Property prices rise from a resilient labor market, pullback in inflation, and mortgage rates

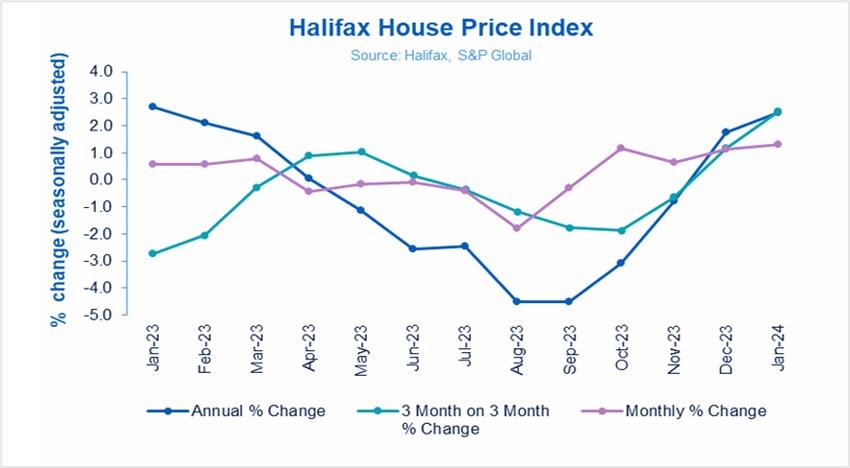

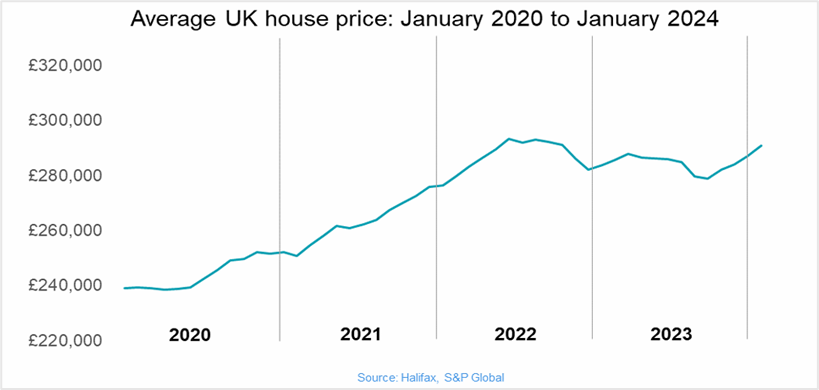

The UK housing market registered its fourth consecutive monthly price increase in January amid falling mortgage rates, cooling inflation, and a resilient labor market, data published by the UK mortgage lender Halifax showed. Average house prices climbed 1.3% in January, marking the biggest monthly gain since June 2022 and at an annual pace of 2.5%, the most in a year. The UK's biggest mortgage lender also said that the average price of a typical home is now 291,029, an increase of over £3,900 month-on-month.

Kim Kinnaird, the director of mortgages at Halifax, believes that a resilient labor market, falling inflation, and a drop in mortgage rates due to competition have all contributed to robust activity in the housing market. However, despite a surge in housing activity over the past few months amid demand outstripping supply, she is cautious about the outlook and expects a modest price fall in home prices arising from affordability challenges and the uncertainty in the macroeconomic environment.

Also, on Wednesday, the deputy governor of the Bank of England, Sarah Breeden, said the robust housing market indicated the demand is stronger than anticipated by central bank officials.

Meanwhile, the average deposit for individuals looking to buy their first home has increased to £53,414, about 19% of the purchase price, driving more than 60% of new buyers to purchase homes in joint names.

The Halifax house price index is based on its mortgage lending and doesn't include people purchasing their homes with cash or buy-to-let deals, which contribute to about one-third of home sales in the UK. With the Bank of England leaving interest rates unchanged at 16-year highs of 5.25% since August last year, first-time homebuyers and those remortgaging properties are paying higher borrowing costs.

According to Moneyfacts, a two-year fixed-rate mortgage was around 5.57% and a five-year 5.22%. Check out the different mortgage rates at Natwest.

Last week, Nationwide released its house price index, which showed prices up by 0.7% in January, the most in a year after declining 1.8% the month earlier. According to the world's largest building society, the cost of a house in the UK averaged £257,656 in January, down 0.2% over the previous 12 months. Although Nationwide sounded optimistic about the UK housing market, Robert Gardner, the building society's chief economist, was skeptical about home prices rebounding rapidly this year.

Also, data from the Royal Institute of Chartered Surveyors (RICS) showed that inquiries from new home buyers fell by 3% in December, improving somewhat after tumbling 13% the month earlier, indicating that more homes were coming onto the market. RICS will release its latest market survey on residential house prices on February 8th, which assesses the current and future outlook of residential sales and rentals across the UK.

