You must learn how to trade the pivot points trading strategy the right way if you want to take full advantage of the power behind pivot points. Trading pivot points is the ultimate support and resistance strategy. It will eliminate the subjectivity of manually plotting support and resistance levels.

Pivot points are derived from the floor traders who used to trade the market in the trading pit. Knowing this fact is important to appreciate the value that pivot points can bring to your trading. The way bankers trade is different.

Floor traders try to frame the day based on the previous day’s trading. They use a framework or limit to analyze the market. Because of this, pivot points are universal levels that can be traded.

Traders using the pivot point system will attempt to identify the price movement of an asset and whether that movement is likely to continue or “pivot” in a different direction. The pivot usually occurs around areas of strong resistance or support. To calculate this, you will identify the open price, high, low, and closing price of the most recent trading period. Pivot points are also called ground pivot points!

Due to their high trading volume, currency price movements are typically much more predictable than those of the stock market or other industries.

Professional traders and algorithms seen in the market use some type of pivot point strategy. In the old days, this was a secret trading strategy that floor traders used to trade the market during the day to make quick profits.

In the future, we will give you an introduction to pivot points and show you how to calculate them. Last but not least, we will give you a couple of examples of how to trade pivot points.

What are pivot points?

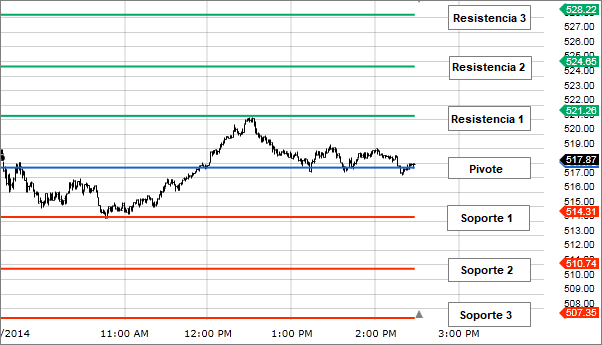

Pivot points are important support and resistance levels that can be used to determine potential trades. Pivot Points are presented as a technical analysis indicator calculated using the high, low and near value of a financial instrument.

Pivot point parameters are usually taken from the previous day’s trading range. This means you will have to use the previous day’s range for today’s pivot points.

Or last week’s range if you want to calculate weekly pivot points or last month’s range for monthly pivot points etc.

Calculate Pivot Points for Trading Success

Pivot points are automatically plotted on your chart, so you won’t have to waste time calculating them. However, if you really want to have an intimate relationship with them, here is the pivot point calculator:

Pivot Point (P) = (High + Low + Near)/3

The primary pivot point (PP) is the central pivot from which all other pivot levels are calculated. The math behind central pivot points is pretty simple. We add yesterday’s high, low, and close and then divide it by 3, which is a simple average of the high, low, and close.

And this is the math behind support and resistance pivots:

Support 1 (S1) = (P x 2) – High

Support 2 (S2) = P – (High – Low)

Resistance 1 (R1) = (P x 2) – Low

Resistance 2 (R2) = P + (High – Low)

The third support and resistance levels are calculated as:

Resistance 3 (R3) = H + 2 * (PP – L)

Support 3 (S3) = L – 2 * (H – PP)

The central PP is just one of the main support/resistance levels. The best pivot point indicator will also plot 10 more distinctive layers of support and resistance levels.

Normally, if we trade above the central pivot point, it is a sign of an uptrend. If the price trades below the central pivot point, it is considered a bearish signal.

Most modern trading platforms or software have the Pivot Points indicator in their library. Therefore, you do not need to calculate these levels manually on your own.

Using Pivot Point Strategies for Successful FOREX Trading

Pivot points are one of the best tools used to time entries and exits in any market.

However, there is a lot of noise about when to buy with pivot points.

To find out what works and what doesn’t, we will cover some trading tactics that work in Forex day trading.

We don’t need to overcomplicate technical indicators. Technical indicators only serve as a guide.

So, as a general rule, the KISS strategy (keep it simple and stupid) most of the time is the best approach.

Maximize Forex Trading Profits with Pivot Points

Here are the five most common ways pivot points can guide you through the ups and downs of the market:

- Find support and resistance levels.

- Pivot Point Breakout Trading.

- Determine short-term market trends. The trend is bullish if we overcome Resistance 1. On the contrary, the trend is bearish if we overcome Support 1.

- Intraday trend changes. If today’s trading range extends too much towards Resistance 2 or Resistance 3, there is a high probability that we will see a short-term bearish reversal signal at the end of the day. On the contrary, if today’s trading range extends too far towards Support 2 and Support 3, we can expect a short-term bullish reversal signal.

- As for entry and profit targets: buy and sell at S3 (R3) if the price cannot move further and close the trade at the end of the current trading session.

All pivot point trading strategies revolve around these 5 commercial principles.

Effective Pivot Point Intraday TRADING Strategy

The most powerful way to day trade using pivot points is the pivot point bounce strategy and central pivot point breakouts.

