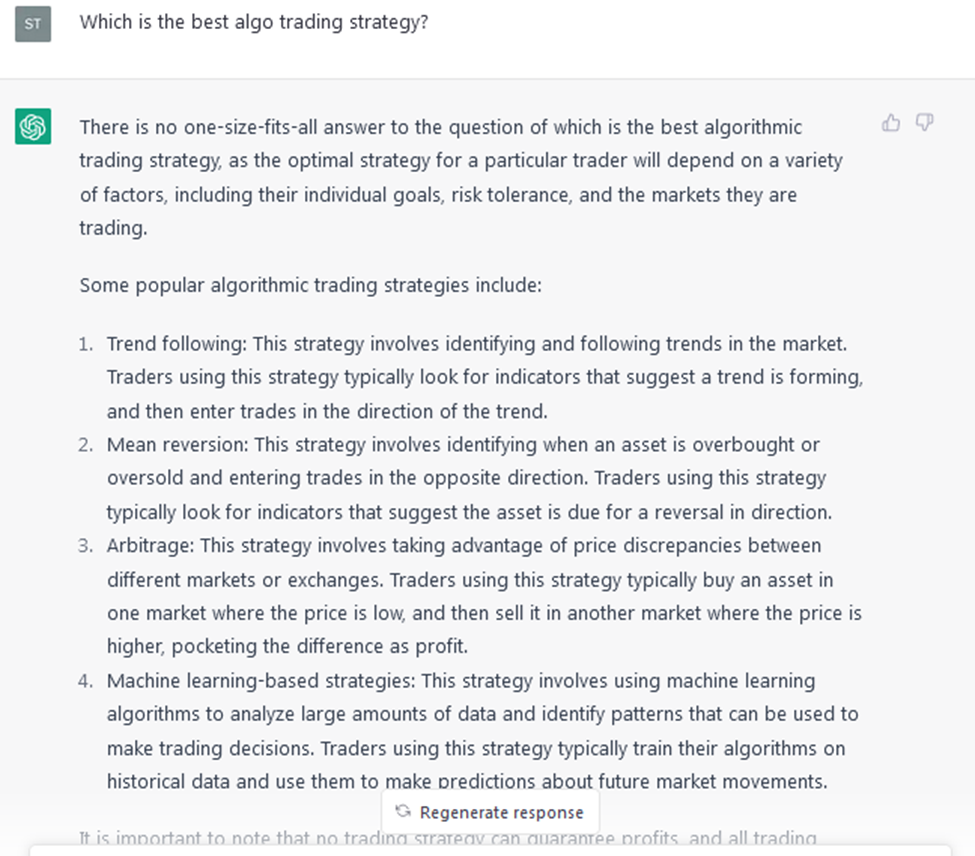

Which Is The Best Algo Trading Strategy?

We asked chatGPT “Which strategy is best for algo trading?” The AI platform responded with 4 of the most popular algorithmic trading strategies including:

-

Trend following strategies

-

Mean reversion strategies

-

Arbitrage strategies

-

Machine learning-based strategies

See the full response below:

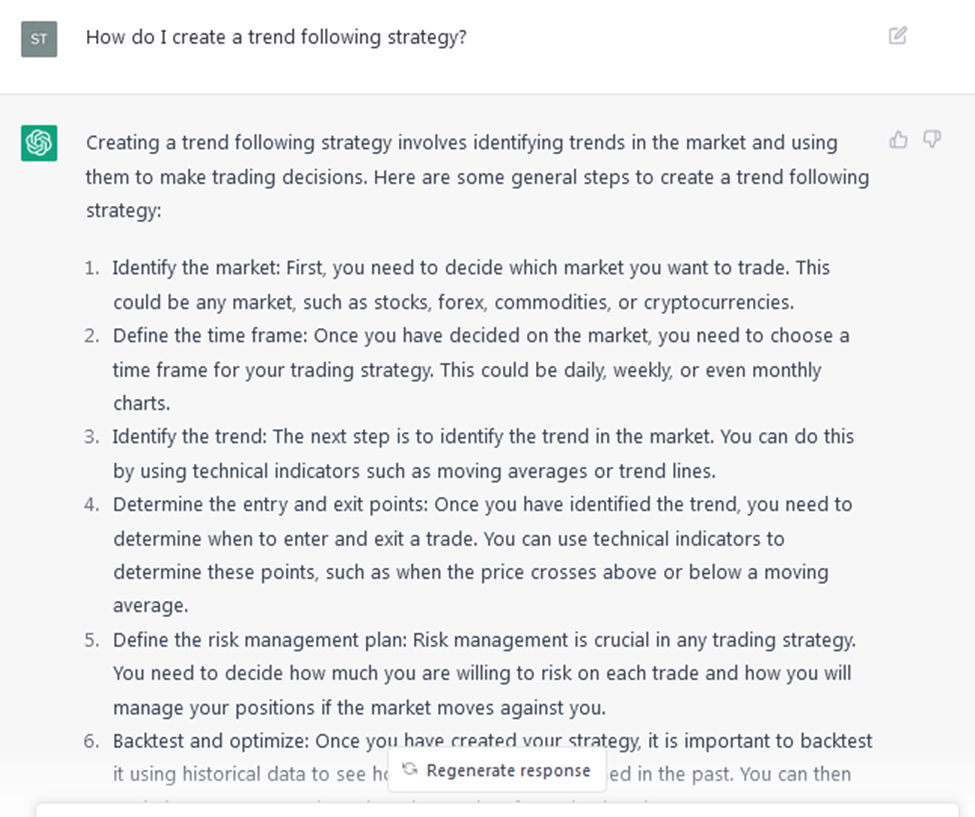

We followed up with a second prompt and asked:

“How do I create a trend following strategy?”

The response we received was very detailed and incorporated a step-by-step guide on how to create a trend-following system:

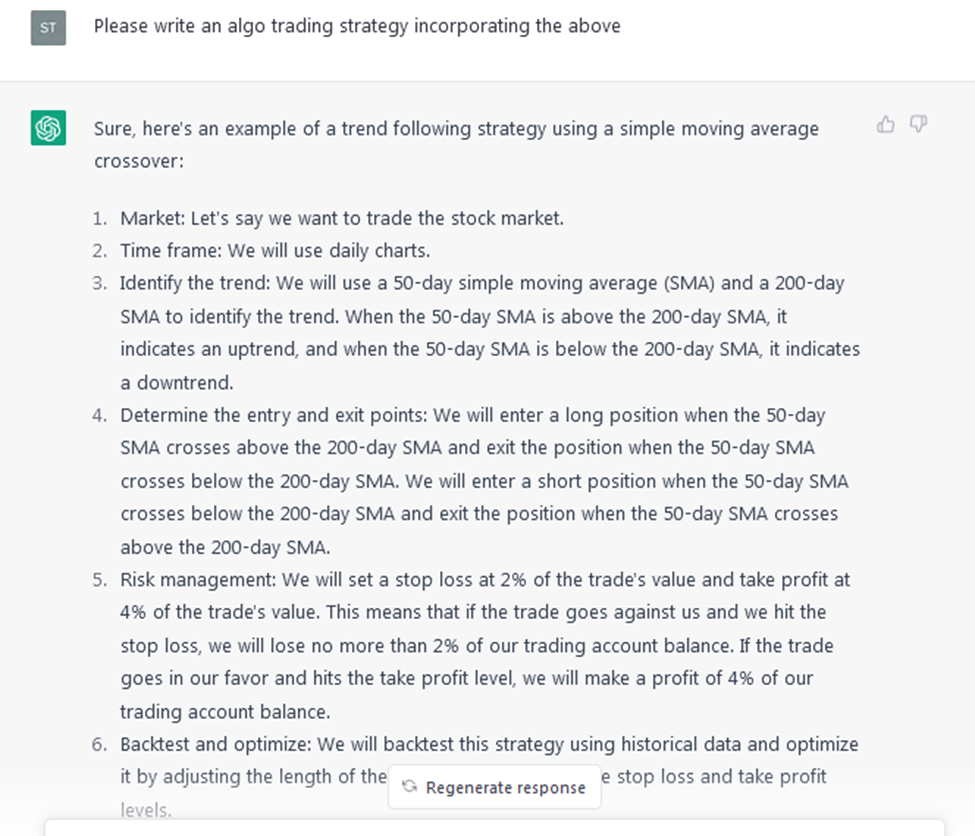

Based on that, we asked chatGPT to:

“Write an algo trading strategy incorporating the above.”