Key highlights of the Halifax house price index data

According to data published by Halifax, property prices in Northern Ireland recorded the most substantial growth within the UK, with house prices up by 5.3% year-on-year. The cost of properties in Northern Ireland now averages £195,760, an increase of £9,761 from the same time in January 2023. Meanwhile, property price movements in Scotland and Wales registered a 4% annual growth to £206,087 and £219,609, respectively. In addition, house prices in the North West surged by 3.2% on an annual basis, Yorkshire and Humber rose by 2.8%, North East by 2.0%, and East Midlands by 0.5%.

On the contrary, house prices in the South East fell the most compared to the other regions in the UK. They dropped by an average of 2.3% or £8,866 to an average of £379,220.

Finally, London retained the top spot in terms of the highest average home price rates in the UK. Home prices in the British capital averaged £529,528, although they declined by -0.4% annually.

Market reaction to the Halifax house prices news

Britain's equities markets finished lower on Wednesday after data by the UK's largest mortgage lender pointed to a continued increase in house prices across most regions. The FTSE 100 closed at 76278.75 on Wednesday, down by 0.68% for the day, its fifth losing session in six, as investors remained nervous that rising home prices will drive the broader headline inflation higher, forcing the Bank of England to delay interest rate cuts, currently at 16-year highs.

Barratt Developments (BDEV) fell 5.47% to 501.00 pence on Wednesday after the company said it would acquire rival Redrow (RDW) in an all-share deal for £2.52 billion. Meanwhile, shares of RDW jumped 14.75% to close at 688.50 pence, the highest settlement since January 7th, 2022.

Meanwhile, homebuilder stocks rose modestly, boosted by the January Halifax house price index data, which signaled a positive outlook for the UK housing sector

The sterling gained for the second successive day on Wednesday after the higher-than-expected Halifax housing price index drove investors to Britain’s currency amid expectations that the surging prices would lift consumer inflation, deterring the Bank of England from pivoting to interest rate cuts anytime soon. The sterling rose to four-day highs against the US dollar and more than one-week highs against Europe’s single currency.

While the sterling’s recent strength was boosted by stubbornly high inflation in the UK, and even as investors have forecast the BoE to maintain the current benchmark interest rates for some more time, they don’t expect the UK’s currency to rally anytime soon. On the contrary, currency strategists anticipate the pound sterling would oscillate in a 200-point range between 1.2560 and 1.2760, especially in light of the solid nonfarm payroll numbers in the US earlier this week and the upcoming CPI data next week.

Technical View

Rolls Royce (RR)

Shares of Rolls Royce surged 1.6% to close at 322.90 on Wednesday, registering another fresh all-time high. The company extended last year's massive 221.57% gains to surge another 7.74% in less than 40 days of 2024 amid multiple earnings upgrades and a solid outlook for 2024.

Earlier this week, the stock broke out of a 25-pence trading range between 287.00 and 313.00 pence and is likely to advance to the 340.00- 360.00 pence zone over the next few weeks. Also, the long-term outlook for the stock remains positive, with the rally likely to extend to 430.00 pence.

On the downside, a close below 313.00 could result in the stock returning to the consolidation zone of 287.00-313.00 pence before breaking out, likely after the company announces its full-year 2023 results on February 22nd.

Trading Strategy:

Go long on the stock at 313.00-314.00 pence, with a stop loss at 307.00 for a profit target in the 340.00-360.00 pence range. Ensure that trailing stops are placed on your positions.

On the downside, place STOP SELL orders to enter short positions if the stock closes below 287.00 pence or breaches 280.00 pence. Maintain a stop loss at 290.00 and exit as prices approach the long-term bullish trendline support at 268.00-269.00.

Rolls Royce- Daily chart

Click the link to view the chart- TradingView — Track All Markets

Spot GBPUSD

The pound sterling rebounded after briefly breaching the long-term support trendline to end the second consecutive session with gains on Wednesday. The pair closed at four-session highs of $1.2627, up 0.23% for the day. The primary support is at $1.2565, a close below which sterling could slide to $1.2380-$1.2400 (channel plotted by selecting the December 2022 and July 2023 highs). On the upside, the resistance zone is placed at 1.2770-1.2800, followed by the breakout of the long-term bearish channel at 1.2860.

Trading Strategy:

Initiate long trades on the GBPUSD pair at 1.2570, with a stop loss at 1.2510 for a profit target of 1.2750-1.2770. If the stops are hit, short the pair on a rebound towards 1.2530/40, with a stop loss at 1.2580, and exit as it approaches 1.2400.

You can also short the pair at 1.2860 with a stop and reverse at 1.2900 for a profit target of 1.2770. If the stop losses hit, hold on to the long trades with a stop loss at 1.2830 for a target of 1.3100-1.3140. Ensure that trailing stops are placed on your SAR positions.

Spot GBPUSD- Daily chart

Click the link to view the chart- TradingView — Track All Markets

IranUS

IranUS