Let me explain:

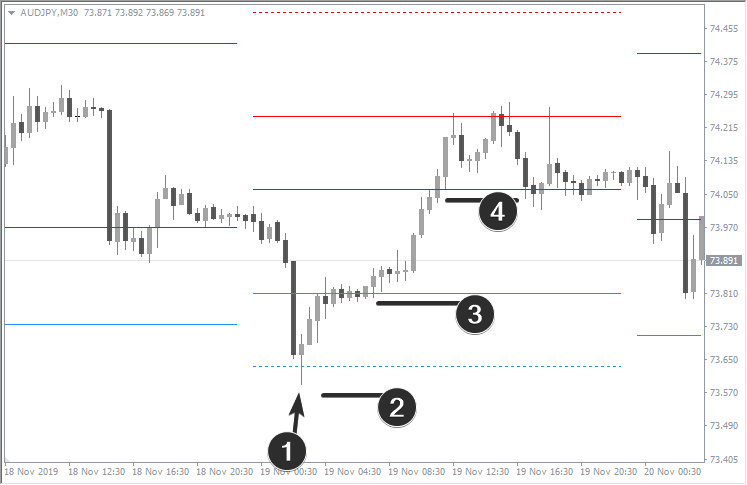

Here is how to identify pivot point day trade setups using the central pivot point.

Step 1:

The market needs to start the new trading day by consolidating above or below the central pivot point.

Step 2:

If the market consolidates below the central pivot point, we will look to buy possible bullish breakouts. On the other hand, if the market consolidates above the central pivot point, we will look to sell any breakout to the downside.

Now let’s look at an example:

Pivot Point Bounce Strategy is simply trading bounces from pivot points R1, R2, S1, S2 with the help of chart patterns.

Let’s discuss why you should keep an eye on daily pivot points.

Pivot Points INTRADAY TRADING Strategy

Daily pivot points are one of the most accurate PP levels because they incorporate the end-of-day closing prices.

Let me explain why daily pivot points are so powerful.

The close of the day is considered the most important price of all OHLC prices. The closing price is basically the liquidation price that shows who won the bullish battle.

So, the conclusion is this:

Daily pivot points are more reliable than intraday pivot points.

If you day trade pivot points, make sure you go to settings and change the pivot points time period daily. This way, it doesn’t matter if you are looking at a 5-minute chart or a 1-hour chart, the pivot points you will see are calculated based on the daily OHLC prices.

Now…

Here is a trading advantage to using daily pivot points.

See below:

Using Daily Pivot Points to Boost Trading Strategy in Forex

The most powerful way to trade daily pivot points is to take care of the central pivot point rejections.

Let me explain this type of pivot point trade setup:

If during the trading day the market has established a strong bias above (below) the central pivot point, we should expect any retest of the central PP to produce a rejection.

This is why…

Suppose the market traded above the central pivot point for most of the day.

Maybe bad news hits the market and the price starts to fall and retests the central pivot point.

At this point, we would expect buyers to reappear and defend their position in the market. So if buyers were really in control, we can expect a rebound.

This is a great opportunity to re-enter the market if you missed the initial start during the day.

Here is an example:

The best pivot point trading

Pivot points are one of our favorite trading setups. We will show you the best method to trade pivot points with the best pivot point strategy.

The pivot point strategy does not require significant trading capital. It can produce positive results immediately.

Most of the time, retail traders use pivot points incorrectly. They typically sell too quickly when the first pivot point resistance level is reached and buy too soon when the first pivot point support level is reached.

This is the wrong way to trade because you are trading against the prevailing momentum, which is one of the reasons why retail traders lose money.

Now, before continuing, we always recommend taking a piece of paper and a pen and writing down the rules of the trading strategy. In this article, we will look at the sales side.

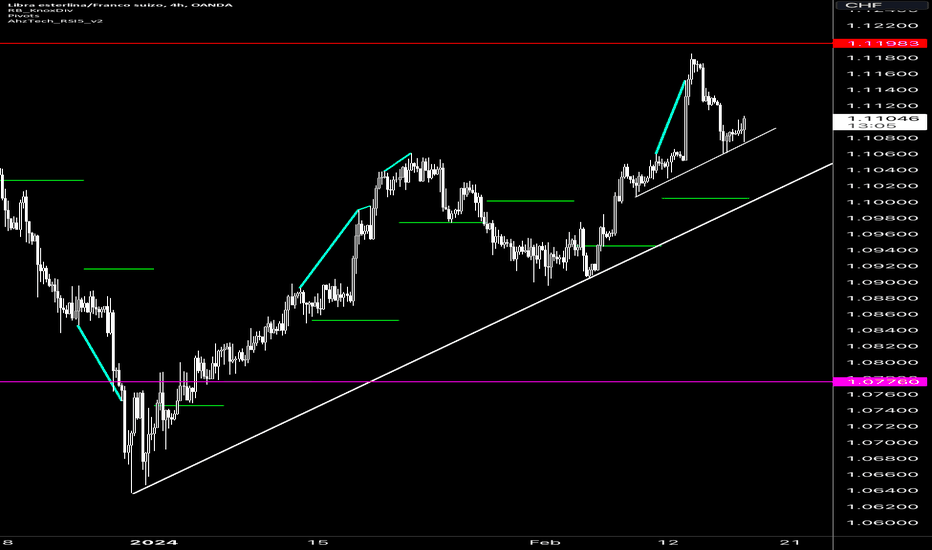

Step #1: Trade only at the London opening or 8:00 a.m. GMT

The best time to trade the pivot point strategy is around the opening of the London session. However, it can be used for the New York open session with the same success rate.

