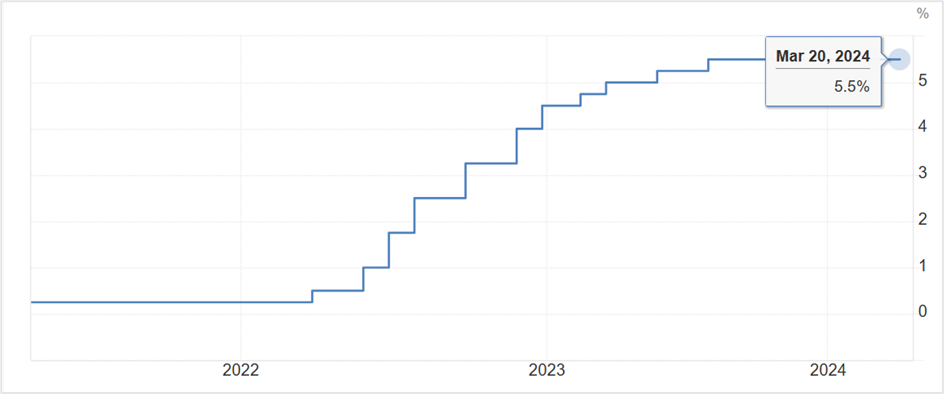

Equities rally while the US dollar and bond yields fall

The US Federal Reserve maintained interest rates at multi-decade highs of 5.25%-5.50% following its two-day monetary policy meeting on Wednesday, even as Chair Jerome Powell reiterated that policymakers will wait for inflation to continue its downward trajectory before lowering the Federal Funds rate. The FOMC interest rate decision was widely anticipated, and while the US central bank did not make any significant changes to its policy statement, some of Powell's dovish announcements cheered investors, driving prices of equities, fixed income, and commodities higher.

US Federal Funds rate

Source: Trading Economics

A recap of what Powell said at the press conference following the FOMC meeting

The Fed Chairman believes inflation would take a nonlinear path downward and expects it to be a bumpy ride. He, however, overturned past statements from Fed officials linking the low unemployment rate to rising inflation and noted that a strong labor market would not deter policymakers from lowering borrowing costs as they are sure that supply constraints due to the pandemic triggered the multi-decade-high inflation in 2022. He also said that the policy rate is likely at its peak this cycle and was confident that inflation would slip lower gradually, which would drive the Fed to dial back rates sometime this year.

In another surprise move, the Fed Chairman said the US central bank will soon slow the pace of its balance sheet reduction program.

The Federal Open Market Committee lifted interest rates for the last time in July, and policymakers are more or less confident that interest rates have peaked. However, while the Fed's dot plot pencils three rate cuts this year, the median estimate of the Fed Funds target rate ticked higher by 25-basis points to a range of 3.75%-4.00% in 2025 and to a range of 3.00%-3.25% at the end of 2026. But, despite this,

Some economists are unconvinced that the Fed will cut as aggressively as indicated this year.

Matt Higgins, the CEO and co-founder of RSE Ventures, thinks the Federal Reserve will unlikely cut interest rates thrice this year despite what Powell said and the dot plot revealed. In fact, he doesn't expect the Fed to lower rates in 2024, and even if they do, it could be a single rate cut later in the year.

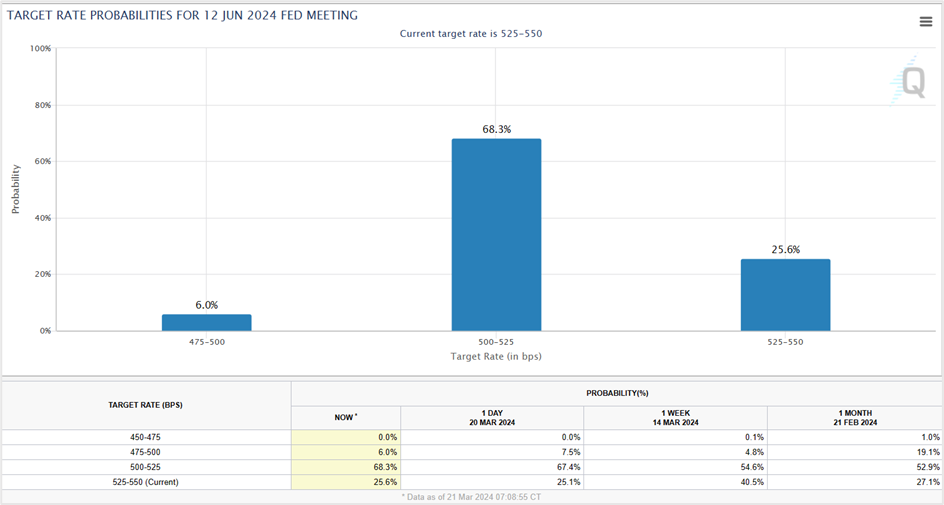

Meanwhile, after Wednesday's FOMC meeting, Fed Funds futures traders have raised the possibility of a June rate cut to 68.3% from 67.4% a day earlier and 52.9% the previous month.

