However, the mixed data showed an increase in the jobless rate and a drop in wage growth

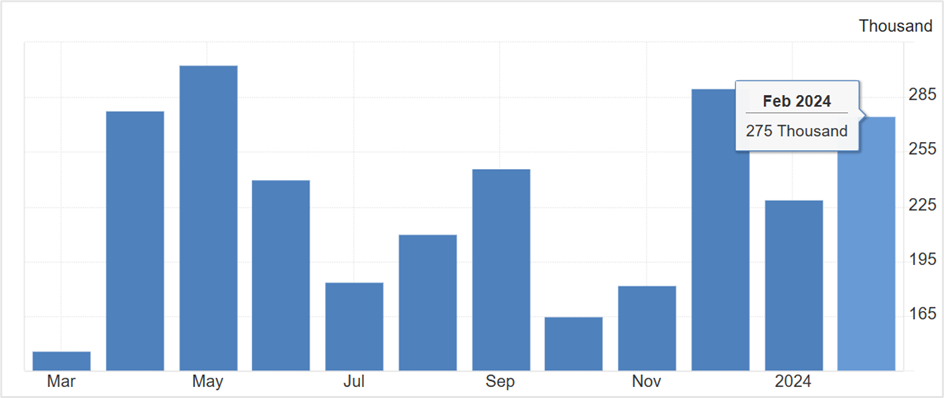

The US economy added 275,000 new jobs in February, above the 12-month average of 230,000 and way higher than economists' forecasts of 198,000. The monthly data from the US Bureau of Labor Statistics showed increased employment across healthcare, food services, government, social assistance, transportation, and warehousing. However, the sharp increase in the payroll numbers was somewhat offset by a rise in the US unemployment rate to 3.9% from 3.7% in January and 3.6% a year earlier, even as wage growth moderated. In addition, job growth in December and January was revised lower from 333,000 to 290,000 and 353,000 to 229,000, respectively. The revision in the previous months' payroll figures and the tepid wage growth in February cheered investors, keeping alive hopes of an interest rate cut by the Federal Reserve in June.

In the meantime, the 'real unemployment rate,' an alternate gauge of the employment rate, which includes discouraged workers and those choosing part-time jobs for economic reasons, rose to 7.3%.

Source: Trading Economics

The nonfarm payroll employment comprises the household and establishment surveys, with the former measuring the labor force's status and the latter gauging employment, wages, and industry-wise earnings.

According to the household survey, the number of unemployed rose by 334,000 to 6.5 million in February from 6.0 million a year back, driving the unemployment rate to 3.9% from 3.6% during the corresponding period. The survey also disclosed that the labor force participation rate was unchanged at 62.5% for the third consecutive month, with little movement in the employment-population ratio.

The key sectors contributing to the job gains in February were healthcare (67,000), government (52,000), food services and drinking places (42,000), social assistance (24,000), construction (23,000), transportation and warehousing (20,000), and retail trade (19,000). On the other hand, the establishment survey showed that employment barely changed in mining, oil and gas, manufacturing, whole trade, and financial services.

Coming to earnings, the average hourly compensation for employees on private nonfarm payrolls rose by 0.1% last month, a sharp drop from the 0.5% increase in January and below economists' estimates of 0.2, while the average workweek for staff ticked higher by 0.1%, month-on-month.

With the payroll numbers out of the way, markets will focus on the February US Consumer Price Index (CPI) report due on Tuesday.

Market reaction to the February labor statistics report

The US equities markets fell on Friday as profit booking in tech stocks drove the key stock indices lower. The Dow Jones Industrial Average slid 0.18%, the S&P 500 declined 0.26%, and the Nasdaq 100 fell 1.53% as semiconductor stocks plummeted after a solid rally over the past few months. Some big losers included Marvel Technology Inc., Broadcom Inc., Nvidia Corp, AMD Inc., and Monolithic Power Systems Inc. But despite the overbought conditions in the broader markets and last week's pullback, many investors remain bullish on equities, although some see Friday's decline extend a bit more.

Among them is Scott Wren, a senior global market strategist at Wells Fargo Investment Institute in St Louis. He believes that markets fell on Friday as investors took a little money off the table, and he doesn't rule out a 5-10% drop in equities over the next couple of months.

Treasury yields ended mostly lower on Friday but were off the session lows after the Labor Department report showed the unemployment rate climbing to 25-month highs in February despite the US economy adding more jobs. The yield on the 2-year Treasury note fell 2.8 basis points to 4.478%, the yield on the benchmark 10-year TNote slid 0.8 basis points to 4.079%, while the 30-year TBond yield rose by 0.9 basis points to 4.255%.