We operate with the opening of London because it is the time when the big banks open their doors and smart money operates in the market.

Note* We will use the 15 minute time frame and trade based on the daily pivot points.

We have highlighted on the chart with a vertical line the opening of London and the beginning of a new trading day.

Step #2: Sell in the market if after the first 15 minutes we are trading below the central pivot point

If after the first 15 minutes of the London trading session we are trading below the central pivot point. Then we sell on the market.

The business logic behind this rule is simple. Once the market shows a willingness to trade below the central pivot point, we assume that bearish momentum will continue to persist.

If the price of any currency pair is trading below the central pivot point, then the bias for the day is bearish and we are only looking for selling opportunities.

Important Note * If after the first 15 minutes of the London session we are too close to the first support level, we better skip this trading opportunity because the profit margin has narrowed.

The next important thing we need to establish for our intraday trading strategy is where to place our protective stop loss.

Step #3: Hide your Protective Stop Loss 5-10 pips above the Central Pivot

It is essential to have a good strategy for both the stop loss and to have an entry strategy.

If the price breaks above the central pivot point, then the sentiment has shifted to the bullish side and it is advisable to exit any short trade. However, to allow for any false breakouts, we also use a margin of approximately 5 to 10 pips above the central pivot point of our SL.

Last but not least, we also need to define a take profit level for our pivot point strategy, which brings us to the last step.

Step #4: Take partial profit #1 on support 1; Take Partial Profit #2 at Support 2.

We employ a multiple take profit strategy because we want to make sure we give the market a chance to reach deeper support levels.

The first pivot point support level is the first problem area and we want to accumulate some of the profits here. We also recommend moving the protective stop loss to the break-even point after taking profits.

At the second pivot point, the support level is where we want to liquidate our entire position and be square for the day.

Note** The above was an example of a SELL trade that I used with the best pivot point strategy. Use the same rules for a BUY trade, but in reverse. In the figure below, you can see a real example of a BUY operation.

Conclusion: Pivot Point Trading Strategy

You should start using a pivot point trading strategy as a complementary tool to your support and resistance strategy if you are not already doing so.

These pivot point trading secrets are very powerful support and resistance levels based on price.

The best pivot point strategy indicates a good entry point near the central pivot point and also provides you with a positive risk-reward ratio, which means your winning trades will be greater than your losing trades.

Leave a comment below if you have any questions about trading pivot points!

Pivot Point Trading Strategy FAQ

What is a pivot point in trading?

A pivot point is a technical analysis indicator used to determine the overall market trend over different time periods. It is calculated by taking the average of the high, low and closing prices of the previous trading session.

How are pivot points used in trading?

Pivot points are used as an indicator of support and resistance level in trading. Traders use them to identify potential reversal points, as well as to determine when to enter or exit trades.

How are pivot points calculated?

Pivot points are calculated using the high, low and close prices of the previous trading session. The pivot point is the average of these prices, while support and resistance levels are calculated using various formulas.

What are the different types of pivot points?

There are several types of pivot points, including standard pivot points, Fibonacci pivot points, and DeMark pivot points. Each type uses a different formula to calculate support and resistance levels.

What are the limitations of pivot points in trading?

Pivot points are based on historical data and do not take into account current market conditions, such as news events or economic data releases. Additionally, pivot points are not always accurate as they are based on averages and do not take into account sudden market movements. Traders should use pivot points along with other technical analysis tools to make informed trading decisions.

How do traders use pivot points to identify support and resistance levels?

Traders use pivot points to identify key price levels that can act as support and resistance. The pivot point itself is considered the first support or resistance level, while additional support and resistance levels are calculated using formulas based on the pivot point.

Can pivot points be used for intraday trading?

Yes, pivot points can be used for intraday trading and swing trading. Day traders often use pivot points to identify key levels for entry and exit points in intraday trading.

What is a pivot point strategy?

A pivot point strategy is a trading approach that uses pivot points to identify potential trades. Traders can use a variety of pivot point strategies, such as trading the bounce off support or resistance levels or using pivot points to identify trend changes.

Are pivot points effective in predicting market movements?

Pivot points can be effective in predicting market movements, but they are not always accurate. Traders should use pivot points in conjunction with other technical analysis tools and consider current market conditions before making trading decisions.

Can pivot points be used in conjunction with other technical analysis tools?

Yes, pivot points can be used in conjunction with other technical analysis tools such as moving averages, trend lines and candlestick patterns. Combining pivot points with other tools can provide traders with a more complete view of the market and increase the accuracy of their trading decisions.

JapanUS

JapanUS