Source: cmegroup website

Market reaction to the Federal Reserve interest rate decision

The US stock markets closed higher on Wednesday after the Federal Reserve left borrowing costs unchanged and signaled three rate cuts this year, although it didn't specify when. In addition, the dovish comments by Fed Chair Jerome at the post-meeting press conference lifted investor sentiment and pushed the benchmark S&P 500 into record territory.

The primary index rose 0.89% to end Wednesday's session at 5,224.62, the 30-share Dow Jones Industrial Average closed at 39,512.13, up by 1.03%, and the Nasdaq 100 settled at 18,240.11, higher by 1.15%. The gains in the primary stock index were led by the consumer discretionary sector, which climbed 1.5%, even as nine out of eleven sectors advanced, with five surging more than a percent.

Meanwhile, stock futures pointed to a positive open on Thursday, with tech stocks leading again. Micron Technologies (MU) is expected to open about 17% higher after the chipmaker reported a solid second-quarter profit and raised its third-quarter guidance ahead of Wall Street estimates.

In the currency markets, the US dollar reversed its Asian session declines on Thursday to trade unchanged at 103.45 in Europe. The rebound in the greenback was prompted by a quarter-point rate cut by the Swiss National Bank (SNB) following its monetary policy meeting on Thursday, which brought its benchmark interest rate to 1.5%. The SNB is the first major global central bank besides China to lower rates amid a slowdown in inflationary pressures. The move pushed the Swiss franc lower against its counterparts, raising hopes that other central banks will follow suit, even as investors keenly await the outcome of the monetary policy announcement by the Bank of England (BoE) later today.

At noon in Europe, the US currency was flat at 1.0915 against the euro, while it traded 0.19% lower at 1.2760 and 150.98 versus the pound sterling and the Japanese yen, respectively. The Swiss franc traded 0.72% lower at 0.8932 versus the greenback and was down by 0.59% against the euro at 0.9742.

US Treasury securities rose on Wednesday, with the yield on the rate-sensitive 2-year Note falling to six-session lows of 4.604% after the Federal Reserve Chairman's dovish statements raised hopes of a rate cut in June and two more this year. Meanwhile, the yield on the benchmark 10-year Note slid by 1.6 basis points to 4.277%, and the 30-year bond yield rose by 1.3 basis points to 4.456%.

Ahead of the Fed's policy statement, traders expected the US central bank to signal two rate cuts in 2024 as both producer and consumer price inflation remained sticky in the first two months, following a sharp decline last year. But the Fed surprised markets, sending yields briefly higher as investors rushed to covered positions.

Meanwhile, more than 80% of investment-grade bonds issued by US corporations traded at a discount on Wednesday after Fed officials remained uncommitted on when they will start easing. That figure is down from 92% in October last year when the yield on the 10-year T-Note climbed to 5%.

Technical View

Spot Gold

Spot Gold rose over 1.3% on Wednesday to close at record highs of $2186 a troy ounce after breaking out of a tight $15 consolidation zone after the Federal Reserve left interest rates unchanged at its March meeting. The yellow metal extended yesterday's rally into the Asian session on Thursday and is on course to end with weekly gains- the fourth in five weeks.

The precious metal pulled back after hitting the near-term resistance at $2225, and any further gains toward the long-term bullish channel at $2320 will occur only if prices close above $2225. On the downside, any pullback will likely be supported at $2190-2195, which are good BUY entry levels.

Trading Strategy:

Initiate long positions at $2190-$2195, with a stop and reverse at $2180 for a profit target of $2220. If prices hit $2180, short the precious metal, with a stop loss at $2200 for a profit target of $2135-$2155. Ensure to trail your profits.

Spot Gold daily chart

Click the link to view the chart- TradingView — Track All Markets

Netflix Inc (NFLX)

Netflix broke out of a three-week consolidation zone to settle 1.12% higher at $627.69 on Wednesday, its strongest closing to date. The breakout of the consolidation zone and the broader market rally will likely drive the shares of the entertainment service provider toward the long-term resistance at $715.

On the downside, the near-term support is at $624, a close below which prices could drop to the next support zone at $595-600.

Trading Strategy:

Go long on Netflix if prices pull back toward $624-$626, the breakout level, with a stop loss at $610 for a three-week to three-month profit target of $715. Ensure to trail your profits.

Netflix daily chart

Click the link to view the chart- TradingView — Track All Markets

IndiaUS

IndiaUS