And, while we were expecting to receive an algorithmic code, chatGPT gave us an example of a trend-following strategy using a simple moving average crossover.

While Chat GPT shows promise in the world of algorithmic trading, it is not without its limitations. The first issue is that chatGPT users need to play around with different prompts based on the responses they receive to get the desired outcome.

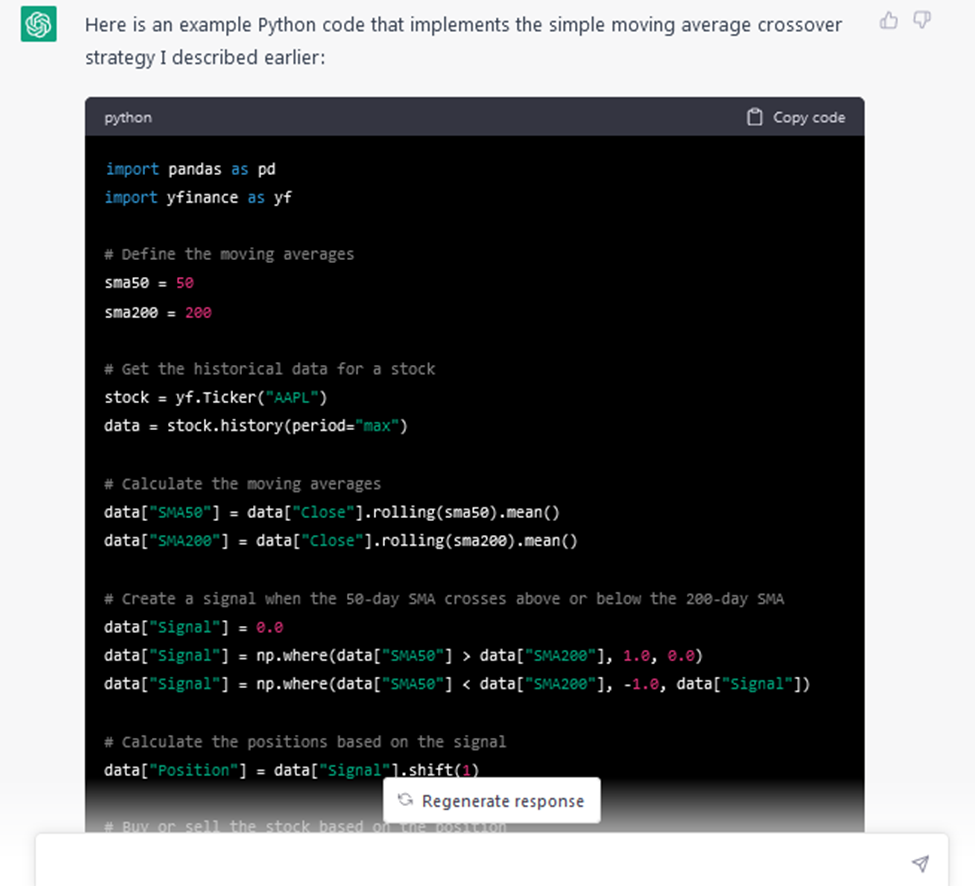

To finally make chat GPT generate the algo code, we followed up with a third prompt:

“Please write a Python algo that implements this simple moving average crossover strategy.”

Here is the chatGPT response to our query:

Keep in mind that this is just an algo implementation of a simple moving average crossover strategy and should be thoroughly tested and optimized before using it in a live trading environment.

The second issue is that chatGPT users need to continue building on whatever algorithmic code they receive because most of the time they are incomplete.

For example, the system Chat GPT came up with was a simple moving average type system but didn’t have a stop loss or a profit target.

So chat GPT users need to continue interacting with the AI platform to improve the algo trading strategy.