The chief investment officer at Key Private Bank, George Mateyo, thinks the February labor statistics report is mixed, with some indicators showing strength while others remained weak. He believes the labor market is healthy but not strong enough for Federal Reserve policymakers to change their interest rate outlook.

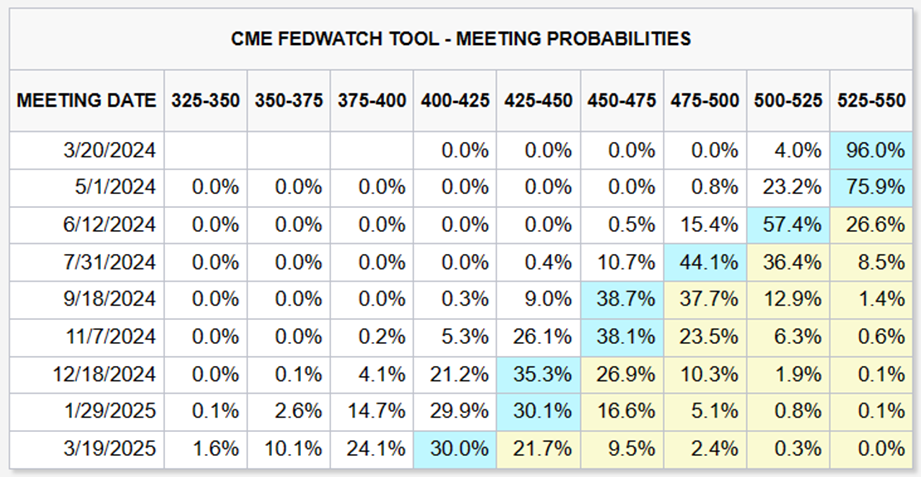

Meanwhile, the mixed jobs report did not alter the view of Fed Funds Futures traders, who continued to price in a 57.4% chance of a 25-basis point rate cut in June, data from the CME FedWatch Tool showed.

Source: CME Group website

The US dollar slid against its counterparts in the currency index on Friday, extending losses for the sixth straight session as the mixed labor statistics data and the easing tensions in the Middle East weakened demand for the reserve currency.

The US dollar index (DXY), a gauge of the greenback's strength against its six counterparts, slipped 0.11% to 102.71 to register the lowest close since January 15th. In addition, a pullback in equities after a strong start and a drop in Treasury yields boosted liquidity demand for the dollar, driving it lower.

Unless something changes drastically on the inflation front, currency strategists expect the US dollar to continue drifting lower amid expectations of a rate cut in the first half of this year.

Meanwhile, the Japanese yen pulled back from more than three-decade lows against the US currency last week to surge to the highest since February 3rd amid reports that central bank policymakers might exit the negative interest rate policy at this month's meeting.

Technical View

S&P 500 March futures (ESH24)

The index futures ended Friday's session at 5192.50, up 0.60% on the day and 0.90% on the week. The benchmark stock index registered its third successive weekly gain and the eighth in nine, primarily led by a massive rally in tech stocks. However, Friday's pullback could lead to a further downside, with the S&P 500 futures likely to test the near-term support zone at 5100-5150. On the upside, the immediate resistance is at 5268, the 50% Fibonacci retracement level, followed by 5368 and 5550.

Trading strategy:

Go long on the index futures if it dips to 5100-5130, with a stop loss at 5100 for a profit target of 5260. Ensure to trail your profits.

Click the link to view the chart- TradingView — Track All Markets

Amazon Inc (AMZN)

Shares of Amazon fell 1.61% last week to close at $175.35, registering its first weekly loss in three amid a broader market selloff. The pullback from the November 2021 highs has pushed the stock toward the near-term support zone at $170.00-174.00, signaling a short-term BUY entry. A close below the level could lead to further downside, with Amazon likely to test $160.00 very quickly, with the probability of the stock falling as low as $140.00.

However, if the stock holds the support, the gains could extend to the top end of the long-term bullish channel and all-time highs of $188.00-190.00 and further toward $208.00-210.00.

Trading strategy:

Buy the stock in the $170.00-174.00 range with a stop loss at $165.00 for a profit target of $188.00. Long trades can also be initiated at $160.00 with a stop & reverse at $154.00 for a profit target of $175.00. If the stops are taken out, continue holding short positions with a stop loss at $164.00 and exit as prices approach $140.00-142.00.

Click the link to view the chart- TradingView — Track All Markets

VietnamUS

VietnamUS