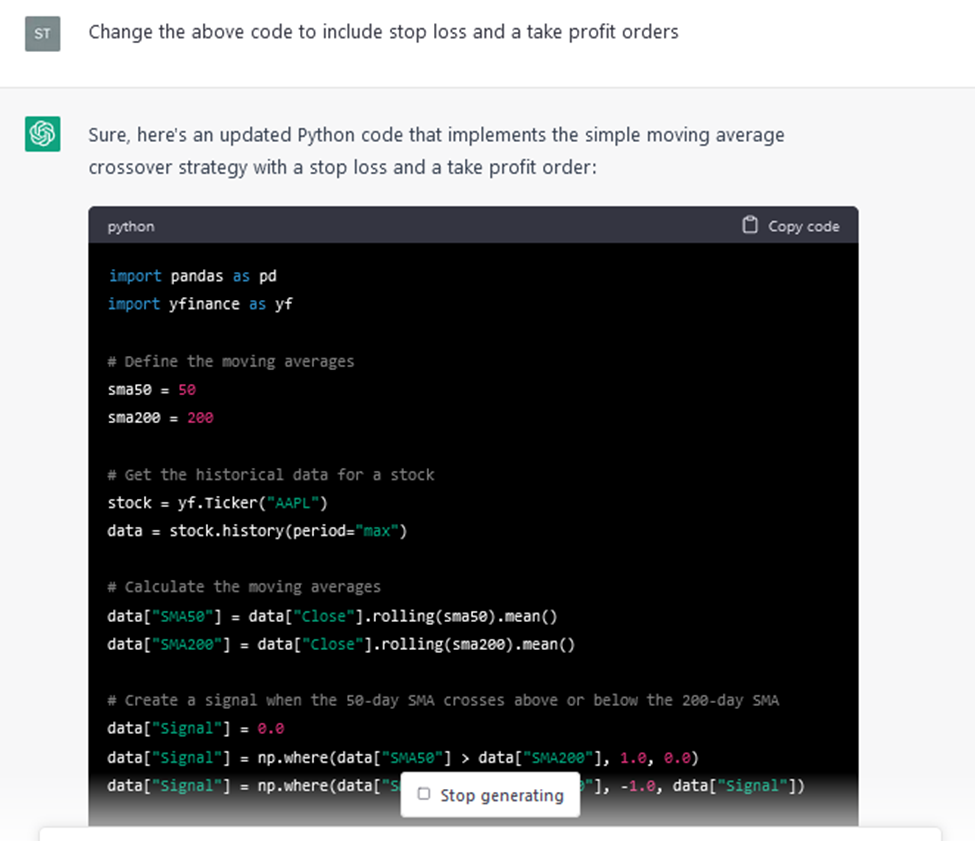

To have a fully usable algo trading system, we asked the chatBot to:

“Change the above code to include stop loss and take profit orders.”

And, in a matter of seconds, chatGPT updates the Python code to include SL and TP orders.

Traders can be more specific than that and feed chatGPT with the actual strategy for taking profits and hiding protective stop losses, instead of relying on whatever the AI platform comes up with.

Does Algo Trading Work In Forex?

So, you want to know if algo trading works in the Forex market, right?

Well, let us tell you, it definitely can!

Say you're a Forex trader looking to make informed decisions based on market data. With algo trading, you can develop an algorithm that analyzes technical indicators like moving averages, stochastic oscillators, and Bollinger Bands, you can also define rules for entry and exit points, stop-loss levels, and profit targets.

But how do you know if it's working?

Test it on historical Forex data, make adjustments, and test it on live market data to see how it performs in real time.

Assuming your algorithm performs well, you can then use it to execute trades in the Forex market automatically, 24/5. The algorithm can monitor the market and make trading decisions based on your rules, so you can sit back and relax while it does the work for you.

What percentage of volume is algorithmic trading?

According to Bank of International Settlement (BIS) research it’s estimated that 70% of total spot forex market turnover globally is generated by algorithmic trading.

If you’re trading forex, chatGPT, and Open AI can guide you along the way to develop your forex algo trading strategy starting from a simple trading idea.

Example Of Forex Algo Trading Using ChatGPT

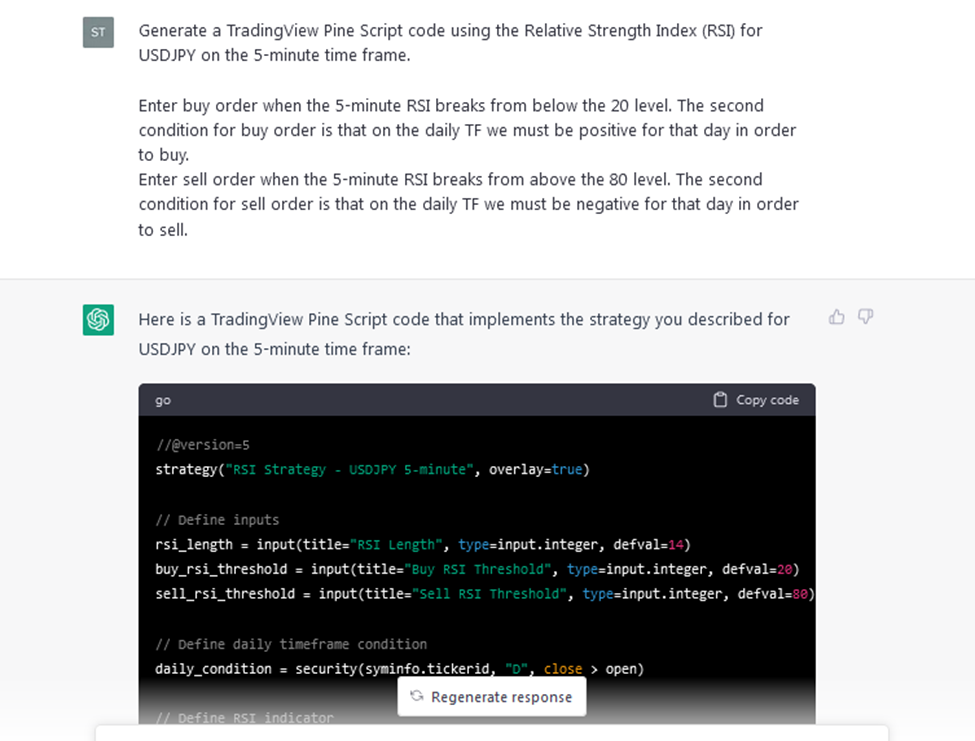

For this example, we asked to chat GPT to generate a TradingView Pine Script code using the Relative Strength Index (RSI) for USDJPY in the 5-minute time frame.

Here is the chatGPT response:

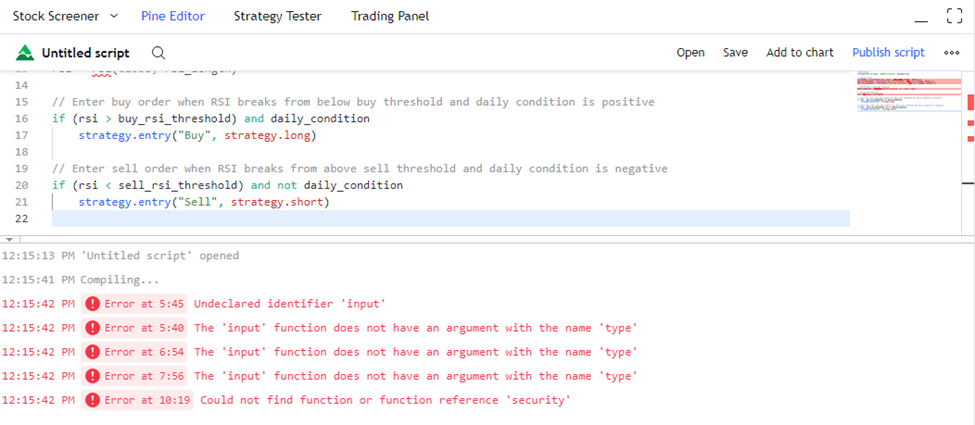

Unfortunately, when we ran the Pine Script the code was incorrect as we encountered some execution errors.

However, the good news is that even if you have no coding experience and don’t know anything about how to resolve script errors, traders can simply go back to chatGPT and feed the AI platform the exact script error to fix it.

Traders may need to go back and forth a couple of times with chatGPT before they get the algo trading strategy working properly.

Or, if you’re lucky you can have your algo trading script working error free from the first try.

Final Thoughts

In conclusion, OpenAI, and chat GPT have made coding trading strategies more accessible than ever before. The traders who are going to master chat GPT and algo trading will win in the long run because it provides a more systematic approach rather than trading based on emotions.

Looking for the best forex broker to implement your trading strategies with? Check out our comprehensive comparison page of the top forex brokers in 2023.

RoboForex

RoboForex Exness

Exness FxPro

FxPro Alfa-Forex

Alfa-Forex Libertex

Libertex FxGlory

FxGlory XM

XM IC Markets

IC Markets Forex.com

Forex.com AXITrader

AXITrader